Bathroom vanities are cabinets or storage units typically found in bathrooms. They serve a dual purpose, providing storage space for toiletries, towels, and other bathroom essentials while also housing a sink and a countertop. Under the report scope, we have considered bathroom vanity units that have attached sinks and countertops. Bathroom vanities come in various styles, sizes, and materials, allowing consumers to choose one that suits their aesthetic preferences and functional needs. They are a key element of bathroom design and can enhance both the functionality and appearance of a bathroom.

The increase in housing construction and renovations in the UK has significantly impacted the bathroom vanities market. As more people invest in upgrading or constructing new homes, the demand for modern and aesthetically pleasing bathroom fixtures, including vanities, has surged. Homeowners and property developers alike are keen on creating stylish and functional bathrooms. According to a recent survey, more than half of homeowners in the country renovated in 2021, up four percent from 49% in 2020. The most popular projects were painting (36%), followed by the kitchen (34%) and bathroom (32%) renovations. One key driver of this trend is the desire for increased property value. Homeowners recognize that well-designed bathrooms can significantly enhance their homes' overall appeal and value. Consequently, they are willing to invest in high-quality bathroom vanities that serve practical purposes and contribute to their properties' overall aesthetics. This focus on property value appreciation has propelled the demand for bathroom vanities as an integral part of the home improvement industry. The shift in consumer preferences toward more extensive and luxurious bathrooms has further boosted the demand for bathroom vanities. With larger bathrooms becoming a common feature in modern homes, there is a growing need for spacious and well-equipped vanities that accommodate double sinks, ample storage space, and various design elements. Manufacturers in the UK have responded to this demand by offering a wide range of vanity options, catering to different design tastes and spatial requirements.

The COVID-19 pandemic affected economies and industries in various countries. Lockdowns, travel bans, and business shutdowns in leading countries in the UK negatively affected the growth of various industries, including the consumer goods industry. The shutdown of manufacturing units disturbed supply chains, manufacturing activities, delivery schedules, and sales of various essential and non-essential products. Various companies announced possible delays in product deliveries and a slump in future sales of their products in 2020. In addition, the bans imposed by various governments in the country on international travel forced the companies to put their collaboration and partnership plans on a temporary hold. All these factors hampered the consumer goods industry in 2020 and early 2021, thereby restraining the growth of the UK bathroom vanities market.

Hawkers Ltd, Kohler Co, C P Hart & Sons Ltd., Roca Sanitario SA, Inter IKEA Holding BV, Roxor Group Ltd., Geberit AG, Villeroy & Boch AG, Harvey George Ltd., and Duravit AG are the key players operating in the UK bathroom vanities market. These market players are focusing on providing high-quality, innovative products to fulfill customers' demands and increase their UK bathroom vanities market share.

The overall UK bathroom vanities market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information about the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights into the topic. Participants in this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants, such as valuation experts, research analysts, and key opinion leaders, specializing in the UK bathroom vanities market.

Reasons to Buy

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the UK bathroom vanities market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table of Contents

Companies Mentioned

- Hawkers Ltd

- Kohler Co

- C P Hart & Sons Ltd.

- Roca Sanitario SA

- Inter IKEA Holding BV

- Roxor Group Ltd.

- Geberit AG

- Villeroy & Boch AG

- Harvey George Ltd.

- Duravit AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 65 |

| Published | September 2023 |

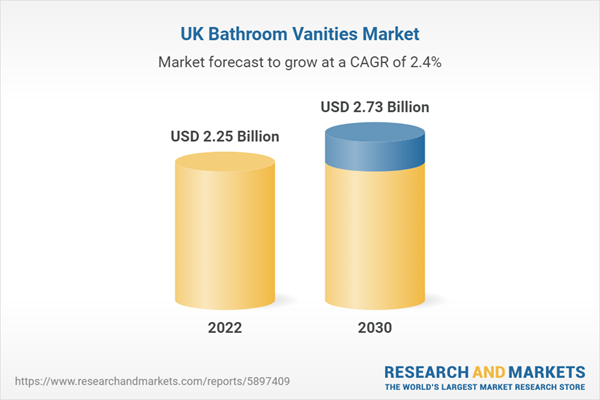

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 2.25 Billion |

| Forecasted Market Value ( USD | $ 2.73 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 10 |