Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

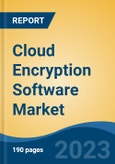

The Global Cloud Encryption Software Market was valued at USD 3.84 Billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 32.89% through 2028.

Key Market Drivers

Data Security Concerns

The global Cloud Encryption Software Market is experiencing robust growth, largely propelled by escalating data security concerns in today's digitally connected world. As organizations increasingly rely on cloud infrastructure and services to store and manage their data, the need to fortify data security has become paramount, making cloud encryption software a critical component of this strategy. Data security concerns stem from the ever-present threat of data breaches, cyberattacks, and unauthorized access to sensitive information. High-profile breaches have exposed the vulnerabilities that exist in cloud environments, eroding trust in cloud service providers and necessitating proactive measures to safeguard data. Cloud encryption software is instrumental in addressing these concerns by providing a robust defense mechanism.

One of the primary drivers of the Cloud Encryption Software Market is the fear of data breaches. Businesses store vast amounts of sensitive data, including customer information, intellectual property, and financial records, in the cloud. Any breach can result in substantial financial losses, reputational damage, and legal consequences. Encryption serves as a shield, rendering data unreadable to anyone without the encryption keys, even if the data is compromised. Regulatory compliance is another factor fueling data security concerns. Laws such as GDPR in Europe and HIPAA in the United States require organizations to protect personal and confidential data. Failure to do so can lead to significant fines and penalties. Cloud encryption software enables organizations to adhere to these regulations by ensuring data is encrypted both at rest and in transit.

The rise of remote work and the prevalence of mobile devices have further heightened data security concerns. Data is often accessed from various locations and devices, increasing the attack surface. Encryption provides a critical layer of protection, ensuring that data remains secure, regardless of where and how it is accessed. Cloud service providers have recognized the imperative nature of encryption in data security and have integrated encryption services into their offerings. This endorsement reinforces the importance of encryption in the cloud ecosystem and encourages its adoption among customers. In summary, data security concerns are driving the global Cloud Encryption Software Market as organizations seek robust solutions to protect their sensitive data. As the digital landscape continues to evolve and threats persist, the demand for cloud encryption software is set to grow, solidifying its position as a fundamental safeguard for data security and privacy in the cloud.

Increasing Cyber Threats

The global Cloud Encryption Software Market is witnessing substantial growth, largely propelled by the ever-increasing and evolving cyber threats that loom over the digital landscape. In an era where data breaches, ransomware attacks, and other malicious activities have become alarmingly commonplace, the demand for cloud encryption software has surged as a vital shield against these cyber perils. Cyber threats have become more sophisticated, relentless, and damaging than ever before. Attackers target sensitive data stored in the cloud, seeking to exploit vulnerabilities and gain unauthorized access to valuable information. The consequences of a successful breach can be catastrophic, including financial losses, reputational damage, and legal liabilities. As a result, organizations are prioritizing robust security measures, with encryption at the forefront, to mitigate these risks.

Cloud encryption software plays a pivotal role in safeguarding data stored in the cloud. It uses advanced encryption algorithms to transform data into an unreadable format, rendering it useless to anyone without the decryption keys. This approach ensures that even if cybercriminals manage to breach cloud systems, the stolen data remains unintelligible, thereby protecting the confidentiality and integrity of sensitive information. Moreover, stringent data protection regulations, such as GDPR in Europe and CCPA in California, have placed increased accountability on organizations to secure personal and sensitive data. Non-compliance with these regulations can result in severe fines and penalties. Cloud encryption software assists in achieving compliance by providing a robust security layer that aligns with regulatory requirements. The escalating frequency and severity of cyberattacks have made encryption an imperative component of a comprehensive cybersecurity strategy. Companies across various sectors, from finance to healthcare, have recognized that prevention and proactive security measures are essential in the face of these growing threats. Consequently, they are investing in cloud encryption solutions to fortify their defenses and protect their digital assets.

In conclusion, the global Cloud Encryption Software Market is being driven by the escalating cyber threats that pose significant risks to organizations' digital assets. As the cyber landscape continues to evolve, the importance of cloud encryption software in mitigating these threats and ensuring data security is poised to grow, making it an indispensable element in the battle against cybercriminals and data breaches.

Cloud Adoption

The global Cloud Encryption Software Market is experiencing significant growth, largely fueled by the accelerating pace of cloud adoption across industries. Cloud adoption has become a fundamental aspect of modern business operations, offering scalability, flexibility, and cost-efficiency. However, with the numerous advantages of cloud computing come inherent security challenges, and this is where cloud encryption software steps in to play a pivotal role. As organizations of all sizes and sectors migrate their data, applications, and workloads to the cloud, the need to secure sensitive information has become paramount. Cloud encryption software is a crucial component of a comprehensive cloud security strategy. It encrypts data at rest, in transit, and in use, ensuring that even if unauthorized access occurs, the data remains unintelligible without the encryption keys.

One of the primary drivers for the Cloud Encryption Software Market is the constant concern over data security. High-profile data breaches and cyberattacks have made headlines, eroding trust in cloud service providers. As a result, businesses are increasingly turning to encryption to safeguard their intellectual property, customer information, and other sensitive data. Furthermore, regulatory compliance requirements, such as GDPR in Europe and HIPAA in the United States, mandate the protection of personal and confidential data. Cloud encryption solutions provide a means to achieve compliance by securing data and ensuring it remains confidential and protected from unauthorized access.

The rise of remote work and the use of mobile devices have also accelerated the need for cloud encryption. With data being accessed from various locations and devices, encryption becomes essential to maintaining data security and privacy. Major cloud service providers have recognized the significance of encryption in cloud security and have integrated encryption services into their offerings. This endorsement further underscores the importance of encryption in the cloud ecosystem. Overall, cloud adoption is driving the global Cloud Encryption Software Market because it brings with it an urgent need to protect data in the cloud environment. As organizations continue to embrace the cloud for its myriad benefits, the demand for robust encryption solutions is expected to grow, making the Cloud Encryption Software Market a critical player in the evolving landscape of data security and privacy.

Key Market Challenges

Complexity and Management Overhead

The global Cloud Encryption Software Market faces a substantial challenge in the form of complexity and management overhead, which can impede its widespread adoption. While cloud encryption is crucial for protecting sensitive data in cloud environments, the intricacies and resource-intensive nature of its implementation and management can deter organizations from fully embracing it. Here are several keyways in which complexity and management overhead can hamper the market, Implementation Complexity: Setting up cloud encryption solutions can be a complex and time-consuming process. Organizations must select the right encryption algorithms, configure encryption policies, and ensure proper integration with their existing cloud infrastructure. This complexity can deter smaller businesses with limited IT resources.

Key Management: Effective encryption relies on secure key management, and this often proves to be a significant challenge. Managing encryption keys securely, ensuring their availability when needed, and protecting them from unauthorized access can be resource-intensive and demanding. Integration Challenges: Integrating encryption solutions with various cloud services and applications can be complex. Customization and development work may be required to ensure that encryption operates seamlessly across different cloud platforms and services.

Performance Impact: Encryption and decryption processes can introduce performance overhead, which can be particularly problematic for applications that require low-latency data access. Organizations must carefully balance security with performance to avoid disrupting critical business operations. User Experience: Complicated encryption processes can negatively impact the user experience. Users may need to enter encryption keys or use multi-factor authentication, which, if not streamlined properly, can be perceived as cumbersome and affect productivity. Resource Requirements: Effective encryption requires dedicated resources, including hardware security modules (HSMs) for key management, additional computing power for encryption processes, and skilled IT personnel to manage and troubleshoot encryption systems.

Interoperability: Ensuring interoperability between different encryption solutions and cloud service providers can be challenging. Organizations may encounter compatibility issues when using multiple cloud platforms or switching between providers. Regulatory Compliance: Meeting data protection regulations often involves additional complexities. Organizations must demonstrate compliance with encryption practices, which requires thorough documentation and reporting, adding to management overhead.

Scalability: As organizations grow and their data volumes increase, scaling encryption solutions to accommodate more data and users can be complex and resource intensive. This scalability challenge can hinder the seamless expansion of encryption infrastructure. User Training: Ensuring that employees are educated and trained on encryption best practices can be time-consuming and costly. Inadequate user training can lead to security vulnerabilities. In conclusion, while cloud encryption software is essential for data security and privacy in the cloud, the complexities and management overhead associated with its implementation and maintenance can pose significant barriers to adoption. Organizations must carefully assess their capabilities and resources to navigate these challenges effectively and realize the full benefits of cloud encryption while ensuring data security.

Costs

Cost considerations indeed play a significant role in hampering the global Cloud Encryption Software Market. While the demand for robust data security in the cloud continues to rise, organizations often grapple with the financial implications associated with implementing and maintaining cloud encryption software. Here are several ways in which costs can pose challenges to the market, Initial Investment: Acquiring and implementing cloud encryption software often involves substantial upfront costs. Organizations need to purchase licenses or subscriptions, acquire hardware security modules (HSMs) for key management, and possibly invest in training and consulting services to ensure proper setup. Operational Expenses: Beyond the initial investment, there are ongoing operational expenses associated with maintaining encryption solutions. This includes costs for software updates, patches, and maintaining encryption keys. Organizations must allocate resources to manage these aspects effectively.

Scalability Costs: As organizations grow and their data volumes increase, the cost of scaling encryption solutions can become prohibitive. Expanding encryption infrastructure to accommodate more data and users may require additional hardware and software licenses. Complex Key Management: Efficient and secure key management is essential for effective encryption. Implementing and maintaining key management systems can be expensive, both in terms of technology and personnel. Hardware security modules (HSMs), which are often recommended for key security, can be costly. Integration Expenses: Integrating encryption solutions with existing cloud environments and applications can be complex and costly. Customization and development efforts may be required to ensure seamless integration, adding to the overall cost. Training and Expertise: Organizations may need to invest in training their IT staff to effectively manage and troubleshoot encryption systems. Alternatively, they may need to hire experts with encryption expertise, which can be expensive.

Vendor Lock-In: Some encryption solutions are tightly coupled with specific cloud providers, potentially leading to vendor lock-in. Migrating data and applications away from such solutions can be costly and complicated. Regulatory Compliance Costs: Meeting regulatory compliance requirements, such as GDPR or HIPAA, often necessitates additional expenditures on auditing, reporting, and ensuring that encryption systems align with specific compliance standards.

Cost-Benefit Analysis: Organizations must conduct a thorough cost-benefit analysis to justify the expenses associated with encryption. Smaller businesses with limited budgets may find it challenging to allocate resources for encryption software. User Experience Improvements: Balancing security with user experience can also incur costs. Implementing user-friendly encryption solutions that do not disrupt productivity can require additional development and user training. In conclusion, while cloud encryption software is essential for data security and compliance in the cloud, the financial burden associated with its acquisition, implementation, and maintenance can hamper its adoption. Organizations must carefully weigh the costs against the benefits of enhanced security and regulatory compliance to make informed decisions regarding the deployment of cloud encryption software.

Key Market Trends

Rising Adoption of Multi-Cloud and Hybrid Cloud Environments

The rising adoption of multi-cloud and hybrid cloud environments is a significant driver propelling the global Cloud Encryption Software Market. Organizations are increasingly recognizing the advantages of diversifying their cloud infrastructure to achieve greater flexibility, resilience, and scalability. However, with the benefits of multi-cloud and hybrid cloud come heightened concerns about data security and the need for robust encryption solutions, which in turn, is driving the demand for cloud encryption software. Flexibility and Vendor Neutrality: Multi-cloud and hybrid cloud approaches allow organizations to avoid vendor lock-in and select the cloud services that best fit their specific needs. This flexibility enables them to choose the most secure and cost-effective cloud solutions, while still maintaining control over their data. Cloud encryption software provides a consistent layer of security that can be applied across various cloud providers and on-premises environments.

Data Resilience and Redundancy: Multi-cloud strategies provide data redundancy and disaster recovery capabilities. By distributing data across multiple cloud providers, organizations reduce the risk of data loss due to cloud provider outages or failures. Encryption ensures that data remains protected during migration between clouds or when transitioning between cloud and on-premises infrastructure. Compliance and Data Sovereignty: Many organizations must adhere to data sovereignty regulations that require certain data to be stored within specific geographic regions or under specific legal jurisdictions. Multi-cloud and hybrid cloud environments allow organizations to maintain compliance while still leveraging the cloud's benefits. Encryption is essential for ensuring that data remains protected and compliant, regardless of where it's stored.

Enhanced Security Posture: The complexity of multi-cloud environments increases the attack surface, making them attractive targets for cyber threats. Cloud encryption software mitigates these risks by securing data at rest and in transit, providing an additional layer of defense against unauthorized access and data breaches. Data Migration and Integration: Multi-cloud and hybrid cloud environments often involve data migration and integration challenges. Encryption solutions assist in securely transferring data between different clouds and integrating it into existing workflows without compromising its security.

Centralized Key Management: To manage encryption keys across multiple cloud environments, organizations often turn to centralized key management solutions. This centralized approach streamlines key lifecycle management, ensuring consistent encryption practices across all clouds and on-premises systems. Cost Optimization: Multi-cloud strategies aim to optimize costs by selecting the most cost-effective cloud services for specific workloads. Cloud encryption software helps organizations minimize the financial risks associated with data breaches and regulatory fines, contributing to overall cost optimization.

In summary, the rising adoption of multi-cloud and hybrid cloud environments is driving the global Cloud Encryption Software Market by highlighting the critical need for data security and privacy in these complex infrastructures. As organizations continue to diversify their cloud strategies, cloud encryption software plays a pivotal role in safeguarding data and maintaining compliance while reaping the benefits of a multi-cloud and hybrid cloud approach.

Zero-Trust Security Model

The global Cloud Encryption Software Market is experiencing a significant boost due to the growing adoption of the Zero-Trust Security Model. Zero-trust is a cybersecurity approach that assumes no entity, whether inside or outside the network perimeter, should be trusted by default. Instead, it requires continuous verification of trust and strict access controls. This model's principles align closely with the need for robust data security, thus driving the demand for cloud encryption software in several ways, Data Protection Across Environments: Zero-trust mandates that data should be protected at all times, irrespective of where it resides. This principle necessitates encryption as a fundamental component of the strategy. Cloud encryption software secures data both at rest and in transit, ensuring that it remains protected, even in cloud and hybrid cloud environments.

Encryption as a Zero-Trust Enabler: Encryption is a critical enabler of zero-trust security. It ensures that even if an unauthorized entity gains access to data, they cannot decipher it without the encryption keys. This aligns perfectly with the zero-trust concept of never trusting, always verifying. Securing Remote and Mobile Access: The zero-trust model acknowledges that threats can exist both inside and outside the traditional network perimeter. With the rise of remote work and mobile device usage, employees access data from various locations and devices. Cloud encryption software ensures data remains secure, regardless of where it's accessed, supporting the zero-trust approach to continuous verification.

User and Entity Behavior Analysis: Zero-trust relies on analyzing user and entity behavior to detect and respond to anomalies. Encryption complements this approach by providing an additional layer of security, ensuring that even if a threat actor manages to infiltrate the network, the data remains encrypted and inaccessible. Risk Mitigation: The zero-trust model is rooted in risk mitigation. Encryption plays a pivotal role in reducing the risk of data breaches and unauthorized access. By encrypting sensitive data, organizations mitigate the potential consequences of security incidents, aligning with zero-trust's risk-centric perspective.

Compliance Alignment: Many industries are subject to stringent regulatory requirements related to data protection and privacy. Zero-trust, when coupled with encryption, helps organizations meet these compliance obligations by ensuring data remains confidential and protected. Adaptive Access Control: Zero-trust relies on adaptive access control mechanisms to grant or deny access based on real-time assessments of trustworthiness. Encryption complements these controls by ensuring that data remains secure even if access is granted to certain users or entities.

In conclusion, the global Cloud Encryption Software Market is benefiting from the growing adoption of the Zero-Trust Security Model as organizations recognize the importance of continuous verification and strict access controls in today's evolving threat landscape. Cloud encryption software is a vital component of this security approach, ensuring that data remains protected and aligned with zero-trust principles, ultimately driving its demand and adoption in cloud environments.

Segmental Insights

Industry Vertical Insights

IT & Telecommunication Segment to Dominate the market during the forecast period. The IT & telecommunication industry is one of the major consumers of the cloud encryption software market. Data security is one of the primary concerns of the telecom and IT industry which is driving the market.

Cloud technologies are integrated into the core levels of the IT and telecom industry. The telecom industry is using cloud services to reduce the time and cost of the processes. With cloud capabilities, the industry is focused to grow at a faster pace, driving the market for cloud encryption software.

Regional Insights

North America plays a significant role in the global Cloud Encryption Software market, North American region is one of the largest economies of the world and holds a major share of the global cloud encryption software market. The cloud encryption software market is expected to witness rapid growth in this region as data privacy and security is becoming one of the major concerns for companies in this region, thus, driving the market.

This region has witnessed some high-profile data breaches in the past few years which have resulted in an outrage on companies providing cloud services, as the privacy of user data was compromised. This compelled various firms to tighten their cloud security and implement better encryption solutions. Moreover, similar breaches have forced many companies to invest highly in better encryption software. This data loss concern is expected to drive the market for these encryption solutions.

Also, the governments in this region have also tightened the security norms by passing strict regulations for firms to provide better cloud security for user’s data.

Report Scope:

In this report, the Global Cloud Encryption Software Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Global Cloud Encryption Software Market, By Organization Size:

- SMEs

- Large Enterprises Natural

Global Cloud Encryption Software Market, By Service:

- Professional Services

- Managed Services

Global Cloud Encryption Software Market, By Industry Vertical:

- IT & Telecommunication

- BFSI

- Healthcare

- Entertainment and Media

- Retail

- Education

- Other

Global Cloud Encryption Software Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Cloud Encryption Software Market.

Available Customizations:

Global Cloud Encryption Software Market report with the given market data, the publisher offers customizations according to a company's specific needs.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Trend Micro

- Ciphercloud

- Symantec Corporation

- Hewlett Packard Enterprise

- Google LLC

- Sophos

- Voltage Security Inc.

- CyberArk

- Safenet

- Hitachi Vantara

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3.84 Billion |

| Forecasted Market Value ( USD | $ 22.21 Billion |

| Compound Annual Growth Rate | 32.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |