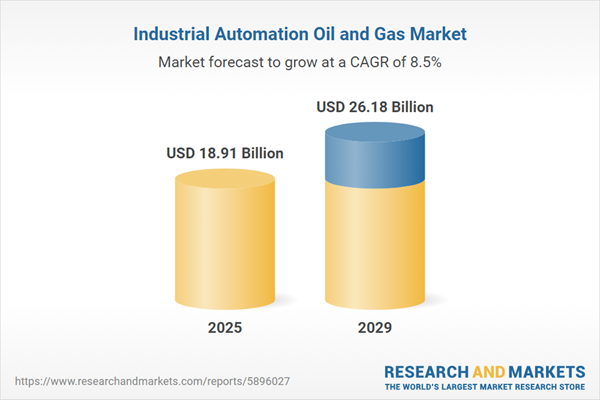

The industrial automation oil and gas market size is expected to see strong growth in the next few years. It will grow to $26.18 billion in 2029 at a compound annual growth rate (CAGR) of 8.5%. The growth in the forecast period can be attributed to demand for remote monitoring and control, adoption of scada (supervisory control and data acquisition) systems, growth in unconventional oil and gas resources, implementation of advanced process control (APC), expansion of industrial internet of things (IIOT), emphasis on cybersecurity in industrial automation, adoption of cloud-based automation solutions, increased use of wireless sensor networks. Major trends in the forecast period include advances in control systems and sensors, integration of artificial intelligence in automation, rise of robotics and autonomous systems, focus on energy efficiency and sustainability, collaboration between automation providers and oil companies, development of digital twins for asset management, use of augmented reality in training and maintenance.

The anticipated growth of the industrial automation oil and gas market is driven by the increasing adoption of the Internet of Things (IoT). The IoT is a networked system that connects various computing devices, electronic machinery, and sensors, allowing them to transfer data without direct human interaction. Integration of IoT devices and sensors into different components and processes of the oil and gas industry enables real-time monitoring and data collection. This facilitates efficient tracking of equipment performance, environmental conditions, and safety parameters, leading to improved predictive maintenance and reduced downtime. As per a report by the Global Mobile Supplier Association (GSA) in March 2023, global IoT connections reached 13.2 billion in 2022 and are projected to grow by 18% to 34.7 billion by 2028. Thus, the increasing utilization of the IoT is a key driver for the industrial automation oil and gas market.

The growth of the industrial automation oil and gas market is further expected to be boosted by the growing energy demand. Energy demand refers to the amount of energy required within a specified period by individuals, industries, or nations. The oil and gas industry invests in advanced technologies to enhance operational efficiency, optimize resource utilization, and ensure consistent, reliable production in response to rising energy demand. According to an April 2023 report by the Energy Information Administration, the United States is projected to experience increased energy consumption across all forms, with an expected growth ranging from 0% to 15% from 2022 to 2050. The industrial sector's energy consumption is anticipated to rise by approximately 5% to 32% during the same period. Therefore, the growing energy demand is a significant factor driving the growth of the industrial automation oil and gas market.

A prominent trend in the industrial automation oil and gas market is the focus on product innovations by major companies. These companies are introducing cutting-edge software tools in the oil and gas industry to maintain their market positions. For instance, GE Digital LLC, a U.S.-based company specializing in data analysis and software development services, launched the Accelerator tools in June 2022. These tools include best-in-class software tools designed to help companies in asset-intensive energy industries quickly configure their asset performance management (APM) and other offerings. The tools aim to expedite time-to-value, scale APM to a broader range of assets, and assist organizations in gaining financial value across facilities and the enterprise. The Accelerator tools are applicable throughout the entire energy value chain, from oil and gas to power-generating assets, encompassing renewable energy and conventional gas power and nuclear production facilities.

Major companies in the industrial automation oil and gas market are also developing advanced technologies, such as real-time monitoring solutions, to cater to larger customer bases, increase sales, and drive revenue growth. Real-time monitoring involves continuous, instantaneous tracking and analysis of data, events, or processes as they occur. In August 2022, TWMA, a UK-based drilling waste management company, launched the XLink solution, a unique hardware and software system upgrade for enhanced wellsite drill cutting processing in the oil and gas industry. This solution offers increased automation, deeper insights, and real-time data monitoring to boost operational efficiency. XLink features a patent-pending air mixing system, XLink CST automation, retrofitted into the cuttings, storage, and transfer tank (CST). It conditions drill cuttings without manual intervention, significantly reducing personnel on board (POB) requirements. Additionally, XLink enables offshore automation for POB reduction and allows live monitoring of drilling waste operations worldwide.

In April 2023, Roeslein & Associates Inc., a U.S.-based company providing engineering, modular manufacturing, and construction services, acquired Method Flow Products LLC for an undisclosed amount. This strategic acquisition expands Roeslein's resource consortium with six additional locations in the United States and 71 specialized services and skilled artisans. The goal is to diversify business into new markets and expand the application of prefabricated and preassembled modular systems into new industries. Method Flow Products LLC, a U.S.-based manufacturer of oil and gas monitoring and automation products, brings expertise in equipment installation, servicing, and measuring calibration to enhance Roeslein's capabilities.

Major companies operating in the industrial automation oil and gas market include Siemens AG, General Electric Company, Mitsubishi Electric Corporation, Schneider Electric SE, Honeywell International Inc., ABB Ltd., Eaton Corp., Emerson Electric Co., Rockwell Automation Inc., FANUC CORPORATION, Fuji Electric Co. Ltd., Omron Corporation, AMETEK Inc., Phoenix Contact, Festo Group, Endress+Hauser Group, Yokogawa Electric Corporation, AZBIL North Americas Inc., KUKA AG, WAGO Corp., Krohne Group, Pepperl+Fuchs SE, Beckhoff Automation LLC, Yokohama Industries Americas, Hitachi Industrial Equipment Systems Co. Ltd., VEGA Grieshaber KG.

Asia-Pacific was the largest region in the industrial automation oil and gas market in 2024. The regions covered in the industrial automation oil and gas market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the industrial automation oil and gas market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Industrial automation in the oil and gas sector involves the application of advanced technologies and control systems to automate processes throughout the extraction, production, refining, and distribution of oil and gas. The implementation of industrial automation in this industry serves to enhance efficiency, safety, and productivity while simultaneously reducing operational costs and minimizing human intervention.

The primary types of components in industrial automation for oil and gas include industrial robots, control valves, field instruments, human-machine interfaces (HMI), industrial PCs, process analyzers, intelligent pigging, and vibration monitoring. Industrial robots are programmable and automated devices capable of executing tasks with multiple axes of motion. These robots find applications across upstream, midstream, and downstream operations and are integrated into various solutions such as supervisory control and data acquisition (SCADA), programmable logic controllers (PLC), distributed control systems (DCS), manufacturing execution systems (MES), functional safety, and plant asset management (PAM).

The industrial automation oil and gas market research report is one of a series of new reports that provides industrial automation oil and gas market statistics, including industrial automation oil and gas industry global market size, regional shares, competitors with an industrial automation oil and gas market share, detailed industrial automation oil and gas market segments, market trends and opportunities, and any further data you may need to thrive in the industrial automation oil and gas industry. This industrial automation oil and gas market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The industrial automation oil and gas market consists of revenues earned by entities by providing drilling systems automation, process automation solutions, robot-as-a-service (RaaS) solutions, and operational digital twins. The market value includes the value of related goods sold by the service provider or included within the service offering. The industrial automation oil and gas market also includes sales of machines, actuators, sensors, processors, and networks that are used in providing automation services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Industrial Automation Oil and Gas Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on industrial automation oil and gas market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industrial automation oil and gas? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The industrial automation oil and gas market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Industrial Robots; Control Valves; Field Instruments; Human Machine Interference (HMI); Industrial PC; Process Analyzer; Intelligent Pigging; Vibration Monitoring2) By Stream: Upstream; Midstream; Downstream

3) By Solutions: Supervisory Control and Data Acquisition (SCADA); Programmable Logic Controller (PLC); Distributed Control Systems (DCS); Manufacturing Execution System (MES); Functional Safety; Plant Asset Management (PAM)

Subsegments:

1) By Industrial Robots: Articulated Robots; SCARA Robots; Collaborative Robots (Cobots)2) By Control Valves: Ball Valves; Gate Valves; Globe Valves; Butterfly Valves

3) By Field Instruments: Pressure Transmitters; Flow Meters; Temperature Sensors

4) By Human Machine Interface (HMI): Software HMI; Hardware HMI

5) By Industrial PC: Panel PCs; Rack-Mount PCs

6) By Process Analyzer: Gas Analyzers; Liquid Analyzers

7) By Intelligent Pigging: Magnetic Flux Leakage (MFL) Pigs; Ultrasonic Pigs

8) By Vibration Monitoring: Portable Vibration Analyzers; Online Vibration Monitoring Systems

Key Companies Mentioned: Siemens AG; General Electric Company; Mitsubishi Electric Corporation; Schneider Electric SE; Honeywell International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- General Electric Company

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Eaton Corp.

- Emerson Electric Co.

- Rockwell Automation Inc.

- FANUC CORPORATION

- Fuji Electric Co. Ltd.

- Omron Corporation

- AMETEK Inc.

- Phoenix Contact

- Festo Group

- Endress+Hauser Group

- Yokogawa Electric Corporation

- AZBIL North Americas Inc.

- KUKA AG

- WAGO Corp.

- Krohne Group

- Pepperl+Fuchs SE

- Beckhoff Automation LLC

- Yokohama Industries Americas

- Hitachi Industrial Equipment Systems Co. Ltd.

- VEGA Grieshaber KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.91 Billion |

| Forecasted Market Value ( USD | $ 26.18 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |