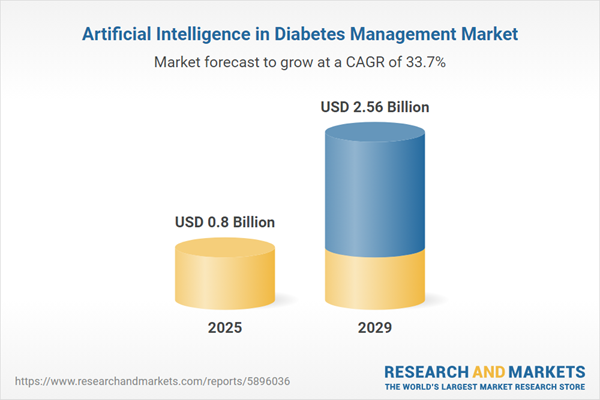

The artificial intelligence in diabetes management market size is expected to see exponential growth in the next few years. It will grow to $2.56 billion in 2029 at a compound annual growth rate (CAGR) of 33.7%. The growth in the forecast period can be attributed to ai-powered decision support systems, telemedicine integration, genomic data utilization, regulatory support. Major trends in the forecast period include advancements in wearable technology, personalized treatment plans, continuous glucose monitoring advances, ai-powered risk prediction, behavioral modification support.

The increasing prevalence of diabetes is expected to drive the growth of artificial intelligence in the diabetes management market in the future. Diabetes occurs when blood glucose, or blood sugar, is elevated, leading to complications such as eye issues, heart attacks, strokes, kidney problems, and more. Artificial intelligence aids in diabetes management by providing insights into high or low blood sugar levels in diabetic patients and collecting previously unused data. For example, in June 2024, according to National Health Service (NHS England), a UK-based publicly funded healthcare system, 3,615,330 people registered with a GP were diagnosed with non-diabetic hyperglycaemia - also known as pre-diabetes - in 2023, compared to 3,065,825 in 2022, reflecting an 18% increase. As a result, the growing prevalence of diabetes is fueling the expansion of artificial intelligence in the diabetes management market.

The escalating demand for telehealth services is poised to bolster the adoption of artificial intelligence within the diabetes management domain. Telehealth involves leveraging telecommunications and digital tools to deliver remote healthcare services to patients and healthcare providers. The amalgamation of artificial intelligence into diabetes care within telehealth services amplifies personalization, monitoring capabilities, and overall efficiency. This integration aids in early complication detection, promotes medication adherence, and provides enhanced decision-making support, thereby elevating patient outcomes and optimizing healthcare resources. For instance, in April 2023, FAIR Health Inc., a non-profit organization in the US, reported a 7.3% surge in national telehealth usage, rising from 5.5% of medical claim lines in December 2022 to 5.9% in January 2023. Consequently, the escalating demand for telehealth services is propelling the advancement of artificial intelligence in the realm of diabetes management.

Advancements in technology stand out as a prominent trend gaining traction within the artificial intelligence segment of the diabetes management market. Key players in this domain are dedicated to pioneering cutting-edge technological solutions to fortify their market presence. For instance, in October 2022, Dr. Mohan’s Diabetes Specialties Center, an India-based chain of hospitals specializing in diabetes care, introduced a groundbreaking artificial intelligence-driven platform for precision diabetes care known as the 3D Initiative. The initiative comprises three components such as DIA, an AI-powered chatbot facilitating pre-recorded digital interactions; DIALA, a user-friendly smartphone application tailored for patients; and DIANA, a medical app focusing on precise diabetic care. Backed by an advanced Total Experience (TX) Automation Platform, this innovation powers an AI-enabled virtual assistant engaging with patients across platforms such as Facebook Messenger, WhatsApp, Google Business Message, and the web.

Significant players in the artificial intelligence sphere of diabetes management are actively developing novel products such as wearable devices aimed at monitoring glucose levels to gain a competitive edge in the market. Wearable glucose monitoring devices are compact, often technologically advanced gadgets designed to continuously or intermittently measure and monitor blood glucose levels. For instance, in October 2023, Dexcom Inc., a US-based medical device manufacturing company, introduced the next-generation G7 continuous glucose monitoring (CGM) system. This system caters to all diabetics nationwide, including pregnant individuals and those aged two years or older. The Dexcom CGM device ensures enhanced user safety by providing alerts for severe hypoglycemia up to 20 minutes in advance, thereby reducing uncertainty in diabetes management. Moreover, the system simplifies sensor replacement with a 12-hour grace period, and its remote monitoring feature facilitates the exchange of glucose data with up to 10 followers.

In January 2022, Glooko Inc., a leading US-based digital diabetes and chronic condition management company, successfully acquired Xbird for an undisclosed amount. Through this acquisition, Xbird is set to play a crucial role in Glooko's strategic vision for leveraging artificial intelligence and providing tailored digital coaching for individuals dealing with chronic diseases. The integration of xbird's innovative Just in Time Adaptive Intervention (JITAI) capabilities with Glooko's well-established global presence is expected to enhance patient outcomes. Xbird GmbH, the acquired company, is based in Germany and specializes in AI-enabled diabetes management.

Major companies operating in the artificial intelligence in diabetes management market include Alphabet Inc., F. Hoffmann-La Roche AG, Abbott Laboratories, Medtronic Plc, Dexcom Inc., Insulet Corporation, Tandem Diabetes Care Inc., LifePlus Inc., Livongo Health Inc., Xeris Pharmaceuticals Inc., Virta Health Corp., Informed Data Systems Inc., Bigfoot Biomedical Inc., Lark Technologies Inc., Smart Meter LLC, Diabeloop SA, Quin Technology Ltd., Wellthy Therapeutics Pvt Ltd., Admetsys LLC, DreaMed Diabetes Ltd., Eyenuk Inc., Glooko Inc., PKvitality, Glytec LLC, Hygieia Inc., TypeZero Technologies Inc., Nemaura Medical Inc., GlucoMe, PredictBGL, Voluntis S.A.

North America was the largest region in the artificial intelligence (AI) in diabetes management market in 2024. The regions covered in the artificial intelligence in diabetes management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the artificial intelligence in diabetes management market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Artificial intelligence in diabetes management involves the use of AI technologies and algorithms to analyze patterns in behavior that may lead to fluctuations in blood sugar levels, whether it be hyperglycemia (high blood sugar) or hypoglycemia (low blood sugar), in patients with diabetes. The application of artificial intelligence in diabetes management contributes to improvements in various aspects of diabetes care, including decision support, prediction of blood sugar levels, lifestyle guidance, and treatment management.

The primary devices integrated into artificial intelligence in diabetes management include diagnostic devices, glucose monitoring devices, insulin delivery devices, and others. Diagnostic devices play a crucial role in determining the nature or underlying cause of specific phenomena, particularly those associated with health issues such as diabetes. The various techniques employed in this context include case-based reasoning and intelligent data analysis. These technologies find application in diverse settings, including hospitals, clinics, home care settings, and research institutes.

The artificial intelligence in diabetes management market research report is one of a series of new reports that provides artificial intelligence in diabetes management market statistics, including the artificial intelligence in diabetes management industry's global market size, regional shares, competitors with artificial intelligence in diabetes management market share, detailed artificial intelligence in diabetes management market segments, market trends and opportunities, and any further data you may need to thrive in the artificial intelligence in diabetes management industry. This artificial intelligence in diabetes management market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The artificial intelligence in diabetes management market consists of revenues earned by entities by providing automated retinal screening, clinical decision support, disease prediction, and treatment management. The market value includes the value of related goods sold by the service provider or included within the service offering. The artificial intelligence in the diabetes management market also includes sales of glucose monitors, support vector machines, and smart wearables. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Artificial Intelligence in Diabetes Management Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on artificial intelligence in diabetes management market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for artificial intelligence in diabetes management? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The artificial intelligence in diabetes management market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Device: Diagnostic Devices; Glucose Monitoring Devices; Insulin Delivery Devices; Other Devices2) By Techniques: Case-Based Reasoning; Intelligent Data Analysis

3) By End-Use: Hospitals; Clinics; Home Care Settings; Research Institutes

Subsegments:

1) By Diagnostic Devices: Blood Glucose Meters; Continuous Glucose Monitors (CGMs); A1C Testing Devices; Urine Testing Devices2) By Glucose Monitoring Devices: Continuous Glucose Monitors (CGMs); Flash Glucose Monitoring Systems; Smart Glucose Meters

3) By Insulin Delivery Devices: Insulin Pens; Insulin Pumps; Insulin Jet Injectors; Smart Insulin Delivery Systems

4) By Other Devices: Diabetes Management Apps; Wearable Devices; Smart Health Monitors; Insulin Refrigerators

Key Companies Mentioned: Alphabet Inc.; F. Hoffmann-La Roche AG; Abbott Laboratories; Medtronic Plc; Dexcom Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Alphabet Inc.

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Medtronic Plc

- Dexcom Inc.

- Insulet Corporation

- Tandem Diabetes Care Inc.

- LifePlus Inc.

- Livongo Health Inc.

- Xeris Pharmaceuticals Inc.

- Virta Health Corp.

- Informed Data Systems Inc.

- Bigfoot Biomedical Inc.

- Lark Technologies Inc.

- Smart Meter LLC

- Diabeloop SA

- Quin Technology Ltd.

- Wellthy Therapeutics Pvt Ltd.

- Admetsys LLC

- DreaMed Diabetes Ltd.

- Eyenuk Inc.

- Glooko Inc.

- PKvitality

- Glytec LLC

- Hygieia Inc.

- TypeZero Technologies Inc.

- Nemaura Medical Inc.

- GlucoMe

- PredictBGL

- Voluntis S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.8 Billion |

| Forecasted Market Value ( USD | $ 2.56 Billion |

| Compound Annual Growth Rate | 33.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |