Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive growth factors, the sector faces a major hurdle regarding the regulatory verification of efficacy claims. Health authorities enforce strict evidentiary standards that demand thorough clinical validation for specific fertility benefits, yet many proprietary blends lack large-scale human trials. This regulatory void creates compliance risks and restricts manufacturers from transparently marketing their products, which can undermine consumer trust and limit market reach.

Market Drivers

The trend of delayed parenthood serves as a major driver for the Global Fertility Supplements Market, as changing demographics require non-invasive solutions to address age-related fertility declines. As people postpone having children for career and educational reasons, the biological window for conception shrinks, leading to a higher demand for nutraceuticals that enhance gamete quality and hormonal balance. This shift is supported by data; the Centers for Disease Control and Prevention’s April 2025 report noted a 3% increase in births among women in their late 30s, highlighting the reliance on reproductive support in older age groups. Furthermore, the sector's commercial potential is confirmed by Silicon Valley Bank's April 2025 report, which cited a record $2.6 billion investment in women's health in 2024, indicating strong investor confidence.Concurrently, the market is transforming with a new emphasis on male fertility, moving away from the traditional view that focused solely on females. With clinical studies increasingly pointing to male factors in conception issues, companies are expanding their ranges to include products that improve sperm motility, count, and DNA integrity. This shift is driven by economic factors as well; Posterity Health’s February 2025 press release revealed that for every dollar spent on male fertility care, employers save $2.30 in female treatment costs. This financial benefit is encouraging insurance providers and consumers to adopt male-specific supplements as a cost-effective initial step, thereby expanding the total market.

Market Challenges

A major impediment to the growth of the global fertility supplements market is the difficulty in providing regulatory substantiation for efficacy claims. Manufacturers face a rigid regulatory environment where health authorities demand rigorous clinical validation to authorize specific fertility benefits. However, the expense and complexity of large-scale human trials mean many formulations enter the market without the scientific evidence required for strong claims, forcing companies to use vague descriptions that often fail to appeal to consumers looking for concrete solutions. This lack of clarity prevents high-quality brands from standing out against inferior products, resulting in a confusing marketplace and compliance risks that hinder retail growth.This absence of validated efficacy limits market penetration by increasing consumer skepticism and discouraging potential users who require proof of value. Without transparent, clinically proven outcomes, the industry faces challenges in convincing a broader audience of the necessity and effectiveness of these supplements. This hesitation is reflected in consumer behavior; according to the Council for Responsible Nutrition in 2024, 41% of non-users identified a lack of perceived need as their primary reason for avoiding dietary supplements. This statistic underscores a critical gap: until manufacturers can align product promises with clinical proof, a significant segment of the target demographic will remain unconvinced, thereby limiting the market's revenue potential.

Market Trends

The rise of Personalized and Customized Fertility Plans marks a significant shift away from generic prenatal vitamins toward regimens tailored to individual biomarkers and genetic profiles. This trend is gaining momentum as brands utilize artificial intelligence and at-home testing to create specific nutrient combinations, optimizing reproductive results through precision nutrition. The quick uptake of these tech-based solutions suggests consumers are increasingly open to data-driven health management; indeed, The Vitamin Shoppe’s June 2025 report indicates that 35% of consumers are already using AI tools for personal health, highlighting a strong demand for the digital integration required to provide these bespoke fertility solutions.At the same time, the emergence of PCOS-Targeted Nutritional Blends is tackling the specific metabolic and hormonal challenges of Polycystic Ovary Syndrome, a major cause of infertility. Manufacturers are evolving beyond general fertility aids to create specialized formulas with ingredients like myo-inositol and berberine, which address insulin resistance and anovulation directly. This condition-specific approach offers tangible benefits that general multivitamins cannot provide. The success of this strategy is shown in patient results; according to an Allara Health survey in October 2025, 70% of patients with irregular periods experienced improved menstrual regularity after following a specialized metabolic and hormonal care plan, confirming the demand for diagnosis-specific nutritional support.

Key Players Profiled in the Fertility Supplements Market

- Fairhaven Health LLC

- Coastal Sciences

- LENUS Pharma GesmbH

- Orthomol Pharmazeutische Vertriebs GmbH

- Exeltis USA Inc.

- PrepMe LLC

- Bionova Inc.

- TTK Healthcare Ltd.

- Vitabiotics Ltd.

- VH Nutrition LLC

Report Scope

In this report, the Global Fertility Supplements Market has been segmented into the following categories:Fertility Supplements Market, by Ingredient:

- Natural

- Synthetic/ Blend of Natural & Synthetic

Fertility Supplements Market, by Product:

- Capsules

- Tablets

- Soft Gels

- Powders

- Liquids

Fertility Supplements Market, by End-use:

- Men

- Women

Fertility Supplements Market, by Distribution Channel:

- OTC

- Prescribed

Fertility Supplements Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fertility Supplements Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Fertility Supplements market report include:- Fairhaven Health LLC

- Coastal Sciences

- LENUS Pharma GesmbH

- Orthomol Pharmazeutische Vertriebs GmbH

- Exeltis USA Inc

- PrepMe LLC

- Bionova Inc

- TTK Healthcare Ltd

- Vitabiotics Ltd

- VH Nutrition LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

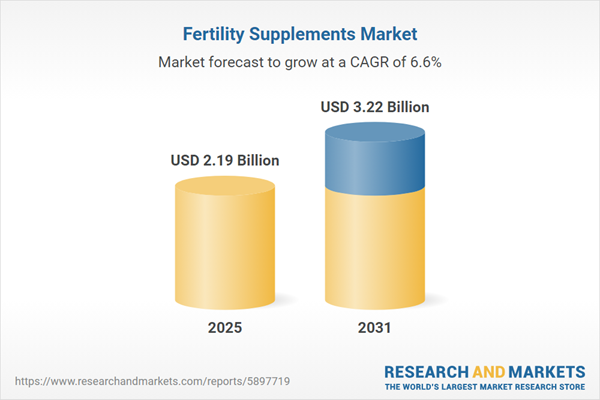

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.19 Billion |

| Forecasted Market Value ( USD | $ 3.22 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |