Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In recent years, there has been an increasing demand for caustic soda in the textile and alumina sectors in India. The government's investments in these sectors have spurred growth and subsequently driven the overall demand for caustic soda in the country. India is currently experiencing a surplus in caustic soda production, with most plants operating at around 85% efficiency. However, the influx of cheaper imports has put pressure on domestic manufacturers, leading to tighter profit margins due to high input and logistics costs within the country.

Despite disruptions caused by overseas trade disruptions and the nationwide lockdown in response to the COVID-19 pandemic, the caustic soda industry has shown resilience. The demand for caustic soda from hand wash and soap manufacturing industries has supported the industry outlook during the pandemic. Additionally, the extension of Anti-Dumping Duty on caustic soda imports from the U.S. and Saudi Arabia, as per the petition filed by the Alkali Manufacturers Association of India (AMAI) in FY2017, has given a strong boost to the domestic caustic soda industry.

The outbreak of COVID-19 in 2020 had a profound impact on the world economy, resulting in disruptions to markets and the temporary closure of production and manufacturing units. Many major market players chose to halt production to prioritize the health and well-being of their employees. However, with the implementation of new regulations and precautionary measures, the market is expected to gradually recover and regain its growth trajectory in the coming years. As the effects of the pandemic subside, the caustic soda market is poised to exhibit robust growth in the forecast period, once again contributing to various industries and sectors.

Key Market Drivers

Growing Demand of Caustic Soda in Textile Industry

Caustic soda, also known as sodium hydroxide, is a crucial raw material in the textile industry. Its versatility and wide range of applications make it indispensable in various stages of textile processing, including desizing, scouring, and mercerizing. During these processes, caustic soda plays a pivotal role in removing impurities, enhancing the absorbency of fabrics, and improving the overall luster and dye-ability of textiles.The textile industry in India holds a prominent position globally and significantly contributes to the country's economy. With its vast scale of operations, it accounts for approximately 2% of India's GDP and provides employment opportunities for over 45 million people. The industry's remarkable growth is further supported by the government's favorable policies and the escalating global demand for Indian textiles, indicating a promising future.

As the textile industry continues to expand, the demand for caustic soda experiences a corresponding surge. The rising production and consumption of textiles in India have led to an increased need for caustic soda, thereby stimulating the growth of the caustic soda market.

The escalating demand for caustic soda in the textile industry has not only positively impacted India's caustic soda market but has also triggered significant developments in terms of production capacity expansions and technological advancements within the industry. This surge in demand has attracted new investments and fostered innovation, further strengthening the market's position. Moreover, the increased demand from the textile industry has played a pivotal role in stabilizing prices within the caustic soda market.

In conclusion, the growing demand for caustic soda in the textile industry serves as a significant driving force for India's caustic soda market. As the textile industry continues its path of expansion, the demand for caustic soda is expected to witness further growth, presenting promising prospects for the caustic soda market in India. The symbiotic relationship between the textile industry and the caustic soda market is poised to shape the future of both sectors, driving progress and innovation in the Indian market.

Growing Demand of Caustic Soda in Pharmaceutical Industry

Caustic soda, also known as sodium hydroxide, is an indispensable chemical compound used extensively in the pharmaceutical industry. Its applications range from drug formulation and manufacturing to cleaning and sanitization of pharmaceutical equipment. It plays a crucial role in maintaining the high standards of quality and safety in pharmaceutical production processes. Additionally, caustic soda is utilized in the production of various pharmaceutical intermediates, contributing to the development of a wide array of drugs with diverse therapeutic properties and applications.India's pharmaceutical industry is not only one of the largest but also one of the fastest-growing globally. With a significant contribution to the country's economy, it ranks third worldwide in terms of volume and 14th in terms of value. The industry has been witnessing remarkable expansion in recent years, primarily driven by factors such as increased healthcare spending, a growing population, and government initiatives supporting pharmaceutical manufacturing. The COVID-19 pandemic has further underscored the importance of a robust pharmaceutical sector, leading to increased investments and initiatives to boost domestic drug manufacturing capacity.

Moreover, as the pharmaceutical industry grows, so does its demand for caustic soda, making it a key driver of the caustic soda market in India. The rising demand for caustic soda in the pharmaceutical industry has positively impacted the market dynamics. It has stimulated production, encouraged capacity expansions, and fostered innovation among manufacturers. This increased demand has also attracted new investments into the market, leading to enhanced competition and technological advancements. As a result, the caustic soda market in India has experienced price stabilization, benefiting both producers and consumers.

In conclusion, the growing demand for caustic soda in the pharmaceutical industry is a significant driver of India's caustic soda market. With the continued expansion of the pharmaceutical industry and increasing emphasis on domestic drug manufacturing, the caustic soda market is poised for further growth. This presents lucrative opportunities for manufacturers, investors, and other stakeholders in the market to capitalize on the evolving needs of the pharmaceutical industry and contribute to the growth of India's caustic soda market.

Key Market Challenges

Lack in Availability of Raw Materials

Caustic soda, also known as sodium hydroxide, is primarily produced through the electrolysis of sodium chloride, a compound commonly found in salt. While salt is abundant and relatively inexpensive, its availability can sometimes be inconsistent, posing a significant challenge to the production of caustic soda. Even a slight 10 percent increase in salt prices can have a ripple effect, resulting in approximately a 1 percent increase in the final cost of caustic soda.In India, a country that is a significant producer of caustic soda, the lack of consistent availability of high-quality salt can have a direct impact on the efficiency of caustic soda production. Furthermore, any fluctuations in salt prices can lead to significant changes in the cost of caustic soda, ultimately affecting the overall profitability of manufacturers in the industry.

The situation is further exacerbated by the fact that India's market is prone to being flooded with cheap caustic soda imports from major producing countries where caustic soda is in excess supply. These imports can create additional pressure on domestic manufacturers who are already grappling with the challenges of securing an adequate supply of raw materials.

To maintain a stable and competitive caustic soda industry in India, it is crucial to address the issues related to the availability and cost of salt, as well as to develop strategies for managing imported caustic soda. By doing so, domestic manufacturers can overcome these hurdles and ensure sustainable growth in the face of global market dynamics.

Key Market Trends

Increasing Use in Alumina Production

Caustic soda, also known as sodium hydroxide, plays a crucial and indispensable role in the production of alumina, which serves as a fundamental raw material for aluminum production. The extraction of alumina from bauxite ore is achieved through the widely adopted Bayer process, wherein caustic soda is utilized to dissolve aluminum-bearing minerals present in bauxite.The demand for alumina is experiencing a steady and upward trajectory, primarily driven by the ever-increasing need for aluminum in various sectors such as construction, automotive, packaging, and electricals. The rapid pace of urbanization and industrialization has further augmented the consumption of aluminum, thereby fueling the demand for alumina and consequently, the demand for caustic soda.

It is noteworthy to mention that the growing utilization of caustic soda in alumina production has yielded positive effects on India's caustic soda market. Not only has it bolstered the demand for caustic soda, but it has also exerted a considerable influence on its pricing and distribution strategies. This, in turn, has created new avenues and opportunities for market players, prompting them to expand their production capacities and invest in research and development activities aimed at enhancing the efficiency and sustainability of caustic soda usage in alumina production.

In conclusion, the increasing utilization of caustic soda in alumina production constitutes a significant and noteworthy trend in India's caustic soda market. As the demand for alumina continues its upward trajectory, this trend is expected to gather even more momentum, thereby driving the overall growth of the caustic soda market in India.

Segmental Insights

Type Insights

Based on the category of type, the Membrane Cell segment emerged as the dominant player in the Indian market for Caustic Soda in 2023. Presently, there is a significant rise in the adoption of membrane cell technology in the chemical industry. This innovative technology offers a more efficient process and yields higher-quality end products compared to older methods such as mercury and diaphragm cell technologies.The membrane cell process is renowned for its ability to produce chlorine and caustic soda with exceptional purity levels. This not only ensures the superior quality of the final products but also enhances their usability in various applications. Moreover, the membrane cell technology is highly regarded for its environmental sustainability. By eliminating the need for mercury, a toxic heavy metal used in the conventional mercury cell process, it effectively prevents mercury pollution, safeguarding both human health and the environment.

In addition to its environmental benefits, the membrane cell technology also boasts improved energy efficiency. It consumes significantly less energy compared to traditional methods, resulting in reduced carbon emissions. This aligns perfectly with the growing global emphasis on sustainable practices and makes the membrane cell technology a preferred choice for chemical manufacturers across the country.

Application Insights

The others segment is projected to experience rapid growth during the forecast period. The industrial grade caustic soda is dominating the market due to its widespread use in various industrial processes. It is extensively used in paper manufacturing, textile processing, soap and detergent production, aluminum refining, biodiesel production, and water treatment. This versatile chemical plays a crucial role in these industries by facilitating cleaning, pH adjustment, and chemical reactions. Moreover, its cost-effectiveness compared to other purer grades, such as pharmaceutical or food grades, makes it a preferred choice for many businesses. With its ability to provide efficient and economical solutions, industrial-grade caustic soda continues to be the go-to option for numerous applications across different sectors.Regional Insights

West India emerged as the dominant player in the India Caustic Soda Market in 2023, holding the largest market share in terms of value. West India, comprising states like Maharashtra and Gujarat, is home to some of the most industrially advanced regions in the country. With a thriving textile, detergent, soap, paper, and pulp industry, these states have a significant reliance on caustic soda. The demand for this essential chemical compound continues to soar, fueled by the ever-growing industrial activities in West India.Stretching over a vast coastline of 1,600 kilometers, West India boasts major ports such as Mumbai, Mundra, and Kandla. These strategic ports serve as crucial gateways for seamless import and export of goods, including raw materials and finished products. For the caustic soda industry, this translates to reduced transportation costs and time, making West India an immensely attractive region for manufacturers to establish their production facilities.

Recognizing the immense potential of West India, the government has implemented a series of policies and initiatives to foster industrial growth. These include lucrative tax incentives, streamlined regulatory procedures, and substantial investments in infrastructure development. These favorable policies are not only attracting significant investment in the caustic soda industry but also reinforcing West India's dominant position in the market.

By leveraging its industrial prowess, expansive coastline, and favorable government policies, West India continues to emerge as a powerhouse in the caustic soda market, driving economic growth and cementing its status as a key player in the region.

Report Scope:

In this report, the India Caustic Soda Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Caustic Soda Market, By Type:

- Membrane Cell

- Diaphragm Cell

- Others

India Caustic Soda Market, By Application:

- Pulp & Paper

- Textile

- Pharmaceutical

- Others

India Caustic Soda Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Caustic Soda Market.Available Customizations:

India Caustic Soda Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Grasim Industries Ltd.

- Gujarat Alkalies and Chemicals Limited

- Atul Ltd.

- Durgapur Chemicals Ltd.

- Tata Chemicals Ltd.

- DCW Ltd.

- Chemplast Sanmar Ltd.

Table Information

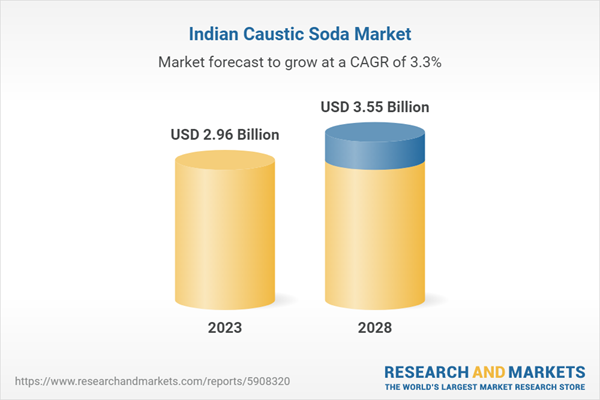

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.96 Billion |

| Forecasted Market Value ( USD | $ 3.55 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |