Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

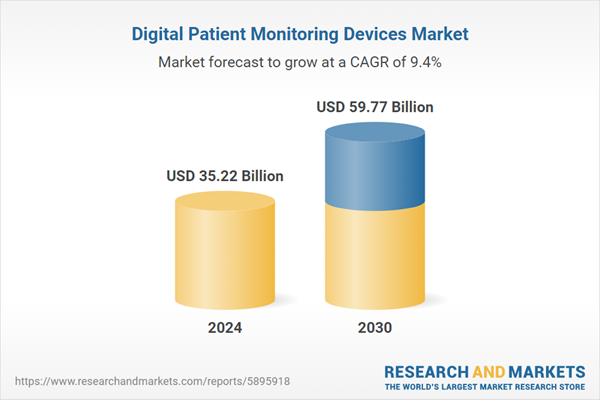

By enabling real-time tracking of patient vitals and chronic conditions, these devices allow healthcare professionals to deliver proactive care while empowering patients to manage their health more effectively. Growth is being fueled by factors such as a rising elderly population, the global surge in chronic diseases, and ongoing technological innovations. Notably, initiatives like Dozee’s AI-powered ECG patch exemplify how real-time, cloud-connected monitoring tools are reshaping remote cardiac care. As the industry shifts toward value-based care and cost efficiency, digital patient monitoring is emerging as a cornerstone of modern healthcare delivery across both clinical and home environments.

Key Market Drivers

Rising Chronic Disease Prevalence is Driving the Global Digital Patient Monitoring Devices Market

The increasing global incidence of chronic diseases is a primary force propelling the digital patient monitoring devices market. Conditions such as diabetes, cardiovascular diseases, respiratory disorders, and hypertension are not only widespread but also require consistent, long-term management. For example, projections indicate that global diabetes cases may more than double from 2021 to 2050. This growing burden has led healthcare systems to adopt more effective disease monitoring strategies. Digital monitoring devices provide continuous, remote tracking of key health indicators, helping to improve clinical outcomes and reduce hospital admissions. With non-communicable diseases responsible for over 70% of global deaths - particularly in low- and middle-income countries - governments and health providers are increasingly turning to these technologies to enhance patient engagement, streamline chronic disease management, and reduce associated healthcare costs.Key Market Challenges

Regulatory Hurdles

A major challenge facing the global digital patient monitoring devices market is navigating diverse and complex regulatory frameworks. Approval processes for medical devices vary significantly across regions, with differing requirements from agencies such as the U.S. FDA, the European Medicines Agency (EMA), and others. These discrepancies can prolong product launch timelines, inflate development costs, and pose obstacles to global market entry. Manufacturers must continually adapt to evolving regulatory standards related to safety, data privacy, cybersecurity, and clinical efficacy. Meeting these criteria, while ensuring interoperability and patient confidentiality, adds layers of complexity that can delay innovation and scale-up in this dynamic market.Key Market Trends

Technological Advancements

Rapid technological progress is reshaping the digital patient monitoring devices market, driving innovations that enhance remote care and improve clinical decision-making. The integration of Internet of Things (IoT) technology with healthcare monitoring solutions has enabled seamless data transmission and real-time connectivity, significantly improving patient outcomes, especially for those managing chronic illnesses. Wearable devices - such as smartwatches and fitness bands - are evolving to monitor not only basic vitals like heart rate and sleep, but also more complex metrics including ECG, blood oxygen saturation, and glucose levels.These tools support preventive care and enable early intervention. Furthermore, artificial intelligence (AI) is being applied to patient data for predictive analytics, allowing healthcare providers to anticipate health events and personalize treatment. As demand for home-based healthcare rises, these advancements are streamlining care delivery while reducing hospital dependency. The market is also witnessing growth in mobile health (mHealth) platforms, which offer app-based interfaces that enhance patient engagement and adherence to treatment plans.

Key Market Players

- GE HealthCare Technologies, Inc

- AT&T Inc.

- Athenahealth, Inc.

- Abbott Laboratories Inc.

- Koninklijke Philips N.V. AB

- Hill-Rom Services Inc.

- Medtronic plc

- Omron Healthcare, Inc.

- FitBit, Inc.

- Garmin Ltd.

Report Scope:

In this report, the Global Digital Patient Monitoring Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Digital Patient Monitoring Devices Market, By Type:

- Telehealth

- Wireless Sensor Technology

- mHealth

- Wearable Devices

- Remote Patient Monitoring

Digital Patient Monitoring Devices Market, By Product:

- Diagnostic Monitoring Devices

- Therapeutic Monitoring Devices

Digital Patient Monitoring Devices Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Digital Patient Monitoring Devices Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- GE HealthCare Technologies, Inc

- AT&T Inc.

- Athenahealth, Inc.

- Abbott Laboratories Inc.

- Koninklijke Philips N.V. AB

- Hill-Rom Services Inc.

- Medtronic plc

- Omron Healthcare, Inc.

- FitBit, Inc.

- Garmin Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.22 Billion |

| Forecasted Market Value ( USD | $ 59.77 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |