Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

They can be applied onto the soil surface, directly onto plants, or utilized as covers for structures like greenhouses. Their utilization offers a multitude of advantages, including weed suppression, moisture retention, temperature regulation, and prevention of soil erosion. Moreover, they create a favorable microclimate that fosters optimal conditions for plant growth, safeguarding crops against adverse weather conditions and pests. Furthermore, they play a crucial role in reducing water and fertilizer requirements, thus contributing to sustainable agricultural practices that optimize productivity and yield quality while minimizing environmental impact.

In addition to their protective and yield-enhancing functions, agricultural films support extended growing seasons and early crop development, especially in colder regions or high-altitude farming areas. By creating controlled environments through greenhouse coverings or low tunnels, these films help regulate temperature and humidity levels, allowing for earlier planting and faster germination. This accelerates crop cycles and facilitates multiple harvests per year, improving land-use efficiency. For horticultural crops like tomatoes, cucumbers, and strawberries, plastic mulching with agricultural films also improves fruit quality by preventing direct contact with soil, reducing the incidence of rot, disease, and contamination.

The rising adoption of biodegradable and recyclable agricultural films further reflects the industry’s shift toward eco-conscious farming solutions. As environmental concerns over plastic waste intensify, manufacturers are developing films made from starch-based and polylactic acid (PLA) polymers that degrade naturally after use, reducing soil pollution and disposal challenges. These next-generation films retain the same agronomic benefits while supporting sustainability goals. Additionally, innovations such as UV-resistant, infrared-blocking, and photo-selective films enable growers to tailor light exposure and heat distribution for specific crops. This integration of advanced film technologies is not only improving productivity but also redefining efficiency in modern agriculture.

Key Market Drivers

Rising Population & Resulting Increased Demand for Food

The global agricultural sector faces mounting pressure to feed an expanding population, which surpassed 8.1 billion in 2024 and is projected to grow steadily over the coming decades. This population growth significantly increases the demand for food, prompting the need for higher crop productivity on limited arable land. Agricultural films play a key role in this effort, helping to enhance crop yields by improving moisture retention, regulating soil temperature, and suppressing weed growth. These benefits allow farmers to maximize output per hectare, making agricultural films vital tools in food production systems.As available farmland continues to shrink due to urbanization and soil degradation, resource optimization becomes even more critical. Agricultural films offer a practical solution by enabling farmers to conserve water, reduce pesticide use, and protect crops from extreme weather. Studies show that the use of mulch films can improve water-use efficiency by up to 30 percent in arid and semi-arid regions. This makes them particularly valuable in areas where water scarcity is becoming a pressing concern. As such, agricultural films help secure stable food supplies even under increasingly challenging growing conditions.

In tandem with increased food demand, sustainable farming is becoming a top priority worldwide. Governments and farmers are seeking agricultural practices that reduce environmental footprints while maintaining high productivity. Biodegradable films, in particular, are gaining momentum. Recent reports indicate that biodegradable mulch films now account for a growing share of agricultural film use in regions such as Europe and East Asia. These eco-friendly alternatives break down naturally in soil, supporting both crop health and environmental goals without contributing to long-term plastic waste.

The multifunctionality of agricultural films - ranging from greenhouse coverings to silage wraps - further enhances their value in modern farming. They enable crop cultivation during off-seasons and protect produce from pests, heavy rain, and temperature fluctuations. As global food demand intensifies, especially in densely populated and climate-sensitive regions, the need for reliable and adaptable farming inputs will grow. Agricultural films, due to their yield-boosting capabilities and alignment with sustainable agriculture practices, are expected to play an increasingly critical role in addressing the world’s food security challenges.

Key Market Challenges

Environmental Concerns by Non-Biodegradable Plastic Films

The escalating environmental concerns associated with non-biodegradable plastic films are anticipated to dampen the overall demand for agricultural films globally. These films, while beneficial for enhancing crop yield and soil productivity, are posing significant harm to the environment due to their non-biodegradable nature. They persist in the environment for hundreds of years, contributing to soil and water pollution, landscape degradation, and harm to wildlife.This has prompted regulatory bodies worldwide to impose stringent regulations on the use of non-biodegradable films in agriculture, forcing farmers and agribusinesses to seek eco-friendly alternatives. Many are turning to biodegradable films that decompose naturally over time, leaving no trace of harmful residues. Furthermore, the growing public awareness and outcry against the environmental damage caused by non-biodegradable plastics are pushing companies to invest in research and development of sustainable agricultural films. Thus, the global demand for traditional agricultural films is expected to decline, paving the way for the rise of eco-friendly alternatives in the market.

Key Market Trends

Rising Use of Greenhouse & Tunnel Farming Practices

The rising adoption of greenhouse and tunnel farming practices is anticipated to significantly drive the global demand for agricultural films. These farming techniques create controlled environments that optimize crop growth by regulating factors like sunlight, temperature, and humidity, thus enhancing yield. Agricultural films play an integral role in these setups, acting as protective layers that further manage environmental conditions, shielding crops from damaging weather patterns, pests, and diseases. As climate change continues to impact traditional farming practices, more farmers are likely to switch to greenhouse and tunnel farming.This shift necessitates the use of substantial agricultural film, thus increasing its global demand. Additionally, the need for efficient food production to cater to the growing global population further amplifies this trend. Agricultural films enable year-round cultivation, reducing dependency on seasonal changes and ensuring consistent food supply. Positioning these films as pivotal elements in sustainable and efficient agriculture, their global demand is expected to surge in tandem with the rise of advanced farming practices.

Key Market Players

- AB Rani Plast Oy

- BASF SE

- Berry Global Inc.

- Plastika Kritis SA

- Novamont SpA

- ExxonMobil Chemical

- Armando Alvarez Group

- Group Barbier Inc.

- The RKW Group

- INDVECO Group

Report Scope:

In this report, the Global Agricultural Films Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Agricultural Films Market, By Type:

- LLDPE

- LDPE

- HDPE

- Reclaim

- EVA

- Others

Agricultural Films Market, By Application:

- Mulch Film

- Greenhouse Film

- Silage Film

Agricultural Films Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Agricultural Films Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AB Rani Plast Oy

- BASF SE

- Berry Global Inc.

- Plastika Kritis SA

- Novamont SpA

- ExxonMobil Chemical

- Armando Alvarez Group

- Group Barbier Inc.

- The RKW Group

- INDVECO Group

Table Information

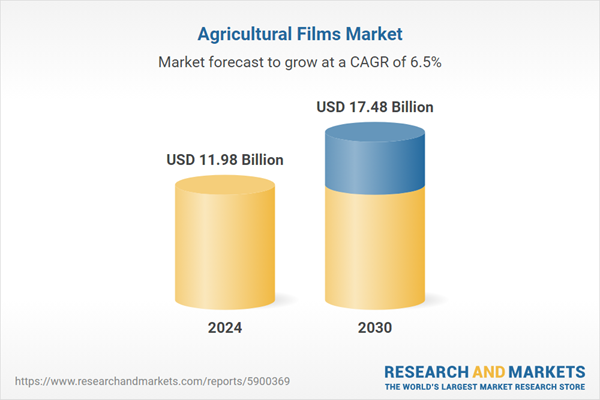

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.98 Billion |

| Forecasted Market Value ( USD | $ 17.48 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |