Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

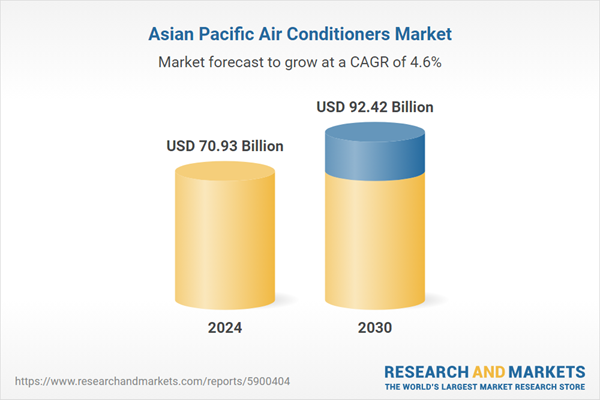

As populations in urban areas expand, the need for climate control solutions has increased, particularly in countries like China, India, and Southeast Asia. From August 1, 2023, to July 31, 2024, China's domestic household air conditioner market saw a 0.5% year-on-year increase in retail volume, influencing market dynamics. Additionally, growing awareness of energy-efficient systems and environmental concerns has fueled demand for energy-saving technologies, further influencing market trends. The market's growth is also supported by technological advancements in air conditioning systems.

Key Market Drivers

Rising Temperatures and Climate Change

One of the most significant drivers of the air conditioners market in Asia Pacific is the region’s increasing temperatures and the long-term effects of climate change. Countries in this region are experiencing hotter summers and more unpredictable weather patterns, making air conditioning a necessity for both residential and commercial spaces. The demand for cooling systems is being fueled by prolonged heatwaves, with temperatures soaring to new highs during summer months.For instance, in countries like India, China, and Southeast Asian nations, where temperatures can exceed 40°C during peak summer, air conditioners provide an essential solution for comfort and safety. This rise in extreme weather conditions is pushing consumers to seek reliable, effective, and energy-efficient cooling solutions, resulting in a steady increase in air conditioning adoption across various segments.

Urbanization and Economic Growth

The Asia Pacific region is undergoing rapid urbanization, with millions of people moving from rural areas to cities in search of better opportunities. This urban migration is contributing to the rising demand for air conditioning systems in both residential and commercial sectors. Urban areas are typically more densely populated and offer better infrastructure, making them more likely to experience higher temperatures due to increased human activity and construction.This trend is especially pronounced in developing countries, where growing middle-class populations are driving demand for modern appliances, including air conditioners. Additionally, with the increase in the number of commercial establishments like offices, malls, hotels, and restaurants, the demand for air conditioning in business settings is growing rapidly. Businesses are more likely to install air conditioners to enhance employee comfort and improve the customer experience, which in turn promotes productivity and growth.

Rising Disposable Incomes and Changing Lifestyles

Rising disposable incomes across the Asia Pacific region are empowering consumers to enhance their lifestyles, with air conditioners becoming a key household upgrade. As the middle class expands in countries such as India, Vietnam, and the Philippines, more consumers are opting for modern and convenient household appliances. This shift is driving an increasing demand for premium, energy-efficient, and advanced air conditioning systems. People are now more willing to invest in products that enhance comfort and improve quality of life. In China, the popularity of household air conditioners has reached new heights. Data from the National Bureau of Statistics indicates that by the end of 2023, the number of air conditioners per 100 households had risen to 145.9 units. As the rising disposable incomes and changing lifestyles across the Asia Pacific region are contributing significantly to the expansion of the air conditioner market.In addition to income growth, there has been a shift in consumer preferences. People are becoming more concerned about comfort and health, particularly in densely populated urban areas where air pollution is also a concern. As a result, consumers are not only looking for cooling solutions but also considering air purifiers integrated into air conditioning units. Products that offer multi-functionality, such as cooling, heating, and air purification, are becoming more popular.

Key Market Challenges

Environmental Concerns and Sustainability Issues

One of the primary challenges facing the air conditioning market in Asia Pacific is the environmental impact of widespread air conditioner usage. The high demand for cooling systems, particularly in emerging economies, is contributing to an increase in energy consumption and carbon emissions. Air conditioners are energy-intensive appliances, and with the growing adoption of these units in residential, commercial, and industrial sectors, the pressure on energy resources is escalating. Many countries in Asia Pacific are heavily dependent on non-renewable energy sources, which further exacerbates the environmental concerns related to air conditioning use.Moreover, traditional refrigerants used in air conditioners, such as hydrofluorocarbons (HFCs), have a high global warming potential (GWP), contributing to climate change. While some countries are working to phase out these refrigerants and replace them with more environmentally friendly alternatives, the transition is slow, and the overall environmental footprint of air conditioning systems remains a major challenge.

Supply Chain and Raw Material Shortages

The air conditioner manufacturing industry in Asia Pacific is highly dependent on a complex global supply chain, involving the procurement of raw materials such as metals, plastics, and electronic components. Disruptions in the supply chain have been a major challenge in recent years, especially in the wake of the COVID-19 pandemic, which caused delays and shortages in critical materials and components. These disruptions, coupled with global trade uncertainties and geopolitical tensions, have led to price hikes and supply bottlenecks for manufacturers in the region.The shortage of key materials such as semiconductors has particularly affected the production of smart air conditioning systems. These systems, which incorporate advanced technologies such as IoT connectivity and energy management features, require high-end components that are in short supply. As demand for smart air conditioners increases, the reliance on these advanced materials further complicates the supply chain dynamics.

Key Market Trends

Shift Toward Energy-Efficient and Eco-Friendly Systems

Energy efficiency has become one of the leading trends in the Asia Pacific air conditioners market. With rising electricity consumption due to the widespread adoption of air conditioning, there is an increasing emphasis on energy-efficient solutions that minimize environmental impact while lowering operational costs. The push for energy-efficient air conditioners is being driven by both consumer demand and government regulations aimed at reducing carbon emissions.Air conditioners that incorporate inverter technology, which adjusts compressor speed based on cooling demand, have become highly sought after. These systems are not only more energy-efficient but also offer superior cooling performance and lower electricity bills. The adoption of inverter-based air conditioners is growing rapidly in countries like Japan, South Korea, and China, where energy conservation is a priority.

Growth of Smart and IoT-Integrated Air Conditioning Systems

The Asia Pacific market is seeing a significant shift toward smart air conditioning systems that are integrated with the Internet of Things (IoT). These air conditioners come with advanced features such as remote control, voice activation, energy management, and integration with smart home ecosystems. As consumers become more tech-savvy and seek more convenient and personalized solutions, demand for smart air conditioning systems is growing rapidly.Smart air conditioners enable users to control their cooling systems remotely via mobile apps or voice assistants such as Amazon Alexa or Google Assistant. These systems not only allow for better convenience but also contribute to energy savings by enabling users to monitor and adjust settings from anywhere, even when they are not at home. For instance, users can set the temperature to a comfortable level before arriving home, ensuring a pleasant environment while reducing energy consumption when not needed.

Rising Demand for Split Air Conditioners

Split air conditioners, which consist of an indoor and outdoor unit, have emerged as the most popular type of air conditioning system in the Asia Pacific region. These systems are known for their flexibility, easy installation, and energy efficiency, making them ideal for both residential and commercial use. The rising demand for split air conditioners is particularly evident in densely populated urban areas where space is limited, and air conditioners must be installed efficiently without disrupting aesthetics.The split air conditioner market is growing due to several factors, including urbanization, rising disposable incomes, and the increasing need for cooling solutions in both residential and commercial sectors. In densely populated cities like Delhi, Mumbai, and Bangkok, where high temperatures are common, split ACs offer an effective and compact solution for cooling individual rooms, making them a preferred choice.

Segmental Insights

End Use Insights

The residential segment was the dominating segment in the Asia Pacific air conditioners market, driven by rising temperatures, increasing disposable incomes, and rapid urbanization. As more consumers in the region seek comfort and cooling solutions for their homes, the demand for air conditioners has surged. This trend is especially prominent in countries like India, China, and Southeast Asia, where extreme heat and growing middle-class populations contribute to higher adoption rates. The availability of affordable, energy-efficient models further fuels this growth, making air conditioning a staple in modern homes. This segment is expected to maintain its dominance in the coming years.Country Insights

China was the dominating region in the Asia Pacific air conditioners market due to its large population, rapid urbanization, and expanding middle class. With increasing temperatures and growing demand for residential and commercial cooling solutions, China has become the largest market for air conditioners in the region. The government’s push for energy-efficient and eco-friendly products has accelerated the adoption of advanced technologies such as inverter-driven and smart air conditioners. Additionally, China’s robust manufacturing sector, coupled with strong domestic demand, allows it to remain a key player in the production and consumption of air conditioning systems across Asia Pacific.Key Market Players

- Midea Group Co. Ltd.

- Panasonic Corporation

- Blue Star Limited

- LG Corporation

- Samsung Electronics Co., Ltd.

- Mitsubishi Electric Corporation

- Haier Group Corporation

- AB Electrolux

- Carrier Global Corporation

- Sharp Corporation

Report Scope:

In this report, the Asia Pacific Air Conditioners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia Pacific Air Conditioners Market, By Product Type:

- Splits

- VRFs

- Chillers

- Windows

- Others

Asia Pacific Air Conditioners Market, By End Use:

- Residential

- Commercial/Industrial

Asia Pacific Air Conditioners Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Singapore

- Vietnam

- Malaysia

- Thailand

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia Pacific Air Conditioners Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Midea Group Co. Ltd.

- Panasonic Corporation

- Blue Star Limited

- LG Corporation

- Samsung Electronics Co., Ltd.

- Mitsubishi Electric Corporation

- Haier Group Corporation

- AB Electrolux

- Carrier Global Corporation

- Sharp Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 70.93 Billion |

| Forecasted Market Value ( USD | $ 92.42 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |