Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary factors fueling the growth of the global automotive lightweight materials market is the pressing need to meet strict fuel efficiency and emissions standards. Governments and regulatory bodies across the globe are imposing increasingly stringent requirements to reduce greenhouse gas emissions and enhance fuel economy. As a result, automakers are under immense pressure to design and produce vehicles that are not only cleaner but also more fuel-efficient. Lightweight materials play a pivotal role in achieving these goals, as they help reduce overall vehicle weight, which in turn enhances fuel efficiency and reduces emissions.

Moreover, the trend towards electrification in the automotive industry is further accelerating the demand for lightweight materials. Electric vehicles (EVs) and hybrid vehicles, including plug-in hybrids (PHEVs), rely on efficient power-to-weight ratios to maximize their range and performance. Lightweight materials are essential for optimizing the energy efficiency of EVs, making them more competitive in the market.

Furthermore, the market is witnessing a notable shift in consumer preferences. Consumers are increasingly valuing fuel-efficient and environmentally friendly vehicles. This shift in demand is compelling automakers to incorporate lightweight materials into their designs to produce vehicles that align with these preferences. Lightweight materials not only improve fuel economy but also enhance the overall driving experience by improving handling and performance.

Innovation and advancements in material technologies are at the forefront of the global automotive lightweight materials market. Manufacturers are continuously developing new materials, including advanced composites, aluminum alloys, and high-strength steel, which offer a unique combination of strength and weight reduction. These materials provide automakers with versatile options to reduce vehicle weight without compromising safety or structural integrity.

The global automotive lightweight materials market is also marked by an increasing emphasis on sustainable and recyclable materials. As environmental concerns become more prominent, automakers and material suppliers are focusing on eco-friendly solutions. Lightweight materials that are both durable and recyclable are gaining traction as they align with the industry's sustainability goals.

In conclusion, the global automotive lightweight materials market is witnessing significant growth driven by the imperative to meet strict emissions standards, improve fuel efficiency, and address consumer preferences for environmentally friendly vehicles. Innovations in material technologies, combined with a commitment to sustainability, are shaping the market's evolution. As automakers continue to invest in lightweight materials, the market is poised for further expansion, offering solutions to the evolving challenges of the automotive industry.

Key Market Drivers

Stringent Emissions Regulations and Fuel Efficiency Demands

One of the primary drivers of the global automotive lightweight materials market is the stringent emissions regulations imposed by governments worldwide. To combat air pollution and reduce greenhouse gas emissions, regulators have mandated increasingly strict emissions standards for vehicles. These regulations have spurred automakers to seek innovative ways to make vehicles more fuel-efficient and environmentally friendly.Lightweight materials play a pivotal role in achieving these goals. by reducing vehicle weight, automakers can improve fuel efficiency and reduce emissions. Advanced lightweight materials, such as carbon fiber composites, aluminum alloys, and high-strength steel, enable manufacturers to design lighter yet durable vehicles that meet or exceed emissions targets. As regulations continue to tighten, the demand for lightweight materials is expected to grow.

Rise of Electric and Hybrid Vehicles

The automotive industry is experiencing a significant shift towards electric and hybrid vehicles. Electric vehicles (EVs) and plug-in hybrid vehicles (PHEVs) rely on efficient power-to-weight ratios to maximize range and performance. Lightweight materials are essential for optimizing the energy efficiency of these vehicles, making them more competitive in the market.In EVs, where every kilogram of weight directly impacts range, lightweight materials are used extensively in the construction of the vehicle's chassis and body. Aluminum and composite materials are commonly employed to reduce weight without compromising structural integrity. As the electric vehicle market expands, the demand for lightweight materials is poised to increase significantly.

Consumer Preference for Fuel Efficiency and Environmental Responsibility

Consumer preferences are evolving, with an increasing number of buyers prioritizing fuel efficiency and environmental responsibility when choosing vehicles. Today's consumers are more conscious of the environmental impact of their vehicles and are seeking options that align with their values.As a result, automakers are under pressure to produce vehicles that are not only fuel-efficient but also eco-friendly. Lightweight materials are a key enabler of this transition. They allow automakers to reduce vehicle weight, which leads to improved fuel economy and reduced emissions. Additionally, lightweight materials can enhance the overall driving experience by improving handling and performance, making them attractive to eco-conscious consumers.

Advancements in Material Technologies

Innovation and advancements in material technologies are driving the adoption of lightweight materials in the automotive industry. Manufacturers are continuously developing new materials with improved properties, offering a unique combination of strength, durability, and weight reduction.Advanced composites, such as carbon fiber-reinforced plastics, are gaining popularity for their exceptional strength-to-weight ratio. These composites are increasingly used in various vehicle components, including body panels and structural elements. Aluminum alloys are another essential lightweight material, with automakers using them extensively in chassis and body construction. High-strength steel, which offers the strength of traditional steel with reduced weight, is also widely employed in modern vehicle designs.

These material advancements provide automakers with versatile options to reduce vehicle weight while maintaining safety and structural integrity. As material technologies continue to evolve, the automotive industry can explore new possibilities for lightweighting.

Emphasis on Sustainability and Recyclability

Environmental sustainability is becoming a paramount concern in the automotive industry. Automakers and material suppliers are increasingly focusing on eco-friendly solutions that minimize the environmental impact of vehicles. Lightweight materials that are both durable and recyclable are gaining prominence in this context.Recyclable materials, such as aluminum and certain plastics, are favored for their ability to be reused in the manufacturing process. These materials align with the industry's sustainability goals and reduce the environmental footprint of vehicle production. Additionally, the emphasis on sustainability extends to the end-of-life phase, where recycling and responsible disposal practices are becoming more critical.

Cost-Efficiency and Competitive Advantage

While lightweight materials can be more expensive than traditional materials, advancements in manufacturing processes and economies of scale are making them more cost-efficient. Automakers recognize that investing in lightweight materials can lead to long-term cost savings through improved fuel efficiency and reduced maintenance costs.Furthermore, lightweight materials can provide a competitive advantage in the market. Automakers that offer fuel-efficient vehicles with lower emissions and superior performance can attract a growing segment of environmentally conscious consumers. This competitive edge can translate into increased market share and brand loyalty.

Technological Integration and Autonomous Vehicles

The integration of advanced technologies and the development of autonomous vehicles are driving the adoption of lightweight materials. These technologies demand efficient power consumption and thermal management systems, which are facilitated by reduced vehicle weight.Autonomous vehicles, in particular, require precise control over power-to-weight ratios to ensure optimal performance and safety. Lightweight materials are essential in achieving the balance needed for autonomous systems to operate effectively. As autonomous vehicles become more prevalent, the demand for lightweight materials in their construction and thermal management systems is expected to rise.

Key Market Challenges

Cost Constraints

One of the primary challenges facing the adoption of lightweight materials in the automotive industry is the cost factor. Lightweight materials, such as carbon fiber composites and advanced aluminum alloys, are often more expensive than traditional materials like steel. While the long-term benefits of reduced fuel consumption and emissions are evident, the initial investment in lightweight materials can be a significant barrier, especially for cost-sensitive consumers and manufacturers.Manufacturers must find ways to reduce production costs for lightweight materials through economies of scale, innovative manufacturing processes, and material recycling. Additionally, automakers need to balance the higher upfront costs with the potential long-term savings and communicate these advantages effectively to consumers.

Material Availability and Supply Chain Challenges

The availability of lightweight materials, particularly advanced composites and specialty alloys, can be limited. Sourcing these materials can be challenging due to factors such as geographic restrictions, supply chain disruptions, and fluctuations in material prices.Global supply chain disruptions, as seen during the COVID-19 pandemic, can impact the timely delivery of materials, leading to production delays and increased costs. To address these challenges, automakers must diversify their supply sources, establish contingency plans, and develop strategies to secure a stable supply of lightweight materials.

Material Recycling and Sustainability

While lightweight materials offer substantial weight reduction benefits, their production and disposal can have environmental implications. The challenge lies in ensuring that lightweight materials are produced and recycled in an eco-friendly manner.Sustainability concerns require automakers to explore recycling options for lightweight materials and incorporate recycled materials into their production processes. This includes designing materials that are easily recyclable and environmentally friendly. Meeting sustainability goals is critical not only for regulatory compliance but also for maintaining a positive public image.

Safety and Crashworthiness

Safety remains a paramount concern in the automotive industry. Lightweight materials, although effective in reducing vehicle weight, may raise questions about safety and crashworthiness. Traditional materials like steel are known for their structural integrity and crash protection capabilities.Automakers must carefully balance weight reduction with safety requirements. This involves extensive testing and engineering to ensure that vehicles made with lightweight materials can meet or exceed safety standards. Public perception and consumer trust in the safety of lightweight materials are also essential factors that automakers need to address.

Material Durability and Longevity

Lightweight materials, particularly composites, may face challenges related to durability and longevity. Factors like exposure to extreme weather conditions, UV radiation, and wear and tear can affect the performance and lifespan of lightweight materials.To overcome these challenges, manufacturers must invest in research and development to enhance the durability of lightweight materials. Protective coatings, advanced manufacturing techniques, and comprehensive testing are crucial to ensure that these materials can withstand the rigors of daily use and maintain their structural integrity over time.

Design and Manufacturing Complexity

Adopting lightweight materials can introduce complexity into the design and manufacturing processes. Lightweight materials often require different manufacturing techniques, tools, and equipment compared to traditional materials like steel.Automakers need to invest in advanced manufacturing capabilities and employee training to effectively work with lightweight materials. Designing vehicles that maximize the benefits of lightweight materials while maintaining performance and safety standards is a delicate balance that requires sophisticated engineering and design expertise.

Integration with Existing Manufacturing Infrastructure

Integrating lightweight materials into existing manufacturing infrastructure can be a significant challenge. Traditional assembly lines and manufacturing processes may not be optimized for working with lightweight materials, leading to inefficiencies and increased production costs.Automakers must carefully plan and invest in upgrading their manufacturing facilities to accommodate lightweight materials effectively. This includes retooling assembly lines, training personnel, and optimizing processes to ensure seamless integration and cost-effective production.

Regulatory Compliance and Certification

Meeting stringent regulatory requirements and obtaining certifications for vehicles constructed with lightweight materials can be a complex and time-consuming process. Ensuring that vehicles comply with safety, emissions, and other regulatory standards is non-negotiable.Automakers need to invest in extensive testing and validation to ensure that vehicles made with lightweight materials can pass regulatory inspections. Additionally, they must navigate the intricacies of varying standards in different regions, adding to the complexity of regulatory compliance.

Consumer Perception and Acceptance

Consumer perception and acceptance of vehicles made with lightweight materials are crucial for their successful adoption in the market. Some consumers may have reservations about lightweight materials, associating them with reduced safety or concerns about long-term durability.Automakers need to educate consumers about the benefits of lightweight materials, emphasizing the positive impact on fuel efficiency, emissions reduction, and overall performance. Building consumer trust in the safety and reliability of vehicles made with lightweight materials is essential to drive adoption.

Competition from Alternative Technologies

While lightweight materials are a popular choice for weight reduction, automakers also face competition from alternative technologies, such as advanced engine designs, hybridization, and alternative fuels. These technologies offer different paths to achieving fuel efficiency and emissions reduction goals.To address this challenge, automakers must carefully evaluate the most suitable technology mix for their vehicles, considering factors like vehicle type, market demand, and regulatory requirements. A balanced approach that combines lightweight materials with other technologies may be necessary to stay competitive.

Key Market Trends

Increasing Use of Advanced Composites

One of the most notable trends in the automotive lightweight materials market is the increasing use of advanced composites, particularly carbon fiber-reinforced plastics (CFRP). These composites offer an exceptional strength-to-weight ratio, making them an attractive choice for reducing vehicle weight while maintaining structural integrity.Automakers are incorporating CFRP in various vehicle components, including body panels, chassis, and interior elements. CFRP's versatility and strength have made it a preferred choice in high-performance and luxury vehicles. As manufacturing processes improve and costs decrease, CFRP's adoption is expected to expand beyond premium segments, becoming more common in mainstream vehicles.

Growing Demand for Aluminum Alloys

Aluminum alloys have long been favored in the automotive industry for their lightweight properties and corrosion resistance. This trend continues to grow as automakers seek ways to reduce vehicle weight without compromising safety.The demand for aluminum alloys is evident in the construction of vehicle bodies, chassis components, and engine parts. Aluminum's malleability allows for intricate designs, contributing to improved vehicle performance and fuel efficiency. As automakers explore ways to increase fuel economy and extend electric vehicle ranges, the use of aluminum alloys is expected to remain a prominent trend.

High-Strength Steel for Weight Reduction

High-strength steel alloys have gained prominence in the automotive lightweight materials market due to their unique combination of strength and weight reduction. These steel alloys enable automakers to design vehicles that are lighter yet maintain safety and crashworthiness standards.High-strength steel is commonly used in structural components, such as vehicle frames and safety cages. It contributes to improved vehicle rigidity and crash protection while reducing overall weight. As automakers seek cost-effective lightweighting solutions, high-strength steel is expected to remain a key material choice.

Focus on Mixed-Material Strategies

A significant trend in the automotive lightweight materials market is the adoption of mixed-material strategies. Automakers are increasingly using a combination of lightweight materials to optimize weight reduction while meeting various performance requirements.Mixed-material strategies involve selecting the most suitable materials for specific vehicle components based on factors such as strength, weight, and cost. For example, a vehicle may incorporate aluminum for body panels, high-strength steel for structural components, and composites for interior elements. This approach allows automakers to achieve weight reduction targets without compromising safety or performance.

Development of Bio-Based and Sustainable Materials

Sustainability is a growing concern in the automotive industry, leading to the development and adoption of bio-based and sustainable materials. Automakers are exploring alternatives to traditional petroleum-based plastics and composites to reduce their environmental footprint.Bio-based materials, such as bio-plastics and natural fibers, are being used in interior components like dashboards and door panels. Additionally, recycled and recyclable materials are gaining traction, aligning with circular economy principles. These sustainable materials not only reduce the environmental impact of vehicle production but also appeal to environmentally conscious consumers.

Lightweight Materials for Electric Vehicles (EVs) and Hybrid Vehicles

The rise of electric vehicles (EVs) and hybrid vehicles is driving the demand for lightweight materials. Weight reduction is crucial in EVs and hybrids to maximize range and energy efficiency. As automakers aim to compete in the growing EV market, lightweight materials play a pivotal role in optimizing vehicle performance.EVs, in particular, benefit from lightweight materials in their battery packs, chassis, and body structures. Advanced composites and aluminum alloys are often used to reduce the overall weight of these components, contributing to improved range and acceleration.

Integration of Smart and Connected Technologies

Another significant trend is the integration of smart and connected technologies in vehicles, which influences the choice of lightweight materials. As vehicles become more technologically advanced, the need to accommodate sensors, wiring, and electronic components is paramount.Lightweight materials that offer electromagnetic interference (EMI) shielding properties are favored to protect sensitive electronics. Additionally, these materials should be designed to facilitate the routing of cables and wires required for smart features like advanced driver-assistance systems (ADAS) and infotainment systems. The integration of these technologies drives the demand for lightweight materials that can accommodate complex wiring while maintaining overall vehicle weight.

3D Printing and Additive Manufacturing

3D printing and additive manufacturing technologies are increasingly being used in the automotive industry to create lightweight components with intricate designs. These technologies enable the production of complex geometries that would be challenging or impossible to achieve using traditional manufacturing methods.Automakers are utilizing 3D printing to produce lightweight components, such as brackets, heat shields, and interior trim pieces. The ability to customize parts and reduce material waste makes 3D printing an attractive option for lightweighting initiatives. As additive manufacturing technologies continue to advance, their role in the automotive lightweight materials market is expected to expand.

Regulatory and Emission Standards Compliance

Stringent emissions regulations and fuel efficiency standards continue to drive the adoption of lightweight materials. Automakers must comply with these regulations to avoid penalties and maintain a positive public image. To meet emission targets, automakers are turning to lightweight materials to reduce vehicle weight and improve fuel economy.Regulatory agencies worldwide are imposing stricter emissions standards, which incentivize automakers to prioritize lightweighting as part of their compliance strategy. This trend is expected to persist as governments and environmental organizations advocate for cleaner and more fuel-efficient vehicles.

Consumer Demand for Performance and Efficiency

Consumer demand for vehicles that offer both performance and efficiency is a trend shaping the automotive lightweight materials market. Modern consumers seek vehicles that provide a dynamic driving experience while also delivering improved fuel economy.Automakers are responding to this demand by incorporating lightweight materials to enhance vehicle performance. Lightweighting not only contributes to better acceleration and handling but also reduces energy consumption, aligning with consumers' expectations for efficient and agile vehicles.

Segmental Insights

Vehicle Type Insights

The global automotive lightweight materials market is segmented into various vehicle types including passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles currently dominate the market due to the high demand for fuel efficiency and performance enhancement. These vehicles extensively use lightweight materials such as high-strength steel, aluminium, and carbon fibre composites for their bodies, chassis, and powertrains. On the other hand, commercial vehicles are slowly adopting lightweight materials to improve payload capacity and fuel economy. As environmental regulations tighten, it's expected that the use of these materials will increase across all vehicle types.Material Type Insights

The global automotive lightweight materials market comprises a diverse range of materials that substantially lower vehicle weight, improving fuel efficiency and performance. This market includes high-strength steel, aluminium, magnesium, titanium, and advanced polymers and composites. High-strength steel and aluminium are widely used due to their substantial weight reduction capabilities and cost-effectiveness. Moreover, advanced polymers and composites, while relatively expensive, offer exceptional weight savings and are increasingly being integrated into high-performance and luxury vehicles. The demand for these materials is set to surge, driven by stringent emission regulations and a growing emphasis on electric vehicle production.Regional Insights

In North America, the automotive lightweight materials market is witnessing significant growth due to stringent government regulations regarding emission control and fuel economy. The surge in demand for electric vehicles is also contributing to market expansion in this region. Additionally, Europe, with its robust automotive industry and high environmental awareness, is adopting lightweight materials to reduce vehicle weight and enhance fuel efficiency. Meanwhile, the Asia-Pacific region, led by China and India, is expected to show substantial growth in the coming years thanks to rapid industrialization, increasing consumer demand for fuel-efficient vehicles, and the presence of major automobile manufacturers.Key Market Players

- Covestro AG

- AcrelorMittal

- Lyondellbassel Industries Holding B.V.

- ThyssenKrupp AG

- Toray Industries Inc.

- BASF SE

- Novelis Inc.

- Alcoa Corporation

- Owens Corning

- Stratasys Ltd.

Report Scope

In this report, the Global Automotive Lightweight Materials Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Lightweight Materials Market, by Material Type:

- Metals

- Composites

- Plastics

- Elastomer

Automotive Lightweight Materials Market, by Component:

- Frame

- Powertrain

- Interior Systems & Components

- Exterior Systems & Components

Automotive Lightweight Materials Market, by Vehicle Type:

- ICE

- Electric

Automotive Lightweight Materials Market, by Region:

- North America

- Europe & CIS

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Lightweight Materials Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Covestro AG

- AcrelorMittal

- Lyondellbassel Industries Holding B.V.

- ThyssenKrupp AG

- Toray Industries Inc.

- BASF SE

- Novelis Inc.

- Alcoa Corporation

- Owens Corning

- Stratasys Ltd.

Table Information

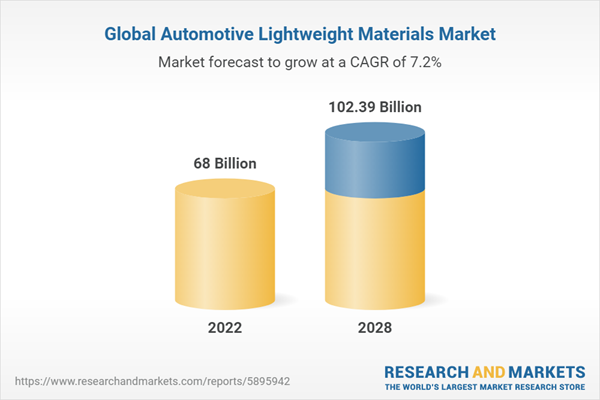

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 68 Billion |

| Forecasted Market Value ( USD | $ 102.39 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |