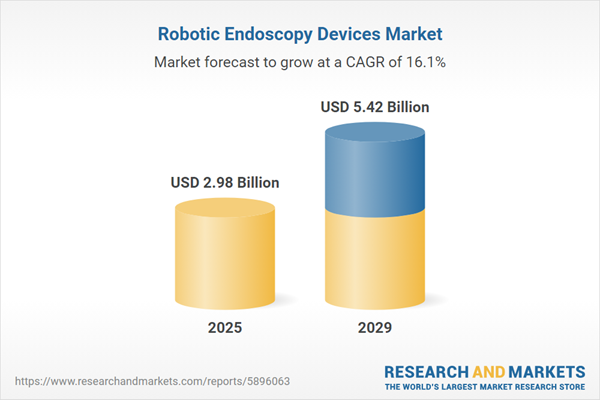

The robotic endoscopy devices market size is expected to see rapid growth in the next few years. It will grow to $5.42 billion in 2029 at a compound annual growth rate (CAGR) of 16.1%. The growth in the forecast period can be attributed to the expansion of robotic surgery applications, rising demand for remote surgery capabilities, increasing healthcare expenditure, growing adoption of endoscopic procedures, and surge in the global patient base for endoscopy. Major trends in the forecast period include the development of flexible robotic endoscopy devices, integration of machine learning in endoscopic diagnostics, the emergence of capsule endoscopy technology, focus on disposable endoscopy devices, and increasing use of robotics in therapeutic endoscopy.

The increasing number of robotic surgery procedures is expected to drive the growth of the robotic endoscopy device market in the future. Robotic surgery is an advanced surgical method that utilizes robotic systems to assist surgeons during operations. These robotic devices are extensively employed in endoscopy procedures to enhance maneuverability and efficiency, simplifying complex tasks by improving visualization, exposure, and tissue manipulation. For example, in June 2023, the Royal Australasian College of Surgeons, a non-profit organization based in Australia, reported that Device Technologies, the local distributor of Intuitive da Vinci robotic platforms, experienced a 12 percent increase in robot-assisted surgeries performed on da Vinci platforms in Australia and Aotearoa New Zealand, rising from 17,852 in 2021 to 19,989 in 2022. Therefore, the growing number of robotic surgery procedures is driving the advancement of the robotic endoscopy device market.

The rising prevalence of chronic diseases, particularly inflammatory bowel disease (IBD), is anticipated to fuel the growth of the robotic endoscopy devices market. IBD, characterized by chronic inflammation affecting the gastrointestinal tract, necessitates endoscopic procedures for evaluation, therapy planning, and ongoing monitoring. As of January 2022, Crohn’s & Colitis Australia estimated that approximately 100,000 to 160,000 people in Australia are expected to be living with ulcerative colitis and Crohn's disease. The increasing incidence of chronic diseases, such as IBD, is a significant factor contributing to the expansion of the robotic endoscopy devices market.

Innovations in products stand out as a prominent trend in the robotic endoscopy device market, with major companies introducing advanced technologies to maintain their market positions. A notable example is Virtuoso Surgical, a US-based manufacturer, launching a new robotic surgery system in May 2023. This revolutionary technology enables surgeons to make dexterous movements at the end of an endoscope using two hands. The system features a rigid endoscope tip with two robotically operated, needle-sized manipulators, significantly reducing the diameter compared to conventional robotic endoscopes.

Major players in the robotic endoscopy device market are adopting a strategic partnership approach to enhance their Revo-i surgical robot. Strategic partnerships involve leveraging strengths and resources for mutual benefits and success. In November 2022, meerecompany, a South Korea-based surgical robot manufacturing company, announced a partnership with the Robot Endoscopy Surgery Center at Severance Hospital in South Korea. The collaboration aims to allow medical professionals to experience the Revo-i systematic training and education program physically. This partnership includes the founding and operation of the Revo-i surgical robot learning and support center, the development and supervision of the Revo-i surgical robot training and education program, and product assessment and education for enhancing medical device functionality.

In April 2023, Boston Scientific, a US-based biomedical engineering company, acquired Apollo Endosurgery for $615 million. This strategic acquisition aligns with Boston Scientific’s objectives to enhance its product offerings in endoluminal surgery procedures and endo-bariatric solutions. Apollo Endosurgery, a US-based manufacturer of endoscopy devices and solutions, complements Boston Scientific's expansion plans in the endoscopy market.

Major companies operating in the robotic endoscopy devices market include Johnson & Johnson Services Inc., Medtronic PLC, FUJIFILM Holdings Corporation, Stryker Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, Carl Zeiss AG, Olympus Corporation, HOYA Corporation, Intuitive Surgical Inc., Smith + Nephew GmbH, Arthrex Inc., ENDO Robotics Co Ltd., Karl Storz SE & Co. KG, Auris Health Inc., Cantel Medical Corp., ConMed Corporation, Ambu A/S, Richard Wolf GmbH, Brainlab AG, Renishaw plc., Fortimedix Surgical B.V., CapsoVision Inc., Asensus Surgical Inc., Medrobotics Corporation, EndoMaster Pte Ltd., Ovesco Endoscopy AG, Medineering GmbH, Virtuoso Surgical Inc., Gray Optics Co.

North America was the largest region in the robotic endoscopy devices market in 2024. The regions covered in the robotic endoscopy devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the robotic endoscopy devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Robotic endoscopy devices refer to advanced medical instruments that integrate robotics technology with the capabilities of flexible endoscopy procedures to enhance precision and automation. These devices are utilized for examining the interior of organs or body cavities, primarily for diagnostic purposes.

The primary types of robotic endoscopy device products include diagnostic and therapeutic devices. Diagnostic endoscopy devices are employed in procedures where an endoscope is inserted into the body through natural openings or small incisions, enabling doctors to directly visualize and assess the affected area. Various applications of these devices include colonoscopy, bronchoscopy, laparoscopy, gastrointestinal endoscopy, and others. They are typically used in settings such as hospitals, ambulatory surgical centers, and other medical facilities.

The robotic endoscopy devices market research report is one of a series of new reports that provides robotic endoscopy devices market statistics, including robotic endoscopy devices industry global market size, regional shares, competitors with a robotic endoscopy devices market share, detailed robotic endoscopy devices market segments, market trends and opportunities, and any further data you may need to thrive in the robotic endoscopy devices industry. This robotic endoscopy devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The robotic endoscopy devices market consists of sales of continuum endoscopes, capsule endoscopes, and add-on endoscopic devices. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Robotic Endoscopy Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on robotic endoscopy devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for robotic endoscopy devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The robotic endoscopy devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Diagnostic; Therapeutic2) By Application: Colonoscopy; Bronchoscopy; Laparoscopy; Gastrointestinal Endoscopy; Other Application

3) By End User: Hospitals; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Diagnostic: Robotic Endoscopes; Imaging Systems; Biopsy Tools2) By Therapeutic: Surgical Robots; Laser Systems; Ablation Devices; Stenting Systems

Key Companies Mentioned: Johnson & Johnson Services Inc.; Medtronic PLC; FUJIFILM Holdings Corporation; Stryker Corporation; Boston Scientific Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Johnson & Johnson Services Inc.

- Medtronic PLC

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Boston Scientific Corporation

- B. Braun Melsungen AG

- Carl Zeiss AG

- Olympus Corporation

- HOYA Corporation

- Intuitive Surgical Inc.

- Smith + Nephew GmbH

- Arthrex Inc.

- ENDO Robotics Co Ltd.

- Karl Storz SE & Co. KG

- Auris Health Inc.

- Cantel Medical Corp.

- ConMed Corporation

- Ambu A/S

- Richard Wolf GmbH

- Brainlab AG

- Renishaw plc.

- Fortimedix Surgical B.V.

- CapsoVision Inc.

- Asensus Surgical Inc.

- Medrobotics Corporation

- EndoMaster Pte Ltd.

- Ovesco Endoscopy AG

- Medineering GmbH

- Virtuoso Surgical Inc.

- Gray Optics Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.98 Billion |

| Forecasted Market Value ( USD | $ 5.42 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |