Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Urbanization and Growing Middle-Class Population

The rapid urbanization and the expanding middle-class population in India have been key drivers for the faucets market. As more people migrate from rural to urban areas, there is an increasing demand for modern residential and commercial infrastructures, including kitchens and bathrooms. The rising disposable income of the middle class has also led to an increased focus on lifestyle upgrades and home renovation.In India per capita disposable income increased by 8% in FY24, following a 13.3% growth in the preceding year. Consumers are increasingly willing to spend on high-quality, aesthetically appealing faucets that not only enhance the functionality of spaces but also contribute to the overall home decor. The demand is particularly prominent in Tier 1 and Tier 2 cities, where real estate development is flourishing. With an ever-growing urban population, the faucets market is expected to continue to grow as consumers seek innovative and technologically advanced products.

Technological Advancements and Product Innovation

Technological advancements are significantly shaping the faucets market in India. The industry has witnessed a surge in demand for touchless faucets, which are not only more hygienic but also more water-efficient. These faucets have gained popularity in both residential and commercial applications, particularly in hotels, malls, airports, and public restrooms. Smart faucets, featuring features like sensor-based activation and temperature control, are also gaining momentum as part of the broader smart home movement. Additionally, innovations such as anti-scald faucets, water-saving technology, and products with durable coatings that resist corrosion and water stains are becoming increasingly popular. As Indian consumers become more tech-savvy, the demand for such advanced faucets is likely to grow, making innovation a critical factor for brands in gaining competitive advantage.Focus on Sustainability and Water Conservation

With increasing concerns over water scarcity and sustainability, consumers in India are becoming more conscious of water usage. This has led to an uptick in demand for water-efficient faucets that reduce water wastage without compromising on performance. The Indian government has also been pushing for water conservation through various initiatives, which has fueled the adoption of water-saving products. Faucets with aerators, low-flow technology, and eco-friendly certifications have become highly sought after. Additionally, the growing awareness about the environment is encouraging consumers to choose products made from sustainable materials, which has led faucet manufacturers to develop eco-friendly solutions. As water conservation continues to be a global priority, the India faucets market is expected to see a rise in products that align with sustainability and environmental consciousness.Expansion of E-commerce and Retail Channels

The growth of e-commerce and the expanding retail sector have provided a significant boost to the faucets market in India. India's e-commerce sector experienced a 12% year-on-year growth in 2024, fueled by the rise in internet penetration, mobile usage, and the adoption of digital payment methods. Online platforms, such as Amazon, Flipkart, and specialized home improvement websites, have made it easier for consumers to compare and purchase faucets from the comfort of their homes. The availability of a wide range of products online, coupled with customer reviews and ratings, has created an informed customer base, thereby increasing sales.In parallel, brick-and-mortar retail outlets, including large home improvement stores and showrooms, have also seen an increase in foot traffic as more consumers focus on upgrading their homes. As the e-commerce sector continues to evolve, faucet manufacturers are increasingly investing in online marketing and distribution strategies to expand their market presence and reach a larger customer base. The convergence of digital and traditional retail channels is expected to be a pivotal factor in the future growth of the India faucets market.

Key Market Challenges

Intense Competition and Price Sensitivity

One of the major challenges in the Indian faucets market is the intense competition, especially from low-cost, unbranded players who dominate the market in Tier 2 and Tier 3 cities. While established brands focus on quality and innovation, the cost-conscious segment of consumers, particularly in smaller towns, is more inclined towards cheaper, often lower-quality alternatives. These products, often produced by local manufacturers, present a significant challenge to established brands who are attempting to maintain their market share.As the faucet market continues to grow, there is a constant struggle for brands to balance the need for high-quality, innovative products with affordable pricing strategies. Price-sensitive consumers are increasingly demanding durable, functional products at competitive prices, leading brands to find innovative ways to reduce manufacturing costs without sacrificing quality. This intense price competition is particularly difficult for premium brands that have to invest heavily in product development, marketing, and distribution, yet often find themselves competing against budget alternatives that offer basic functionality at a fraction of the price.

Lack of Standardization and Quality Assurance

The lack of standardization and inconsistent quality across different segments of the faucets market is another challenge that hampers growth. While international and well-established national brands maintain strict quality controls, there is a significant presence of unbranded and low-cost products, especially in the unorganized sector, which can lack durability and performance. These products may not adhere to industry standards, leading to potential safety concerns or dissatisfaction among customers.The absence of clear regulations and certifications governing product quality can result in poor user experiences, which may eventually harm the overall reputation of the faucet market. Furthermore, inconsistent quality across products can also make it difficult for consumers to make informed purchasing decisions, hindering the overall growth of the market. Manufacturers must invest in robust quality assurance processes and align with global standards to stay competitive and ensure long-term customer satisfaction. As consumers become more discerning, the focus on standardized, high-quality products will become a key factor in building trust and loyalty in the market.

Supply Chain Disruptions and Raw Material Price Volatility

Another significant challenge faced by faucet manufacturers in India is the vulnerability of supply chains to disruptions, as well as the volatility in raw material prices. Faucet production relies on various materials such as brass, stainless steel, and plastic, all of which are subject to fluctuating prices and global supply chain issues. For instance, changes in the cost of raw materials like copper, zinc, and aluminum can directly impact manufacturing costs, making it difficult for manufacturers to maintain consistent pricing.In addition, the COVID-19 pandemic and ongoing geopolitical uncertainties have highlighted the fragility of global supply chains, leading to delays in production, transportation issues, and an overall rise in lead times. These disruptions create uncertainty for manufacturers, forcing them to either absorb higher costs or pass them on to the consumer.

Furthermore, India’s dependence on imported raw materials for high-end faucet production adds another layer of complexity, as exchange rate fluctuations and global supply chain disruptions can affect material availability and costs. Manufacturers are forced to either build more resilient supply chains, localize production, or navigate price adjustments that can directly impact their profit margins and competitiveness in the market. As demand for faucets continues to rise, ensuring a stable, cost-effective supply of raw materials is essential for manufacturers looking to meet consumer expectations and maintain steady production.

Key Market Trends

Rising Popularity of Smart Faucets

One of the most significant trends in the Indian faucets market is the increasing adoption of smart faucets. As part of the broader smart home trend, more consumers are embracing advanced technologies that provide greater convenience and enhanced functionality in their everyday lives. Smart faucets, which come with features like touchless operation, sensor-based water flow control, temperature regulation, and even smartphone integration, are rapidly gaining popularity.These products not only offer increased hygiene by minimizing contact but also improve water conservation, a crucial feature in a country where water scarcity is a growing concern. Additionally, the growing trend of home automation is contributing to the acceptance of smart faucets in both residential and commercial spaces. The integration of these faucets into systems that control lighting, temperature, and other home utilities is making them increasingly attractive to tech-savvy consumers. As the awareness and affordability of smart technology increase, the demand for these faucets is expected to rise, particularly in urban areas where consumers are more open to new technologies and innovations.

Sustainability and Eco-Friendly Products

Sustainability is becoming a central focus in the Indian faucets market, driven by increasing environmental awareness and a demand for eco-friendly products. Water conservation is particularly important in India due to frequent water scarcity issues, and this has led to a growing preference for faucets designed with water-saving features. Products with aerators, flow restrictors, and low-flow technologies that reduce water consumption without sacrificing performance are in high demand. Additionally, there is a significant shift towards using materials that are recyclable and have a minimal environmental impact during production.Faucets made from brass or stainless steel, which have a longer life cycle compared to plastic alternatives, are becoming more popular. Moreover, manufacturers are focusing on reducing their carbon footprint by adopting energy-efficient production processes and using sustainable raw materials. This trend is not just limited to water-saving technologies but extends to overall product lifecycles, including the packaging, transportation, and disposal processes. Consumers, especially in urban areas, are increasingly looking for products that align with their sustainability values, pushing brands to innovate and offer greener alternatives.

Customizable and Designer Faucets

Another growing trend in the Indian faucets market is the demand for customizable and designer faucets. As consumers place more emphasis on creating personalized and aesthetically pleasing spaces, the focus on home decor is shifting to include every detail, including faucets. Consumers now expect faucets that not only provide functionality but also enhance the design and overall aesthetic of their kitchens and bathrooms. This shift has led to a rise in demand for faucets that come in various styles, finishes, and customizable features.Manufacturers are responding by offering a wide range of designs, including contemporary, vintage, and minimalistic styles, along with different colors, textures, and materials. The availability of customizable options allows consumers to select faucets that match their unique tastes and the overall design of their homes. Additionally, brands are integrating advanced manufacturing techniques like 3D printing, which allows for more intricate designs and greater customization. This trend is especially prevalent in high-end residential segments and is gaining traction in luxury hotels and commercial establishments that prioritize aesthetic appeal alongside functionality.

Integration with Bathroom and Kitchen Trends

The Indian faucets market is increasingly being influenced by the latest trends in bathroom and kitchen design. With the growing focus on luxury living and home improvement, faucets are becoming integral parts of larger interior design schemes. For instance, in modern bathrooms and kitchens, faucets are being designed to complement other elements such as countertops, sinks, and tiles, creating a cohesive and stylish environment. The popularity of open-concept kitchen designs and spa-like bathrooms has spurred demand for faucets that offer a blend of form and function.In line with these design trends, manufacturers are introducing products with sleek, minimalist designs that fit into contemporary settings, as well as faucets with a more organic, nature-inspired look for those interested in rustic or eco-friendly themes. Additionally, as more homes move towards modular and flexible designs, faucets are being developed with features that allow for easy installation and adaptability to different layouts and settings. This trend is also reflected in the increasing demand for multi-functional faucets that can cater to both kitchen and bathroom needs, like pull-out or pull-down kitchen faucets that offer a combination of utility and style. By aligning their products with the latest kitchen and bathroom trends, faucet manufacturers are tapping into the broader lifestyle movement, where consumers expect products to not only perform well but also contribute to the visual appeal of their living spaces.

Segmental Insights

End Use Insights

The commercial segment was emerging as the fastest-growing region in the Indian faucets market, driven by the expansion of industries such as hospitality, retail, and healthcare. Increasing investments in commercial infrastructure, including hotels, restaurants, shopping malls, and office buildings, are fueling the demand for high-quality, durable, and aesthetically appealing faucets. Additionally, the growing trend of luxury and modern bathroom designs in commercial spaces is further accelerating the adoption of innovative faucet technologies, including touchless and smart faucets. With rising construction and renovation activities, the commercial segment is poised for significant growth, offering lucrative opportunities for faucet manufacturers.Regional Insights

Among the regions in India, the North region dominated the faucets market. This is primarily due to the high concentration of urban centers, such as Delhi, Chandigarh, and other major cities in states like Uttar Pradesh, Haryana, and Punjab, which drive demand for both residential and commercial faucet products. The region’s rapid urbanization, high disposable income, and growing construction activities contribute to the rising demand for modern, high-quality faucets. Additionally, the North's preference for premium and designer products in luxury residential and commercial spaces further strengthens its position as the leading market for faucets in India.Key Market Players

- Jaquar and Company Private Limited

- Bosch Limited

- Waterman Industries Private Limited

- Roca Bathroom Products Private Limited

- Cera Sanitaryware Ltd.

- Cavier Bath Fittings Limited

- Hindware Limited

- Delta Electronics India Private Limited

- Grohe India Private Limited

- Kohler India Corporation Private Limited

Report Scope:

In this report, the India Faucets Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Faucets Market, By Product Type:

- Ball

- Disc

- Cartridge

- Compression

India Faucets Market, By Technology:

- Manual

- Automatic

India Faucets Market, By Application:

- Bathroom

- Kitchen

- Others

India Faucets Market, By End Use:

- Residential

- Commercial

India Faucets Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Faucets Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Jaquar and Company Private Limited

- Bosch Limited

- Waterman Industries Private Limited

- Roca Bathroom Products Private Limited

- Cera Sanitaryware Ltd.

- Cavier Bath Fittings Limited

- Hindware Limited

- Delta Electronics India Private Limited

- Grohe India Private Limited

- Kohler India Corporation Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

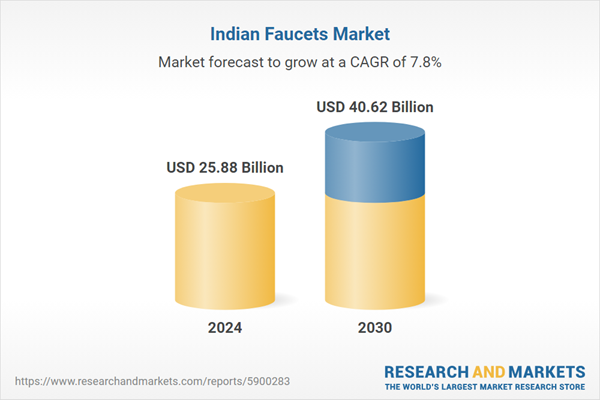

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.88 Billion |

| Forecasted Market Value ( USD | $ 40.62 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |