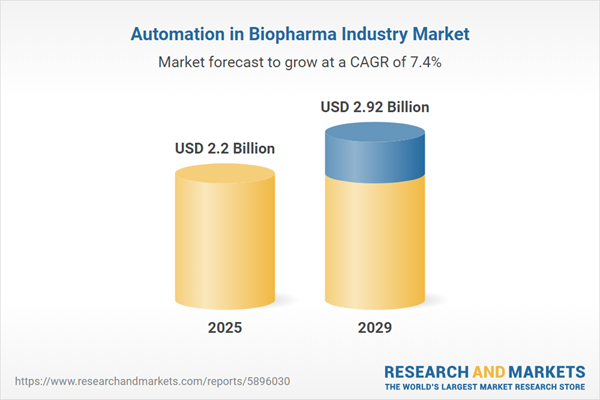

The automation in biopharma industry market size is expected to see strong growth in the next few years. It will grow to $2.92 billion in 2029 at a compound annual growth rate (CAGR) of 7.4%. The growth in the forecast period can be attributed to enhanced data integrity and documentation, rise of personalized medicine, rise of modular and flexible bioprocessing facilities, evolution of automation platforms, rising demand for biosimilars, adoption of smart sensors and internet of things (iot). Major trends in the forecast period include advances in robotics and automation technologies, advancements in single-use technologies, integration of artificial intelligence in bioprocessing, advances in process analytical technologies (pat), collaboration between biopharma and technology companies, emphasis on sustainability in biopharma automation.

The rising adoption of robots in pharmaceutical manufacturing is expected to drive the growth of automation in the biopharma industry market. Robots in this context refer to advanced automated systems and machines that carry out various tasks in the production and packaging of pharmaceutical products. They are utilized across multiple applications in pharmaceutical manufacturing, including secondary packaging, intralogistics, laboratory automation, pick and place, pharmacy process automation, and personalized medicine. This leads to greater productivity, enhanced precision, reduced contamination risks, and improved worker safety. For instance, in September 2024, the International Federation of Robotics, a Germany-based professional non-profit organization, reported that industrial robot installations in the manufacturing sector in Europe rose by 9%, reaching a record high of 92,393 units. Of these, 80% were installed within the European Union, totaling 73,534 units - a 2% increase from the previous year. Therefore, the growing adoption of robots in pharmaceutical manufacturing will drive the expansion of automation in the biopharma industry market.

The growth of automation in the biopharma industry market is further expected to be fueled by the increasing pace of drug development. The process of drug development involves the discovery and introduction of new pharmaceutical products to the market. As drug development intensifies, the automation of processes becomes essential within the biopharma industry. Automated systems play a crucial role in streamlining processes, expediting research, ensuring precision, and enhancing overall efficiency. For example, in 2022, the Center for Drug Evaluation and Research (CDER) granted approval to 37 new drugs, categorized as novel drugs, with 54% of them receiving approval in the same year. Hence, the surge in drug development activities acts as a catalyst for the growth of automation in the biopharma industry market.

A prominent trend in the automation in the biopharma industry market is the adoption of technological advancements by major companies. These companies are actively engaged in developing advanced product technologies to fortify their positions in the market. An illustration of this trend is observed in the actions of PerkinElmer Inc., a US-based company providing scientific solutions and technologies. In September 2022, PerkinElmer Inc. introduced the Cellaca PLX Image Cytometry System, an advanced automated cell analysis solution designed to simplify cell and gene therapy research and manufacturing. This platform enables researchers to assess critical quality attributes of cell samples, including identity, quantity, and quality, through an automated workflow. The integrated system encompasses image cytometer hardware, software, validated consumables, and trackable data reporting, streamlining calibration and training requirements.

Major companies in the automation in biopharma industry market are actively developing advanced technologies, including automated customer data platforms (CDP)To cater to a larger customer base, boost sales, and increase revenue. An automated CDP is a software solution designed to automatically collect, organize, and analyze customer data from diverse sources in a centralized manner. For instance, Tealium, a US-based provider of customer data orchestration tools, launched Tealium for Pharma in July 2022. This verticalized platform is meticulously crafted to fully automate and enhance the customer experience for Pharma audiences, addressing the challenges posed by dynamic privacy and security regulations in the industry. Tealium's data-first offering integrates and automates data seamlessly, resulting in an elevated customer experience while adhering to the highest standards of Health Insurance Portability and Accountability Act (HIPAA) compliance.

In April 2022, Bruker Corporation, a US-based company specializing in scientific instruments for molecular and materials research, acquired Optimal Industrial Automation Limited for an undisclosed amount. This acquisition positions Bruker as a key provider of software and solutions for small molecule, biologic, and new drug modalities in pharma companies. Optimal Industrial Automation Limited, based in the UK, offers pharmaceutical and biopharmaceutical automation solutions, including process analytical technology (PAT), manufacturing automation, quality assurance (QA) software, and systems integration.

Major companies operating in the automation in biopharma industry market include F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Danaher Corporation, ABB Ltd, Siemens Healthineers AG, Emerson Electric Co., Becton Dickinson and Company (BD), Corning Incorporated, Rockwell Automation Inc., Agilent Technologies Inc., PerkinElmer Inc., Sartorius AG, bioMérieux SA, Mettler-Toledo International Inc., Beckman Coulter Inc., Waters Corporation, Pall Corporation, Bruker Corporation, Qiagen N.V., Eppendorf AG, Tecan Group Ltd., Promega Corporation, Brooks Automation Inc., Omron Automation, Hamilton Company, Integra Biosciences AG, Gilson Inc., Analytik Jena AG, BioTek Instruments Inc.

North America was the largest region in the automation in biopharma industry market in 2024. The regions covered in the automation in biopharma industry market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the automation in biopharma industry market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Automation within the biopharma industry involves the incorporation of advanced technologies and robotics across different stages of the biopharmaceutical manufacturing process. This entails utilizing automated systems and equipment to execute tasks that were conventionally handled by humans, with the aim of enhancing efficiency, precision, and overall productivity in the production of biopharmaceutical products.

The principal technologies driving automation in the biopharma industry encompass automation technology and digitization technology. Automation technology encompasses the utilization of diverse technologies, such as robotics, artificial intelligence (AI), and software systems, to automate and streamline processes and tasks that were traditionally carried out by humans. This includes various components such as automation hardware, automation software, service project phases, and service operation phases, with applications spanning clinical phases, drug discovery phases, and production phases.

The automation in biopharma industry research report is one of a series of new reports that provides automation in biopharma industry market statistics, including the automation in biopharma industry's global market size, regional shares, competitors with a automation in biopharma industry market share, detailed automation in biopharma industry market segments, market trends and opportunities, and any further data you may need to thrive in the automation in biopharma industry. This automation in the biopharma industry market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The automation in biopharma industry market consists of revenues earned by entities by providing high-throughput screening, sample management, and cell culture automation used during the process. The market value includes the value of related goods sold by the service provider or included within the service offering. The automation in biopharma industry market also includes sales of automated dissolution testing systems, robotic sample storage and retrieval systems, and chromatography systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Automation in Biopharma Industry Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on automation in biopharma industry market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automation in biopharma industry? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automation in biopharma industry market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Automation Technology; Digitization Technology2) By Component: Automation Hardware; Automation Software; Services Project Phase; Services Operation Phase

3) By Application: Clinical Phase; Drug Discovery Phase; Production Phase

Subsegments:

1) By Automation Technology: Process Automation; Laboratory Automation; Robotics and Artificial Intelligence; Control Systems; Programmable Logic Controllers (PLCs)2) By Digitization Technology: Data Analytics and Visualization; Electronic Lab Notebooks (ELN); Cloud Computing; Internet of Things (IoT) in Pharma; Digital Twin Technology

Key Companies Mentioned: F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific Inc.; Danaher Corporation; ABB Ltd; Siemens Healthineers AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- ABB Ltd

- Siemens Healthineers AG

- Emerson Electric Co.

- Becton Dickinson and Company (BD)

- Corning Incorporated

- Rockwell Automation Inc.

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Sartorius AG

- bioMérieux SA

- Mettler-Toledo International Inc.

- Beckman Coulter Inc.

- Waters Corporation

- Pall Corporation

- Bruker Corporation

- Qiagen N.V.

- Eppendorf AG

- Tecan Group Ltd.

- Promega Corporation

- Brooks Automation Inc.

- Omron Automation

- Hamilton Company

- Integra Biosciences AG

- Gilson Inc.

- Analytik Jena AG

- BioTek Instruments Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 2.92 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |