Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

3D TSV in dynamic random-access memory (DRAM) that stores each bit of data in a separate tiny capacitor within an integrated circuit propels the growth of the 3D TSV market. Micron’s 3D DRAM with re-architected DRAM achieves significant improvements in power and timing, which help in developing advanced thermal modeling.

Key Market Drivers

Miniaturization and Higher Performance Requirements

Miniaturization and higher performance requirements are fundamental drivers propelling the growth of the global 3D TSV (Through-Silicon Via) devices market. This dynamic is at the heart of technological evolution, shaping industries from consumer electronics to data centers and beyond. In the realm of consumer electronics, there is an insatiable appetite for sleeker, more compact, yet incredibly powerful devices. Consumers demand smartphones, tablets, and wearables that are not only visually appealing but also capable of handling increasingly sophisticated tasks. This demand has pushed manufacturers to seek innovative solutions, and 3D TSV technology has emerged as a game-changer. By vertically stacking multiple chips, TSVs enable manufacturers to significantly reduce the physical footprint of devices while simultaneously enhancing their performance. This perfect synergy addresses consumers' desires for both style and substance.The trend extends beyond consumer gadgets to data centers, where the insatiable hunger for processing power and memory capacity prevails. As businesses grapple with ever-expanding volumes of data and the need for rapid analysis, the importance of 3D TSV devices becomes evident. These devices offer the ability to stack memory and processing components, increasing memory density and bandwidth. In data centers, where space is at a premium and energy efficiency is crucial, 3D TSV's compact form factor and reduced power consumption prove invaluable.

Moreover, high-performance computing (HPC) and artificial intelligence (AI) applications increasingly rely on 3D TSV technology. These fields demand exceptional computational capabilities, and 3D TSVs facilitate the integration of specialized chips like GPUs and FPGAs for unparalleled processing power. In conclusion, miniaturization and higher performance requirements are not mere trends but enduring expectations in our tech-driven world. The global 3D TSV devices market is not only meeting these expectations but also propelling innovation in electronics, data processing, and AI. As the demand for smaller, more powerful, and energy-efficient devices continues to surge, 3D TSV technology stands as a pivotal enabler of progress, ensuring that our devices keep getting smarter and more capable while fitting in the palm of our hands.

Increasing Demand for Memory Solutions

The increasing demand for memory solutions is a powerful force driving the growth of the global 3D TSV (Through-Silicon Via) devices market. This demand is fueled by a variety of factors, including the explosion of data in the digital age, the growth of cloud computing, and the ever-increasing sophistication of consumer electronics. One of the most significant drivers of the demand for memory solutions is the data-centric nature of modern society. We are generating and consuming data at an unprecedented rate, driven by activities such as online streaming, social media, e-commerce, and IoT devices. This data needs to be stored and processed efficiently, and 3D TSV technology offers a compelling solution. By vertically stacking memory modules using TSVs, manufacturers can significantly increase memory density within a smaller physical footprint. This is especially crucial for data centers and server farms, where space is at a premium, and energy efficiency is a top priority.Cloud computing, which underpins many online services and applications, relies heavily on memory solutions to provide rapid access to data and applications. 3D TSV devices enable cloud providers to optimize their data center infrastructure by packing more memory capacity into their server racks. This not only enhances the performance of cloud services but also reduces operational costs by requiring less physical space and power. Furthermore, consumer electronics, including smartphones, tablets, and gaming consoles, are becoming increasingly memory intensive. Consumers expect devices with ample storage capacity to store photos, videos, apps, and games. 3D TSV technology enables manufacturers to incorporate more memory into these devices while maintaining a slim form factor. This is particularly critical in the competitive consumer electronics market, where slim, high-performance devices are in demand.

Additionally, the automotive industry is seeing a surge in memory requirements as vehicles become more connected and autonomous. 3D TSV devices can meet the demands of advanced driver-assistance systems (ADAS) and in-car entertainment systems, enhancing both safety and user experience. In conclusion, the increasing demand for memory solutions is a multifaceted driver that touches various industries and applications. 3D TSV technology plays a pivotal role in meeting these demands by offering higher memory densities, improved bandwidth, and space-efficient solutions. As our reliance on data and memory-intensive applications continues to grow, the global 3D TSV devices market is well-positioned for sustained expansion.

High-Performance Computing (HPC) and AI Applications

High-Performance Computing (HPC) and Artificial Intelligence (AI) applications are poised to be significant drivers in propelling the growth of the global 3D TSV (Through-Silicon Via) devices market. These transformative technologies have insatiable appetites for computational power, memory bandwidth, and energy efficiency, all of which are significantly enhanced by 3D TSV technology. In the realm of HPC, where complex simulations, scientific research, and data analysis demand immense computational capabilities, 3D TSV devices are becoming indispensable. These devices enable the vertical stacking of multiple chips, including high-performance processors and memory modules, within a single package. This integration offers several advantages, including reduced interconnect length, which translates to faster data transfer and lower latency. For HPC applications, where microseconds can make a difference, this reduction in communication overhead is a game-changer. Furthermore, the increased memory density and bandwidth provided by 3D TSVs contribute to faster data access, crucial for handling massive datasets and executing intricate calculations efficiently.AI applications, including machine learning and deep learning, are another driving force behind the adoption of 3D TSV technology. The training of AI models involves vast amounts of data and complex matrix computations. To accelerate these operations, specialized hardware such as GPUs and TPUs are integrated alongside traditional CPUs. 3D TSVs enable the tight coupling of these components, reducing data transfer bottlenecks and enhancing the overall efficiency of AI training. Additionally, the compact form factor of 3D TSV devices aligns with the demands of AI deployments in edge computing and autonomous systems, where space constraints are common. Furthermore, as AI finds applications in various industries, from healthcare to autonomous vehicles, the demand for 3D TSV-equipped devices is poised to grow across multiple sectors.

In conclusion, HPC and AI applications are at the forefront of technological advancement, and 3D TSV technology serves as an enabler for their continued evolution. The ability to stack high-performance chips and memory in a compact form factor not only boosts computational capabilities but also contributes to energy efficiency, a critical consideration in these power-hungry domains. As these technologies become more pervasive, the global 3D TSV devices market is well-positioned for sustained growth, supporting innovation and efficiency across a broad spectrum of applications.

Key Market Challenges

Complex Manufacturing Processes

The complex manufacturing processes associated with 3D TSV (Through-Silicon Via) devices present a significant impediment to the widespread adoption and growth of the global 3D TSV devices market. These intricate processes entail multiple steps and intricate technologies, which can hamper production efficiency, increase costs, and pose challenges for manufacturers. Technological Complexity: The manufacturing of 3D TSV devices involves several sophisticated processes, including thin wafer handling, wafer bonding, TSV etching, backside thinning, and microfabrication. Each of these steps requires specialized equipment, materials, and expertise. The intricate nature of these processes makes them more prone to errors and challenges, necessitating skilled personnel and meticulous quality control.Capital-Intensive Equipment: Setting up a 3D TSV manufacturing facility requires substantial investments in specialized machinery and equipment. The capital expenditure can be a significant barrier to entry for smaller companies or startups, limiting market competition and innovation. Additionally, the ongoing maintenance and upgrades of these machines contribute to operational costs. Materials and Supply Chain: 3D TSV processes demand specific materials, including advanced silicon wafers, dielectric materials, and bonding materials. Ensuring a reliable supply chain for these materials is crucial, and any disruptions can lead to production delays and increased costs.

Yield Management: Achieving high yields (the percentage of defect-free devices) is paramount in semiconductor manufacturing. Due to the complexity of 3D TSV processes, ensuring consistently high yield rates can be challenging. Defective devices result in increased production costs, wasted resources, and delays in product delivery. Manufacturers must invest in rigorous quality control and defect detection systems to minimize yield losses. Process Variation: Variability in manufacturing processes can lead to inconsistent product quality. This is particularly critical in industries where reliability and performance are essential, such as aerospace and automotive. Managing and reducing process variation requires continuous monitoring and optimization.

Time-to-Market: The intricate nature of 3D TSV manufacturing processes can result in longer development cycles and time-to-market. In rapidly evolving industries, such as consumer electronics and telecommunications, delays in bringing products to market can be detrimental to a company's competitiveness. Scaling Challenges: Scaling up production to meet increasing demand while maintaining quality and consistency can be challenging. Manufacturers must find ways to optimize processes and control costs as production volumes grow.

Intellectual Property Protection: Protecting intellectual property in the semiconductor industry is crucial. However, the complexity of 3D TSV processes can make it difficult to safeguard proprietary technologies and designs. To overcome these challenges, the industry continues to invest in research and development efforts aimed at streamlining manufacturing processes, improving yield rates, and reducing costs. Collaboration among industry players and the development of standardized processes can also help mitigate these obstacles. While the complexity of 3D TSV manufacturing remains a significant challenge, the potential benefits in terms of performance and miniaturization continue to drive innovation and investment in this field.

Costs and Yield Management

Costs and yield management represent a significant challenge in the global 3D TSV (Through-Silicon Via) devices market, posing potential hurdles to widespread adoption and profitability for manufacturers. These challenges are intricately linked and impact various aspects of the industry. High Manufacturing Costs: One of the primary challenges in the 3D TSV market is the substantial cost associated with manufacturing. The process involves multiple complex steps, including thin wafer handling, wafer bonding, TSV etching, and backside thinning, each of which requires specialized equipment and materials. The initial capital expenditure required for setting up a 3D TSV manufacturing facility is substantial, deterring some companies from entering the market. These high manufacturing costs can also translate into higher prices for 3D TSV devices, potentially limiting their adoption in cost-sensitive markets.Yield Management: Achieving high yield rates in 3D TSV production is critical for cost-effectiveness. Yield refers to the percentage of defect-free devices in a production run. Given the complexity of the manufacturing process, ensuring consistently high yields can be challenging. Defective devices result in wasted resources, increased production costs, and potentially delayed time-to-market. Manufacturers must invest in stringent quality control measures and defect detection systems to minimize yield losses. Any yield-related issues can erode profit margins and hinder market competitiveness. Economies of Scale: The challenges related to costs and yields are amplified when scaling up production. As demand for 3D TSV devices increases, manufacturers must find ways to maintain high yields while producing larger volumes. Achieving economies of scale, which typically lead to lower per-unit production costs, can be challenging due to the intricate nature of 3D TSV manufacturing.

Technological Advancements: The semiconductor industry is characterized by rapid technological advancements. As technology evolves, manufacturers need to continually invest in research and development to improve yield rates and reduce production costs. Falling behind technological innovation can put companies at a competitive disadvantage. Competitive Pressures: In a competitive market, companies are under constant pressure to deliver innovative products at competitive prices. Manufacturers that cannot manage costs effectively may struggle to compete with rivals offering lower-priced alternatives.

To address these challenges, the industry is actively engaged in research and development efforts aimed at streamlining the 3D TSV manufacturing process, improving yield rates, and reducing production costs. Collaboration among industry players and the development of standardized processes can also help mitigate these challenges. Additionally, as the market matures and more manufacturers enter the 3D TSV space, economies of scale and increased competition may lead to cost reductions. Despite these challenges, the potential benefits of 3D TSV technology, such as improved performance and miniaturization, continue to drive investment and innovation in the field.

Key Market Trends

Growing Role in AI and HPC

The growing role of 3D TSV (Through-Silicon Via) devices in AI (Artificial Intelligence) and HPC (High-Performance Computing) applications is a pivotal driver propelling the global 3D TSV devices market. These technologies demand exceptional computational power, memory bandwidth, and energy efficiency, all of which are significantly enhanced by the unique capabilities of 3D TSV technology. Acceleration of AI Workloads: AI, including machine learning and deep learning, relies on vast amounts of data and complex mathematical computations. 3D TSV devices are instrumental in accelerating AI workloads by integrating specialized components like GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units) alongside traditional CPUs. This integration facilitates parallel processing and reduces data transfer bottlenecks, thereby improving AI model training times and inference performance.Memory Bandwidth Enhancement: AI and HPC applications require access to large and high-bandwidth memory. 3D TSV technology enables the vertical stacking of memory modules, resulting in higher memory density and bandwidth. This capability is especially critical for handling massive datasets and conducting complex simulations in HPC and AI research. Energy Efficiency for Edge AI: Edge AI, which involves AI processing on devices at the edge of the network, demands energy-efficient solutions due to power constraints. 3D TSV devices optimize power consumption by reducing the distance between components and minimizing energy wastage during data transfer. This makes them well-suited for edge AI deployments in applications like autonomous vehicles and IoT devices.

Space Optimization: AI and HPC systems often require significant computational resources, and space-efficient solutions are essential, especially in data centers and research environments. 3D TSV technology enables the dense packing of processing units, memory, and accelerators within a smaller footprint, making it an attractive option for space-constrained environments. Customized Hardware: AI and HPC often require specialized hardware configurations to achieve optimal performance. 3D TSV devices allow for the customization of chip configurations, enabling the integration of specific hardware components tailored to the needs of AI and HPC workloads. Parallel Processing Power: The parallel processing capabilities of 3D TSV devices are ideal for AI tasks that involve matrix multiplication and neural network operations. This parallelism enhances the speed and efficiency of AI model training and execution.

Emerging AI Applications: As AI continues to evolve, new applications such as natural language processing, computer vision, and AI-driven robotics are emerging. These applications demand the computational muscle and memory capacity that 3D TSV devices can provide. In conclusion, the growing role of 3D TSV devices in AI and HPC applications aligns with the increasing demand for high-performance, energy-efficient computing solutions. 3D TSV technology addresses the critical needs of these domains by enabling advanced chip integration, memory enhancements, and energy efficiency, positioning it as a key enabler for the continued advancement of AI and HPC technologies. As AI and HPC applications proliferate across various industries, the global 3D TSV devices market is set to thrive, supporting innovation and breakthroughs in these fields.

Expansion in IoT Devices

The expansion of IoT (Internet of Things) devices is poised to be a significant driver in propelling the growth of the global 3D TSV (Through-Silicon Via) devices market. IoT represents a transformative force in connecting and automating a wide range of devices and systems, and 3D TSV technology is becoming increasingly crucial in supporting the demands of this burgeoning ecosystem. Miniaturization for IoT Sensors: IoT devices often require a multitude of sensors, communication modules, and processing units to function effectively. These components need to be compact and energy-efficient to fit seamlessly into various IoT applications, from smart home devices to industrial sensors. 3D TSV technology enables the vertical integration of these components, reducing the physical footprint of IoT devices while enhancing their functionality.Energy Efficiency: IoT devices are often battery-powered or have limited access to power sources. Energy efficiency is paramount in extending the lifespan of these devices and reducing maintenance requirements. 3D TSV devices can minimize power consumption by reducing the length of interconnects between components, making them well-suited for IoT applications where power efficiency is a critical consideration. High Integration Levels: IoT applications demand high levels of integration to accommodate multiple functions within limited space. 3D TSV technology allows for the stacking of chips with different functionalities, such as sensors, microcontrollers, and wireless communication modules, in a single package. This integration streamlines IoT device designs and improves their performance.

Advanced Communication: IoT relies on efficient data transfer and communication between devices and networks. 3D TSV devices can incorporate advanced communication components, such as RF (Radio Frequency) chips, directly into the device's package, enabling reliable and high-speed wireless connectivity. Customization and Versatility: The diverse nature of IoT applications requires customization to meet specific needs. 3D TSV technology allows for the flexible integration of various components, making it easier to tailor IoT devices for specific applications, whether it's environmental monitoring, healthcare, or industrial automation.

Market Growth: The IoT market continues to expand rapidly across industries, including healthcare, agriculture, smart cities, and industrial automation. This growth drives the demand for 3D TSV devices that can deliver the required performance, miniaturization, and energy efficiency. Emerging Use Cases: As IoT technology evolves, new use cases emerge, such as edge computing, where data is processed locally within IoT devices. 3D TSV devices are well-suited for these emerging applications, as they can house powerful processors and memory components in compact form factors.

In conclusion, the expansion of IoT devices is a compelling driver for the global 3D TSV devices market. By addressing the specific requirements of IoT applications, 3D TSV technology enables manufacturers to create smaller, more energy-efficient, and highly integrated devices. As IoT continues to permeate various sectors, the demand for 3D TSV devices is expected to rise, further solidifying their role in shaping the future of connected devices and systems.

Segmental Insights

Product Insights

LED Packaging segment is expected to dominate the market during the forecast period. The increasing use of light-emitting diodes (LED) in products has promoted the development of higher power, greater density, and lower-cost devices. The use of three-dimensional (3D) packaging through-silicon via (TSV) technology allows a high density of vertical interconnects, unlike 2D packaging.TSV integrated circuit reduced connection lengths, and thus, smaller parasitic capacitance, inductance, and resistance are required where a combination of monolithic and multifunctional integration is done efficiently, which provides high-speed low-power interconnects. The embedded design with thin silicon membranes at the bottom optimizes the thermal contact and therefore minimizes the thermal resistance. Through silicon via (TSV) provides the electrical contact to the surface-mounted devices and mirrored sidewalls increase the package reflectivity and improve the light efficiency.

The SUSS AltaSpray technology is capable of coating integration of 90° corners, KOH (Potassium Hydroxide) etched cavities, Through Silicon Via (TSV) ranging from a few microns to 600μm or more. The ability to produce conformal resist coatings on severe topography, such as TSV, makes them the ideal choice for wafer-level packaging in LED, which increases the market growth.

Regional Insights

Asia Pacific is expected to dominate the market during the forecast period. Asia-Pacific is the fastest-growing market as countries in the region, such as China, Japan, South Korea, Indonesia, Singapore, and Australia, have recorded high levels of manufacturing in the consumer electronics, automotive, and transportation sectors, which a key source of demand for 3D TSV market.Asia-Pacific is also one of the most active manufacturing hubs in the world. The rising popularity of smartphones and demand for new memory technologies have increased the growth of computationally intensive consumer electronics, thereby, creating a wide range of opportunities in this region. As silicon wafers are widely used to manufacture smartphones, the introduction of 5G technology is expected to boost the sales of 5G smartphones, which may grow the market in the telecommunication sector.

Report Scope:

In this report, the Global 3D TSV Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global 3D TSV Devices Market, By Product:

- Memory

- MEMS

- CMOS Image Sensors

- Imaging and Opto Electronics

- Advanced LED packaging

Global 3D TSV Devices Market, By Application:

- Consumer Electronics Sector

- Information and Communication Technology Sector

- Automotive Sector

- Military

- Aerospace

- Defense Sector

Global 3D TSV Devices Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global 3D TSV Devices Market.Available Customizations:

Global 3D TSV Devices Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- Samsung Group

- Toshiba Corporation

- Pure Storage Inc.

- ASE Group

- Amkor Technology

- United Microelectronics Corp.

- STMicroelectronics NV

- Broadcom Ltd

- Intel Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2023 |

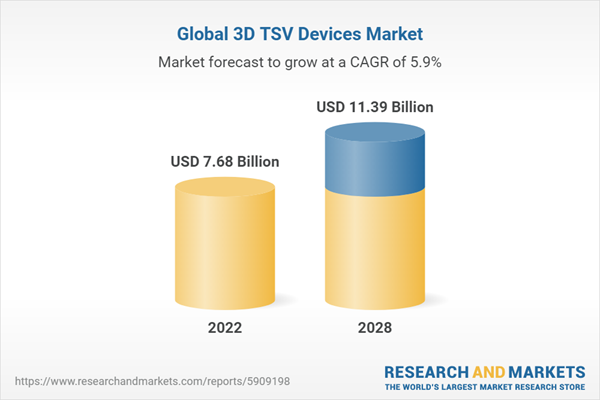

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 7.68 Billion |

| Forecasted Market Value ( USD | $ 11.39 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |