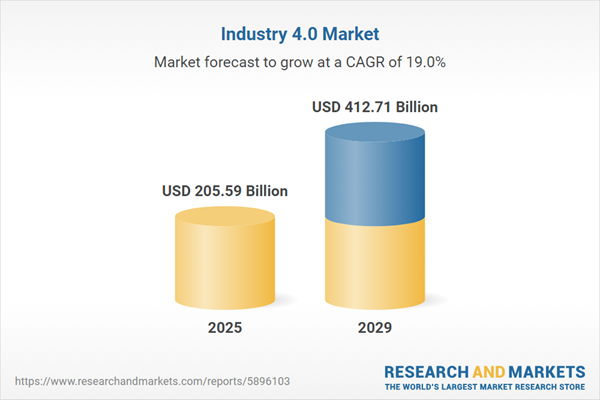

The industry 4.0 market size has grown rapidly in recent years. It will grow from $177.47 billion in 2024 to $205.59 billion in 2025 at a compound annual growth rate (CAGR) of 15.8%. The growth in the historic period can be attributed to advancements in connectivity, automation and robotics, big data and analytics, cloud computing adoption, cyber-physical systems (cps)

The industry 4.0 market size is expected to see rapid growth in the next few years. It will grow to $412.71 billion in 2029 at a compound annual growth rate (CAGR) of 19%. The growth in the forecast period can be attributed to ai and machine learning growth, advanced robotics integration, 5g technology impact, blockchain in supply chain, edge computing advancements. Major trends in the forecast period include smart factories, digital twins implementation, human-machine collaboration, cybersecurity emphasis, remote operations and monitoring.

The industry 4.0 market is anticipated to experience growth due to the rising adoption of industrial robots. Industrial robots, which are mechanical machines designed for automated production tasks in industrial settings, leverage industry 4.0 by integrating advanced technologies such as automation, IoT, and artificial intelligence. This integration enables intelligent, autonomous, and interconnected robotic systems, enhancing productivity, adaptability, and efficiency in production operations. For example, in June 2023, the International Federation of Robotics reported an expected installation of 72,000 industrial robot units in 2022 in the European Union, marking a 6% year-on-year increase from 67,000 units in 2021. The increased adoption of industrial robots is thus a driving force in the industry 4.0 market.

The growing adoption of cloud technology is expected to drive the growth of the Industry 4.0 market in the future. Cloud adoption refers to the process and strategy through which individuals, organizations, or businesses transition their computing infrastructure, data, applications, and services from on-premises environments to cloud-based solutions. It serves as a fundamental enabler of Industry 4.0, providing the essential infrastructure and tools for manufacturers to embrace digital transformation, improve efficiency, and remain competitive in an increasingly connected and data-driven industrial landscape. For example, in December 2023, the European Commission (EC), the Belgium-based executive body of the European Union (EU), reported that the adoption of cloud-based solutions in 2023 within the EU increased by 4.2 percentage points, with 45.2% of enterprises purchasing cloud computing services, reflecting a significant rise compared to 2021. Therefore, the increasing adoption of cloud technology is driving the growth of the Industry 4.0 market.

Technological innovation is emerging as a prominent trend in the industry 4.0 market, with companies strategically incorporating innovations to maintain their market position. For example, in August 2022, Unbox Robotics, an Indian robotic technology company, introduced UnboxSort, a pioneering vertical robotic sortation solution. This industry 4.0 plug-and-play robotics system, driven by Swarm Intelligence, utilizes Autonomous Mobile Robots (AMRs) to efficiently sort parcels vertically into smart racks within limited spaces at e-commerce fulfillment centers and warehouses, enabling merchants to scale up logistics for high parcel volumes.

Major industry players are also launching new products to enhance profitability, such as IoT controllers in the field of Industry 4.0. An IoT controller in this context serves as a device or system responsible for managing and coordinating connected devices, sensors, and machines within smart industrial environments. For instance, in May 2023, NOVUS Automation, a Brazil-based manufacturer specializing in data solutions and process control, unveiled the N20K48 IoT controller. Featuring a robust core controller and expandable micromodules, including a Wi-Fi micromodule for enhanced Industry 4.0 integration, the N20K48 facilitates seamless communication, legacy device incorporation, and centralized data management on a single network. This innovation streamlines real-time monitoring and issue identification in production, showcasing NOVUS Automation's commitment to delivering cutting-edge instruments for control, data acquisition, and SCADA systems.

In November 2022, Lear Corporation, a US-based automotive technology company, acquired InTouch Automation Inc. for an undisclosed amount. This acquisition strengthens Lear’s capabilities in automation and manufacturing flexibility. InTouch Automation's product line aligns with Lear’s Industry 4.0 strategy, focusing on deploying technology to automate the validation and testing of components and finished seats. InTouch Automation Inc., based in the US, is a provider of automated testing equipment and Industry 4.0 technologies.

Major companies operating in the industry 4.0 market include Siemens AG, General Electric Company, Intel Corporation, International Business Machines Corporation, Cisco Systems Inc., Mitsubishi Electric Corporation, Honeywell International Inc., ABB Ltd., NVIDIA Corporation, Emerson Electric Co, Rockwell Automation Inc., Omron Corporation, Bosch Rexroth AG, Fanuc Corporation, Dassault Systemes SE, Daifuku Co Ltd., KUKA AG, Advantech Co Ltd., PTC Inc., Cognex Corporation, Stratasys Ltd., 3D Systems Inc., John Bean Technologies Corporation, Universal Robots A/S, Basler AG, Techman Robot Inc., Addverb Technologies Limited, Algolux, AIBrain Inc., Beckhoff Automation Pvt. Ltd.

Europe was the largest region in the industry 4.0 market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the industry 4.0 market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the industry 4.0 market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Industry 4.0 denotes intelligent and interconnected production systems designed to perceive, anticipate, and interact with the physical world, enabling real-time decision-making to support production. This concept is instrumental in creating intelligent factories and facilitating smart manufacturing.

The primary categories of Industry 4.0 technologies include industrial robots, blockchain, industrial sensors, industrial 3D printing, machine vision, human-machine interface (HMI), artificial intelligence in manufacturing, digital twin, automatic guided vehicles (AGV), and machine condition monitoring. Industrial robots are mechanical machines engineered to automate production-related tasks in industrial settings. These technologies encompass solutions and services tailored for both small and medium enterprises as well as large enterprises. The end-users of Industry 4.0 technologies span various industries, including manufacturing, automotive, oil and gas, energy and utilities, electronics and foundry, food and beverage, aerospace and defense, among others.

The industry 4.0 market research report is one of a series of new reports that provides industry 4.0 market statistics, including industry 4.0 industry global market size, regional shares, competitors with an industry 4.0 market share, detailed industry 4.0 market segments, market trends and opportunities, and any further data you may need to thrive in the industry 4.0 industry. This industry 4.0 market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The industry 4.0 market consists of revenues earned by entities by providing services such as implementation and integration, support and maintenance, and consulting and training. The market value includes the value of related goods sold by the service provider or included within the service offering. The industry 4.0 market also includes sales of hardware, software, and industrial automation solutions. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Industry 4.0 Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on industry 4.0 market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industry 4.0? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The industry 4.0 market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Industrial Robots; Blockchain; Industrial Sensors; Industrial 3D Printing; Machine Vision; Human Machine Interface (HMI); Artificial Intelligence in Manufacturing; Digital Twin; Automatic Guided Vehicles (AGV); Machine Condition Monitoring2) By Component: Solution; Services

3) By Enterprise Size: Small and Medium Enterprises; Large Enterprise

4) By End-User: Manufacturing; Automotive; Oil and Gas; Energy and Utilities; Electronics and Foundry; Food and Beverage; Aerospace and Defense; Other End-Users

Subsegments:

1) By Industrial Robots: Articulated Robots; Collaborative Robots (Cobots); SCARA Robots2) By Blockchain: Supply Chain Management Solutions; Data Security Applications; Smart Contracts

3) By Industrial Sensors: Temperature Sensors; Pressure Sensors; Proximity Sensors

4) By Industrial 3D Printing: Additive Manufacturing Systems; Materials For 3D Printing; Software For Design and Simulation

5) By Machine Vision: Image Processing Systems; Quality Inspection Solutions; Identification and Tracking Systems

6) By Human Machine Interface (HMI): Touchscreen Panels; Software Interfaces; Remote Monitoring Tools

7) By Artificial Intelligence in Manufacturing: Predictive Maintenance Tools; Production Optimization Software; Quality Control Algorithms

8) By Digital Twin: Simulation Software; Monitoring and Analytics Platforms; Integration Solutions With IoT

9) By Automatic Guided Vehicles (AGV): Navigation Systems; Fleet Management Software; Charging and Maintenance Solutions

10) By Machine Condition Monitoring: Vibration Analysis Tools; Temperature Monitoring Systems; Acoustic Emission Monitoring Systems.

Key Companies Mentioned: Siemens AG; General Electric Company; Intel Corporation; International Business Machines Corporation; Cisco Systems Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- General Electric Company

- Intel Corporation

- International Business Machines Corporation

- Cisco Systems Inc.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- ABB Ltd.

- NVIDIA Corporation

- Emerson Electric Co

- Rockwell Automation Inc.

- Omron Corporation

- Bosch Rexroth AG

- Fanuc Corporation

- Dassault Systemes SE

- Daifuku Co Ltd.

- KUKA AG

- Advantech Co Ltd.

- PTC Inc.

- Cognex Corporation

- Stratasys Ltd.

- 3D Systems Inc.

- John Bean Technologies Corporation

- Universal Robots A/S

- Basler AG

- Techman Robot Inc.

- Addverb Technologies Limited

- Algolux

- AIBrain Inc.

- Beckhoff Automation Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 205.59 Billion |

| Forecasted Market Value ( USD | $ 412.71 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |