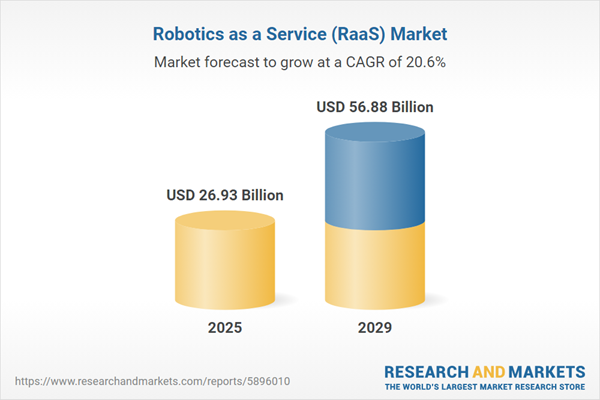

The robotics as a service (RaaS) market size is expected to see exponential growth in the next few years. It will grow to $56.88 billion in 2029 at a compound annual growth rate (CAGR) of 20.6%. The growth in the forecast period can be attributed to the expansion of Industry 4.0, the rising need for flexible and scalable automation solutions, growth in the healthcare sector, the adoption of robotics in agriculture, and increasing demand for collaborative robots (cobots). Major trends in the forecast period include technological advancements or innovations, development of robot-as-a-service business models, integration of artificial intelligence in robotics, increased use of robotics in customer service, and focus on human-robot collaboration.

The growing demand for automation is anticipated to drive the expansion of the robotics as a service (RaaS) market in the future. Automation involves utilizing technology, machinery, or systems to carry out tasks and processes with minimal or no human involvement. It plays a vital role in robotics-as-a-service (RaaS) by facilitating the efficient and seamless operation of robotic systems across various industries. By harnessing automation, RaaS providers can deliver cost-effective, scalable, and advanced robotic solutions customized to meet their clients' specific requirements. For example, in May 2023, the International Federation of Robotics, a Germany-based non-profit organization, reported that industrial robot installations in manufacturing rose by 12% overall in 2022, reaching 41,624 units. The automotive sector, primarily comprising US, Canadian, and Mexican companies, was the leading adopter, with 20,391 units installed, marking a 30% increase from 2021. Therefore, the increasing demand for automation is propelling the growth of the robotics as a service (RaaS) market.

A significant catalyst for the expansion of the RaaS market is the surging demand in the hospitality industry. Embraced by this sector, RaaS facilitates efficient and contact-minimized services, such as navigating hotel corridors for order deliveries to guest rooms and conducting routine inspections and minor repairs. The hospitality industry's growing prominence is evident, with the National Restaurant Association revealing $997 billion in industry sales and 15.5 million in industry employment in 2023. Consequently, the increasing demand for RaaS solutions in the hospitality sector propels the overall growth of the robotics-as-a-service market.

Major companies in the robotics-as-a-service market are concentrating on investing in RaaS to improve operational efficiency, lower upfront costs for clients, and provide scalable solutions that can be tailored to meet industry-specific requirements. Investing in Robotics as a Service (RaaS) entails funding or acquiring services where robots are offered on a subscription or pay-per-use basis, enabling businesses to expand their automation capabilities without the substantial initial investment required to purchase robots. For example, in July 2023, Instock, a US-based provider of robotic-as-a-service, secured $3.2 million in new funding, led by the Amazon Industrial Innovation Fund. This investment from the Amazon Industrial Innovation Fund is particularly significant as it highlights a larger trend toward automation in warehousing and fulfillment processes, driven by the rapid expansion of eCommerce.

Major players in the RaaS market are not only embracing technological innovations but also introducing next-generation solutions, such as agricultural robots. These robots, designed for the agriculture industry, provide a range of services, including harvesting, weed control, planting seeds, and environmental monitoring. Solinftec, a Brazil-based ag-tech company, launched Solix in May 2022. Solix is an autonomous crop monitoring robot equipped with AI technology, onboard cameras, and sensors to monitor plant health, detect insect damage, and assess changes in the field. Such advancements underscore the commitment of RaaS providers to delivering reliable and cutting-edge solutions.

In October 2023, Rockwell Automation Inc., a US-based company specializing in automation, acquired Clearpath Robotics Inc. for an undisclosed amount. This acquisition is intended to bolster Rockwell Automation's capabilities in autonomous robotics and broaden its range of advanced automation solutions, facilitating improved efficiency and flexibility in manufacturing and industrial operations. Clearpath Robotics Inc. is a Canada-based company that provides robotics as a service.

Major companies operating in the robotics as a service (RaaS) market include Lely Industries N.V., Kongberg Maritime AS, GreyOrange Pte Ltd., Locus Robotics Corp., 6 River Systems Inc., Avidbots Corporation, Sarcos Technology and Robotics Corporation, Mobile Industrial Robots A/S, Omron Adept Technology Inc., Seegrid Corporation, Soft Robotics Inc., DroneDeploy Inc., Nuro Inc., Kiwibot Inc., Northrop Grumman Corporation, Fetch Robotics Inc., inVia Robotics Inc., AutoX, Aethon Inc., Starship Technologies Inc., Cyberdyne Inc., Udelv, Cobalt Robotics Inc., CRG Automation, FANUC Corp., Knightscope Inc., Relay Robotics Inc.

Asia-Pacific was the largest region in the robotics as a service (RaaS) market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the robotics as a service (raas) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the robotics as a service (raas) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Robotics as a Service (RaaS) is a model where robotic technologies and capabilities are provided to customers on a subscription or pay-per-use basis. This model offers several advantages to businesses and organizations, fostering the democratization of robotics by making advanced robotic technologies accessible to a broader range of companies. It enables automation, efficiency, and innovation across diverse sectors.

The main types of Robotics as a Service (RaaS) are professional and personal. Professional service robots are semi-autonomous or fully autonomous robots with mobility that interact with people in various professional settings. These robots find applications in handling, assembling, dispensing, processing, welding and soldering, among others. They are utilized in sectors such as agriculture, inspection and maintenance, healthcare, search and rescue, hospitality, professional cleaning, gardening, transport and logistics, and others.

The robotics as a service (RaaS) market research report is one of a series of new reports that provides robotics as a service (RaaS) market statistics, including robotics as a service (RaaS) industry global market size, regional shares, competitors with a robotics as a service (RaaS) market share, detailed robotics as a service (RaaS) market segments, market trends and opportunities, and any further data you may need to thrive in the robotics as a service (RaaS) industry. This robotics as a service (RaaS) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The robotics as a service (RaaS) market consists of revenues earned by entities by providing services such as leasing robotic, cloud-based subscription services, customization, data analytics, and reporting. The market value includes the value of related goods sold by the service provider or included within the service offering. The robotics as a service (RaaS) market also includes sales of autonomous mobile robots (AMRs), industrial robots, and collaborative robots. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Robotics As a Service (RaaS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on robotics as a service (raas) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for robotics as a service (raas)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The robotics as a service (raas) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Professional; Personal2) By Application: Handling; Assembling; Dispensing; Processing; Welding and Soldering; Other Applications

3) By End User: Agriculture; Inspection and Maintenance; Healthcare; Search and Rescue; Hospitality; Professional Cleaning; Gardening; Transport and Logistics; Other End Users

Subsegments:

1) By Professional: Industrial Robots; Commercial Service Robots; Logistics and Warehouse Robots; Medical Robots; Agricultural Robots2) By Personal: Domestic Service Robots; Companion Robots; Educational Robots; Entertainment Robots; Healthcare Support Robots

Key Companies Mentioned: Lely Industries N.V.; Kongberg Maritime AS; GreyOrange Pte Ltd.; Locus Robotics Corp.; 6 River Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Lely Industries N.V.

- Kongberg Maritime AS

- GreyOrange Pte Ltd.

- Locus Robotics Corp.

- 6 River Systems Inc.

- Avidbots Corporation

- Sarcos Technology and Robotics Corporation

- Mobile Industrial Robots A/S

- Omron Adept Technology Inc.

- Seegrid Corporation

- Soft Robotics Inc.

- DroneDeploy Inc.

- Nuro Inc.

- Kiwibot Inc.

- Northrop Grumman Corporation

- Fetch Robotics Inc.

- inVia Robotics Inc.

- AutoX

- Aethon Inc.

- Starship Technologies Inc.

- Cyberdyne Inc.

- Udelv

- Cobalt Robotics Inc.

- CRG Automation

- FANUC Corp.

- Knightscope Inc.

- Relay Robotics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 26.93 Billion |

| Forecasted Market Value ( USD | $ 56.88 Billion |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |