An industrial gearbox is a mechanical device that is designed for the transmission of power and torque between rotating components within machinery and industrial equipment. It can modify the speed, direction, and torque of the output shaft, which makes it essential for achieving the desired operational parameters of heavy machinery and equipment. It is widely available in various types and configurations that cater to the different needs of various sectors. As it assists in enhancing the performance and reliability of industrial processes, the demand for industrial gearboxes is increasing across the globe.

At present, the rising number of infrastructure developments, such as construction and transportation projects, around the world is supporting the growth of the market. Besides this, the increasing adoption of industrial gearboxes, as they ensure the smooth operation of conveyor belts, is strengthening the growth of the market. Additionally, the growing demand for energy-efficient solutions that minimize energy consumption is positively influencing the market. Apart from this, the increasing popularity of replacing and upgrading aging industrial gearboxes in existing machinery to improve efficiency and reduce downtime is providing lucrative growth opportunities to industry investors. Furthermore, the introduction of more compact, efficient, and durable gearboxes is bolstering the growth of the market. In line with this, the increasing adoption of industrial gearboxes that withstand heavy loads and provide precise control over equipment is propelling the growth of the market.

Industrial Gearbox Market Trends/Drivers:

Increasing popularity of industrial automation

The rising popularity of industrial automation in several industries is contributing to the growth of the market. In addition, various industries are rapidly seeking to optimize their operations to enhance productivity. Besides this, the increasing adoption of gearboxes, as they provide precise and efficient power transmission, is bolstering the growth of the market. Moreover, they can assist in controlling speed, torque, and direction of rotation, which makes them essential components in automated machinery. Furthermore, automation not only enhances production efficiency but also improves safety by reducing the need for manual labor in hazardous environments. There is a rise in the demand for reliable and high-performance gearboxes across numerous industries.Growing number of manufacturing processes in various sectors

The rising number of manufacturing processes in various sectors is supporting the growth of the market. In line with this, industrial gearboxes play a vital role in various manufacturing processes, such as metalworking, plastics, and textiles, where they provide the required power transmission and speed control. Apart from this, industries like food and beverage, pharmaceuticals, and electronics rely on precision machinery and conveyors that incorporate industrial gearboxes for seamless production. In addition, the increasing need for cost-effective production is strengthening the growth of the market. Furthermore, there is an increase in the demand for heavy machinery and equipment that are often powered by these gearboxes.Rising preferences for renewable energy sources

The growing preference for renewable energy sources, such as wind and solar power, is positively influencing the market. Wind turbines rely on gearboxes to convert the slow rotation of turbine blades into high-speed rotation for power generation. The rising number of wind energy installation projects due to the increasing focus on reducing carbon emissions is bolstering the growth of the market. In addition, people are increasingly preferring a cleaner energy alternative to maintain sustainability in the environment. Besides this, there is an increase in the demand for reliable and efficient gearboxes that can withstand the harsh conditions of wind turbine operation. On the other hand, solar tracking systems, which ensure solar panels capture maximum sunlight throughout the day, also utilize these gearboxes to adjust the orientation of solar arrays.Industrial Gearbox Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global industrial gearbox market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, design, and application.Breakup by Type:

- Helical Gearbox

- Planetary Gearbox

- Bevel Gearbox

- Spur Gearbox

- Worm Gearbox

- Others

Helical gearbox represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes helical gearbox, planetary gearbox, bevel gearbox, spur gearbox, worm gearbox, and others. According to the report, helical gearbox represented the largest segment. A helical gearbox is a type of mechanical transmission system that employs helical gears to transmit power efficiently. Helical gears have teeth that are cut at an angle to the gear axis, forming a helix shape. This design enables smoother and quieter operation as compared to other gear types, which makes it ideal for applications where noise reduction and precision are essential. In addition, helical gears can handle high torque loads and provide uniform power transmission across the gear teeth that reduce wear and extend the lifespan of the gearbox. It is widely used in manufacturing, automotive, and material handling purposes.Breakup by Design:

- Parallel Axis

- Angled Axis

- Others

Parallel axis accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the design. This includes parallel axis, angled axis, and others. According to the report, parallel axis represented the largest segment. Parallel axis gearboxes are a common design type used in industrial applications for transmitting power and torque between two parallel shafts. These gearboxes consist of gears with parallel axes of rotation, which means the input and output shafts run side by side, which makes them suitable for applications where space constraints are a concern. In addition, they offer simplicity and efficiency in power transmission. They come in various gear configurations, such as spur, helical, or planetary gears, each offering specific benefits. Parallel axis gearboxes are used in various applications, such as conveyor systems, material handling equipment, and machine tools.Breakup by Application:

- Construction and Mining Equipment

- Automotive

- Chemicals, Rubber and Plastic

- Wind Power

- Material Handling

- Power Generation

- Agriculture

- Others

Power generation holds biggest market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction and mining equipment, automotive, chemicals, rubber and plastic, wind power, material handling, power generation, agriculture, and others. According to the report, power generation represented the largest segment. In the power generation sector, these gearboxes facilitate the conversion of mechanical energy into electrical power. They are an integral part of various types of power generation equipment, such as turbines and generators, to ensure efficient and reliable operation. In wind power generation, gearboxes are a vital component, as they connect the low-speed rotation of the turbine blades to the high-speed rotation required by the generator. In hydropower plants, these gearboxes can convert the kinetic energy of flowing water into mechanical energy, which is then transformed into electricity.Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest industrial gearbox market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific held the biggest market share due to the increasing demand for efficient power transmission solutions in several sectors. In addition, the rising adoption of automation and industrialization is strengthening the growth of the market in the region. Besides this, the growing demand for advanced gearboxes for energy conversion is offering a positive market outlook. In line with this, the increasing number of solar and wind power projects is contributing to the growth of the market in the Asia Pacific region.

Competitive Landscape:

Various companies are continuously investing in research and development (R&D) activities to create innovative gearboxes with more compact, efficient, and durable designs that are capable of handling higher torque loads. These innovations address the growing demand for advanced gearbox solutions in various industries. In addition, this flexibility allows them to provide solutions that align precisely with the requirements of diverse applications and industries. Apart from this, major manufacturers are incorporating sensors, data analytics, predictive maintenance, and the Internet of Things (IoT) into their products, which allows customers to monitor health and performance, reduce downtime, and enhance operational efficiency of gearboxes. They are also investing in stringent quality control processes and certifications to build trust among their customers.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Altra Industrial Motion Corp.

- Bonfiglioli Riduttori SPA (Bonfi SRL)

- Bondioli & Pavesi S.p.A.

- Emerson Electric Co.

- Elecon Engineering Company Ltd.

- Johnson Electric Holdings Limited

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- SEW-EURODRIVE GmbH & Co KG.

Key Questions Answered in This Report

1. How big is the industrial gearbox market?2. What is the expected growth rate of the global industrial gearbox market during 2025-2033?

3. What are the key factors driving the global industrial gearbox market?

4. What has been the impact of COVID-19 on the global industrial gearbox market?

5. What is the breakup of the global industrial gearbox market based on the type?

6. What is the breakup of the global industrial gearbox market based on the design?

7. What is the breakup of the global industrial gearbox market based on the application?

8. What are the key regions in the global industrial gearbox market?

9. Who are the key players/companies in the global industrial gearbox market?

Table of Contents

Companies Mentioned

- ABB Ltd.

- Altra Industrial Motion Corp.

- Bonfiglioli Riduttori SPA (Bonfi SRL)

- Bondioli & Pavesi S.p.A.

- Emerson Electric Co.

- Elecon Engineering Company Ltd.

- Johnson Electric Holdings Limited

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- SEW-EURODRIVE GmbH & Co KG.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

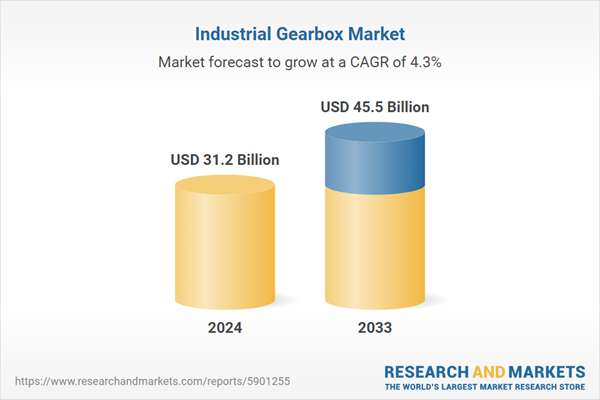

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 31.2 Billion |

| Forecasted Market Value ( USD | $ 45.5 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |