Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Secondly, the high efficiency of CNG and LPG vehicles is another driving factor behind the market growth. These vehicles offer better fuel efficiency, resulting in cost savings for consumers and businesses alike. Additionally, advancements in technology have made CNG and LPG vehicles more reliable and practical for everyday use.

Furthermore, government initiatives and tax incentives in various countries have played a significant role in promoting the adoption of CNG and LPG vehicles. Governments are incentivizing the use of these vehicles to reduce air pollution and dependence on fossil fuels. These incentives include subsidies, grants, and tax breaks, making CNG and LPG vehicles more affordable for consumers.

However, there are still challenges that need to be addressed in the CNG and LPG vehicle market. The high cost of infrastructure, such as refueling stations and storage facilities, remains a key barrier to widespread adoption. Additionally, the volatility in natural gas prices can impact the cost-effectiveness of these vehicles, making it important for consumers to carefully consider the long-term cost benefits.

Despite these challenges, the future of the CNG and LPG vehicle market looks promising. Technological advancements continue to improve the performance and efficiency of these vehicles, making them even more attractive to consumers. The growing demand for sustainable transportation solutions, coupled with the increasing focus on environmental conservation, will continue to drive the market growth in the coming years.

Key Market Drivers

Environmental Concerns and Regulations

One of the primary drivers of the global CNG and LPG vehicle market is the increasing concern about environmental pollution and climate change. Governments around the world are implementing stringent emission regulations to combat air pollution and reduce greenhouse gas emissions. CNG and LPG vehicles produce significantly fewer emissions compared to their gasoline and diesel counterparts. This makes them an attractive option for both individual consumers and fleet operators looking to meet emission targets and comply with regulatory standards.Cost Savings

Cost savings are a major driver for the adoption of CNG and LPG vehicles. Both CNG and LPG are generally cheaper than gasoline and diesel fuels, making them a more economical choice for consumers and businesses. Additionally, the maintenance costs of CNG and LPG vehicles are often lower due to cleaner combustion and reduced wear and tear on engines. This cost-efficiency is particularly appealing in regions where fuel prices are high or where government incentives and subsidies are available to promote the use of alternative fuels.Energy Security

Reducing dependence on imported oil is another key driver for the adoption of CNG and LPG vehicles. Many countries are keen to enhance their energy security by diversifying their fuel sources. Natural gas, which is used in CNG vehicles, is often domestically sourced or available through reliable pipelines, reducing vulnerability to global oil price fluctuations and geopolitical tensions.Technological Advancements

Advancements in technology have played a crucial role in the growth of the CNG and LPG vehicle market. Vehicle manufacturers have developed engines and fuel systems that are optimized for CNG and LPG use, resulting in improved performance and efficiency. These advancements have made CNG and LPG vehicles more appealing to consumers by addressing concerns about power and range limitations.Infrastructure Development

The availability of refueling infrastructure is a critical factor in the adoption of CNG and LPG vehicles. Governments and private companies are investing in building a network of CNG and LPG refueling stations to support the growing demand for these alternative fuels. As infrastructure becomes more widespread, consumers and businesses are more likely to consider CNG and LPG vehicles as viable options, knowing they can refuel conveniently.Corporate Social Responsibility (CSR)

Many companies are embracing corporate social responsibility (CSR) and sustainability as part of their business strategies. They are actively seeking ways to reduce their carbon footprint and demonstrate a commitment to environmental stewardship. Switching to CNG and LPG vehicles can help companies achieve their sustainability goals and enhance their public image as environmentally responsible organizations.Incentives and Subsidies

Government incentives and subsidies have played a significant role in driving the adoption of CNG and LPG vehicles. Incentives can include tax credits, rebates, and grants for purchasing alternative fuel vehicles, as well as reduced registration fees and toll discounts. These financial incentives make CNG and LPG vehicles more affordable and attractive to consumers and businesses.Fuel Diversity

Diversifying the fuel mix in the transportation sector is a priority for many countries. By promoting CNG and LPG vehicles alongside electric and hydrogen vehicles, governments can reduce the environmental impact of transportation and enhance energy security. Fuel diversity also ensures that there are multiple options available to consumers, allowing them to choose the one that best suits their needs and preferences.Growing Awareness

Public awareness of the environmental and economic benefits of CNG and LPG vehicles is increasing. Media coverage, educational campaigns, and advocacy groups are helping to inform consumers and businesses about the advantages of these alternative fuels. As awareness grows, more individuals and organizations are likely to consider CNG and LPG vehicles when making transportation choices.Emerging Markets

The CNG and LPG vehicle market is experiencing rapid growth in emerging markets, particularly in Asia, Latin America, and the Middle East. These regions are witnessing urbanization, population growth, and increased demand for transportation. Governments in these areas are recognizing the potential of CNG and LPG as cost-effective and environmentally friendly solutions to meet their transportation needs.Download Free Sample Report

Key Market Challenges

Limited Refueling Infrastructure

One of the most significant challenges facing the CNG and LPG vehicle market is the limited availability of refueling infrastructure. Unlike traditional gasoline and diesel vehicles that benefit from a well-established refueling network, CNG and LPG vehicles require specialized refueling stations. The scarcity of these stations can be a major deterrent for potential buyers, as the convenience of refueling plays a crucial role in vehicle choice. Expanding the refueling infrastructure is costly and time-consuming, making it a significant barrier to market growth.Range Limitations

CNG and LPG vehicles often have a more limited range compared to gasoline and diesel vehicles. This limitation is primarily due to the lower energy density of CNG and LPG fuels. As a result, consumers may experience anxiety about running out of fuel when driving longer distances, particularly in regions with sparse refueling infrastructure. Addressing this challenge requires advancements in fuel storage technologies or hybridization to extend the range of CNG and LPG vehicles.Initial Vehicle Cost

The upfront cost of CNG and LPG vehicles can be higher than their gasoline or diesel counterparts. This is mainly because of the additional technology required for fuel storage and delivery systems. While the long-term operational cost savings from cheaper fuels can offset this initial expense, many consumers are discouraged by the higher purchase price. Manufacturers and governments must work together to reduce the price gap and incentivize the adoption of CNG and LPG vehicles.Fuel Price Volatility

Although CNG and LPG fuels are often more price-stable than gasoline and diesel, they are not immune to price fluctuations. The cost of natural gas, which affects CNG prices, can still experience variations. This volatility can undermine the economic advantage of CNG and LPG vehicles, especially when compared to electricity as a fuel source. To address this challenge, governments and industry stakeholders should consider implementing pricing mechanisms that provide more predictability for consumers.Consumer Perception and Awareness

Many consumers remain unaware of the benefits of CNG and LPG vehicles or have misconceptions about their performance and safety. This lack of awareness can deter potential buyers from considering these alternative fuel options. Market education campaigns are crucial to dispel myths and promote the advantages of CNG and LPG vehicles, including their lower emissions and cost savings. Improving consumer perception is essential for market growth.Limited Vehicle Model Availability

The availability of CNG and LPG vehicle models is still relatively limited compared to traditional gasoline and diesel vehicles. Consumers often have limited choices in terms of vehicle types, sizes, and brands, which can restrict adoption. Automakers should invest in expanding their CNG and LPG vehicle offerings to cater to a wider range of consumer preferences and needs.Safety Concerns

Safety considerations surrounding CNG and LPG vehicles, including fuel storage and vehicle modifications, are challenges that need to be addressed. While CNG and LPG are generally considered safe, accidents involving gas leaks or fires can occur if proper safety measures are not followed during refueling, storage, or maintenance. Ensuring rigorous safety standards and educating consumers and technicians about safe handling practices is crucial to mitigate these concerns.Regulatory Hurdles

The regulatory landscape for CNG and LPG vehicles can be complex and inconsistent across regions. In some areas, stringent regulations may pose barriers to market entry, while in others, a lack of clear guidelines can create uncertainty for manufacturers and consumers. Harmonizing regulations and providing clear, consistent guidelines for vehicle certification, safety standards, and emissions testing can help alleviate these challenges.Competition from Electric Vehicles

As electric vehicles (EVs) gain popularity and advancements in battery technology continue, they pose a formidable challenge to the CNG and LPG vehicle market. EVs offer zero-emission transportation and are supported by extensive charging infrastructure investments. The increasing focus on EVs by governments and automakers could divert attention and resources away from CNG and LPG vehicle development and promotion.Geopolitical Factors

Global geopolitics can impact the availability and pricing of CNG and LPG fuels. Disruptions in natural gas or propane supplies due to political tensions or other factors can affect fuel availability and pricing, making it challenging to maintain the stability and attractiveness of CNG and LPG as alternative fuels.Key Market Trends

Increasing Emission Regulations

As environmental regulations become increasingly stringent worldwide, automakers are compelled to seek alternatives to traditional petrol and diesel engines. This shift has resulted in a significant rise in the demand for Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) vehicles, which are widely recognized for their comparatively lower emission profiles. These eco-friendly vehicles offer a greener and more sustainable transportation solution, aligning with the global efforts to reduce carbon emissions and combat climate change.CNG is a cleaner-burning fuel that produces fewer harmful pollutants such as carbon monoxide, nitrogen oxide, and particulate matter. It is sourced from natural gas reserves and is stored in high-pressure cylinders, making it an efficient and viable option for powering vehicles. LPG, on the other hand, is a byproduct of petroleum refining and is known for its low greenhouse gas emissions. It burns cleaner than traditional gasoline and diesel, reducing the overall carbon footprint.

In addition to their environmental benefits, CNG and LPG vehicles also offer economic advantages. These alternative fuel options are often more cost-effective compared to gasoline and diesel, providing potential savings for both consumers and fleet operators. Furthermore, the widespread availability of natural gas and petroleum resources ensures a reliable supply chain for these fuel types.

As the demand for greener transportation solutions grows, the automotive industry is investing in the development and production of CNG and LPG vehicles. Manufacturers are continuously improving the technology and efficiency of these vehicles, making them more accessible and attractive to consumers.

By embracing CNG and LPG vehicles, we can contribute to the global efforts in reducing air pollution and combating climate change. These eco-friendly alternatives offer a promising future for the automotive industry, promoting sustainable mobility and a cleaner environment for generations to come.

Economic Advantages

Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) vehicles are gaining significant popularity due to their remarkable cost-effectiveness. These alternative fuel options not only offer a greener way of transportation but also provide a substantial advantage in terms of affordability. By utilizing natural gases, which are more environmentally friendly, consumers can contribute to a greener future while curbing their fuel expenses.CNG and LPG vehicles have witnessed a surge in demand, as they offer a smart and economical choice for individuals looking to reduce their carbon footprint and save money on fuel costs. With their lower emissions and cost-effectiveness, these vehicles have become an attractive option for environmentally conscious consumers who are seeking a sustainable and budget-friendly transportation solution.

By embracing CNG and LPG vehicles, individuals can make a positive impact on the environment while enjoying the benefits of reduced fuel expenses. The growing popularity of these vehicles reflects a shift towards a greener and more sustainable future, where affordability and environmental consciousness go hand in hand.

Infrastructure Development

The growth of the Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) vehicle market is further bolstered by significant infrastructure development. Governments and organizations across countries are actively expanding their network of natural gas and LPG refilling stations, making these eco-friendly vehicles a highly practical and convenient option for daily commuting and transportation needs. This infrastructure expansion not only enhances the accessibility and availability of CNG and LPG refueling points but also instills confidence in the viability and sustainability of using these alternative fuel vehicles as a long-term solution for reducing emissions and promoting a greener future.Technological Innovations

Advances in technology are revolutionizing the market, with notable trends shaping its trajectory. One such trend is the development of highly efficient and reliable CNG & LPG engines, propelling the industry forward. Through enhanced injection systems, improved tanks, and more sophisticated fuel management systems, these vehicles are becoming increasingly appealing to consumers, offering not only greater fuel economy but also reduced emissions, ultimately contributing to a greener and more sustainable future.Market Acceptance

The acceptance and adoption of Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) vehicles in the market has been steadily growing. This is primarily due to their significant advantages, such as their reduced environmental impact and cost benefits. Not only are CNG and LPG vehicles more eco-friendly, emitting fewer pollutants compared to traditional gasoline or diesel vehicles, they also offer cost savings in terms of fuel expenses.To further encourage the use of these vehicles, many local and national governments have implemented incentives and subsidies. These initiatives aim to make CNG and LPG vehicles more accessible and affordable for consumers, thereby accelerating their popularity and market growth. As a result, more and more individuals are opting for CNG and LPG vehicles as a sustainable and cost-effective transportation solution.

Shift Towards Alternative Fuels

The global trend of transitioning away from fossil fuels towards cleaner and more sustainable alternatives, such as compressed natural gas (CNG) and liquefied petroleum gas (LPG), is having a profound impact on the CNG & LPG vehicle market. This shift is driven by a growing awareness of the environmental consequences of traditional fuel sources and a desire for greener transportation options. As governments and individuals alike prioritize sustainability, the demand for CNG & LPG vehicles is expected to continue rising, leading to a further expansion of the market and stimulating innovation in this sector.Segmental Insights

Fuel Type Insights

The global Compressed Natural Gas (CNG) and Liquified Petroleum Gas (LPG) vehicle market have seen considerable growth in recent years due to the increasing focus on alternative, cleaner fuels. CNG is touted for its lower emission levels compared to traditional petrol and diesel fuels, making it attractive in light of stringent emission standards worldwide. Cars powered by CNG also tend to have a lower cost of ownership due to the reduced cost of the fuel itself. On the other hand, LPG vehicles are popular for their versatility and the extensive LPG distribution network. These vehicles can run on either LPG or conventional fuels, offering flexibility to the user. Despite their differences, both CNG and LPG vehicles contribute to the broader goal of reducing dependency on non-renewable and polluting fossil fuels.Vehicle Type Insights

Delving deeper into vehicle type insights, the global market for CNG and LPG vehicles can be divided into three categories: light-duty vehicles, medium-duty vehicles, and heavy-duty vehicles. Light-duty vehicles, such as passenger cars and mini trucks, have emerged as the dominant segment due to their extensive usage in urban areas and the increasing number of CNG and LPG refueling stations. Medium-duty vehicles, which include city buses and delivery trucks, have also witnessed a steady growth in adoption, especially in public transportation and logistics sectors where the cost and environmental advantages of CNG and LPG are significant. Although heavy-duty vehicles constitute a smaller segment, they are increasingly embracing these alternative fuels, particularly in regions with supportive government policies and well-established infrastructure. It is worth noting the notable shift in focus from conventional fossil fuels to CNG and LPG in the transportation sector, which reflects the global inclination towards more sustainable and cleaner energy consumption.Regional Insights

From a regional perspective, Asia-Pacific has been leading in the adoption of CNG and LPG vehicles, primarily driven by populous countries like India and China with high pollution levels and vast public transportation networks. These nations have been actively promoting the use of alternative fuels via subsidies and strict emission norms. Europe follows next, where countries like Italy and Germany have a well-established infrastructure for CNG and LPG refueling, backed by stringent emission regulations and supportive government policies. In contrast, North America, despite having a technologically advanced automobile industry, has lagged due to the region's abundant crude oil reserves and the consequent lower fuel prices. However, growing environmental concerns are gradually driving a shift towards cleaner fuels in this region as well. The Middle East and Africa, while still nascent markets, exhibit potential growth in the CNG and LPG vehicle segment, owing to the region's efforts to diversify their energy mix and reduce carbon emissions.Report Scope:

In this report, the Global CNG & LPG Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

CNG & LPG Vehicle Market, By Fuel Type:

- Compressed Natural Gas (CNG)

- Liquefied Petroleum Gas (LPG)

CNG & LPG Vehicle Market, By Demand Category:

- OEM

- Retrofitting

CNG & LPG Vehicle Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

CNG & LPG Vehicle Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global CNG & LPG Vehicle Market.Available Customizations:

Global CNG & LPG Vehicle Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hyundai Motor Company

- Suzuki Motor Corporation

- Nissan Motor Co. Ltd

- Volkswagen AG

- Honda Motor Company

- Ford Motor Company

- Fiat Automobiles S.p.A.

- Tata Corporation

- AB Volvo

- Traton SE

Table Information

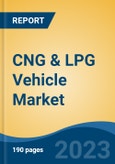

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 4.54 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |