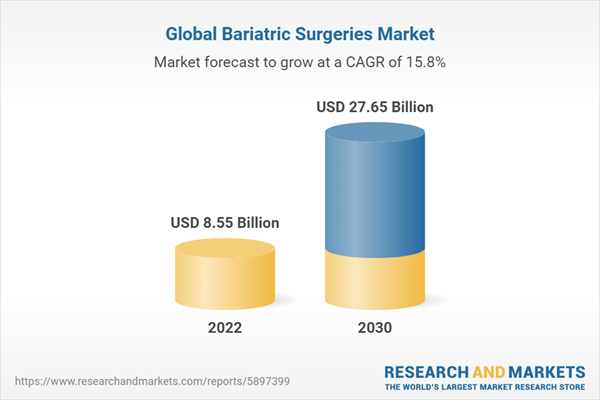

The bariatric surgeries market growth is attributed to increasing prevalence of obesity and growing demand for minimally invasive surgeries. However, stringent regulatory policies and increase in safety concerns is hindering the market growth.

Growing Demand for Minimally Invasive Surgeries to Develop Bariatric Surgeries

Over a period of time, there has been significant growth in the prevalence of chronic disorders, leading to an increase in surgical procedures. Invasive surgical procedures have high risk factors, and patients take longer time in recovery. These procedures have a high risk of infections and a high rate of complications on a global level. To overcome the consequences associated with invasive procedures, minimally invasive procedures are preferred by healthcare professionals. Healthcare professionals are more inclined toward minimally invasive procedures due to various advantages such as shorter recovery periods, very limited to no complications, high success rates, and reduction in procedure time. As per North Kansas City Hospital (NKCH), ~15 million laparoscopic procedures are performed in the US annually. Additionally, an increase in minimally invasive procedures led to product launches and development of specialized instruments that help during the surgery.The positive outcomes of minimally invasive surgeries have increased the inclination toward minimally invasive bariatric surgeries as market players focus on developing and launching advanced products. Nowadays, several minimally invasive bariatric surgeries are performed, including laparoscopic gastric bypass, laparoscopic sleeve gastrectomy, and laparoscopic gastric binding. As per the National Health Institutes 2022 report, nowadays, ~90% of gastric bypasses are done laparoscopically, with a death rate of 0.22%, which is less than 0.82% for open surgery. Each procedure has advantages and disadvantages, and the choice will depend on the medical history and patient needs. Moreover, the rising inclination toward non-invasive bariatric devices is expected to proliferate the market growth. Various manufacturers focus on developing gastric balloons, which can be placed into the stomach through endoscopy procedures and easily removed when required. These balloons have limited to no side effects with positive outcomes. Therefore, the surge in minimally invasive bariatric surgeries, the launch and development of specialized instruments, and positive patient outcomes contribute to the growth of the bariatric surgeries market.

Bariatric Surgeries Market: Segmental Overview

The bariatric surgeries market is segmented on the basis of type, end user, and geography.The bariatric surgeries market, by type, is segmented into adjustable gastric bands (AGB), sleeve gastrectomy, gastric bypass, biliopancreatic diversion with duodenal switch (BPD-DS), and others. In 2022, the sleeve gastrectomy segment held the largest market share, and the gastric bypass segment is estimated to register the fastest CAGR during 2022-2030. In sleeve gastrectomy, the stomach is divided and stapled vertically by removing more than 85% of stomach, forming a banana-shaped pouch or tube limiting the amount of food ingested and absorbed by the body. In this surgery, most of the stomach is removed, lowering levels of the hormone ghrelin, which is responsible for appetite, and limiting food intake and absorption. Risks of sleeve gastrectomy include heartburn, stomach ulcers, gastritis, injury to the intestines, stomach, or other organs during surgery, and vomiting. Also, poor nutrition and scarring inside the belly could lead to a future blockage in the bowel.

Based on end user, the bariatric surgeries market is segmented into hospitals and ambulatory surgical centers. In 2022, the hospitals segment held a larger market share, and the ambulatory surgical centers segment is estimated to register a faster CAGR during 2022-2030. An ambulatory surgical center (ASC) is a healthcare facility that allows patients to have same-day surgery, such as Roux-en-Y gastric bypass surgery or sleeve gastrectomy, duodenal switch surgery, laparoscopic gastric banding (Lap-Band), and non-surgical gastric balloon. Healthy Life Bariatrics is an accredited ambulatory surgical center that focuses on sanitation, cleanliness, safety, and personalized care. Atlanta General and Bariatric Surgery Center (AGBSC) is located in Georgia, across from Emory Hospital.

Bariatric Surgeries Market: Geographical Overview

In terms of geography, the global bariatric surgeries market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America is anticipated to hold the largest market share during 2022-2030. The market in this region is further divided into the US, Canada, and Mexico. North America holds the largest share of the bariatric surgeries market. The market growth in the region is attributed to increasing burden of obesity, rising government initiatives to curb obesity, and a surging number of mergers, collaborations, and partnerships among market players. In addition, the significantly growing prevalence of diabetes is propelling the demand for bariatric surgeries. The bariatric surgeries market in the US is primarily driven by the increasing burden of obesity and growing prevalence of diabetes. The demand for bariatric surgeries has increased remarkably over the past few years to reduce burden of associated a wide range of chronic diseases.The Asia Pacific bariatric surgeries market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. Collaborations between companies widely drive the growth of the bariatric surgeries market in this region, the rising incidence of diabetes, and an increasing number of obese people. Growing cases of chronic diseases such as diabetes and heart disease are driving the market growth in India, as the obese population in the country is increasing. Diabetes significantly affects individuals with higher body fat percentages. Thus, patients prefer bariatric surgeries, including minimally invasive surgeries such as gastric bands and balloons. According to the International Diabetes Federation (IDF), about 74 million population in India suffered from diabetes in 2021, and this number is expected to reach 124 million by 2045. Thus, the expected increase in the diabetic population aggravates the risk of getting overweight, which would consequently fuel the demand for bariatric surgeries for weight loss to prevent the risk of developing other chronic diseases such as heart disease and organ dysfunction.

Several market players are adopting organic strategies to stay competitive in the market. For instance, in September 2022, Allurion launched its swallowable gastric balloon capsule in India for weight loss. According to Allurion, it is the only medical weight-loss device fully approved by the Central Drugs Standard Control Organisation (CDSCO). In June 2021, Intuitive launched the Robotic-Assisted Surgical Stapler SureForm with Smart Fire technology. Surgical stapling with robotic staplers is the most advanced choice available to surgeons for the transection, resection, and/or creation of anastomosis.

A few of the major primary and secondary sources referred to while preparing the Bariatric Surgeries market report on the World Health Organization (WHO), National Council of Aging (NCOA), American Society for Metabolic and Bariatric Surgery, World Obesity Atlas, Health Canada, International Diabetes Federation (IDF), The National Center for Biotechnology Information (NCBI), National Library of Medicine (NLM).

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the bariatric surgeries market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the global bariatric surgeries market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global bariatric surgeries market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Intuitive Surgicals Inc

- Integra Lifesciences Holdings Corp

- Apollo Endosurgery Inc.

- Conmed Corp

- Medtronic Plc

- Ethicon USA LLC

- Olympus Corp

- Reshape Lifesciences Inc

- Spartz FGIA Inc

- Helioscopie SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | October 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 8.55 Billion |

| Forecasted Market Value ( USD | $ 27.65 Billion |

| Compound Annual Growth Rate | 15.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |