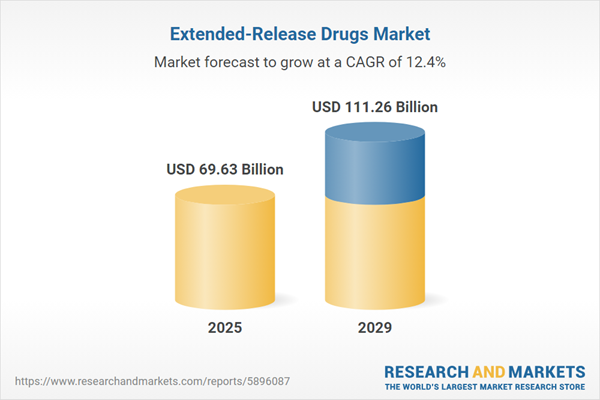

The extended-release drugs market size is expected to see rapid growth in the next few years. It will grow to $111.26 billion in 2029 at a compound annual growth rate (CAGR) of 12.4%. The growth in the forecast period can be attributed to personalized medicine approaches, patient-centric drug development, rising incidence of lifestyle diseases, drug repurposing, global access to extended-release therapies. Major trends in the forecast period include pharmaceutical innovation, advancements in drug delivery systems, advancements in nanotechnology, 3d printing in drug formulations, use of artificial intelligence, environmental sustainability.

The forecast of 12.4% growth over the next five years reflects a slight reduction of 0.2% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. Trade barriers may impact U.S. medication adherence by increasing prices of controlled-release polymer matrices and precision coating equipment imported from Switzerland and China, raising chronic disease treatment costs and generic drug production challenges. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated rise in the incidence of chronic conditions is poised to drive the growth of the extended-release drug market. Chronic conditions are characterized by lasting a year or longer and requiring ongoing medical care, impacting everyday activities. Heart disease, cancer, obesity, and diabetes are examples of such conditions. Extended-release drug delivery systems are specifically designed to maintain a consistent medication level in the body over an extended period, ensuring a steady therapeutic effect and minimizing fluctuations in drug levels that can occur with immediate-release medications. As per projections from the National Center for Biotechnology Information (NCBI) in January 2023, the number of individuals aged 50 years and older with at least one chronic illness is expected to surge by 99.5% by the year 2050, reaching 142.66 million. Thus, the increasing incidence of chronic conditions is a significant driver of the extended-release drug market's growth.

The growing demand within the pharmaceutical industry is anticipated to fuel the expansion of the extended-release drugs market. The pharmaceutical industry, which concentrates on the discovery, development, production, and marketing of drugs and medications, is witnessing increased adoption of extended-release drugs. These drugs contribute to improved patient compliance, enhanced therapeutic outcomes, reduced administration frequency, steady drug levels in the bloodstream, minimized side effects, reduced symptom fluctuations, and an overall enhanced pharmaceutical experience. In June 2023, the European Federation of Pharmaceutical Industries and Associations (EFPIA) reported that the total pharmaceutical production in Europe reached $384.2 billion (€340,000 million) in 2022, marking a 4.95% increase from the previous year. The rising demand in the pharmaceutical industry is thereby propelling the extended-release drugs market.

A key trend gaining momentum in the extended-release drug market is product innovation. Major companies operating in this market are focusing on developing innovative products to maintain their market position. For example, in July 2022, Zydus Pharmaceuticals (USA) Inc., a US-based generic pharmaceutical manufacturer, introduced Topiramate extended-release capsules for epilepsy. The US Food and Drug Administration (USFDA) had previously approved the company to commercialize these capsules, making it the first business in the country to receive final approval for and launch Topiramate extended-release capsules. These capsules are approved for individuals with partial onset or primary generalized tonic-clonic seizures. Product innovation remains a crucial strategy for companies in the extended-release drug market.

Major companies in the extended-release drugs market are also innovating by developing new products such as next-generation extended-release tablets to enhance their product offerings and gain a competitive edge. Extended-release tablets are a specific pharmaceutical formulation designed to release active ingredients gradually over an extended period. In February 2023, Teva Pharmaceutical Industries Ltd., an Israel-based pharmaceutical company, received approval from the U.S. Food and Drug Administration (FDA) for Austedo XR (deutetrabenazine). This extended-release tablet is recommended for treating adults with chorea and tardive dyskinesia related to Huntington's disease. With dosages available in 6, 12, and 24 mg, Austedo XR provides a once-daily administration option, offering an efficient treatment alternative for patients with certain movement disorders. Such developments in next-generation extended-release tablets signify significant progress in managing movement disorders.

In March 2022, Pfizer Inc., a US-based pharmaceutical and biotechnology corporation, completed the acquisition of Arena Pharmaceuticals for approximately $6.7 billion. This strategic acquisition grants Pfizer access to a portfolio of promising development-stage pharmaceutical prospects from Arena Pharmaceuticals, particularly in cardiology, dermatology, and gastroenterology. Arena Pharmaceuticals, a US-based biopharmaceutical company, specializes in small-molecule extended-release medications under development for potential clinical use in various therapeutic fields.

Major companies operating in the extended-release drugs market include Pfizer Inc., AbbVie Inc., Novartis AG, Sanofi SA, GlaxoSmithKline PLC, AstraZeneca Plc, Gilead Sciences Inc., Boehringer Ingelheim International GmbH, Viatris Inc., Teva Pharmaceuticals Inc., Eastman Chemical Company, Catalent Pharma Solutions Inc., Sun Pharmaceutical Industries Limited, Purdue Pharma LP, Amneal Pharmaceuticals Inc., Endo Pharmaceuticals Inc., Mallinckrodt LLC, Allergan plc, Hisamitsu Pharmaceutical Co. Inc., Janssen Pharmaceuticals Inc., Noven Pharmaceuticals Inc., Mayne Pharma Group Ltd., Neos Therapeutics Inc., Ardena Holding NV, UPM Pharmaceuticals Inc., Oakwood Laboratories LLC, Roxane Laboratories Inc., Lavipharm Laboratories Inc., Watson Pharmaceuticals Inc.

North America was the largest region in the extended-release drugs market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the extended-release drugs market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the extended-release drugs market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The extended-release drugs research report is one of a series of new reports that provides extended-release drugs market statistics, including the extended-release drugs industry's global market size, regional shares, competitors with extended-release drugs market share, detailed extended-release drugs market segments, market trends and opportunities, and any further data you may need to thrive in the extended-release drugs industry. This extended-release drugs market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Extended-release drugs are a specific dosage form designed to release medication gradually over an extended period, following a predetermined rate, duration, and location in a controlled manner. This enables patients to take the medication less frequently compared to immediate-release forms, often requiring only 1 to 2 doses per day instead of 3 to 4.

The main types of extended-release drugs include sustained-release drugs and controlled-release drugs. Sustained-release drugs are medications intended to slowly release in the body over time, primarily to maintain therapeutic levels. These drugs are available in both over-the-counter and prescription forms and are distributed through various channels, including hospital pharmacies, retail pharmacies, mail-order pharmacies, and drug store channels.

The extended-release drug market consists of sales of extended-release tablets, extended-release capsules, and implants. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Extended-Release Drugs Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on extended-release drugs market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for extended-release drugs? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The extended-release drugs market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Sustained Release Drug; Controlled Release Drug2) By Mode: Over-The-Counter; Prescription

3) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Mail Order Pharmacies; Drug Stores

Subsegments:

1) By Sustained Release Drug: Matrix Systems; Coating Systems2) By Controlled Release Drug: Osmotic Systems; Microencapsulation Systems; Targeted Delivery Systems

Companies Mentioned: Pfizer Inc.; AbbVie Inc.; Novartis AG; Sanofi SA; GlaxoSmithKline PLC; AstraZeneca Plc; Gilead Sciences Inc.; Boehringer Ingelheim International GmbH; Viatris Inc.; Teva Pharmaceuticals Inc.; Eastman Chemical Company; Catalent Pharma Solutions Inc.; Sun Pharmaceutical Industries Limited; Purdue Pharma LP; Amneal Pharmaceuticals Inc.; Endo Pharmaceuticals Inc.; Mallinckrodt LLC; Allergan plc; Hisamitsu Pharmaceutical Co. Inc.; Janssen Pharmaceuticals Inc.; Noven Pharmaceuticals Inc.; Mayne Pharma Group Ltd.; Neos Therapeutics Inc.; Ardena Holding NV; UPM Pharmaceuticals Inc.; Oakwood Laboratories LLC; Roxane Laboratories Inc.; Lavipharm Laboratories Inc.; Watson Pharmaceuticals Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Extended-Release Drugs market report include:- Pfizer Inc.

- AbbVie Inc.

- Novartis AG

- Sanofi SA

- GlaxoSmithKline PLC

- AstraZeneca Plc

- Gilead Sciences Inc.

- Boehringer Ingelheim International GmbH

- Viatris Inc.

- Teva Pharmaceuticals Inc.

- Eastman Chemical Company

- Catalent Pharma Solutions Inc.

- Sun Pharmaceutical Industries Limited

- Purdue Pharma LP

- Amneal Pharmaceuticals Inc.

- Endo Pharmaceuticals Inc.

- Mallinckrodt LLC

- Allergan plc

- Hisamitsu Pharmaceutical Co. Inc.

- Janssen Pharmaceuticals Inc.

- Noven Pharmaceuticals Inc.

- Mayne Pharma Group Ltd.

- Neos Therapeutics Inc.

- Ardena Holding NV

- UPM Pharmaceuticals Inc.

- Oakwood Laboratories LLC

- Roxane Laboratories Inc.

- Lavipharm Laboratories Inc.

- Watson Pharmaceuticals Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 69.63 Billion |

| Forecasted Market Value ( USD | $ 111.26 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |