Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the most promising applications of printed sensors is in the field of healthcare. These sensors have the potential to transform patient monitoring and diagnostics. They can be seamlessly integrated into wearable devices, allowing for continuous monitoring of vital signs, glucose levels, and other critical health parameters. This real-time data is invaluable for both patients and healthcare providers, enabling proactive interventions and personalized healthcare solutions. Moreover, the lightweight and flexible nature of printed sensors makes them comfortable for patients to wear, promoting compliance with monitoring regimens and improving overall health outcomes.

In the automotive industry, printed sensors are making significant inroads. They find application in various aspects of vehicle design and performance, enhancing safety, comfort, and efficiency. For instance, printed pressure sensors are used in tire pressure monitoring systems to ensure optimal tire inflation, contributing to road safety and fuel efficiency. Additionally, capacitive touch sensors based on printed technology are integrated into infotainment systems, enabling touch-sensitive screens for intuitive user interactions. The versatility of printed sensors extends to emerging applications within the automotive interior, such as smart textiles that provide enhanced comfort and functionality to occupants.

Consumer electronics represent another domain where printed sensors are driving innovation. These sensors are at the heart of modern devices, enabling features like touch-sensitive screens, fingerprint recognition, and gesture control. In smartphones and tablets, printed touch sensors provide the responsive and intuitive interfaces that consumers have come to expect. Additionally, fingerprint sensors based on printed technology enhance device security and user convenience. As the demand for smaller, more versatile, and energy-efficient sensors grows, printed sensors are poised to play an increasingly central role in the evolution of consumer electronics.

Environmental monitoring is yet another area where printed sensors are making a meaningful impact. The scalability and affordability of printed sensors make them ideal for large-scale deployments in applications such as air quality monitoring, water quality assessment, and structural health monitoring. Distributed sensor networks equipped with printed sensors enable real-time data collection and analysis, facilitating more informed decision-making and proactive interventions. These sensors are contributing to the global efforts to address environmental challenges, from mitigating air pollution to ensuring the safety and sustainability of infrastructure.

The global printed sensors market's growth trajectory is further accelerated by advancements in materials science and manufacturing techniques. Researchers are continuously developing materials with enhanced sensitivity, durability, and environmental resilience, expanding the scope of printed sensor applications. Additionally, ongoing innovations in printing technologies enable the production of increasingly complex and precise sensor designs. This evolving landscape positions printed sensors as a versatile and reliable sensing solution for a wide range of industries and applications. The integration of printed sensors into the Internet of Things (IoT) ecosystem is a pivotal driver for the market's growth. IoT relies on sensors to collect data from the physical world and transmit it for analysis and action. Printed sensors, with their cost-effectiveness and scalability, are well-suited for deployment within IoT networks. They enable the creation of sensor-rich environments that can enhance automation, optimize resource utilization, and improve overall operational efficiency. From smart cities to industrial IoT applications, printed sensors are playing a pivotal role in shaping the future of connected systems.

In conclusion, the global printed sensors market is on an upward trajectory, driven by their versatility, cost-effectiveness, and applicability across diverse industries. These sensors have already transformed healthcare, automotive, consumer electronics, and environmental monitoring, with continued innovation and advancements in materials and manufacturing techniques expanding their reach. As industries seek innovative solutions to address complex challenges and harness the power of sensor data, printed sensors are poised to play an increasingly vital role in shaping the future of sensor technology and its diverse applications.

Key Market Drivers

Healthcare Revolution

One of the primary drivers behind the growth of the global printed sensors market is the healthcare revolution. Printed sensors are poised to revolutionize patient monitoring and diagnostics. They are lightweight, flexible, and can be seamlessly integrated into wearable devices, providing continuous monitoring of vital signs, glucose levels, and other health parameters. This real-time data is invaluable for both patients and healthcare providers, enabling proactive interventions and personalized healthcare solutions. Additionally, the comfortable nature of printed sensors encourages patient compliance with monitoring regimens, improving overall health outcomes.Automotive Advancements

The automotive industry is experiencing a significant transformation, and printed sensors are at the forefront of this change. These sensors find applications in various aspects of vehicle design and performance, enhancing safety, comfort, and efficiency. For instance, printed pressure sensors are used in tire pressure monitoring systems to ensure optimal tire inflation, contributing to road safety and fuel efficiency. Capacitive touch sensors based on printed technology are integrated into infotainment systems, enabling touch-sensitive screens for intuitive user interactions. The versatility of printed sensors extends to emerging applications within the automotive interior, such as smart textiles that provide enhanced comfort and functionality to occupants.Consumer Electronics Evolution

Consumer electronics have become an integral part of modern life, and printed sensors play a crucial role in their evolution. These sensors are essential components in devices such as smartphones and tablets, enabling features like touch-sensitive screens, fingerprint recognition, and gesture control. Printed touch sensors provide the responsive and intuitive interfaces that consumers expect, while fingerprint sensors based on printed technology enhance device security and user convenience. As consumer demand for smaller, more versatile, and energy-efficient sensors grows, printed sensors are poised to play an increasingly central role in the evolution of consumer electronics.Environmental Monitoring Imperative

Environmental monitoring is a critical area where printed sensors are making a meaningful impact. Their scalability and affordability make them ideal for large-scale deployments in applications such as air quality monitoring, water quality assessment, and structural health monitoring. Distributed sensor networks equipped with printed sensors enable real-time data collection and analysis, facilitating more informed decision-making and proactive interventions. These sensors are contributing to global efforts to address environmental challenges, from mitigating air pollution to ensuring the safety and sustainability of infrastructure.Key Market Challenges

Limited Sensing Capabilities and Accuracy

One of the primary challenges facing the global printed sensors market is the limited sensing capabilities and accuracy of printed sensors compared to their traditional counterparts. Printed sensors are often designed to be cost-effective and flexible, which can come at the expense of precision and sensitivity. While they excel in certain applications, such as large-scale environmental monitoring, they may fall short in scenarios requiring high levels of accuracy. For industries like healthcare and automotive, where precise measurements are critical, the inherent limitations of printed sensors can pose challenges. For instance, in medical devices like glucose monitors, the accuracy of sensor readings is paramount for patient safety and effective disease management. Any compromise in accuracy can have significant consequences. Additionally, printed sensors may struggle with complex or dynamic environments. In applications where environmental conditions change rapidly or where sensors are exposed to extreme temperatures or harsh chemicals, the reliability and accuracy of printed sensors may be compromised. This limits their applicability in certain industries and use cases. To address this challenge, continuous research and development efforts are essential to improve the sensing capabilities of printed sensors. This includes advancements in materials science, sensor design, and signal processing techniques to enhance accuracy and broaden their range of applications. While progress is being made, the limitations of printed sensors remain a significant challenge for manufacturers and end-users alike.Limited Adoption in Established Industries

Another significant challenge facing the global printed sensors market is the limited adoption of printed sensor technology in well-established industries. While printed sensors offer unique advantages, such as flexibility and cost-effectiveness, they often face resistance to adoption in sectors that have long relied on traditional sensor technologies. In industries like aerospace, where safety and reliability are paramount, the transition to printed sensors can be slow and cautious. Established industries often have stringent regulations and standards in place, making it challenging for new technologies to gain acceptance. Moreover, the investment in research, development, and certification of printed sensors to meet industry-specific requirements can be substantial. Furthermore, in industries with existing supply chains and infrastructure built around traditional sensors, the integration of printed sensors can be disruptive and costly. Companies may be hesitant to invest in new manufacturing processes and equipment required for printed sensor production.Key Market Trends

Increasing Adoption of Cloud-Based Simulation Software

The global simulation software market is experiencing a significant trend towards the adoption of cloud-based solutions. Cloud-based simulation software offers several advantages over traditional on-premises software, driving its popularity among businesses and organizations. One key benefit is scalability; cloud solutions can easily accommodate the growing computational needs of simulations without the need for substantial hardware investments. This scalability is particularly crucial in industries like aerospace, automotive, and healthcare, where complex simulations require substantial computing power.Moreover, cloud-based simulation software enables greater collaboration and accessibility. Teams spread across different locations can easily access and collaborate on simulation projects, promoting cross-functional teamwork and knowledge sharing. Additionally, cloud solutions facilitate real-time data sharing and analysis, enhancing decision-making processes. Furthermore, the cloud offers cost-effectiveness through a subscription-based pricing model. This eliminates the need for significant upfront capital expenditure on hardware and software licenses, making simulation technology accessible to smaller enterprises and startups. As a result, the adoption of cloud-based simulation software is expected to continue its upward trajectory, driving market growth in the coming years.

Integration of Artificial Intelligence and Machine Learning

Another prominent trend in the global simulation software market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. Simulation software, when combined with AI and ML capabilities, becomes more predictive, adaptive, and efficient. These technologies enhance the realism and accuracy of simulations, making them invaluable tools across industries. AI and ML algorithms are being used to optimize simulations, automating tasks like model parameterization and scenario generation. This not only reduces the time and effort required for simulation setup but also improves the accuracy of results. In manufacturing, for instance, AI-driven simulations can optimize production processes, leading to reduced costs and improved product quality.Moreover, AI-powered simulations enable predictive modeling, allowing businesses to anticipate future scenarios and make proactive decisions. This is particularly valuable in fields such as finance, where AI-driven simulations can model market trends and help organizations develop risk mitigation strategies. Additionally, AI and ML are used for data analytics in simulation software. They can process and analyze vast amounts of simulation data, identifying patterns and insights that may not be apparent through manual analysis. This data-driven approach enhances the decision-making process and fosters innovation in product design, process optimization, and research. As AI and ML technologies continue to advance, their integration with simulation software will likely become more sophisticated and widespread, opening new possibilities, and driving market growth.

Virtual Reality (VR) and Augmented Reality (AR) Integration

The integration of virtual reality (VR) and augmented reality (AR) technologies is a compelling trend in the global simulation software market. These immersive technologies enhance the user experience and expand the scope of simulation applications. In training and education, VR and AR simulations provide an interactive and realistic learning environment. For example, in healthcare, medical students can practice surgeries in a virtual environment before operating on real patients, reducing the risk, and improving their skills. In manufacturing, VR and AR simulations enable workers to train on equipment and processes without the need for physical prototypes, increasing efficiency and safety.Moreover, VR and AR enhance product design and prototyping. Engineers and designers can visualize and interact with 3D models in real-time, making it easier to identify design flaws and improvements. This leads to faster product development cycles and cost savings. In gaming and entertainment, VR and AR are revolutionizing the simulation experience. These technologies provide immersive and interactive gaming environments, enhancing user engagement and enjoyment.

Furthermore, the integration of VR and AR in the architecture, engineering, and construction (AEC) industry is gaining momentum. Architects and engineers can use VR to walk through virtual building designs, identifying issues and making adjustments before construction begins. This reduces construction errors and improves project efficiency. As VR and AR technologies become more accessible and affordable, their integration with simulation software is expected to accelerate, driving market growth, and expanding the range of applications across industries.

Segmental Insights

Sensor Type Insights

Based on sensor type, the biosensor segment emerges as the predominant segment, exhibiting unwavering dominance projected throughout the forecast period. These sensors are specifically designed to detect and analyze biological markers, making them indispensable in applications such as healthcare, biotechnology, and environmental monitoring. One of the key factors driving the biosensor segment's dominance is its vital role in the healthcare sector. Biosensors are employed in medical devices for diagnostics, monitoring, and disease management, enabling rapid and precise measurements of various biomarkers, including glucose levels and specific proteins. This has revolutionized the field of personalized medicine and patient care.Furthermore, biosensors find extensive use in environmental monitoring, particularly in detecting pollutants, pathogens, and contaminants in air and water. Their real-time and on-site detection capabilities contribute significantly to environmental sustainability efforts. Additionally, biosensors are instrumental in the food industry for quality control and safety assessments, ensuring that consumers have access to safe and high-quality products. The biosensor segment's unwavering dominance is a testament to the ever-expanding applications of biosensors across diverse industries. As technology continues to advance, biosensors are expected to play an increasingly pivotal role in shaping the future of healthcare, environmental protection, and food safety, further solidifying their position at the forefront of the printed sensors market.

End User Insights

Based on end user, the smart packaging segment emerges as a formidable frontrunner, exerting its dominance and shaping the market's trajectory throughout the forecast period. Smart packaging, which integrates printed sensors for real-time data monitoring and communication, has witnessed a surge in demand across various sectors. This surge can be attributed to the transformative impact it brings to industries such as food and beverage, pharmaceuticals, and logistics. In the realm of food and beverage, smart packaging is revolutionizing product freshness and safety. Printed sensors embedded within packaging materials enable consumers to access vital information, such as product expiration dates and storage conditions, through their smartphones. This transparency empowers consumers to make informed choices and reduces food waste.Likewise, the pharmaceutical industry benefits significantly from smart packaging, where sensors can monitor temperature-sensitive medications and ensure their integrity during transportation and storage. This technology is pivotal in maintaining the efficacy of drugs and safeguarding patient health. Furthermore, logistics and supply chain management rely on smart packaging to enhance tracking and traceability. Real-time data collection enables companies to monitor the conditions and location of products in transit, thereby improving inventory management and reducing losses. As the adoption of smart packaging continues to soar, the segment's dominance is set to persist. Its ability to enhance product safety, improve supply chain efficiency, and empower consumers with information aligns perfectly with the evolving demands of various industries. In doing so, smart packaging stands as a key driver in shaping the trajectory of the printed sensors market.

Regional Insights

North America firmly establishes itself as a commanding presence within the global printed sensors market, affirming its preeminent position, and highlighting its pivotal role in shaping the industry's course. This region plays a pivotal role in shaping the trajectory of the printed sensors industry. Several factors contribute to North America's prominence in this market. Firstly, North America boasts a thriving technology ecosystem and a strong culture of innovation. This fosters the development and adoption of cutting-edge sensor technologies, including printed sensors. Leading research institutions, startups, and established tech giants in the region continually push the boundaries of sensor applications, spanning healthcare, aerospace, automotive, and more. Secondly, the healthcare sector in North America has embraced printed sensors, particularly in wearable medical devices and diagnostics. The region's commitment to advancing healthcare technology fuels the demand for innovative sensors that can monitor patients' health, leading to better healthcare outcomes. Moreover, North America's robust manufacturing and industrial base offers a conducive environment to produce printed sensors at scale. This aligns with the growing demand for sensors in various industries, including automotive, where printed sensors are utilized in applications like vehicle safety and automation. Lastly, the region's regulatory framework ensures quality and safety standards are met, instilling confidence in both manufacturers and consumers. This regulatory diligence is particularly important in industries like healthcare, where sensor accuracy is critical.Key Market Players

- FlexEnable Limited

- ISORG SA

- Plastic Logic HK Ltd.

- Renesas Electronics Corporation

- Butler Technologies Inc.

- Canatu Oy

- KWJ Engineering inc. (SPEC Sensors LLC)

- Peratech Holdco Limited

- Pressure Profile Systems Inc.

- T+Ink Inc. (IDTechEx Ltd.)

Report Scope

In this report, the global printed sensors market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Printed Sensors Market, by Printing Technology:

- Gravure Printing

- Inkjet Printing

- Screen Printing

- Flexography

- Others

Global Printed Sensors Market, by Sensor Type:

- Image

- Biosensor

- Temperature

- Touch

- Humidity

- Proximity

- Others

Global Printed Sensors Market, by End User:

- Automotive

- Consumer Electronics

- Industrial Equipment

- Medical Devices

- Building Automation

- Smart Packaging

- Others

Global Printed Sensors Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Printed Sensors Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- FlexEnable Limited

- ISORG SA

- Plastic Logic HK Ltd.

- Renesas Electronics Corporation

- Butler Technologies Inc.

- Canatu Oy

- KWJ Engineering inc. (SPEC Sensors LLC)

- Peratech Holdco Limited

- Pressure Profile Systems Inc.

- T+Ink Inc. (IDTechEx Ltd.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2023 |

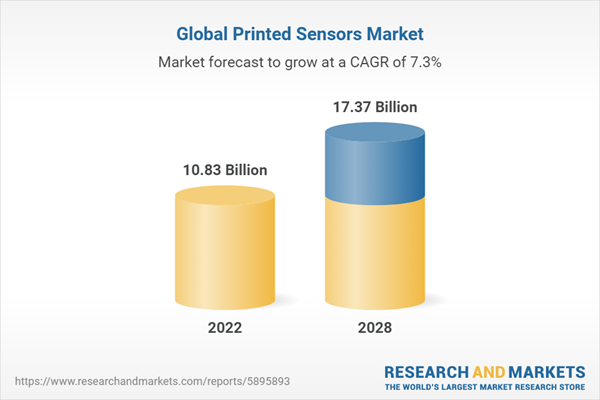

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 10.83 Billion |

| Forecasted Market Value ( USD | $ 17.37 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |