Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand for Energy Efficiency and Sustainability

The growing awareness of energy conservation and the need to reduce carbon footprints are among the primary drivers of the Europe HVAC market. Governments across Europe have introduced stringent energy efficiency standards and environmental regulations, encouraging the adoption of sustainable HVAC systems. For example, the European Green Deal aims to make the continent carbon-neutral by 2050, promoting the widespread use of energy-efficient heating and cooling technologies.Consumers and businesses are increasingly shifting toward systems that reduce operational energy costs and minimize environmental impact. The development of heat pumps and HVAC systems integrated with energy recovery features is becoming more prevalent, contributing to a greener and more efficient HVAC landscape. In March 2024, the European Parliament updated building energy performance rules to support a climate-neutral building sector by 2050, with the REPowerEU initiative targeting the installation of 10 million heat pumps by 2025. This has fueled a surge in demand for air-to-water (A2W) systems, which offer lower CO2 emissions and environmental impact compared to traditional fossil fuel-based heating solutions. A2W systems capture heat from the atmosphere to produce hot water, which is then circulated throughout a building to provide warmth, aligning with Europe’s sustainability and energy efficiency goals.

Growing Construction and Retrofitting Activities

The resurgence of the construction sector, along with retrofitting and renovation projects, is driving the HVAC market in Europe. Urbanization and population growth in major European cities have led to increased demand for residential, commercial, and industrial spaces. As new buildings are constructed, the need for efficient HVAC systems has risen, contributing to market growth. Additionally, Europe’s aging building infrastructure has created opportunities for HVAC system replacements and upgrades. Retrofitting older systems with modern, energy-efficient alternatives aligns with European Union initiatives to improve building energy performance. The focus on enhancing indoor air quality and thermal comfort in both public and private buildings has further boosted the adoption of advanced HVAC solutions.Climate Change and Rising Temperature Extremes

The impact of climate change and the increasing frequency of temperature extremes are driving demand for efficient HVAC systems in Europe. As summers become hotter and winters colder in many parts of the continent, the need for reliable heating, ventilation, and air conditioning systems has grown. Regions that traditionally did not require air conditioning are now witnessing a surge in demand for cooling solutions. This shift is prompting HVAC manufacturers to develop innovative and adaptable solutions capable of providing year-round climate control. Additionally, consumers are looking for systems that offer both heating and cooling functions to meet the changing climate conditions more effectively.Key Market Challenges

Stringent Regulatory and Environmental Compliance Requirements

One of the most significant challenges in the Europe HVAC market is the complex and evolving regulatory landscape. As governments and environmental bodies strive to achieve ambitious climate goals, regulations surrounding energy efficiency and emissions standards are becoming more stringent. The European Green Deal, the Energy Performance of Buildings Directive (EPBD), and F-Gas regulations are examples of initiatives pushing for the adoption of low-emission HVAC solutions. While these regulations aim to promote environmental sustainability, compliance often requires significant investments in research and development (R&D), manufacturing, and product innovation. HVAC manufacturers must constantly redesign systems to meet evolving efficiency benchmarks, which increases production costs and product development timelines.High Installation and Maintenance Costs

The initial installation and ongoing maintenance costs of advanced HVAC systems remain a significant barrier to market growth in Europe. Although energy-efficient systems offer long-term cost savings, their upfront investment is often higher compared to traditional systems. This financial burden can deter residential and small business consumers from upgrading to more efficient HVAC solutions.Furthermore, the complexity of modern HVAC systems equipped with IoT, automation, and energy recovery features requires specialized installation and maintenance services. A shortage of skilled HVAC technicians in certain regions exacerbates this challenge, leading to increased service costs and extended wait times for repairs and maintenance.

The need for frequent maintenance to ensure system efficiency and longevity further adds to the total cost of ownership, making price-sensitive customers hesitant to adopt advanced HVAC technologies.

Key Market Trends

Growth in Demand for Heat Pumps

The demand for heat pumps has surged in the European HVAC market due to their high energy efficiency and ability to reduce carbon emissions. Unlike traditional heating systems that rely on fossil fuels, heat pumps use renewable energy sources to provide both heating and cooling solutions. For instance, Panasonic has launched a new production line for its Big Aquarea heat pump range at its Pilsen factory in the Czech Republic. This USD 2.66 million investment aims to meet the growing demand for energy-efficient heating solutions in Europe. The Big Aquarea T-CAP M Series is designed for residential and commercial applications, offering high efficiency, low noise, and integration with existing systems, which is expected to further boost market demand.This trend is fueled by the European Union's goal of achieving carbon neutrality by 2050 and the widespread adoption of energy efficiency initiatives, such as the Fit for 55 package. Governments are offering incentives and subsidies to encourage the use of heat pumps, driving their adoption across residential, commercial, and industrial sectors.

As technology advances, manufacturers are developing more efficient and quieter heat pump models, making them a preferred choice for European consumers seeking sustainable and versatile HVAC solutions.

Integration of Smart and IoT-Enabled HVAC Systems

The adoption of smart and IoT-enabled HVAC systems is transforming the market landscape in Europe. These systems offer real-time monitoring, predictive maintenance, and automated adjustments to optimize energy usage and enhance user comfort.Consumers are increasingly demanding smart solutions that can be controlled remotely via smartphones or integrated with other home automation systems. In commercial and industrial applications, smart HVAC systems enable facility managers to monitor and control energy consumption more efficiently. Leading manufacturers are investing in IoT technology and cloud-based platforms to offer predictive analytics and advanced control features. This trend aligns with the growing focus on digitalization and energy management, creating new growth opportunities for the HVAC sector.

Adoption of Hybrid and Renewable Energy-Based Systems

As Europe intensifies its efforts to reduce carbon emissions, there is a growing shift toward hybrid and renewable energy-based HVAC systems. These systems combine traditional energy sources with renewable technologies such as solar, geothermal, and wind power to provide efficient and sustainable heating and cooling solutions. Hybrid HVAC systems are particularly popular as they offer flexibility and can switch between different energy sources based on availability and cost-effectiveness. This trend is driven by the rising cost of conventional energy sources and increasing consumer awareness of environmental sustainability.Manufacturers are focusing on developing integrated solutions that seamlessly combine renewable energy technologies with traditional HVAC systems. These advancements are not only reducing energy consumption but also helping businesses and homeowners meet their sustainability targets.

Segmental Insights

Product Type Insights

Direct Expansion (DX) systems was the fastest-growing segment in the Europe HVAC market due to their energy efficiency, cost-effectiveness, and compact design. These systems offer precise temperature control and faster cooling and heating capabilities, making them ideal for residential, commercial, and industrial applications. The growing demand for sustainable and energy-efficient solutions has accelerated the adoption of DX systems, particularly in regions with stringent energy efficiency regulations. Additionally, advancements in variable refrigerant flow (VRF) technology and the integration of smart controls have enhanced the performance and flexibility of DX systems, further driving their growth in the European HVAC market.Country Insights

Germany dominated the Europe HVAC market due to its strong focus on energy efficiency, technological advancements, and stringent environmental regulations. As a pioneer in adopting sustainable heating and cooling technologies, the country has a robust demand for energy-efficient solutions, including heat pumps and smart HVAC systems. The German government’s incentives and initiatives, such as the Energy Efficiency Strategy for Buildings, further drive market growth. Additionally, the presence of key industry players and ongoing investments in research and development contribute to Germany's leadership position. The nation's emphasis on eco-friendly and innovative solutions cements its dominance in the European HVAC market.Key Market Players

- Daikin Industries, Ltd.

- Robert Bosch GmbH

- Mitsubishi Electric Europe B.V.

- Danfoss A/S

- Vaillant GmbH

- Carrier Global Corporation

- Alfa Laval Corporate AB

- Lennox International Inc.

- Ariston Thermo S.p.A.

- BDR Thermea Group

Report Scope:

In this report, the Europe HVAC Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe HVAC Market, By Product Type:

- Direct Expansion Systems

- Central Air Conditioning Systems

Europe HVAC Market, By End User:

- Residential

- Commercial

- Institutional

- Others

Europe HVAC Market, By Country:

- Germany

- United Kingdom

- France

- Italy

- Netherlands

- Spain

- Russia

- Switzerland

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe HVAC Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Daikin Industries, Ltd.

- Robert Bosch GmbH

- Mitsubishi Electric Europe B.V.

- Danfoss A/S

- Vaillant GmbH

- Carrier Global Corporation

- Alfa Laval Corporate AB

- Lennox International Inc.

- Ariston Thermo S.p.A.

- BDR Thermea Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | February 2025 |

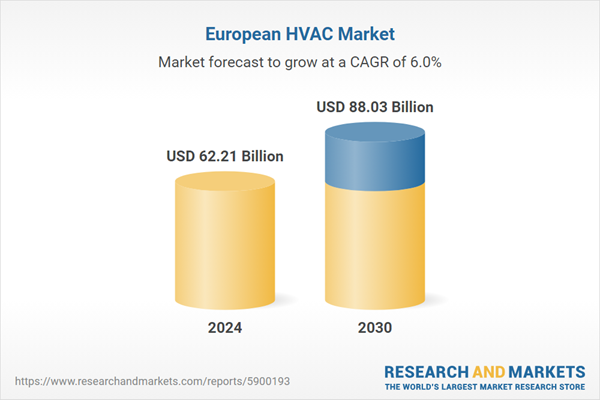

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 62.21 Billion |

| Forecasted Market Value ( USD | $ 88.03 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |