Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Several key factors drive the United States Rodenticides Market. Firstly, the increasing urbanization and expansion of residential and commercial spaces have created conducive environments for rodent infestations. As a result, demand for effective rodenticides has risen steadily over the years. Secondly, the stringent regulations and safety standards governing rodenticide use have spurred innovation in the industry, leading to the development of safer and more environmentally friendly products.

The market offers a wide range of rodenticide products, including baits, traps, and poisons, catering to various consumer preferences and specific pest control needs. Traditional rodenticides have given way to more modern and humane alternatives, such as non-lethal traps and bio-based rodenticides. These developments reflect a growing concern for animal welfare and environmental sustainability.

Furthermore, the United States Rodenticides Market is characterized by a competitive landscape, with several established players and emerging companies vying for market share. The industry is also influenced by trends such as increased adoption of integrated pest management (IPM) practices, which emphasize a holistic and sustainable approach to pest control.

In recent years, the COVID-19 pandemic has brought new challenges and opportunities to the rodenticides market. Lockdowns and disruptions in supply chains have led to an uptick in rodent infestations in various settings, from restaurants and warehouses to residential areas. Consequently, the demand for rodenticides surged during the pandemic, underscoring the market's resilience and adaptability.

Key Market Drivers

Urbanization and Expansion of Commercial Spaces

Urbanization and the expansion of commercial spaces have emerged as significant drivers behind the robust growth of the United States Rodenticides Market. As cities continue to expand and urban areas become more densely populated, the prevalence of rodent infestations has risen dramatically. This trend is primarily attributed to the favorable conditions that urban environments offer rodents: access to abundant food sources, shelter in buildings and infrastructure, and ample hiding places.The increased human activity in commercial spaces, such as restaurants, warehouses, and retail establishments, further exacerbates the problem by providing rodents with easy access to food and shelter. On November 29, 2022, the U.S. Environmental Protection Agency (EPA) proposed new mitigation measures for 11 rodenticides. These measures aim to minimize potential exposure risks for three federally listed endangered and threatened species, as well as one critical habitat. This initiative aligns with the EPA’s objectives outlined in its April 2022 Endangered Species Act (ESA) Workplan and is part of the ESA pilot programs detailed in its November 2022 update.

The consequences of rodent infestations in urban and commercial settings are manifold, ranging from health hazards and property damage to economic losses. In response to these challenges, there has been a growing demand for effective rodent control solutions, which has fueled the expansion of the rodenticides market. Urbanization has made rodent infestations a pressing concern for businesses and homeowners alike, necessitating the use of rodenticides to combat these pests.

Furthermore, the expansion of commercial spaces, including the construction of new buildings and infrastructure, has created opportunities for rodents to establish nests and breeding grounds. This expansion has also led to increased competition for available resources, further driving rodent infestations. As a result, property managers, business owners, and pest control professionals have turned to rodenticides as a crucial tool in their pest management strategies.

To address the unique challenges posed by urbanization and the expansion of commercial spaces, rodenticide manufacturers have developed a range of innovative products and formulations. These products are designed to be effective in urban environments while adhering to stringent safety and regulatory standards.

Key Market Challenges

Regulatory Hurdles

The United States Rodenticides Market, despite its critical role in pest control and public health protection, faces significant challenges stemming from a complex and stringent regulatory landscape. These regulatory hurdles, while designed to ensure safety and environmental responsibility, can impede the growth and innovation of the market.The Environmental Protection Agency (EPA) plays a central role in regulating rodenticides and other pesticide products in the United States. The primary goal of these regulations is to mitigate the potential risks posed by rodenticides to non-target species, wildlife, pets, and the environment. While this regulatory oversight is essential for public safety and environmental protection, it introduces several challenges for the industry.

Compliance with EPA regulations demands substantial resources, both in terms of time and finances. Manufacturers must invest in rigorous testing, data collection, and analysis to meet the stringent safety and efficacy standards required for product approval. Navigating the regulatory process can be time-consuming and costly, especially for smaller manufacturers with limited resources.

Furthermore, the regulatory landscape for rodenticides is constantly evolving. New research findings or emerging concerns may lead to changes in regulations, requiring manufacturers to adapt their products to remain compliant. This dynamic environment can pose challenges in terms of product development, market planning, and maintaining a competitive edge.

Key Market Trends

Consumer Preferences for Humane and Sustainable Solutions

Consumer preferences for humane and sustainable solutions have emerged as a powerful driver of growth in the United States Rodenticides Market. In recent years, there has been a notable shift in the way consumers approach pest control, with a growing emphasis on ethical and environmentally friendly methods. This shift has significantly influenced the rodenticides market, leading to the development and adoption of alternative, more responsible products.One of the primary aspects of evolving consumer preferences is the increasing concern for animal welfare. Traditional rodenticides, which often involve the use of lethal toxins, have come under scrutiny due to the suffering they cause to target rodents and non-target species. This ethical concern has driven the demand for more humane alternatives. Non-lethal traps, for example, provide a way to capture rodents without causing harm, allowing for their safe relocation away from human dwellings. In February 2021, Anticimex U.S., a global pest control provider, has launched its new U.S. website. With locations in 21 states and 18 countries, the website provides easy access to each location through dedicated links. Anticimex currently operates across North America, Central America, Europe, and Asia.

Environmental sustainability is another key consideration for today's consumers. Many people are now acutely aware of the ecological impact of pest control chemicals and are seeking rodenticides that are eco-friendly. This shift in mindset has led to the development of bio-based rodenticides, which are derived from natural sources and biodegradable, reducing their environmental footprint. These sustainable alternatives resonate with consumers who prioritize responsible environmental practices.

Furthermore, consumers are increasingly making choices based on the overall safety of their households and the welfare of their pets. Accidental exposure to toxic rodenticides can pose health risks to both humans and animals, leading consumers to seek safer solutions. Manufacturers have responded by creating rodenticides with lower toxicity profiles, safer handling instructions, and improved packaging to prevent accidental ingestion.

Key Market Players

- BASF Corporation

- Bayer Corporation

- Neogen Corporation

- Bell Laboratories Inc.

- Liphatech Inc.

- Beyond Pesticides

- Integrated Pest Management, Inc.

- Pest & Pollinator LLC

- Orkin LLC

- The Rainforest Alliance

Report Scope:

In this report, the United States Rodenticides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Rodenticides Market, By Type:

- Anticoagulant

- Non-anticoagulant

United States Rodenticides Market, By Mode of Application:

- Pellet

- Spray

- Powder

United States Rodenticides Market, By Rodent Type:

- Rat

- Mice

- Chipmunk

- Hamster

- Others

United States Rodenticides Market, By End Use:

- Agricultural Fields

- Warehouses

- Urban Centers

United States Rodenticides Market, By Region:

- North-East

- Mid-west

- West

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Rodenticides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF Corporation

- Bayer Corporation

- Neogen Corporation

- Bell Laboratories Inc.

- Liphatech Inc.

- Beyond Pesticides

- Integrated Pest Management, Inc.

- Pest & Pollinator LLC

- Orkin LLC

- The Rainforest Alliance

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

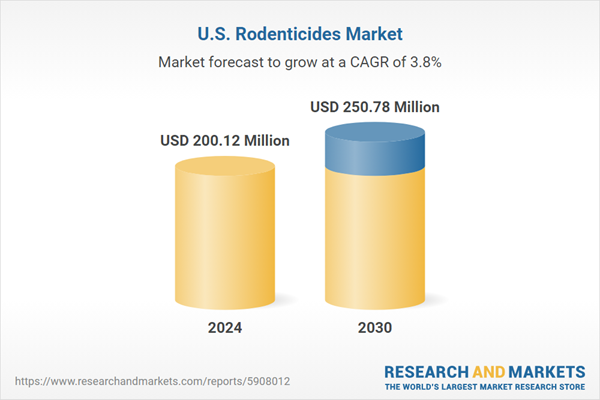

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 200.12 Million |

| Forecasted Market Value ( USD | $ 250.78 Million |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |