Contraceptive devices are essential tools that help individuals and couples prevent unintended pregnancies. These devices effectively prevent pregnancy by inhibiting the fertilization process. They are made using various materials and technologies, depending on the type of device. Barrier methods, such as condoms and diaphragms, prevent sperm from reaching the egg and are typically made of latex, polyurethane (PU), or other materials. Hormonal contraceptives, such as birth control pills, injections, and patches contain synthetic hormones that regulate the woman's menstrual cycle and prevent ovulation. On the other hand, intrauterine devices (IUDs) are made of either copper or plastic and are inserted into the uterus to prevent pregnancy. Contraceptive devices offer numerous advantages, such as providing individuals with the autonomy to plan their families and make informed choices about their reproductive health. They can be used by both men and women, offering a wide range of options for contraception. They are generally safe and effective when used correctly, and many devices also provide additional benefits, such as protection against sexually transmitted infections (STIs) or reduced menstrual bleeding.

Contraceptive Devices Market Trends:

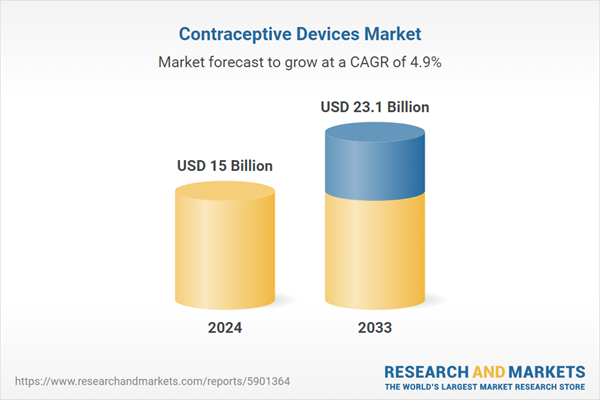

The global contraceptive devices market is driven by several factors, including the increasing awareness and adoption of family planning methods and the growing incidence of unintended pregnancies. Moreover, the rising government initiatives and funding to promote family planning programs and the surging prevalence of STIs are boosting the market growth. Furthermore, the availability of various contraceptive devices, including oral contraceptives, intrauterine devices, condoms, and subdermal implants, and inflating consumer expenditure power are driving the market growth. Apart from this, the development of long-acting reversible contraceptives, the expansion of the e-commerce sector, and the inflating trend of product innovations are fueling the market growth. In line with this, the increasing demand for non-hormonal and natural contraceptives and the surging acceptance of female-controlled contraceptive methods are also contributing to the market growth. Other factors, such as the growing number of partnerships and collaborations between manufacturers and healthcare providers, as well as the expansion of distribution networks in emerging markets, are expected to propel the market growth further.Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global contraceptive devices market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on device type, end user and distribution channel.Device Type Insights:

- Condoms

- Diaphragms

- Cervical Caps

- Sponges

- Vaginal Rings

- IUDs

- Others

End User Insights:

- Male

- Female

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Stores

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global contraceptive devices market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Allergan plc, Bayer AG, Church & Dwight Co., Inc., CooperSurgical Inc., Merck & Co., Mylan Inc., Pfizer Inc., Reckitt Benckiser Group plc, Teva Pharmaceutical Industries Ltd., and The Female Health Company. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

1. How big is the global contraceptive devices market?2. What is the expected growth rate of the global contraceptive devices market during 2025-2033?

3. What are the key factors driving the global contraceptive devices market?

4. What has been the impact of COVID-19 on the global contraceptive devices market?

5. What is the breakup of the global contraceptive devices market based on the device type?

6. What is the breakup of the global contraceptive devices market based on the end user?

7. What is the breakup of the global contraceptive devices market based on the distribution channel?

8. What are the key regions in the global contraceptive devices market?

9. Who are the key players/companies in the global contraceptive devices market?

Table of Contents

Companies Mentioned

- Allergan plc

- Bayer AG

- Church & Dwight Co. Inc.

- CooperSurgical Inc.

- Merck & Co.

- Mylan Inc.

- Pfizer Inc.

- Reckitt Benckiser Group plc

- Teva Pharmaceutical Industries Ltd.

- The Female Health Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 15 Billion |

| Forecasted Market Value ( USD | $ 23.1 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |