Green hydrogen and the broader energy transition are transforming the industrial gases market dynamics. Green hydrogen offers a zero-carbon fuel alternative critical for decarbonizing heavy industries, power generation, and transportation. As countries commit to net-zero goals, demand for green hydrogen surges, pushing gas producers to invest in electrolysers, large-scale hydrogen production, and distribution infrastructure. In March 2024, Egypt targeted USD 40 billion in green hydrogen investments via multiple MoUs, positioning itself as a renewable energy hub. This shift accelerates innovation in low-carbon gas technologies, including blue hydrogen (from natural gas with carbon capture) and green ammonia.

Gas producers are adopting smart sensor-driven systems, real-time consumption tracking, predictive maintenance, and remote control to optimize operations and safety. Predictive maintenance uses data analytics to foresee equipment issues before failures occur, minimizing downtime. Remote control capabilities allow operators to manage processes safely from afar, enhancing response times and reducing risks. In January 2025, InflowControl launched the Gas AICV®, the world’s first autonomous inflow control valve designed exclusively for gas reservoirs.

This digital transformation supports sustainability goals and meets growing demand for reliable, safe gas delivery.

Key Trends and Recent Developments

May 2025

Pune Gas inaugurated its first-ever LPG based Experience Centre in Kochi, marking its sixth in India and debut in Kerala. Designed for commercial and industrial clients, the unit offers hands-on demos of smart LPG systems, dual fuel generators, and leak detection technology for helping businesses reduce costs and embrace cleaner energy.June 2025

Linde entered a long-term agreement to supply oxygen and nitrogen to Blue Point Number One’s low-carbon ammonia plant in Ascension Parish, Louisiana. The deal includes a USD 400 million investment to build, own, and operate a massive air separation unit, starting operations in 2029 and enabling annual output of 1.4 million tonnes.February 2025

Air Liquide partnered with TotalEnergies to invest over EUR 1 billion to build two green hydrogen plants in the Netherlands. A 200 MW electrolyser in Rotterdam and a joint venture 250 MW electrolyser in Zeeland aim to cut CO₂ emissions from refineries by up to 500,000 tonnes annually, operational by 2027-2029.October 2024

SEFE and ConocoPhillips initiated a long-term natural gas partnership allowing ConocoPhillips to deliver up to 9 billion m³ of gas over the next decade to Germany’s SEFE via various European trading hubs. Initial shipments have already begun, enhancing Europe’s energy security and diversifying SEFE’s supply portfolio.Expanding Manufacturing & Metal Production

The surge in global manufacturing, especially automotive, electronics, and aerospace, is boosting the industrial gases market revenue. This can be attributed to the surging need to cater to cutting, welding, and steelmaking applications. In October 2024, Linde India launched a 250 TPD air separation unit in Ludhiana, India for supplying oxygen, nitrogen, and argon to nearby automotive plants via pipeline. Advanced fabrication techniques and rising output in Asia and North America have also led companies to scale up supply capacity.Electronics & Semiconductor Expansion

The appetite of the semiconductor industry for ultra-high purity gases is growing rapidly as tiny impurities can cause defects in microchips. According to the Semiconductor Industry Association (SIA), the global semiconductor sales hit USD 57 billion during April 2025. As chips become smaller and more complex, the demand for gases with extremely low contamination levels is increasing sharply to ensure high-quality, reliable semiconductor manufacturing. This drives rapid growth in the need for ultra-high purity gases.Technological Innovation in Gas Production

Advancements, such as cryogenic distillation, PSA, membrane separation, and smart digital are fostering the industrial gases industry value for improving purity, energy efficiency, reliability, and safety. In December 2024, Toray Industries constructed a pilot plant in Japan for its proprietary all-carbon CO₂ separation membrane. The plant aims to develop mass production techniques and is expected to start operations in 2026. These advancements add significant value by making industrial gas production cleaner, safer, and more cost-effective.Nuclear-Powered Gas Generation

Some nuclear energy facilities are exploring using surplus electricity and heat to produce hydrogen and oxygen for offering low-carbon and round-the-clock industrial gas supply. In March 2023, Constellation Energy commenced hydrogen production at its Oswego plant in New York. This facility employs a low-temperature electrolysis system powered by nuclear energy to produce hydrogen, marking the first nuclear-powered clean hydrogen production facility in the United States. Such approaches help to integrate clean energy production with industrial gas supply, advancing a more sustainable and low-carbon energy future.Regulatory & Environmental Pressures

Strict regulations, carbon ceilings, HFC restrictions, and green energy goals, are pushing industrial gas industry players toward low-carbon solutions in hydrogen, oxygen, and carbon dioxide sectors. In October 2023, Air Liquide invested EUR 140 million to launch a low-carbon gas platform in Québec, Canada, for producing hydrogen, oxygen, nitrogen, and argon. Governments and international bodies are enforcing these rules to reduce environmental impacts and combat climate change. This transition helps the industry to comply with regulations, while meeting the growing demand for cleaner industrial gases.Industrial Gases Industry Segmentation

The report titled “Industrial Gases Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Breakup by Product

- Nitrogen

- Oxygen

- Carbon Dioxide

- Argon

- Hydrogen

- Acetylene

- Others

Breakup by Application

- Manufacturing

- Metallurgy and Glass

- Energy

- Chemicals

- Healthcare

- Food and Beverages

- Retail

- Others

Breakup by Distribution

- Packaged

- Bulk

- On-site

- Cylinder

Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Industrial Gases Market Share

Hydrogen & Carbon Dioxide to Gain Popularity

Hydrogen records a significant share in the industrial gases industry with primary usage in refining, ammonia production, and clean energy solutions. With the global push for decarbonization, hydrogen is at the forefront of green energy innovations. Several firms are investing heavily in large-scale hydrogen projects in Saudi Arabia, the Netherlands, and the United States. In June 2024, Wärtsilä unveiled the world’s first large-scale, 100% hydrogen-ready engine power plant, enabling carbon-free operations in power generation. Hydrogen is further poised for future leadership due to its pivotal role in energy transition.Carbon dioxide (CO₂) is used extensively in the food and beverage sector for carbonation, packaging, and preservation, as well as in fire suppression systems and enhanced oil recovery. This gas plays a role in water treatment and pharmaceutical production. With increasing focus on sustainability, CO₂ capture and utilization are gaining prominence. Companies are investing in carbon capture technologies to reuse CO₂ in industrial processes, making it a key player in the evolving circular economy and decarbonization initiatives.

Surging Industrial Gases Application in Metallurgy and Glass & Energy

The metallurgy and glass segment is driving the industrial gases market expansion with growing adoption in steelmaking to increase furnace temperatures and reduce fuel consumption. In May 2024, Linde built and operated a USD 150 million on-site air separation unit in Boden, Sweden for supplying oxygen, nitrogen, and argon to H2 Green Steel’s green steel plant. With rising infrastructure projects and construction demand, especially in Asia and the Middle East, gas usage in metallurgy and glass is substantial.The energy segment is a fast-growing industrial gases consumer, especially with the transition to cleaner fuels. Hydrogen is increasingly used in refining processes and as a clean fuel in power generation and transport. Air Products and Linde are investing in green and blue hydrogen projects globally. Oxygen also plays a role in gasification and combustion processes. As countries push for net-zero goals, industrial gases, such as hydrogen are becoming central to sustainable energy infrastructure, boosting demand in this segment significantly.

On-site & Cylinder Distribution to Boost Industrial Gases Demand

On-site industrial gases market share is growing with wide usage in refineries, electronics manufacturing, and steel production to render high purity and uninterrupted supply. On-site setups reduce logistics costs, ensure reliability, and offer environmental benefits by minimizing transportation emissions. The preference for this model is also growing due to long-term cost savings and energy efficiency. Rising prominence in emerging hydrogen economies and large semiconductor projects is also driving the segment growth.Cylinder supply is essential, particularly for smaller-scale operations, research labs, and medical facilities. Gases are compressed and stored in steel or aluminium cylinders, often delivered via distributors. Companies offer extensive cylinder portfolios for oxygen, acetylene, and specialty gases. In August 2024, Luxfer launched a new lightweight and efficient 70-bar portable calibration gas cylinder, built to top industry standards for precision use. As digital tracking and safety features improve, cylinders are likely to remain important in localized and developing market segments.

Industrial Gases Market Regional Analysis

Thriving Industrial Gases Penetration in North America & Europe

North America records a significant share in the industrial gases market, driven by advanced manufacturing, energy production, and healthcare infrastructure. The United States leads in innovation and large-scale industrial gas projects. In May 2025, the FERC approved the construction of the CP2 LNG plant, projected to export 28 million metric tons/year, making it the largest U.S. LNG export facility. Strong regulatory frameworks and technological advancements further support steady growth.Europe industrial gases market dominance remains critical due to its advanced industries and sustainability focus. The region leads in automotive, pharmaceuticals, and high-end manufacturing, which demand high-purity gases and precision supply systems. Europe is also at the forefront of the global energy transition, investing heavily in green hydrogen, carbon capture, and clean industrial processes. This blend of innovation, regulatory support, and sustainability goals sustains Europe’s strategic importance.

Competitive Landscape

Key players operating in the industrial gases market are deploying key strategies to drive growth and maintain competitiveness. One major strategy is technological innovation, with companies investing in advanced gas production, storage, and distribution technologies to improve efficiency and reduce environmental impact. This includes the development of green hydrogen, carbon capture and storage, and energy-efficient air separation units. Strategic partnerships and joint ventures are also widely used to expand geographic presence, enter emerging markets, and leverage shared expertise.Mergers and acquisitions further enable companies to consolidate market share, diversify product portfolios, and strengthen supply chains. Capacity expansion is another critical strategy, particularly in high-growth regions such as Asia-Pacific, where rising demand from sectors like healthcare, manufacturing, and electronics is fuelling investment in new production facilities. Sustainability is a growing priority, with firms focusing on low-carbon solutions and aligning operations with global climate goals. Companies are also enhancing their service offerings via integrated gas solutions, including on-site gas generation and digital monitoring.

Air Liquide

Founded in 1902 and headquartered in Paris, France, Air Liquide is a global leader in industrial gases and has pioneered hydrogen energy technologies and carbon capture solutions. The firm’s achievements include advancements in clean energy, healthcare gases, and the development of hydrogen refuelling infrastructure for sustainable transportation.Linde AG

Linde AG, established in 1879 and based in Dublin, Ireland, is a major player in the global gases and engineering sector and has developed innovative cryogenic and gas processing technologies. Linde's contributions to clean hydrogen, sustainable energy solutions, and global LNG projects have cemented its position as an industry innovator.Praxair Technology, Inc.

Praxair, founded in 1907 and headquartered in Connecticut, the United States, is known for its expertise in atmospheric gases. Before merging with Linde, Praxair was recognized for developing advanced gas supply systems and environmentally efficient production methods and plays a significant role in industrial gas applications for electronics and healthcare.

Air Products Inc.

Founded in 1940 and headquartered in Allentown, the United States, Air Products Inc. specializes in atmospheric and process gases. The company has led major hydrogen and gasification projects with a focus on sustainable technologies, such as the world’s largest green hydrogen plant and innovations in low-carbon and energy-efficient industrial gas solutions.

Other players in the industrial gases market include INOX-Air Products Inc., Iwatani Corp., Messer, SOL Group, Strandmøllen A/S, and Taiyo Nippon Sanso Corp., among others.

Key Features of the Industrial Gases Market Report

- In-depth quantitative analysis of market size, share, and growth forecasts to 2034.

- Detailed segmentation by gas type, end-use industry, distribution type, and regional markets.

- Competitive landscape profiling major players with SWOT, market share, and strategy insights.

- Emerging market trends shaping demand across sectors like energy and semiconductors.

- Coverage of recent investments, technological advancements, and global expansion projects.

- Regulatory landscape analysis impacting industrial gas production and emissions compliance.

- Trusted industry insights backed by robust data and verified research methodology.

- Customized reports tailored to your specific business goals and market challenges.

- Access to expert analysts for post-report queries and strategic support.

- Proven track record of serving global clients across energy, chemicals, and manufacturing sectors.

Table of Contents

Companies Mentioned

The key companies featured in this Industrial Gases market report include:- Air Liquide

- Linde AG

- Praxair Technology, Inc.

- Air Products Inc.

- INOX-Air Products Inc.

- Iwatani Corp.

- Messer

- SOL Group

- Strandmøllen A/S

- Taiyo Nippon Sanso Corp.

Table Information

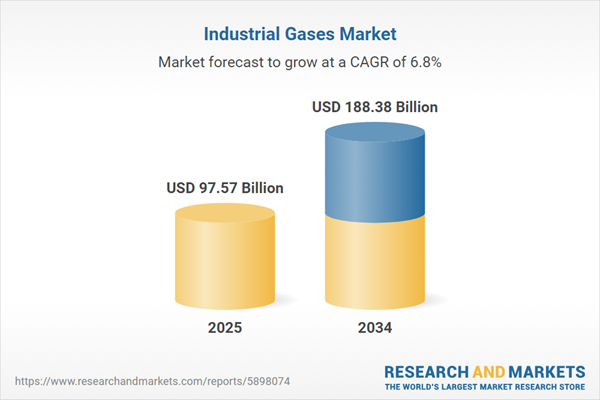

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 97.57 Billion |

| Forecasted Market Value ( USD | $ 188.38 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |