Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

To minimize this interaction and ensure the preservation of taste over an extended period, a specialized coating is applied to the inner surface. This coating serves multiple functions, including preventing chemical migration into the food, protecting the metal of the can, preserving the quality of the food or beverage, and maintaining its nutritional or organoleptic properties for prolonged periods. Additionally, the coatings used for general lines and aerosol cans should possess inert properties.

The Global Can Coating Market is driven primarily by the increasing demand for lightweight vehicles, which is attributed to stringent emission policies. Global light vehicle sales estimated to reach approximately 85.1 million units by 2025, reflecting a strong rebound in consumer demand, improved supply chain stability, and accelerated adoption of electric and hybrid models across major automotive markets. As a result, there is a growing need for lightweight materials to enhance safety and fuel efficiency, which positively impacts the can coating industry. Furthermore, the rising utilization of plastic and paper as packaging materials is also contributing to the growth of the Can Coating Market.

Another key factor driving market growth is the widespread adoption of self-cleaning technologies across various end-user industries worldwide. This versatile product finds applications in numerous areas, such as self-cleaning fabric, antimicrobial coatings for preventing hospital infections, self-cleaning paints, self-cleaning concrete, and polycarbonate substrates. These applications are expected to drive steady growth in the Can Coating Market during the forecast period. However, it is important to note that despite the advantages of titanium oxide, there are certain factors that can restrain and challenge market growth.

Key Market Drivers

Growth in Food and Beverage Industry

The primary drivers of the can coatings market is the increasing demand for packaged food and beverages. In today's fast-paced world, consumers are seeking convenience in their busy lifestyles, leading to a growing trend towards packaged foods and drinks. Globally, approximately 60% of consumers consume convenience foods at least once a week, while 20% incorporate them into their daily routines. This trend underscores a marked shift toward packaged food products, driven by changing lifestyles, urbanization, and a growing demand for time-efficient meal solutions. The data reflects a sustained consumer inclination toward ready-to-eat and easy-to-prepare food options, positioning the packaged food industry for continued growth.Food and beverage cans require coatings to prevent corrosion and contamination, ensuring the safety and longevity of the products inside. Recognizing the importance of consumer health and safety, governments worldwide have implemented stringent regulations regarding food packaging materials. These regulations have further fueled the demand for high-quality can coatings that meet the required standards.

The beverage industry, particularly the craft beer and energy drink sectors, has experienced remarkable growth in recent years. According to data from the National Institutes of Health (NIH), approximately 54.7% of individuals have consumed energy drinks at some point in their lives, while 43.4% reported usage within the past year. To stand out in a crowded market, these industries often use innovative can designs to attract consumers. Advanced can coatings are not only vital for preserving the product inside but also for maintaining the exterior aesthetics, contributing to brand image and consumer satisfaction.

The ongoing COVID-19 pandemic has had a profound impact on the food and beverage industry. With lockdowns and safety concerns, many consumers have shifted towards packaged foods as a safer and more convenient option. This change in consumer behavior has indirectly driven the growth of the can coatings market, as the demand for packaged food continues to rise.

The growth of the food and beverage industry serves as a significant driver of the global can coatings market. As the demand for packaged foods and innovative beverage cans continues to rise, the market for can coatings is expected to experience sustained growth. The industry's focus on consumer health and safety, along with evolving consumer preferences, will continue to shape the future of can coatings, driving innovation and further expanding the market.

Key Market Challenges

Volatility in Prices of Raw Materials

Can coatings rely on a wide range of raw materials, including resins, solvents, and additives, which contribute to their unique properties and performance. However, the prices of these materials are susceptible to fluctuations due to various factors such as changes in supply and demand, geopolitical tensions, and natural disasters.One important factor that significantly affects the cost of can coatings is the reliance on petrochemical derivatives. As these derivatives are closely tied to oil prices, any fluctuations in the oil market can directly impact the costs of the raw materials used in can coatings. This inherent connection between oil prices and raw material costs introduces a level of uncertainty and instability in the can coatings market, posing challenges for manufacturers.

The volatility in raw material costs presents manufacturers with significant hurdles. It disrupts effective planning, impacts profit margins, and complicates pricing strategies. When the prices of raw materials increase, manufacturers often face the dilemma of either absorbing the additional costs, which can squeeze profit margins, or passing them onto customers, which may result in a decrease in demand.

In addition to price volatility, the scattered availability of raw materials further complicates the can coatings market. The production of certain raw materials is concentrated in specific regions, making the supply chain susceptible to disruptions. This scattered availability can lead to delays and increased procurement costs, further impacting manufacturers and hindering market growth.

Considering these complexities, manufacturers in the can coatings industry must navigate through the challenges posed by price volatility, supply chain vulnerabilities, and market demand fluctuations to ensure sustainable growth and stability.

Key Market Trends

Growing Demand for Anti-Microbial and Anti-Bacterial Coatings

Anti-microbial and anti-bacterial coatings are specially formulated coatings that are designed to inhibit the growth of microorganisms on the surface of cans. These coatings have gained significant attention and are increasingly sought after due to their remarkable ability to enhance the shelf life of packaged products, particularly in the food and beverage industry.The ongoing COVID-19 pandemic has further accelerated the demand for these coatings. With a heightened awareness about hygiene and disease prevention, consumers now have a stronger preference for packaging that offers anti-microbial and anti-bacterial properties. This shift in consumer behavior has led to a significant increase in the adoption of such coatings.

The benefits of these coatings extend beyond their antimicrobial properties. They not only protect the product inside the can but also help maintain the can's aesthetic appeal by preventing discoloration and unpleasant odors caused by microbial growth. Additionally, these coatings play a crucial role in ensuring compliance with stringent food safety regulations. As governments worldwide enforce stricter standards for food packaging, the use of anti-microbial and anti-bacterial coatings has become essential for manufacturers to meet these requirements.

In response to the growing demand, manufacturers are investing heavily in research and development to create more effective and long-lasting anti-microbial and anti-bacterial coatings. Innovations in this space include coatings that release antimicrobial agents over time, providing extended protection and further enhancing the safety and longevity of packaged products.

Looking ahead, the demand for these coatings is expected to continue rising. This trend presents a lucrative opportunity for players in the can coatings market to expand their product offerings and capitalize on the growing consumer demand for safe and hygienic packaging. By staying at the forefront of research and development, manufacturers can meet the evolving needs of the market and contribute to the overall advancement of the can coatings industry.

Key Market Players

- Akzo Nobel NV

- ALTANA AG

- Covestro AG

- Henkel AG & Co KGaA

- Kansai Paint Co Ltd

- National Paints Factories Co. Ltd.

- PPG Industries, Inc.

- The Valspar Corporation

- Toyochem Co., Ltd.

- TIGER Coatings GmbH & Co. KG

Report Scope:

In this report, the Global Can Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Can Coatings Market, By Resin:

- Epoxy

- Polyester

- Acrylic

- Polyolefins

- Others

Can Coatings Market, By End User:

- Food

- Beverage

- Others

Can Coatings Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Can Coatings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Akzo Nobel NV

- ALTANA AG

- Covestro AG

- Henkel AG & Co KGaA

- Kansai Paint Co Ltd

- National Paints Factories Co. Ltd.

- PPG Industries, Inc.

- The Valspar Corporation

- Toyochem Co., Ltd.

- TIGER Coatings GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2025 |

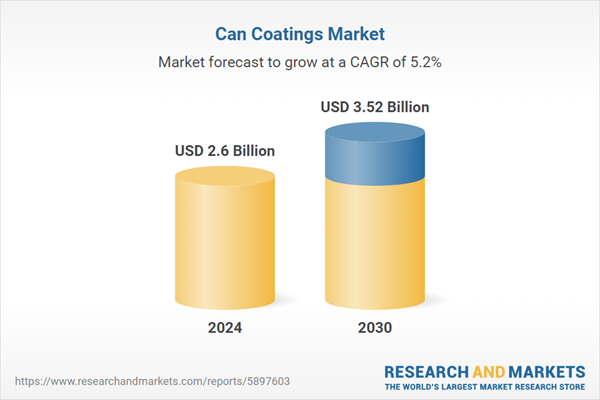

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 3.52 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |