Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Treatment options for optical disorders are diverse and depend on the nature and progression of the condition. Interventions may include corrective lenses (eyeglasses or contact lenses), pharmacological therapies (eye drops or oral medications), surgical procedures, lifestyle changes, and routine eye examinations aimed at early detection and ongoing monitoring. The overarching goal of these treatments is to preserve visual function and maintain overall ocular health.

Key Market Drivers

Technological Advancements

Recent technological progress in ophthalmology has significantly shaped the pharmaceutical landscape. One major development is the introduction of sustained-release drug delivery systems that provide controlled and extended medication release, reducing the frequency of administration. A notable example is Roche’s Susvimo (ranibizumab injection), which received FDA approval in February 2025 for the treatment of diabetic macular edema (DME). It is the first and only FDA-approved therapy shown to maintain vision in DME patients with fewer treatments compared to standard care.Nanotechnology is playing a critical role in enhancing ocular drug delivery. Nanogels and other nano-sized carriers have demonstrated improved tissue penetration and bioavailability, particularly in treating anterior segment conditions such as glaucoma, cataracts, dry eye syndrome, and bacterial keratitis.

Advancements in topical ophthalmic formulations are also contributing to market growth. For example, lipid-based eye drops have been developed to effectively manage evaporative dry eye disease by stabilizing the tear film and reducing tear evaporation.

Biotechnology has facilitated the emergence of gene therapies that target specific molecular pathways involved in various ocular diseases. These therapies have shown potential in delivering long-term visual improvements for patients suffering from inherited or degenerative retinal conditions.

Key Market Challenges

Generic Competition

The growing presence of generic drugs poses a significant challenge for brand-name pharmaceutical companies operating in the optical disorders segment. Once patent protections expire, lower-cost generics enter the market, often at substantially reduced prices, impacting revenue streams of original drug manufacturers. Patients and healthcare providers frequently opt for generics due to their affordability, leading to decreased market share for innovator products.The rapid adoption of generics can lead to price erosion and force originator companies to reduce prices or offer discounts to maintain competitiveness. This shift adversely affects profit margins and limits the ability to reinvest in research and development (R&D). Moreover, the loss of exclusivity following patent expiry often results in diminished market dominance.

This competitive pressure can discourage pharmaceutical firms from pursuing new drug innovations in the ophthalmic space, given the reduced commercial incentives once generics become viable. As a result, companies must carefully balance R&D investments with strategic planning to mitigate the risks associated with generic competition.

Key Market Trends

Patient-Centric Treatment Approaches

There is a growing trend toward tailoring ophthalmic treatment plans to align with individual patient preferences and lifestyles. Healthcare providers are increasingly considering factors such as daily routines, treatment goals, and comfort when selecting medications and therapeutic approaches.Patients express varied preferences for modes of drug administration - some favor eye drops, while others may opt for ointments or less frequent dosing schedules. In response, pharmaceutical companies are expanding their product portfolios to include a range of delivery formats designed for ease of use and integration into daily life.

User-friendly packaging and intuitive application mechanisms are being developed to improve adherence to treatment protocols. Additionally, reducing the occurrence of side effects is a major focus in drug development, as improved tolerability leads to higher compliance and better clinical outcomes.

Flexibility in dosing is also highly valued by patients. Drugs offering once-daily or extended dosing intervals provide greater convenience and enhance patient autonomy. The industry is further shifting toward collaborative care models, emphasizing patient education and shared decision-making between patients and healthcare providers. This approach ensures that treatment plans reflect individual values and objectives, leading to increased satisfaction and better management of eye disorders.

Key Market Players

- Alcon Inc.

- Novartis ag

- Johnson & Johnson services, Inc.

- Bausch health

- Merck & co. Inc.

- Coherus biosciences, Inc.

- Allergan

- Pfizer, Inc.

- Bayer ag

- Santen pharmaceuticals co. Ltd.

- Genetech, Inc.

Report Scope:

In this report, the Global Optical Disorders Drugs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Optical Disorders Drugs Market, By Prescription Type:

- Over-The-Counter Drugs

- Prescription Ophthalmic Drugs

Optical Disorders Drugs Market, By Therapeutics:

- Age-Related Macular Degeneration

- Conjunctivitis

- Diabetic Macular Edema

- Diabetic Retinopathy

- Dry Eye

- Eye Cancer

- Glaucoma

- Others

Optical Disorders Drugs Market, By End User:

- Diagnostic Centers

- Eye Clinics

- Hospitals

Optical Disorders Drugs Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- South Korea

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- Italy

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Optical Disorders Drugs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Alcon inc.

- Novartis ag

- Johnson & Johnson services, inc.

- Bausch health

- Merck & co. Inc.

- Coherus biosciences, inc.

- Allergan

- Pfizer, inc.

- Bayer ag

- Santen pharmaceuticals co. Ltd.

- Genetech, Inc.

Table Information

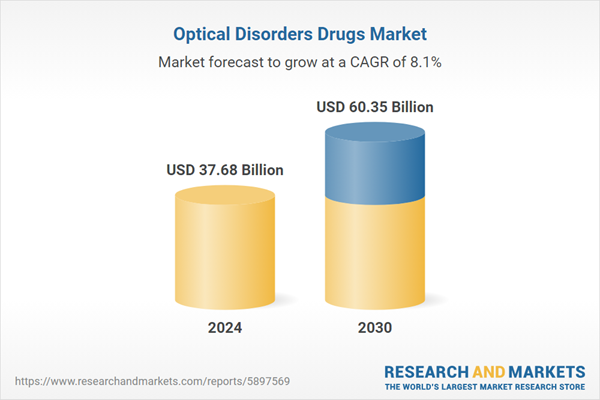

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 37.68 Billion |

| Forecasted Market Value ( USD | $ 60.35 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |