Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Global Passenger Car ABS (Antilock Braking System) Motor Circuit Market serves as a pivotal component within the automotive industry, contributing significantly to the safety and stability of passenger vehicles. This market's overview reveals a multifaceted landscape shaped by various interrelated factors.

First and foremost, stringent safety regulations and a heightened global awareness of road safety have propelled the widespread adoption of ABS technology in passenger cars. The ABS motor circuit is at the core of this technology, enabling precise control over individual wheel braking to prevent lockup during hard braking or slippery road conditions. As governments worldwide prioritize enhanced road safety, automakers have responded by integrating ABS systems into their vehicles, driving the demand for ABS motor circuits.

Technological advancements constitute a defining feature of this market. ABS motor circuits are continually evolving to meet the demands of modern driving. Manufacturers are developing increasingly sophisticated ABS systems equipped with advanced sensors and faster response times. These improvements are vital in ensuring that ABS systems can operate effectively in complex and challenging driving scenarios, such as sudden braking on icy roads or navigating sharp turns.

Moreover, the integration of ABS technology into broader Advanced Driver Assistance Systems (ADAS) is a noteworthy trend. ABS motor circuits are integral to the functionality of ADAS features like adaptive cruise control, lane-keeping assistance, and collision avoidance systems. As vehicles become smarter and more interconnected, the demand for ABS motor circuits capable of facilitating these advanced functionalities is on the rise.

The electric vehicle (EV) market also plays a pivotal role in shaping the ABS motor circuit market's trajectory. EVs often employ regenerative braking systems, which capture and convert kinetic energy into electrical energy during deceleration. ABS motor circuits in EVs must seamlessly integrate regenerative and friction braking, ensuring optimal performance and safety across various driving conditions.

Furthermore, the global reach of the market is a notable aspect. The demand for ABS motor circuits transcends geographical boundaries, with both established and emerging markets recognizing the importance of this technology for road safety. Governments and consumers alike are increasingly prioritizing ABS-equipped vehicles, driving the growth of the market worldwide.

Finally, the market encompasses both original equipment manufacturers (OEMs) and the aftermarket segment. OEMs integrate ABS motor circuits into new vehicles, ensuring that they meet safety and regulatory standards. In contrast, the aftermarket segment caters to vehicle owners seeking replacement or upgrades for existing ABS systems. This segment responds to the demand for retrofitting older vehicles with ABS technology or enhancing the performance of current ABS systems.

In conclusion, the Global Passenger Car ABS Motor Circuit Market is an integral part of the automotive industry's commitment to road safety and technological innovation. As vehicles become more sophisticated and safety-conscious, ABS motor circuits will continue to evolve to meet the demands of modern driving, ensuring efficient and reliable braking systems that prevent wheel lockup and enhance passenger safety on the road.

Key Market Drivers

Stringent Safety Regulations

One of the primary drivers is the increasing stringency of safety regulations worldwide. Governments and regulatory bodies are mandating the inclusion of ABS technology in passenger vehicles to enhance road safety. This has led automakers to integrate ABS systems, including motor circuits, into their vehicles to ensure compliance with these regulations.Growing Awareness of Road Safety

A heightened awareness of road safety among consumers has driven the demand for ABS-equipped vehicles. The recognition that ABS can prevent wheel lockup and improve steering control during hard braking has made it a sought-after feature among car buyers. This consumer awareness drives automakers to incorporate ABS motor circuits into their vehicles to meet market demand.Technological Advancements

Continuous technological advancements in ABS systems and motor circuits play a significant role in market growth. Manufacturers are constantly improving the performance, efficiency, and reliability of these components. Advanced sensors, quicker response times, and more precise control over individual wheel braking are key developments that enhance ABS effectiveness and safety.Integration with Advanced Driver Assistance Systems (ADAS)

The integration of ABS into broader ADAS is a driving force. ABS motor circuits are essential for ADAS functionalities like adaptive cruise control, collision avoidance, and lane-keeping assistance. As ADAS features become standard in modern vehicles, the demand for ABS motor circuits capable of supporting these systems continues to rise.

Urbanization and Congestion

Increasing urbanization and the resulting traffic congestion have amplified the need for advanced braking systems. ABS motor circuits ensure vehicles maintain stability and steering control even in congested traffic conditions or sudden stops. As more people move to urban areas, the market for ABS-equipped passenger cars expands.Consumer Preference for Safety Features

Consumer preferences have shifted toward vehicles equipped with advanced safety features. ABS technology, including motor circuits, is a key factor influencing car purchase decisions. As consumers prioritize safety, automakers are incentivized to incorporate ABS systems into their vehicle lineups.Government Support and Incentives

Many governments offer incentives and subsidies to promote the adoption of safer vehicles. These incentives encourage automakers to equip their passenger cars with ABS technology, spurring the market's growth. Governments also invest in road safety campaigns that raise awareness about the benefits of ABS-equipped vehicles.Emerging Markets

Emerging markets, with growing middle-class populations and urbanization, present significant growth opportunities. As these regions modernize their transportation infrastructure, the demand for ABS-equipped passenger cars, and consequently ABS motor circuits, is on the rise. This expansion in emerging markets contributes to the global market's growth.In summary, the Global Passenger Car ABS Motor Circuit Market is driven by a combination of factors, including regulatory mandates, consumer demand for safety, technological innovation, integration with ADAS, urbanization, government support, and the burgeoning markets in developing regions. These drivers collectively underscore the pivotal role of ABS motor circuits in enhancing vehicle safety and performance on a global scale.

Key Market Challenges

High Initial Cost

The cost of integrating ABS systems, including motor circuits, into passenger cars is relatively high. This poses a challenge, especially in markets where price sensitivity is a significant factor for consumers. While ABS systems offer long-term safety benefits, the upfront cost can deter potential buyers.Maintenance and Repair Costs

ABS systems require specialized maintenance and repair procedures. The need for trained technicians and specific diagnostic tools can result in higher maintenance and repair costs compared to conventional braking systems. This complexity can discourage some consumers.Complexity of Components

ABS systems are inherently complex, comprising various components, including sensors, valves, and control units. This complexity increases the potential for component failures, necessitating intricate diagnostics and repairs. Component failures can lead to ABS system malfunctions and compromise vehicle safety.Compatibility Issues

Ensuring seamless compatibility between ABS motor circuits and other vehicle systems, such as electronic stability control (ESC) and advanced driver assistance systems (ADAS), can be challenging. Integration issues may arise, affecting overall vehicle performance, safety, and reliability.Environmental Considerations

The disposal of ABS components, especially batteries and sensors, raises environmental concerns. Proper disposal and recycling methods are essential to minimize environmental impact. Developing eco-friendly solutions for the disposal and recycling of ABS components is a critical challenge.Market Fragmentation

The ABS motor circuit market is highly fragmented, with numerous manufacturers producing components. This fragmentation can result in varying levels of quality, reliability, and compatibility among components. Automakers must navigate this complexity to ensure they source reliable and standardized ABS motor circuits.Regulatory Variations

While many regions mandate the inclusion of ABS in passenger cars, there can be variations in specific requirements and standards. Navigating these regional differences in regulations and standards can be complex for automakers and component suppliers, requiring meticulous compliance efforts.Consumer Education

Educating consumers about the benefits and importance of ABS technology remains a challenge. Some consumers may not fully comprehend the advantages of ABS, which can influence their willingness to pay for ABS-equipped vehicles. Raising awareness and providing clear information about safety benefits is essential.Despite these challenges, the ABS motor circuit market continues to advance, primarily due to the increasing emphasis on road safety and technological progress. Manufacturers are actively addressing these challenges through innovation, cost-effective solutions, improved reliability, and environmental responsibility. As ABS technology becomes more standardized and integrated into vehicles, some of these challenges may gradually diminish, promoting wider adoption and enhancing overall road safety.

Key Market Trends

Integration with Electronic Stability Control (ESC)An important trend is the integration of ABS with ESC systems. ESC enhances vehicle stability by preventing skidding during abrupt maneuvers. Combining ABS and ESC in a single system improves overall vehicle control and safety.

Transition to Electronic Control Units (ECUs)

The market is shifting towards the use of advanced electronic control units for ABS systems. These ECUs provide precise control over braking, improving the system's efficiency and response time, especially in complex driving scenarios.

Hybrid and Electric Vehicle Adoption

With the rise of hybrid and electric vehicles (EVs), ABS motor circuits are evolving to meet the specific demands of these platforms. Components are being designed to work seamlessly with regenerative braking systems, optimizing overall vehicle performance and energy efficiency.Advanced Sensor Technology

ABS systems are benefiting from advanced sensor technologies, including LiDAR and radar sensors. These sensors enhance the system's ability to detect and respond to obstacles and changing road conditions, further improving vehicle safety.Data Connectivity and Telematics Integration

The integration of ABS systems with vehicle data connectivity and telematics is gaining traction. This trend enables real-time monitoring of braking performance and system health, offering valuable insights for vehicle maintenance and safety.Autonomous Vehicle Compatibility

As autonomous vehicle development progresses, ABS motor circuits are being designed to seamlessly integrate with autonomous driving systems. This integration ensures that braking systems align with the requirements of autonomous vehicles for enhanced safety and control.Energy Efficiency and Lightweight Materials

A focus on energy efficiency is driving innovations in ABS motor circuit design. Lightweight materials and energy-efficient components help reduce the overall power consumption of the ABS system, contributing to improved fuel efficiency in conventional vehicles and extended range in EVs.Global Standardization

Increasing efforts toward global standardization of ABS technologies and regulations are a notable trend. This harmonization streamlines compliance for automakers, reduces development costs, and ensures consistent safety standards across regions.These trends collectively reflect the industry's commitment to enhancing vehicle safety, optimizing braking systems, and preparing for the future of mobility, which includes electric and autonomous vehicles. As ABS motor circuits continue to evolve in response to these trends, they play a crucial role in ensuring the safety and reliability of passenger cars on the road.

Segmental Insights

By Vehicle Type

Sedans and hatchbacks have historically been significant segments for ABS adoption. These vehicle types prioritize passenger comfort and safety. ABS systems in sedans and hatchbacks are often designed for smooth, responsive braking, ensuring stability and safety during everyday driving. The trend in this segment is towards more compact and lightweight ABS motor circuits to enhance fuel efficiency and handling.SUVs and crossovers have gained popularity globally due to their versatility and spacious interiors. ABS systems in this segment are designed to provide stability and control, even on off-road terrain. The trend is towards ABS motor circuits that can adapt to different driving conditions, including on-road and off-road scenarios.

Sports cars demand high-performance ABS systems and motor circuits to support rapid acceleration and precise braking. The trend in this segment is focused on reducing braking distances and enhancing handling through advanced ABS technologies, such as electronic limited-slip differentials and torque vectoring.

The EV and hybrid segment is witnessing a surge in ABS adoption. ABS motor circuits in these vehicles are optimized for regenerative braking, which converts kinetic energy into electrical energy during deceleration. The trend is towards highly efficient ABS systems that can seamlessly integrate regenerative and friction braking for maximum energy recovery and vehicle range.

The emergence of autonomous vehicles is reshaping ABS technology. ABS motor circuits are being designed to work in tandem with autonomous driving systems, providing precise control and responsiveness in dynamic driving situations. The trend is towards ABS systems that can adapt to the changing requirements of autonomous driving modes.

In the commercial vehicle segment, which includes trucks and vans, ABS systems are essential for load stability and driver safety. The trend is towards robust and durable ABS motor circuits that can withstand the demands of heavy-duty applications, including cargo transportation and delivery services.

As urbanization increases, microcars and urban mobility solutions like electric scooters and e-bikes are gaining traction. ABS systems in these vehicles are designed for compactness and efficiency. The trend is towards lightweight and space-saving ABS motor circuits that contribute to the overall efficiency and safety of micro-mobility options.

In summary, the Vehicle Type segment significantly influences the design and features of ABS motor circuits. Manufacturers tailor ABS systems to meet the specific needs and preferences of each vehicle type, whether it's optimizing for performance in sports cars, off-road capabilities in SUVs, or energy efficiency in EVs. As vehicle types continue to evolve and diversify, ABS technology will adapt to ensure safety and performance across the automotive spectrum.

By Component

The ECU is the brain of the ABS system. It processes data from wheel speed sensors and makes rapid decisions to modulate brake pressure. Advances in ECU technology include faster processing speeds, improved algorithms, and enhanced diagnostic capabilities, allowing for more precise and responsive braking control.These sensors monitor the rotational speed of each wheel. They provide critical data to the ECU, enabling it to detect wheel lockup and adjust brake pressure accordingly. Ongoing trends focus on the development of more accurate and durable wheel speed sensors to enhance ABS performance.

The hydraulic modulator controls brake fluid pressure to each wheel. It consists of solenoid valves that open and close rapidly to regulate brake pressure. Trends in this component involve the use of advanced materials and design optimization to improve the speed and precision of pressure modulation.

The pump and motor assembly is responsible for maintaining proper brake fluid pressure. It ensures that the ABS system can function optimally even under varying conditions. Advances in this component aim to enhance energy efficiency, reduce noise, and increase durability.

The integrity of brake lines and the quality of hydraulic fluid are critical for ABS performance. Trends in this segment focus on the development of corrosion-resistant materials for brake lines and high-performance hydraulic fluids that can withstand extreme temperatures and provide consistent braking.

Valves and actuators play a key role in controlling brake pressure. Advances in valve technology involve the use of lightweight materials and compact designs to reduce the overall weight of the ABS system and improve responsiveness.

Reliable connectors and wiring are essential for maintaining the integrity of ABS signals and data transmission. Trends in this segment focus on enhanced durability and resistance to environmental factors, ensuring long-term performance.

Modern ABS systems include diagnostic and communication interfaces that allow for real-time monitoring and communication with other vehicle systems. Trends in this area involve improved connectivity options and more user-friendly diagnostic tools for technicians.

To enhance overall safety, some ABS systems incorporate sensor fusion technology. This involves the integration of data from multiple sensors, such as wheel speed sensors, steering angle sensors, and yaw rate sensors, to provide a more comprehensive picture of vehicle dynamics. The trend is toward more advanced sensor fusion algorithms to improve ABS performance in diverse driving conditions. In summary, the Component Type segment underscores the complexity and sophistication of ABS systems. Ongoing trends in ABS components focus on improving precision, responsiveness, durability, and energy efficiency, all contributing to enhanced braking performance and overall vehicle safety. These advancements are crucial as ABS technology continues to evolve to meet the demands of modern vehicles and driving conditions.

By Channel

OEMs are at the forefront of ABS integration in passenger cars. They directly incorporate ABS systems, including motor circuits, into vehicles during the manufacturing process. OEMs work closely with ABS component suppliers to ensure that ABS technology meets safety and performance standards. This channel ensures that new vehicles come equipped with ABS systems as a standard feature.The aftermarket segment is essential for providing ABS solutions to existing vehicles. Aftermarket suppliers offer ABS components, including motor circuits, to vehicle owners, repair shops, and service centers. This channel allows consumers to retrofit older vehicles with ABS systems or upgrade existing ABS technology. Trends in the aftermarket segment include a wide range of ABS components and kits to cater to different vehicle makes and models.

Online Retail: The rise of e-commerce has led to the emergence of online retail channels for ABS components. Consumers can purchase ABS motor circuits and related parts through online marketplaces and automotive e-commerce platforms. This channel offers convenience and a wide selection of ABS products, making it accessible to a broad audience.

Regional Insights

North America, comprising the United States and Canada, boasts a mature market for ABS motor circuits. Stringent safety regulations have long mandated the inclusion of ABS systems in passenger vehicles. The region places a strong emphasis on advanced safety technologies, with ABS being a foundational component of this approach. North America is at the forefront of ABS development and innovation. Additionally, the increasing adoption of electric and hybrid vehicles in the region has prompted the development of specialized ABS motor circuits tailored to address the distinct braking needs of these platforms. With a significant preference for larger vehicles like SUVs and trucks, North America has seen the optimization of ABS systems to accommodate the demands of heavier and more massive vehicles.Europe is renowned for setting stringent vehicle safety standards, and ABS has been a mandatory feature in new cars for an extended period. European automakers prioritize safety and have been instrumental in driving widespread ABS adoption. The region closely aligns with advanced driver assistance systems (ADAS) and autonomous driving initiatives, leading to seamless integration of ABS technology with these evolving systems. European consumers hold safety features, including ABS, in high regard when making vehicle purchasing decisions, contributing to the broad acceptance of ABS technology. Furthermore, European ABS motor circuit manufacturers concentrate on developing lightweight, energy-efficient components to bolster vehicle performance and meet rigorous emissions standards.

The Asia-Pacific region stands as a rapidly growing market for passenger car ABS motor circuits, largely propelled by the flourishing automotive industry, particularly in countries like China and India. Government regulations in numerous Asian nations are increasingly mandating ABS inclusion in vehicles as a critical measure to bolster road safety. The region's penchant for compact and budget-friendly vehicles has spurred demand for cost-effective ABS solutions precisely tailored to meet the needs of these segments. Asia-Pacific is also a significant manufacturing hub for ABS components, exporting them to markets worldwide.

Latin America exhibits varying degrees of ABS adoption, often shaped by economic conditions and regulatory disparities across countries. Growing awareness of the advantages of ABS in preventing accidents is driving higher adoption rates in some nations. Brazil, for example, has implemented regulations mandating ABS in new vehicles, providing a stimulus for market growth. Simultaneously, local production of ABS motor circuits is on the rise to cater to the expanding demand within the region.

The Middle East and Africa represent emerging markets for ABS motor circuits with an increasing focus on vehicle safety. Government regulations and safety campaigns are propelling the adoption of ABS technology to curtail road accidents. The region's diverse climate conditions, ranging from arid deserts to high-altitude regions, pose specific challenges and requirements for ABS systems. To meet the growing demand and reduce import costs, local production and assembly of ABS components are gradually increasing.

These detailed insights into each region highlight the dynamic nature of the Global Passenger Car ABS Motor Circuit Market, where factors such as regulations, consumer preferences, and climate conditions significantly shape the market landscape. Mature markets like North America and Europe continue to prioritize advanced safety technologies, while emerging markets in Asia-Pacific, Latin America, and the Middle East are catching up as awareness of ABS benefits continues to grow.

Report Scope:

In this report, the Global Passenger Car ABS Motor Circuit Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Passenger Car ABS Motor Circuit Market, By Vehicle Type:

- SUV

- Sedan

- Hatchback

- MUV

Passenger Car ABS Motor Circuit Market, By Component:

- Sensors

- Electronic Control Unit

- Hydraulic Unit

Passenger Car ABS Motor Circuit Market, By Channel:

- Single

- Dual

- Three

- Four

Passenger Car ABS Motor Circuit Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Passenger Car ABS Motor Circuit Market.Available Customizations:

Global Passenger Car ABS Motor Circuit Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Continental Reifen Deutschland GmbH

- Delphi Technologies PLC

- DENSO Corporation

- Autoliv Inc.

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Haldex AB

- WABCO Holdings Inc.

- Hyundai Mobis Co. Ltd

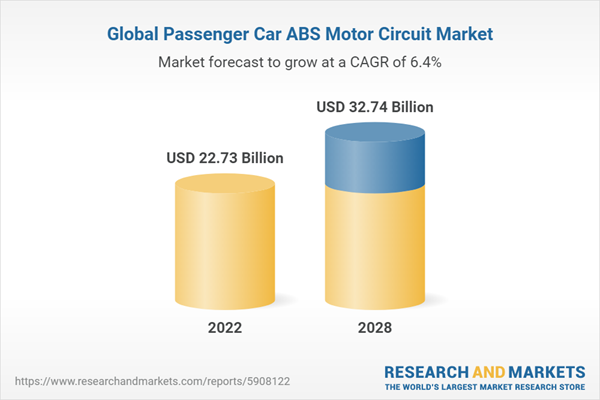

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 22.73 Billion |

| Forecasted Market Value ( USD | $ 32.74 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |