Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Asia-Pacific region is witnessing notable expansion, driven by rising birth rates, higher disposable incomes, and growing demand for premium infant formulas. Markets like China and India are leading in functional nutrition adoption, supported by government regulations favoring fortified products. Despite strong growth prospects, high production costs remain a key constraint, as lactoferrin is derived in limited amounts from milk or whey, making the extraction process resource-intensive and expensive.

Key Market Drivers

Rising Health Consciousness

The surge in global health awareness is significantly contributing to the growing demand for lactoferrin. As a multifunctional glycoprotein found in milk and human secretions, lactoferrin is gaining traction for its wide-ranging health benefits. With about 63% of consumers globally now actively seeking immune-supportive products, lactoferrin’s ability to strengthen immune response positions it as a critical component in health and wellness routines. Its antimicrobial and anti-inflammatory properties are especially valued in preventive care and daily supplementation, particularly in the post-pandemic context.Key Market Challenges

High Production Costs

High production costs represent a substantial challenge for the lactoferrin market. Naturally present in only trace amounts in cow’s milk, lactoferrin requires large quantities of raw material to yield even small outputs. The extraction and purification processes, including membrane filtration and chromatography, are technologically complex and capital-intensive.These factors limit scalability and make it difficult for manufacturers to offer affordable pricing, which restricts product availability in cost-sensitive markets. Additionally, maintaining protein integrity during processing adds complexity, as deviations in conditions can degrade its bioactivity. Smaller producers are especially affected by these barriers, leading to limited competition, fewer innovations, and price fluctuations in markets with fragile dairy supply chains.

Key Market Trends

Cosmetic and Personal Care Industry

The incorporation of lactoferrin into cosmetic and personal care products is a rising trend, fueled by consumer demand for clean-label, multifunctional skincare ingredients. Known for its antimicrobial, anti-inflammatory, and healing properties, lactoferrin is increasingly used in formulations designed to treat acne, soothe sensitive skin, and promote wound healing.Its inclusion in serums, creams, and facial masks targeting inflammation, scarring, and skin barrier repair caters to consumers seeking natural solutions for common dermatological concerns. This trend is particularly prominent among younger users and those with rosacea-prone or irritation-sensitive skin. As interest in natural, science-supported skincare continues to grow, lactoferrin is emerging as a valued component in premium cosmetic lines.

Key Market Players

- Hilmar Cheese Co Inc

- Pharming Group NV

- Royal FrieslandCampina N.V.

- Synlait Milk Ltd

- Ingredia SA

- MP Biomedicals LLC

- Tatura Milk Industries Ltd

- Glanbia PLC

- APS BioGroup Inc

- ProHealth Care Inc

Report Scope:

In this report, the Global Lactoferrin Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Lactoferrin Market, By Function:

- Iron Absorption

- Anti-inflammatory

- Intestinal Flora Protection

- Antibacterial

- Immune Cell Stimulation

- Antioxidant

Lactoferrin Market, By Application:

- Food & Beverages

- Infant Formula

- Sports & Functional Foods

- Pharmaceuticals

- Personal Care Products

- Animal Feed

Lactoferrin Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lactoferrin Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hilmar Cheese Co Inc

- Pharming Group NV

- Royal FrieslandCampina N.V.

- Synlait Milk Ltd

- Ingredia SA

- MP Biomedicals LLC

- Tatura Milk Industries Ltd

- Glanbia PLC

- APS BioGroup Inc

- ProHealth Care Inc

Table Information

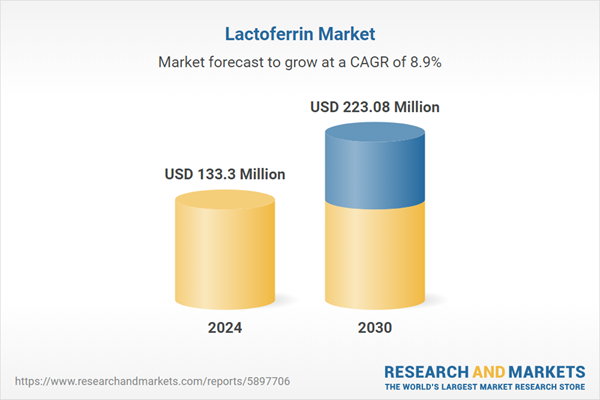

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 133.3 Million |

| Forecasted Market Value ( USD | $ 223.08 Million |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |