A smart process application (SPA) is a software ecosystem designed to streamline complex work activities. It comprises several components, including process management, data manipulation, collaboration tools, analytics, and inbound and outbound communication. SPA is widely used in customer service, sales automation, human resources (HR), supply chain management, healthcare, financial services, logistics, energy, education, and telecommunications. It enhances process automation, bolsters data-driven decisions, improves customer experiences, facilitates regulatory compliance, accelerates response times, and streamlines collaboration. SPA also enables real-time monitoring, simplifies process changes, minimizes human errors, and boosts overall business productivity.

The widespread adoption of cloud-based SPA owing to its cost-effectiveness, scalability, high security, and easy access is propelling the market growth. Furthermore, the rising software utilization to enhance customer engagement, simplify transactions, and accelerate response time is boosting the market growth. Apart from this, the increasing emphasis on regulatory compliance in the finance and healthcare industry is facilitating the software demand to simplify compliance management and reduce associated risks. Besides this, the growing software demand for business process monitoring, as it delivers real-time visibility into operations and enables quicker responses to changes, is supporting the market growth. Other factors, including rising remote work culture, increasing investment in developing advanced SPA solutions, rising demand for process agility among businesses, and growing awareness regarding various software benefits, are anticipated to drive the market growth.

Smart Process Application Market Trends/Drivers:

The rapid digital transformation across the globe

Digital transformation is a comprehensive process that integrates digital technology into all areas of a business. The shift towards digital platforms is stimulating the demand for smart process applications (SPAs). SPAs assist businesses in streamlining operations, enhancing productivity, and improving customer service. They also aid businesses in staying relevant and competitive in the rapidly evolving digital landscape. Additionally, the digital transformation journey involves dealing with complex tasks that can be effectively managed through SPAs. Their in-built analytical capabilities allow businesses to harness and interpret the large amounts of data generated during this transformation, turning it into actionable insights. Therefore, the worldwide push for digital transformation is a significant driver of the SPA market, promoting their adoption across various sectors, including healthcare, logistics, telecommunications, and financial services.The increasing adoption of automation

Automation is widely adopted in business processes, as it plays a crucial role in improving efficiency, reducing costs, and gaining competitive advantages. This growing need for automation is a significant factor propelling the SPA market. SPAs enable businesses to automate complex, labor-intensive tasks, thus freeing up valuable time and resources that can be redirected toward more strategic initiatives. Automation through SPAs aids in boosting operational efficiency and improving accuracy by carrying out processes with high precision and accuracy and minimizing the risk of human errors. It provides a consistent approach to tasks, enhancing the predictability and reliability of outcomes. SPAs' automation capabilities are particularly beneficial in areas, such as customer service and human resource (HR) management, where they can automate tasks, such as query handling and employee onboarding, leading to faster response times and improved service levels.The growing demand for data-driven decision making.

The rise of big data has revolutionized decision-making processes. Organizations across the globe are shifting towards data-driven decision-making, which utilizes verifiable data to formulate strategic business decisions. SPAs, with their advanced analytics component, are perfectly poised to support this transition. They allow businesses to process vast amounts of data, transforming it into valuable insights that provide essential information for decision-making processes. Furthermore, SPAs facilitate the real-time analysis of data, enabling organizations to respond promptly to emerging trends, changes in consumer behavior, and operational inefficiencies. Additionally, they provide an improved understanding of performance metrics, assisting businesses in identifying areas of improvement. Moreover, predictive analytics integrated within SPAs allow companies to foresee potential issues and enable proactive decision-making.

Smart Process Application Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global smart process application market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on offering, deployment type, organization size and vertical.Breakup by Offering:

- Solutions

- Enterprise Content Management

- Business Process Management

- Customer Experience Management

- Business Intelligence and Analytics

- Others

- Services

- Support and Maintenance Services

- Professional Services

- Managed Services

Solutions have witnessed considerable growth as they can be tailored to align with the specific needs and requirements of businesses. This customization ensures a higher degree of applicability and effectiveness, providing greater value to businesses. Furthermore, they streamline and automate complex business processes, increase productivity, and boost operational efficiency. Moreover, solutions provide robust data management and analytical capabilities, which allow businesses to gain meaningful insights from their data.

Services play an essential role in SPA as they offer vital support during implementation, ensuring the seamless integration of SPAs into existing systems. Furthermore, it provides necessary training and education to employees, ensuring effective utilization of the application. Moreover, services offer valuable advice on how to leverage SPAs for maximum benefits.

Breakup by Deployment Type:

- On-premises

- Cloud-based

On-premises deployment offers businesses a greater degree of control over their data, providing robust security measures. This control is essential for businesses operating in sectors where data privacy and security are paramount. Furthermore, it provides businesses the flexibility to customize their SPAs to meet specific operational needs, leading to a more tailored solution that aligns with their unique workflows and processes.

Cloud-based deployment eliminates the need for significant capital expenditure on hardware, software, and network infrastructure. Furthermore, it offers excellent scalability features, allowing businesses to easily increase or decrease their resource usage based on demand. Moreover, cloud-based SPAs can be accessed from anywhere with an internet connection, which aligns with the emerging trend of remote and distributed work environments.

Breakup by Organization Size:

- Small Sized Businesses

- Medium Sized Businesses

- Large Enterprises

Small sized businesses are utilizing SPAs to automate and streamline their processes, which aids in increasing operational efficiency and productivity without the need for extensive resources. Furthermore, SPAs offer subscription-based payment, which makes them more affordable for small businesses as they don't require a large initial investment. Additionally, it offers scalability, allowing small businesses to increase or decrease their usage.

Large enterprises deal with complex business operations spanning multiple locations and divisions. In line with this, SPAs assist in streamlining complex processes, enabling efficient and cohesive operation. Furthermore, it provides robust data management and analytical capabilities, allowing large enterprises to make informed decisions. Additionally, SPAs offer the necessary scalability to meet the evolving requirements of large enterprises, ensuring they remain effective as the business expands.

Breakup by Vertical:

- BFSI

- Telecom & IT

- Public Sector, Energy and Utilities

- Media and Entertainment

- Manufacturing

- Retail

- Healthcare

- Education

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on vertical. This includes BFSI, telecom and IT, public sector, energy and utilities, media and entertainment, manufacturing, retail, healthcare, education, transportation and logistics, and others. According to the report, healthcare represented the largest market segment.

SPA is widely used in healthcare facilities to streamline and automate administrative and patient care processes, which aids in enhancing efficiency, reducing errors, and saving time. Furthermore, it assists healthcare providers in complying with complex regulatory requirements by automating the compliance process and reducing the risk of non-compliance. Apart from this, SPA enables healthcare professionals to improve patient experiences by facilitating personalized care, efficient scheduling, timely follow-ups, and faster response times. It also provides robust data management and analytics capabilities, enabling hospitals, clinics, and other healthcare facilities to derive valuable insights for improved patient care and operational effectiveness. Moreover, SPA can be seamlessly integrated with existing systems in healthcare organizations, enabling effective communication and data exchange among different systems, which is crucial for providing comprehensive care.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest smart process application market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, Others); Latin America (Brazil, Mexico, Others); and the Middle East and Africa. According to the report, North America accounted the largest market segment.North America is dominating the smart process application market due to the presence of numerous technology giants and startups that are fostering a culture of innovation and technological advancement. Furthermore, the region's strong economy provides businesses with the necessary resources to invest in advanced technologies, such as SPAs. Additionally, North American businesses are at the forefront of digital transformation, employing advanced technologies to streamline processes, improve customer experiences, and gain a competitive edge. Moreover, the region has a high rate of technology adoption, both at the consumer and enterprise level, which is contributing to the market growth. Apart from this, the imposition of stringent regulatory requirements by the regional governments, particularly in healthcare and financial services, is propelling the market growth.

Competitive Landscape:

The leading companies in the market are heavily investing in research and development (R&D) to introduce innovative, efficient, and more advanced SPA solutions to stay ahead of the competition and meet the rising demand of customers. Furthermore, several key players are forging strategic partnerships and collaborations with other tech companies, service providers, and research institutions to enhance their offerings, expand their reach, and share knowledge and resources. Apart from this, top companies are continuously expanding their service portfolios to include a broader range of SPA solutions, catering to various industries and business functions. Moreover, they are adopting a customer-centric approach, tailoring their solutions to meet specific customer needs and providing personalized customer service.The report has provided a comprehensive analysis of the competitive landscape in the global smart process application market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Appian Corporation Inc.

- Dell Technologies

- IBM Corporation

- Blue Yonder Group, Inc.

- Verint Systems Inc.

- Thomas Bravo

- Open Text Corporation

- Pegasystems Inc.

- Salesforce.com, inc.

- SAP SE.

Key Questions Answered in This Report:

- How has the global smart process application market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global smart process application market?

- What is the impact of each driver, restraint, and opportunity on the global smart process application market?

- What are the key regional markets?

- Which countries represent the most attractive smart process application market?

- What is the breakup of the market based on the offering?

- Which is the most attractive offering in the smart process application market?

- What is the breakup of the market based on the deployment type?

- Which is the most attractive deployment type in the smart process application market?

- What is the breakup of the market based on organization size?

- Which is the most attractive organization size in the smart process application market?

- What is the breakup of the market based on vertical?

- Which is the most attractive vertical in the smart process application market?

- What is the competitive structure of the global smart process application market?

- Who are the key players/companies in the global smart process application market?

Table of Contents

Companies Mentioned

- Appian Corporation Inc.

- Dell Technologies

- IBM Corporation

- Blue Yonder Group Inc.

- Verint Systems Inc.

- Thomas Bravo

- Open Text Corporation

- Pegasystems Inc.

- Salesforce.com Inc.

- SAP SE

Table Information

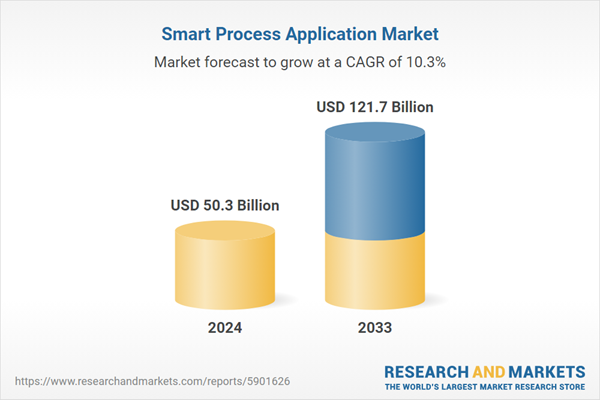

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 50.3 Billion |

| Forecasted Market Value ( USD | $ 121.7 Billion |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |