The demand for luxury travel focused on wellness continues to grow, with travelers actively seeking experiences, itineraries, and products tailored to health, fitness, nutrition, appearance, sleep, and mindfulness. According to a 2021 American Express survey, 76% of respondents expressed a desire to allocate more of their travel budget toward improving their overall well-being, while 55% indicated a willingness to invest extra in wellness activities for future vacations. Although many spas and health retreats faced closures during the pandemic, the Global Wellness Institute anticipates a robust recovery, projecting an annual growth rate of 17% and an estimated market value of USD 150 billion by 2025. In terms of luxury cultural tourism, festivals have become a major focus, and notions of authenticity have become spots of attraction in the festivals.

Tourists seek an authentic experience of festivals and associated cultural rituals performed by locals and their traditional practices. For instance, in August 2022, the Indian government announced new waterways between Mathura, Vrindavan, and Agra to promote religious tourism. Under this project, the cruises to Gokul, Vrindavan, and Mathura will be connected by waterways on the Yamuna River at affordable rates. Vrindavan and Mathura havehave a rich cultural heritage of fairs and festivals, to name a few: Holi, Charkula dance, Raasleela, Latthmar Holikotsav, Yamuna Janmotsav, Janmashtami Mela, and many more. Social connectivity is another emerging trend among luxury travelers to connect and experience different societies and cultures. For example, G Adventures (formerly known as Gap Adventures) is a social enterprise and small-group adventure travel company that brings travelers closer to society and its culture.

G Adventures is capitalizing on the social connectivity trend by providing an opportunity for local communities to connect and socialize with travelers seeking cultural exploration. Companies in the industry are focusing on strategies, such as mergers and acquisitions, to gain higher industry share and increase their service footprint. In June 2021, Inspirato LLC, the innovative luxury travel subscription brand, and Thayer Ventures Acquisition Corp., a publicly traded special purpose acquisition company, announced that they have entered into a definitive merger agreement that will result in Inspirato becoming a publicly listed company. This merger enabled the company to increase and broaden its service capabilities and bolster its package offerings.

Luxury Travel Market Report Highlights

- Culinary travel & shopping is anticipated to be the fastest-growing segment from 2024 to 2030. The primary purpose of culinary travel, often referred to as food tourism packages, is to experience the unique foods and beverages of a particular region or area and understand the culture. These packages are tailored to include destinations, sites, attractions, or events with a focus on the culinary aspect

- The millennial segment is expected to witness substantial growth from 2024 to 2030. Millennials prioritize experiences over material possessions, valuing the memories and personal growth that luxury travel can provide. Millennials are hence shifting their focus from traditional pampering to a wider range of compelling traveling experiences

- Europe dominated the global market in 2023 due to rising travel connectivity, coupled with rapid penetration of high-speed internet, which has made even the most remote places in countries like Germany accessible to travelers. This is driving the need to explore new, exotic, and exciting locations across the region, thereby boosting the regional market growth

Table of Contents

Companies Mentioned

- TUI Group

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Scott Dunn Ltd.

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Geographic Expeditions, Inc.

- Micato Safaris

- Exodus Travels Limited

- Travel Edge (Canada) Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | December 2023 |

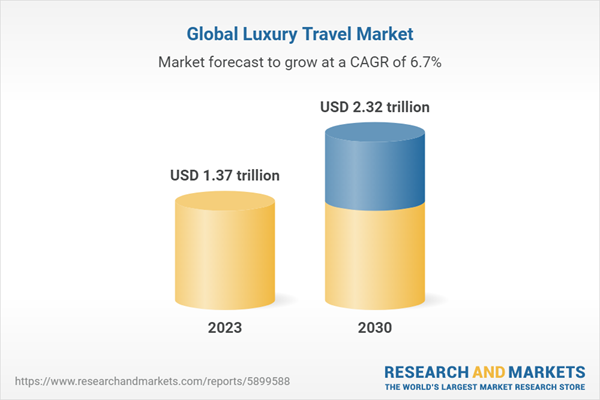

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 1.37 trillion |

| Forecasted Market Value ( USD | $ 2.32 trillion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |