Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for ICs

The increasing demand for Integrated Circuits (ICs) is a pivotal driver propelling the growth of the global IC socket market. ICs, often referred to as the 'brains' of electronic devices, are essential components in a vast array of applications, ranging from smartphones and laptops to automotive systems and industrial equipment. As technology continues to advance, the demand for more powerful, efficient, and specialized ICs has surged across various industries, catalyzing the need for reliable IC sockets. One of the primary reasons for the rising IC demand is the pervasive integration of electronics in modern life. Consumers now expect smarter, more connected, and feature-rich devices, such as smart appliances, wearable gadgets, and IoT-enabled solutions. This consumer-driven demand necessitates the constant development of cutting-edge ICs, creating a steady market for IC socket manufacturers.Furthermore, industries like automotive and aerospace increasingly rely on ICs for advanced safety features, navigation systems, and autonomous driving capabilities. This surge in IC adoption within safety-critical applications underscores the importance of IC sockets in these sectors. IC socket solutions enable easy maintenance, repair, and upgrades in complex systems, ensuring optimal performance and safety. In addition to consumer and industrial applications, the telecommunications sector plays a vital role in driving IC demand. The advent of 5G technology, which requires higher frequencies and more sophisticated ICs, has led to a substantial uptick in the production and deployment of ICs. IC sockets, designed to accommodate these advanced ICs, are essential for testing and quality assurance during the manufacturing process.

The IC socket market is also buoyed by innovations in packaging technologies and the increasing prevalence of miniaturization. As ICs become smaller and more specialized, there is a growing need for precise and compact socket solutions that can handle these diminutive components. In conclusion, the increasing demand for ICs across diverse industries, fueled by technological advancements and consumer expectations, is a driving force behind the robust growth of the global IC socket market. These sockets enable efficient testing, maintenance, and replacement of ICs, ensuring that electronic devices and systems continue to meet the evolving needs of the modern world. As technology continues to advance, the IC socket market is poised to remain a critical component of the semiconductor industry's ecosystem.

Rapid Technological Advancements

Rapid technological advancements stand as a formidable driving force behind the burgeoning growth of the global IC socket market. The semiconductor industry, which heavily relies on integrated circuits (ICs), is characterized by relentless innovation, with new ICs being developed at an astonishing pace. These constant advancements have a cascading effect on the demand for IC sockets, as they play a pivotal role in accommodating the evolving form factors and functionalities of these sophisticated ICs. One of the primary drivers of rapid technological change is the relentless pursuit of higher performance and miniaturization. As ICs become more powerful and compact, the design and compatibility of IC sockets must keep pace. Miniaturization is particularly notable in consumer electronics, where smartphones, tablets, and wearables continuously strive for thinner profiles and enhanced capabilities. IC socket manufacturers must innovate to create smaller, more precise sockets that can accommodate these smaller ICs without compromising on reliability.Moreover, the increasing complexity of ICs is driving the need for specialized sockets tailored to specific applications. Industries like automotive, aerospace, and telecommunications require ICs with unique features and functions, and corresponding IC sockets must be developed to accommodate these specialized components. This customization and specialization drive innovation in the IC socket market as manufacturers strive to meet diverse industry demands. The growth of emerging technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is another significant factor contributing to the rapid evolution of ICs and IC sockets. IoT devices require energy-efficient, compact ICs, while AI applications demand high-performance ICs capable of processing vast amounts of data rapidly. IC socket manufacturers must adapt to these changing requirements by designing sockets that cater to the specific needs of these emerging technologies.

Furthermore, as ICs continue to advance, they often employ new packaging technologies, such as ball grid array (BGA) and chip-on-board (COB). IC sockets must evolve to support these new packaging formats, necessitating ongoing innovation and development in the field. In conclusion, rapid technological advancements are the driving engine behind the global IC socket market. The ever-accelerating pace of innovation in the semiconductor industry, coupled with the demand for miniaturization, specialization, and compatibility with emerging technologies, ensures a continuous need for innovative IC socket solutions. As ICs remain at the heart of countless electronic devices and systems, the IC socket market is poised to remain dynamic and thriving in the face of ever-evolving technology.

Higher Operating Frequencies

The burgeoning demand for higher operating frequencies is a compelling force propelling the growth of the global IC socket market. As the world becomes increasingly connected and reliant on high-speed data transfer, the need for integrated circuits (ICs) capable of handling higher frequencies has surged across various industries, such as telecommunications, data centers, and advanced computing. This burgeoning demand for high-frequency ICs, in turn, drives the necessity for specialized IC sockets designed to accommodate these cutting-edge components. One of the most prominent drivers behind the push for higher operating frequencies is the rapid evolution of communication technologies, particularly the deployment of 5G networks. 5G represents a transformative leap in wireless communication, delivering unprecedented data speeds and low latency. To harness the power of 5G, a new generation of ICs with the ability to operate at extremely high frequencies is required. IC sockets play a pivotal role in the testing and quality assurance of these specialized ICs, ensuring that they meet the stringent performance requirements of 5G networks.Moreover, the proliferation of high-performance computing (HPC) and data-intensive applications, such as artificial intelligence (AI) and machine learning, has created a surge in demand for ICs that can process data at lightning speeds. These applications require ICs capable of handling higher frequencies to support the intense computational requirements. IC sockets are instrumental in facilitating the interchangeability of these high-frequency ICs, making it easier for organizations to upgrade and maintain their computing infrastructure. The aerospace and defense industries are also major contributors to the demand for high-frequency ICs and, subsequently, IC sockets. Radar systems, communication systems, and electronic warfare equipment rely on ICs that operate at microwave and millimeter-wave frequencies. The precise and reliable connections provided by IC sockets are essential to ensuring the functionality and performance of these mission-critical systems. In conclusion, the escalating demand for higher operating frequencies, driven by the rollout of 5G technology, the expansion of HPC and data-intensive applications, and the needs of the aerospace and defense sectors, is a pivotal factor propelling the global IC socket market. These specialized sockets facilitate the testing, replacement, and maintenance of high-frequency ICs, enabling industries to harness the full potential of advanced technologies and meet the demands of a hyper-connected world. As the pursuit of higher frequencies continues, the IC socket market is poised for sustained growth and innovation.

Key Market Challenges

Miniaturization and Form Factor Compatibility

Miniaturization and form factor compatibility represent significant challenges that can potentially hamper the growth of the global IC (Integrated Circuit) socket market. As electronic devices continue to evolve towards smaller and more compact designs, the IC socket industry faces a series of intricate challenges Reduced Space for Components: Miniaturization of electronic devices means that there is less physical space available for components, including IC sockets. This constraint forces IC socket manufacturers to develop increasingly compact sockets without compromising their functionality or reliability. Achieving this delicate balance is a complex engineering challenge.Higher Density and Pin Counts: Despite their smaller size, modern ICs often have higher pin counts and greater functionality. Designing IC sockets that can accommodate these densely packed ICs while maintaining signal integrity and electrical performance becomes increasingly difficult as the size of the socket decreases. Thermal Management: Miniaturized electronic devices can generate significant heat due to the high-power densities associated with compact designs. IC sockets must effectively manage heat to prevent overheating and ensure the reliability of both the IC and the socket, adding an additional layer of complexity to the design. Manufacturing Precision: Miniaturization requires extremely precise manufacturing processes. The manufacturing tolerances for small IC sockets are tighter, which increases production costs and complexity. Manufacturers must invest in advanced machining and quality control processes to meet these exact standards.

Reliability Concerns: Smaller form factors can sometimes compromise the mechanical stability and durability of IC sockets. Frequent insertions and removals in tight spaces may lead to wear and tear, potentially reducing the lifespan and reliability of both the socket and the IC it holds. Customization for Varied Applications: Different industries and applications require specialized IC sockets, each with unique form factors. Meeting these diverse customization needs while maintaining economies of scale can be challenging for manufacturers. Consumer Electronics Trends: The consumer electronics market, where miniaturization is most pronounced, is a significant driver of the IC socket industry. Rapid changes in consumer preferences and design trends can quickly impact the demand for specific types of IC sockets, creating uncertainty for manufacturers.

Cost-Performance Trade-off: Developing smaller and more precise IC sockets can be cost-prohibitive due to the increased complexity of design and manufacturing. Balancing cost-efficiency with the ability to meet the demanding specifications of miniaturized electronics can be challenging. In conclusion, while miniaturization and form factor compatibility are essential trends in the electronics industry, they pose substantial challenges to the IC socket market. Manufacturers must continually innovate to produce smaller, more reliable, and efficient sockets that can accommodate increasingly compact ICs. Meeting these challenges is crucial to ensure that IC sockets remain compatible with the ever-shrinking electronic devices while delivering the required performance and reliability standards.

Customization for Specialized Applications

Customization for specialized applications can indeed present challenges that may hinder the growth of the global IC (Integrated Circuit) socket market. While customization is essential to meet the unique requirements of various industries and applications, it introduces complexities and potential obstacles for IC socket manufacturers, Diverse Industry Demands: Different industries, such as automotive, aerospace, medical devices, and telecommunications, often require IC sockets tailored to their specific needs. These customizations can include variations in form factor, materials, pin counts, and performance characteristics. Meeting such diverse demands requires significant engineering expertise and resources.Design Complexity: Developing customized IC sockets is inherently more complex than producing standardized, off-the-shelf components. Customizations must align with the specific requirements of the application, which may involve intricate design adjustments and testing to ensure compatibility and reliability.

Economies of Scale: Customization can disrupt economies of scale. Manufacturing specialized IC sockets in smaller quantities can be less cost-effective than producing standardized sockets in large volumes. Manufacturers must strike a balance between meeting specialized needs and maintaining cost efficiency. Longer Lead Times: Customized IC socket solutions often come with longer lead times compared to off-the-shelf options. Industries relying on just-in-time manufacturing or rapid product development cycles may find extended lead times a challenge. Supply Chain Complexity: Sourcing customized components can be more complex than procuring standardized ones. Manufacturers may need to work closely with suppliers to ensure a steady supply of customized IC sockets, potentially introducing supply chain disruptions or delays. Quality Assurance: Customization requires rigorous quality control processes to ensure that the sockets meet the specific performance and reliability standards of the target application. Rigorous testing and validation are essential but can be time-consuming and resource intensive. Market Dynamics: Market conditions can change rapidly, impacting on the demand for customized IC sockets. Shifts in customer preferences, technological advancements, or changes in regulations can affect the viability of certain customizations, potentially leaving manufacturers with excess inventory or underutilized production capacity.

Competitive Pressures: While customization can be a differentiator, it also exposes manufacturers to competition from other companies willing to invest in tailored solutions. Maintaining a competitive edge in the customized IC socket market requires ongoing innovation and adaptation to changing industry needs. In conclusion, customization for specialized applications is a double-edged sword in the IC socket market. While it offers opportunities for niche solutions and differentiation, it comes with challenges related to complexity, cost, lead times, and market dynamics. IC socket manufacturers must carefully balance customization efforts with standardized offerings to navigate these challenges successfully and remain competitive in a rapidly evolving industry.

Key Market Trends

High-Speed Data Transfer

The demand for high-speed data transfer is a pivotal driver propelling the growth of the global IC (Integrated Circuit) socket market. As the world becomes increasingly connected and reliant on high-speed data communication, the need for integrated circuits (ICs) capable of handling higher operating frequencies and faster data rates has surged across various industries. This burgeoning demand for high-speed ICs, in turn, catalyzes the necessity for specialized IC sockets that can keep pace with these cutting-edge components. One of the primary drivers behind the push for high-speed data transfer is the relentless advancement of communication technologies. The rollout of 5G technology, in particular, has revolutionized wireless communication, delivering unprecedented data speeds and low latency. To harness the full potential of 5G, a new generation of ICs has been developed to operate at extremely high frequencies, requiring specialized IC sockets for testing, quality assurance, and deployment in 5G infrastructure.Moreover, the rapid growth of data-intensive applications, including cloud computing, artificial intelligence (AI), and high-definition multimedia streaming, has intensified the demand for ICs capable of processing vast amounts of data at lightning speeds. These applications necessitate ICs that can operate at higher frequencies, placing even more significance on IC sockets that can handle the stringent performance requirements. In addition to consumer electronics, industries such as automotive and aerospace are increasingly relying on high-speed data transfer for advanced safety features, autonomous driving, and in-flight entertainment systems. These applications demand high-speed ICs and corresponding IC sockets to ensure that data is transferred reliably and with minimal latency.

Furthermore, the emergence of edge computing, where data is processed closer to its source to reduce latency, is driving the demand for high-speed ICs and IC sockets in edge devices. These devices require rapid data processing capabilities and dependable connections to support real-time decision-making. In conclusion, the increasing demand for high-speed data transfer, driven by the deployment of 5G technology, the growth of data-intensive applications, and the adoption of edge computing, is a vital factor propelling the global IC socket market. Specialized IC sockets designed to accommodate high-frequency ICs and ensure reliable data transfer are critical components in meeting the requirements of a hyper-connected world. As technology continues to advance and data transfer speeds increase, the IC socket market is poised for sustained growth and innovation.

Advanced Packaging Technologies

The global IC (Integrated Circuit) socket market is experiencing a significant boost due to the emergence and proliferation of advanced packaging technologies. These packaging innovations, such as ball grid array (BGA), chip-on-board (COB), and other high-density interconnects, are reshaping the semiconductor industry. They not only enhance the performance and functionality of ICs but also drive the need for specialized IC sockets, making advanced packaging technologies a major driver in the market. Compatibility with New Packaging Formats: Advanced packaging technologies like BGAs, which feature an array of solder balls beneath the IC, offer advantages such as higher pin counts and improved thermal performance. IC socket manufacturers are developing solutions that can accommodate these new packaging formats, ensuring compatibility with the latest ICs.Higher Integration and Miniaturization: Advanced packaging allows for higher integration of components within a smaller footprint. This trend toward miniaturization necessitates smaller and more precise IC sockets that can maintain signal integrity and reliability while accommodating densely packed ICs. Improved Electrical Performance: Advanced packaging technologies often offer enhanced electrical performance, including reduced signal losses and improved heat dissipation. IC sockets must be designed to complement these benefits, ensuring that the sockets do not introduce any degradation in electrical performance.

Testing and Prototyping: Advanced packaging can make it challenging to access and test ICs directly on the PCB. IC sockets provide a solution by allowing for easy insertion and removal of ICs during prototyping, testing, and development stages. This is crucial for streamlining the product development process. Diverse Applications: Advanced packaging technologies are not limited to a single industry. They are utilized in a wide range of applications, including consumer electronics, automotive, aerospace, and telecommunications. As a result, IC socket manufacturers must develop solutions tailored to the unique requirements of each sector.

Enhanced Thermal Management: Many advanced packaging technologies offer improved thermal management capabilities, which is particularly critical for ICs in high-performance and high-power applications. IC sockets must be designed to effectively dissipate heat to ensure IC reliability. Rapid Technological Advancements: The semiconductor industry is known for its rapid technological advancements. As new packaging technologies emerge, IC socket manufacturers must stay agile and adapt their products to support the latest innovations.

Customization for Specific Applications: Different industries and applications often require customized IC sockets to meet their specific performance, form factor, and reliability requirements. The versatility of advanced packaging technologies necessitates customization capabilities in the IC socket market. In conclusion, advanced packaging technologies are a driving force in the global IC socket market. These innovations are reshaping the semiconductor landscape, offering improved performance, integration, and miniaturization. IC socket manufacturers are poised to benefit from this trend by providing solutions that enable the seamless integration and testing of advanced ICs across diverse industries and applications. As packaging technologies continue to evolve, the IC socket market will play a crucial role in facilitating their adoption and ensuring reliable connectivity.

Segmental Insights

Application Insights

Consumer Electronics Segment to Dominate the market during the forecast period. Consumer electronics lead the market on account of the massive sales of laptops, smartphones, PCs, tablets, and other consumer electronic devices that incorporate integrated circuits. These electronic appliances are manufactured with some simple or complex circuits. Electronic components in these circuits are connected by wires or conducting wires for the flow of electric current through the circuit's multiple components, such as resistors, capacitors, inductors, diodes, and transistors. Due to the increasing sales of consumer electronics, IC sockets are expected to witness a greater adoption in these devices.Regional Insights

Asia-Pacific Expected to Have Significant Growth in the global IC Socket market, Asia-Pacific is expected to have significant growth in this market. Various companies have almost reduced the product development period by half, owing to the changing consumer demands. This trend requires companies to continuously design and test products, driving the adoption of IC sockets.Countries in the region, including China, have the most significant markets for the ICs and IC test sockets, owing to its dominance in the manufacturing of the global semiconductor industry, consumer electronic industry, and communication equipment, among others. The country is also one of the major investors in the global automotive manufacturing industry. Along with these, favorable government policies and initiatives and motivating many domestic players to increase their investment in the region.

Report Scope:

In this report, the Global IC Socket Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global IC Socket Market, By Application:

- Memory

- CMOS Image Sensors

- High Voltage

- RF

- SOC,CPU,GPU,etc

- Other

Global IC Socket Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global IC Socket Market.Available Customizations:

Global IC Socket Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- TE Connectivity Ltd.

- Smith’s Interconnect Inc.

- Yamaichi Electronics Co., Ltd.

- Enplass Corporation

- ISC Co Ltd

- Leeno Industrial Inc

- Sensata Technologies Inc

- Ironwood Electronics Inc

- Plastronics Socket Company Inc.

- INNO Global Corporation

Table Information

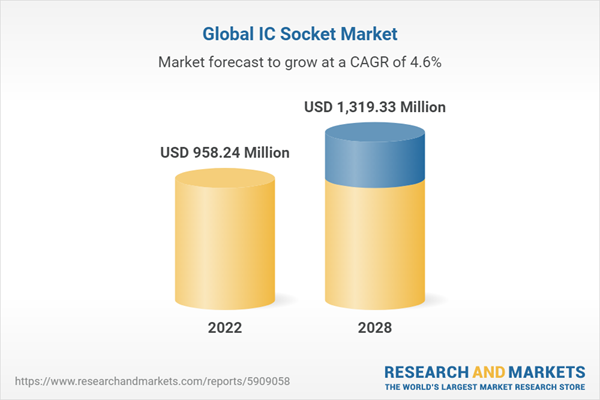

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 958.24 Million |

| Forecasted Market Value ( USD | $ 1319.33 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |