Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Assisted Reproductive Technology (ART) sector is a primary driver of market growth. Vitrification has revolutionized oocyte and embryo preservation, substantially improving success rates in in vitro fertilization (IVF) procedures. The technique also plays a vital role in stem cell banking and regenerative medicine, facilitating the long-term storage of pluripotent stem cells for use in advanced therapies and drug discovery. Additionally, vitrification is increasingly adopted in biobanking, where it enables the secure, long-term storage of biological specimens critical for clinical research.

Emerging applications include organ preservation, where vitrification holds the potential to extend the viability of donor organs and enhance transplant outcomes. Moreover, in environmental conservation, the technology is being utilized to preserve genetic material from endangered species and to safeguard plant biodiversity through seed cryopreservation.

Key Market Drivers

Growth in Biobanking and Tissue Engineering

The rapid expansion of biobanking and tissue engineering has become a major catalyst for the global vitrification market. Vitrification's ability to preserve biological specimens in a glass-like state at ultra-low temperatures is essential for ensuring the long-term integrity of samples used in both research and clinical settings.Biobanks, which store a wide range of biological materials - such as DNA, tissues, and cells - play a crucial role in medical research and therapeutic development. According to the World Health Organization (WHO), over 120 biobanks globally held more than 20 million biological samples as of 2023. The increasing demand for reliable preservation methods has positioned vitrification as a preferred technique due to its superior ability to maintain cellular structure and viability over extended periods.

Key Market Challenges

High Cost of Vitrification Technology

Despite its advantages, the high cost associated with vitrification technology presents a significant barrier to market expansion. The process requires advanced equipment, specialized cryoprotectants, and highly skilled personnel, all of which contribute to elevated capital and operational expenditures.Establishing a vitrification facility necessitates investment in programmable freezers, cryogenic storage systems, and other high-grade materials. Additionally, continuous maintenance - including liquid nitrogen supply, regulatory compliance, and equipment calibration - further inflates operational costs.

Labor costs are also considerable, as embryologists and laboratory technicians must undergo extensive training to handle sensitive biological materials with precision. Any deviation from protocol can compromise the viability of preserved samples, emphasizing the need for highly qualified professionals.

In developing countries or regions with constrained healthcare budgets, the cost of implementing vitrification technologies can be prohibitive. This limits geographic expansion and restricts access to fertility preservation services for lower-income populations - particularly patients undergoing cancer treatment or gender-affirming care.

Moreover, insurance coverage for fertility preservation is often limited or unavailable, placing the financial burden on patients. The high out-of-pocket expenses discourage many from pursuing vitrification, especially when multiple treatment cycles are required. These economic limitations hinder the widespread adoption of vitrification technologies and raise broader concerns about equitable access to advanced reproductive healthcare.

Key Market Trends

Advancements in Technology

Technological innovation continues to reshape the vitrification landscape, particularly in cryopreservation. Traditional freezing methods often resulted in ice crystal formation, leading to cellular damage. New vitrification techniques eliminate this risk, enabling safer and more effective preservation of cells, tissues, and even entire organs. This progress has significant implications for organ transplantation, IVF, and stem cell therapies.In materials science, the development of enhanced glass-forming substances with improved resistance to thermal shock and greater transparency is facilitating broader application of vitrification in optics, where precision components such as lenses and prisms require high-quality materials.

The pharmaceutical and biotechnology sectors are also embracing vitrification to develop stable and long-lasting formulations for biopharmaceuticals and vaccines. These methods ensure the preservation of drug efficacy during storage and transport - particularly valuable in resource-limited settings.

In the electronics industry, vitrification is being applied to the production of high-performance devices. Technologies like amorphous silicon and other vitrified materials are central to the manufacture of thin-film transistors and liquid crystal displays (LCDs), contributing to more efficient, lightweight, and visually superior electronic products.

These diverse advancements are expanding the scope of vitrification well beyond traditional biological preservation, positioning it as a transformative technology across multiple high-growth industries.

Key Market Players

- Vitrolife Inc.

- Genea Biomedx inc.

- NidaCon International AB

- Minitube International

- IMV Technologies Group (Cryo Bio System)

- The Cooper Companies, Inc. (A CooperSurgical Fertility Company)

- FUJIFILM Corporation (FUJIFILM Irvine Scientific)

- Biotech, Inc.

- Kitazato Corporation

- Shenzhen VitaVitro BiotechAGEN N.V.

Report Scope:

In this report, the Global Vitrification Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vitrification Market, By Specimen:

- Oocytes

- Embryo

- Sperm

Vitrification Market, By End-use:

- IVF Clinics

- Biobanks

Vitrification Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Vitrification Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Vitrolife Inc.

- Genea Biomedx inc.

- NidaCon International AB

- Minitube International

- IMV Technologies Group (Cryo Bio System)

- The Cooper Companies, Inc. (A CooperSurgical Fertility Company)

- FUJIFILM Corporation (FUJIFILM Irvine Scientific)

- Biotech, Inc.

- Kitazato Corporation

- Shenzhen VitaVitro BiotechAGEN N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | April 2025 |

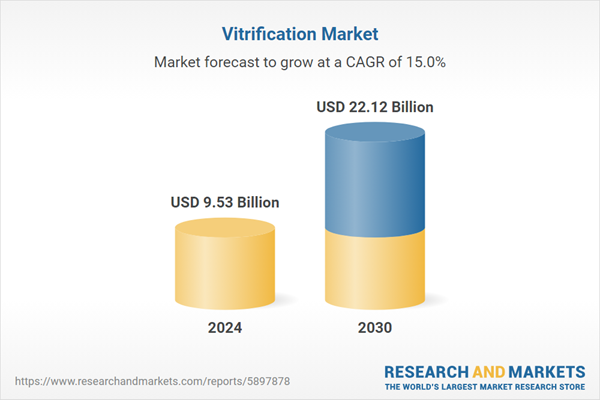

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.53 Billion |

| Forecasted Market Value ( USD | $ 22.12 Billion |

| Compound Annual Growth Rate | 15.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |