Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

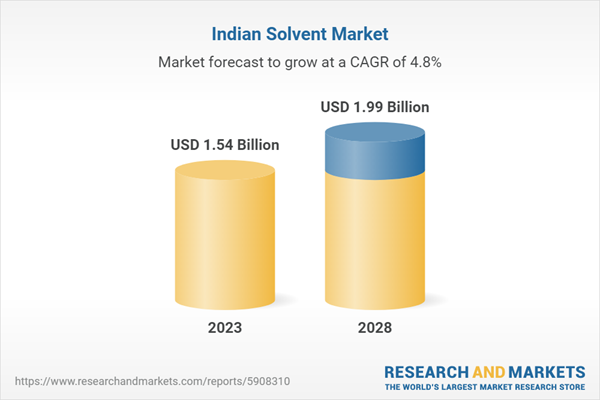

In conclusion, the Indian solvent market is on a promising upward trajectory, fueled by the growing demand across diverse industries. As technology continues to advance and industries expand, the demand for solvents, including high purity and de-aromatic variants, is expected to maintain its upward momentum. This sustained growth highlights the vital role that solvents play in supporting and enabling the development of numerous sectors within the Indian economy.

Key Market Drivers

Growing Demand of Solvent in Paints & Coatings Industry

The solvent market in India is witnessing a significant growth trajectory, largely fueled by the escalating demand from the paints and coatings industry. Solvents play an integral role in paint and coating formulations, aiding in viscosity reduction, pigment dispersion, and drying time modulation. These versatile chemicals act as essential components that contribute to the overall performance and durability of paints and coatings.Solvents are indispensable to the paints and coatings industry. They serve several critical functions such as dissolving or dispersing various components, enhancing the application properties, and controlling the drying rate. The versatility of solvents and their ability to modify the properties of paints and coatings to meet specific requirements make them a vital ingredient in the industry.

With the rapid pace of urbanization and infrastructure development in India, the demand for paints and coatings is on the rise. This, in turn, drives the demand for solvents used in these products. As the population grows and cities expand, the construction sector experiences a surge, increasing the need for paints and coatings for buildings, bridges, and other infrastructure projects. This upward trend in construction activities further amplifies the demand for solvents.

The automotive industry, a significant consumer of paints and coatings, is experiencing robust growth in India. As the production of vehicles increases, so does the need for solvents. From car manufacturers to automotive repair shops, solvents are essential for various processes such as surface preparation, painting, and cleaning. As the automotive sector continues to thrive, the demand for solvents in the paints and coatings industry continues to soar.

Innovations in coating technology, such as waterborne and high solids coatings, also contribute to the rising demand for solvents. These advanced coatings often require specific solvents to optimize their performance. Waterborne coatings, for example, offer environmental advantages, but they rely on solvents for proper formulation and application. As the industry continues to explore and develop new coating technologies, the demand for specialized solvents will continue to grow.

The push towards environmentally friendly and low VOC (Volatile Organic Compounds) coatings is driving the demand for green and bio-based solvents. As awareness of environmental concerns increases, both manufacturers and consumers are seeking eco-friendly alternatives. Solvents derived from renewable sources, such as plant-based or bio-based solvents, are gaining popularity due to their lower environmental impact. This shift towards sustainable practices creates new opportunities for green solvents in the paints and coatings industry.

In conclusion, the increasing demand for solvents in the paints and coatings industry is a major driver propelling the growth of the Indian solvent market. As the paints and coatings industry continues to expand and innovate, this trend is expected to continue, providing a significant boost to the solvent market in India. With the growing focus on sustainability and advancements in coating technologies, the demand for solvents is poised to evolve, creating a dynamic landscape for the Indian solvent industry.

Growing Demand of Solvent in Pharmaceutical Industry

Solvents find extensive use in the pharmaceutical industry for multiple purposes. They serve as reaction media in drug synthesis, aiding in the precise and controlled formation of pharmaceutical compounds. Additionally, solvents play a crucial role in the extraction of medicinal compounds from natural sources, helping to unlock the potential of traditional medicine. Moreover, solvents assist in purification processes, ensuring the high quality and purity of drugs. Furthermore, they act as vehicles in drug formulation, enabling the effective delivery of medications to patients. Their versatility and indispensability have led to an escalating demand within the pharmaceutical sector.The pharmaceutical sector in India is experiencing robust growth, driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and the expanding market for generic medicines. This growth translates into a higher demand for solvents that support the manufacture of various pharmaceutical products, including tablets, capsules, injections, and syrups. The demand for solvents is further fueled by the intensified research and development (R&D) activities in the pharmaceutical sector. As scientists explore new drug molecules and formulations, the need for high purity solvents becomes paramount. These solvents, known for their exceptional quality and low impurity levels, are crucial in laboratory applications and in the development of new drugs.

Regulatory bodies such as the US FDA and the Indian Pharmacopeia Commission play a pivotal role in ensuring the safety and efficacy of pharmaceutical products. These bodies mandate the use of specific solvents in drug manufacturing processes to maintain quality standards. Compliance with these regulations necessitates the use of solvents in pharmaceutical production, further driving the demand for these essential chemicals.

The global shift towards green chemistry and sustainability has become an imperative in the pharmaceutical industry. As environmental concerns grow, there is an increased demand for bio-based solvents that offer a greener and more sustainable alternative. These solvents, derived from renewable sources such as plants and agricultural waste, are environmentally friendly and help reduce the industry's carbon footprint. The adoption of bio-based solvents aligns with the industry's commitment to sustainable practices and responsible manufacturing.

In conclusion, the rising demand for solvents in the pharmaceutical industry is a major driving force behind the growth of the Indian solvent market. As the pharmaceutical industry continues to expand and innovate, this trend is expected to persist, offering a significant impetus to the solvent market in India. With the continued emphasis on quality, safety, and sustainability, solvents will remain an integral part of the pharmaceutical manufacturing landscape, supporting the development of life-saving medications and contributing to the advancement of healthcare.

Key Market Challenges

Volatility in Prices of Raw Materials

The Indian solvent market is currently experiencing a period of substantial growth, driven by escalating demand from various industries such as paints and coatings, pharmaceuticals, and automotive. This growth can be attributed to the increasing need for solvents in these sectors due to their versatile properties and applications. Solvents play a crucial role in enhancing the performance and functionality of products in these industries, making them an indispensable component of their manufacturing processes.However, amidst this upward trajectory, the market also faces significant challenges that need to be addressed. One of the primary challenges is the volatility in the prices of raw materials used in solvent production, primarily petroleum and natural gas. Solvents are derived from these raw materials, and their prices are subject to global market fluctuations. The unpredictable nature of these prices directly impacts the cost of solvent production, leading to uncertainty in the solvent market.

This volatility in raw material prices can result in increased production costs for solvents, which are often passed on to the end consumer. Consequently, this leads to higher prices for products that utilize solvents, potentially affecting the demand for solvents and disrupting the balance of the market. The prices of petroleum and natural gas are influenced by various factors, including global geopolitical events, supply-demand dynamics, and economic conditions. Additionally, changes in exchange rates can also influence the prices of raw materials, especially when they are imported. Moreover, natural disasters can disrupt the supply chain, causing a sudden spike in raw material prices and further adding to the volatility in the solvent market.

To mitigate these challenges and ensure stability in the solvent market, industry players need to closely monitor raw material prices, diversify their sourcing strategies, and explore alternative solvents with more stable pricing structures. Collaborative efforts between manufacturers, suppliers, and consumers can also help in developing innovative solutions and practices to address these challenges effectively.

Overall, while the Indian solvent market continues to witness growth and opportunities, understanding and managing the volatility in raw material prices is crucial for the long-term sustainability and success of the industry.

Key Market Trends

Growth in Chemical Industry

Solvents play a crucial role in the chemical industry, serving a multitude of purposes such as providing a medium for reactions, facilitating the extraction of compounds, and enabling purification processes. Their versatility and adaptability make them an indispensable component in the manufacturing of a wide array of chemical products.India's chemical industry is witnessing a significant influx of investments, which is not only contributing to its growth but also fueling the demand for solvents. This surge in investments is driven by factors such as favorable government policies, a skilled workforce, and a growing domestic market. As the chemical industry continues to attract investments and expand its operations, the demand for solvents is expected to experience a substantial upswing.

The growth in the chemical industry is having a profound impact on the Indian solvent market. The increasing demand for chemical products translates into a higher requirement for solvents, as they are indispensable in formulating solutions without altering the physical properties of the substances. This growing reliance on solvents is expected to drive the growth of the solvent market in India.

In conclusion, the ascending trend in the chemical industry serves as a major driver of the growth witnessed in the Indian solvent market. As the chemical industry continues to expand and attract investments, the demand for solvents is anticipated to rise correspondingly, creating a positive and promising outlook for the Indian solvent market. The growing importance of solvents in various applications within the chemical industry further underscores their significance in driving the overall growth of the sector.

Segmental Insights

Product Type Insights

Based on the category of product type, the alcohols segment emerged as the dominant player in the Indian market for Solvent in 2023. The growth of ethanol can be attributed to its strong polarity, which sets it apart from hydrocarbons or ketones. This unique characteristic makes ethanol an excellent solvent, as it has the ability to dissolve many organic compounds that are not soluble in water. Due to its safety and versatility, ethanol finds extensive use in various industries, particularly in cosmetics and perfumes where it plays a vital role in enhancing fragrance and formulation.Application Insights

The paints & coatings segment is projected to experience rapid growth during the forecast period. The demand for paints and coatings in India continues to soar, driven by rapid urbanization, a surge in construction activities, and the thriving automotive industry. As the demand for paints and coatings increases, so does the need for solvents, which play a vital role in their production.The development of solvent-based technology in the paint and coating industry has revolutionized the solvent market. Solvent-based paints and coatings offer not only a high-quality finish but also exceptional durability, making them highly sought after in various industrial and automotive applications.

In fact, the paints and coatings application segments collectively contribute to over 48% of the total revenue generated by the solvent market in India. This remarkable share underscores the dominant role played by the sector in the Indian market.

With such a strong demand and significant contribution, the paints and coatings industry in India is poised for further growth and success. As urbanization and construction activities continue to thrive, along with the ever-evolving automotive sector, the need for paints, coatings, and solvents will remain at the forefront of the Indian market landscape.

Regional Insights

West India emerged as the dominant player in the India Solvent Market in 2023, holding the largest market share in terms of value. West India, known for its thriving industries, houses a diverse range of sectors such as pharmaceuticals, paints & coatings, and agriculture, all of which have emerged as major consumers of solvents. The presence of these industries in the region has significantly contributed to its industrial dominance, directly correlating with the high consumption of solvents.One of the key advantages that West India possesses is its access to some of the busiest ports in the country. This strategic advantage enables the region to efficiently import the necessary raw materials for solvent production and seamlessly export the produced solvents to global markets. This accessibility to international trade plays a pivotal role in maintaining the region's dominance in the solvent market.

Furthermore, West India takes pride in its well-developed infrastructure, encompassing robust transportation and logistics systems. This infrastructure facilitates the seamless movement of goods, further enhancing the efficiency of the solvent industry in the region. Additionally, the region benefits from favorable government policies that encourage investments in the chemical industry, providing an added impetus to the growth of the solvent market in West India.

With its thriving industries, well-established infrastructure, and supportive government policies, West India continues to assert its dominance in the solvent market, attracting investments and driving innovation in the chemical industry.

Report Scope:

In this report, the India Solvent Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Solvent Market, By Product Type:

- Alcohols

- Chlorinated Solvent

- Ketones

- Hydrocarbon Solvent

- Others

India Solvent Market, By Application:

- Printing Ink

- Paints & Coatings

- Metal Working

- Industrial Cleaning

- Adhesives & Sealants

- Others

India Solvent Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Solvent Market.Available Customizations:

India Solvent Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Shree R. R. Chemical Industries

- Vikalpa Incorporated

- Modi Chemicals Pvt. Ltd.

- Reliance Industries Limited

- Chemtech corporation

- N r chemicals corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.54 Billion |

| Forecasted Market Value ( USD | $ 1.99 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 6 |