Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

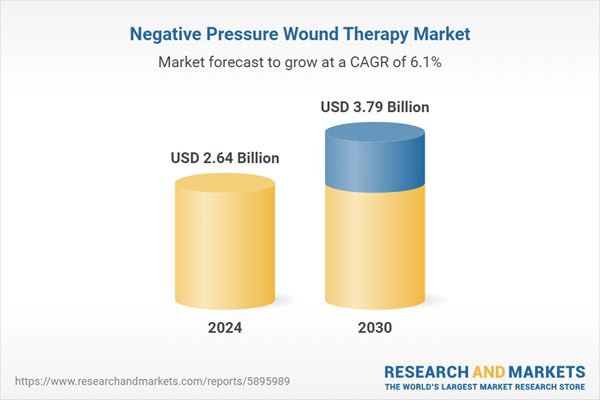

For example, WHO reported that 422 million adults were living with diabetes as of 2014, significantly increasing the burden of wound-related complications. Currently, conventional NPWT systems hold the largest market share, particularly in clinical environments, while single-use variants are growing rapidly due to their convenience and affordability. North America leads in market share due to robust healthcare infrastructure, while the Asia-Pacific region is projected to witness the fastest growth, fueled by an increasing patient base and improving medical facilities.

Key Market Drivers

Aging Population

The increasing global elderly population significantly contributes to the growth of the NPWT market. According to WHO, by 2030, one in six people globally will be aged 60 or older, with this number expected to rise from 1.4 billion in 2030 to 2.1 billion by 2050. Aging is commonly linked to chronic illnesses such as diabetes, obesity, and circulatory disorders, all of which heighten the risk of chronic wounds like pressure ulcers. As longevity improves worldwide, the demand for advanced wound care, particularly NPWT, is rising. For example, the World Obesity Federation estimates that by 2030, one billion people will be living with obesity, a condition that increases the risk of pressure injuries. The combination of these trends underscores a growing need for effective wound management solutions tailored to an aging, comorbidity-prone demographic.Key Market Challenges

High Initial Costs

A key obstacle in the Negative Pressure Wound Therapy market is the high initial investment required for equipment and consumables. NPWT systems - including pumps, dressings, and accessories - can represent a considerable expense for healthcare providers. Smaller hospitals, outpatient clinics, and under-resourced facilities may struggle to implement this technology due to budgetary constraints. This financial barrier limits adoption, particularly in developing markets, despite the therapy's proven clinical benefits.Key Market Trends

Portable and Wearable Devices

The NPWT market is witnessing a notable shift toward portable and wearable devices. Unlike traditional NPWT systems that are often bulky and limit patient mobility, new compact systems offer patients the ability to continue daily activities during treatment. These devices enhance convenience, improve compliance, and support outpatient and home care settings. With growing demand for user-friendly wound care solutions, the development and adoption of portable NPWT technology is expected to accelerate, transforming how wound therapy is delivered across healthcare environments.Key Market Players

- Acelity LP Inc

- Talley's Group Ltd

- Smith & Nephew PLC

- Devon Health Services Inc

- Molnlycke Health Care AB

- Medela AG

- DeRoyal Industries Inc

- ConvaTec Inc

- Cardinal Health Inc

- PAUL HARTMANN AG

Report Scope:

In this report, the Global Negative Pressure Wound Therapy Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Negative Pressure Wound Therapy Market, By Product:

- Conventional NPWT

- Single-Use NPWT

Negative Pressure Wound Therapy Market, By Wound Type:

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Pressure Ulcers

- Burn Wounds

- Others

Negative Pressure Wound Therapy Market, By End-use:

- Hospitals

- Homecare

- Others

Negative Pressure Wound Therapy Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Negative Pressure Wound Therapy Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Acelity LP Inc

- Talley's Group Ltd

- Smith & Nephew PLC

- Devon Health Services Inc

- Molnlycke Health Care AB

- Medela AG

- DeRoyal Industries Inc

- ConvaTec Inc

- Cardinal Health Inc

- PAUL HARTMANN AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.64 Billion |

| Forecasted Market Value ( USD | $ 3.79 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |