Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Oil and Gas Exploration and Production

Oil and gas exploration and production play a pivotal role in driving the global oil and gas light towers market. These activities are the heartbeat of the industry, involving the search for and extraction of hydrocarbon reserves deep beneath the Earth's surface. As exploration and production operations expand and evolve, the demand for reliable and efficient lighting solutions, such as light towers, becomes increasingly pronounced. One of the primary reasons oil and gas exploration and production activities drive the demand for light towers is the need for continuous, 24/7 operations. In many cases, these activities occur in remote, desolate, and often harsh environments, such as offshore drilling rigs, remote onshore drilling sites, and deep underground oilfields. These locations lack natural lighting, making artificial illumination essential for safety and operational efficiency.Light towers are deployed to provide illumination for a variety of critical tasks within the oil and gas sector. These include drilling operations, wellhead maintenance, equipment inspection, and transportation logistics. The safety of personnel and the integrity of the infrastructure depend on well-lit workspaces, especially during nighttime operations or in regions with limited daylight hours. Moreover, oil and gas exploration and production can be a long-term endeavor. Projects often span months or even years, requiring continuous lighting solutions that can withstand the rigors of the environment. Light towers are designed to meet these demands, offering durability and reliability in challenging conditions.

Furthermore, as the industry continues to explore new frontiers and tap into unconventional reserves, the demand for light towers is likely to remain strong. Emerging markets and untapped resources in regions like the Arctic, deepwater offshore areas, and remote shale plays are expected to drive the need for advanced lighting solutions that can support these challenging operations. In conclusion, oil and gas exploration and production activities are the driving force behind the global oil and gas light towers market. The industry's reliance on continuous operations in remote and challenging environments underscores the critical role that light towers play in ensuring safety, efficiency, and productivity. As the industry evolves and expands its horizons, the demand for innovative and energy-efficient light tower solutions is expected to persist, making this sector a key growth driver for the market.

Events, Entertainment, and Outdoor Activities

The global Oil & Gas light towers market is experiencing significant growth due to the increasing demand driven by events, entertainment, and outdoor activities. These sectors rely heavily on effective and efficient lighting solutions to create safe, well-illuminated spaces for various purposes, which has led to a surge in the adoption of Oil & Gas light towers. Events, ranging from music festivals and sports competitions to corporate gatherings and community celebrations, require well-lit environments, especially when they take place during the evening or in outdoor venues. Oil & Gas light towers provide the necessary illumination to ensure the safety of participants and spectators, facilitate operations, and enhance the overall experience. Their versatility in terms of mobility and easy setup makes them indispensable in event management.Entertainment is another key driver of the Oil & Gas light towers market. Outdoor concerts, movie screenings, and theatrical performances are becoming increasingly popular, attracting large audiences. To create immersive and visually captivating experiences, organizers rely on Oil & Gas light towers to light up stages, seating areas, and surrounding spaces. This not only ensures that audiences can enjoy the show safely but also adds to the aesthetic appeal of the event. Outdoor activities, including camping, sports practices, and recreational events, often take place in remote or off-grid locations where access to traditional lighting infrastructure is limited. Oil & Gas light towers, equipped with features like solar panels and battery storage, are ideal solutions for such scenarios. They provide reliable and efficient lighting, extending the hours during which outdoor activities can be enjoyed.

Moreover, advancements in lighting technology, such as LED technology, have made Oil & Gas light towers more energy-efficient and environmentally friendly. Event organizers and outdoor activity enthusiasts appreciate the reduced energy consumption and longer lifespan of LED-equipped light towers, which align with sustainability goals. The COVID-19 pandemic has also played a role in driving the demand for Oil & Gas light towers in outdoor settings. Many indoor events and entertainment activities were moved outdoors to comply with social distancing guidelines. As a result, the need for effective outdoor lighting solutions became even more pronounced.

In conclusion, the global Oil & Gas light towers market is experiencing a surge in demand, thanks to the growing prevalence of events, entertainment, and outdoor activities. These sectors rely on Oil & Gas light towers to provide essential illumination, enhance safety, and elevate the overall experience for participants and audiences. As these industries continue to expand, the market for Oil & Gas light towers is expected to grow in tandem, further driving innovation and efficiency in lighting technology.

Key Market Challenges

Environmental Concerns and Regulations

Environmental concerns and increasingly stringent regulations are emerging as potential challenges for the global Oil & Gas light towers market. While these lighting solutions are essential for various industries, their environmental impact and compliance with eco-friendly standards are becoming significant factors affecting their adoption and operation. One of the primary environmental concerns associated with Oil & Gas light towers is energy consumption. Traditional light towers often use metal halide lamps or other non-energy-efficient lighting technologies, which can lead to high energy consumption and increased greenhouse gas emissions. This heightened energy usage not only contributes to environmental degradation but also results in higher operational costs for businesses.To address these concerns, the industry has been transitioning to more energy-efficient solutions, such as LED lighting technology. LEDs consume significantly less energy, have a longer lifespan, and produce less heat, making them a more environmentally friendly choice. However, older, less efficient light towers may still be in use, posing challenges in meeting sustainability goals and complying with stricter regulations. Another environmental consideration is noise pollution. Some Oil & Gas light towers are powered by diesel engines, which can generate noise pollution in quiet or residential areas. As environmental regulations related to noise pollution become more stringent, businesses may face limitations on where and when they can use diesel-powered light towers. Furthermore, emissions from diesel-powered light towers contribute to air pollution, which has health and environmental implications. To mitigate these issues, companies are developing and adopting cleaner-burning engines and emissions control technologies. While these advancements can help reduce emissions, they may also add to the cost of light tower systems, impacting affordability for some users.

Environmental regulations vary by region and are becoming increasingly complex and stringent. Compliance with these regulations can be challenging for manufacturers and end-users alike. Failure to meet these standards can result in fines and legal issues, leading businesses to invest in costly upgrades or modifications to their light towers to remain compliant. In conclusion, environmental concerns and regulatory pressures pose significant challenges to the global Oil & Gas light towers market. While the industry is making efforts to address these issues through the adoption of more energy-efficient technologies and emissions control measures, the transition may not be seamless, and older equipment may still pose environmental challenges. To thrive in this evolving landscape, manufacturers and users of Oil & Gas light towers must remain vigilant in adopting eco-friendly solutions and complying with ever-stricter environmental regulations to ensure a sustainable and environmentally responsible future.

Technological Evolution and Integration

Technological evolution and integration can potentially create challenges for the global Oil & Gas light towers market, even as they offer opportunities for improvement and innovation. While technology can enhance the capabilities of light towers, it can also pose hurdles related to complexity, cost, and compatibility. One of the primary challenges posed by technological evolution is the rapid pace of change. As new technologies emerge and existing ones evolve, Oil & Gas light tower manufacturers must continuously update their products to remain competitive. This can lead to shorter product lifecycles and increased costs associated with research and development, potentially driving up the prices of light tower systems for consumers.Integration can also be a double-edged sword. While integrating technologies like remote monitoring, telematics, and IoT sensors can provide valuable data and control capabilities, it can also introduce complexities. Compatibility issues between various integrated components and systems can arise, leading to operational challenges and potential downtime. Moreover, the need for skilled technicians to install and maintain these integrated systems can add to the overall cost of ownership. Furthermore, Oil & Gas light towers are often used in harsh and remote environments, which can pose challenges for technology integration. Ensuring the reliability and durability of integrated components in such conditions is critical. Failures or malfunctions in technology-intensive light towers can disrupt operations, increase maintenance costs, and undermine user confidence. Cost considerations are another potential hindrance. While technology integration can lead to improved efficiency and functionality, it can also raise the upfront cost of acquiring Oil & Gas light towers. Smaller businesses or budget-conscious buyers may find it challenging to invest in advanced systems, potentially limiting market penetration.

Additionally, the Oil & Gas light tower market is traditionally associated with rugged, straightforward equipment. The introduction of sophisticated technology may require additional training and skill sets for operators and maintenance personnel, which can be a barrier to adoption. In conclusion, technological evolution and integration present both opportunities and challenges for the global Oil & Gas light towers market. While advancements can enhance performance, efficiency, and functionality, they may also lead to increased complexity, costs, and compatibility issues. Manufacturers must strike a balance between innovation and practicality to meet the diverse needs of their customers, ensuring that technology integration ultimately adds value without compromising reliability or affordability.

Key Market Trends

Transition to LED Lighting Technology in the Global Oil & Gas Light Towers Market

The global market for light towers has experienced a significant shift towards the adoption of LED (Light Emitting Diode) lighting technology. This trend is driven by the numerous advantages that LED lights offer over traditional lighting sources, such as metal halide or halogen lamps. LED lights are renowned for their energy efficiency, durability, extended lifespan, and superior illumination quality. As a result, they have become the preferred choice for manufacturers and end-users in various industries that rely on light towers for temporary illumination. One of the key factors behind the transition to LED lighting in light towers is the substantial reduction in energy consumption. LED lights consume significantly less energy compared to traditional lighting technologies, resulting in reduced fuel consumption and operational costs. This energy efficiency is particularly important in applications where light towers need to operate for extended periods, such as construction sites, mining operations, and emergency response situations. Furthermore, the longevity of LED lights contributes to decreased maintenance requirements and costs. Traditional lighting sources often have shorter lifespans and are prone to frequent failures, necessitating frequent replacements and repairs. In contrast, LED lights can last tens of thousands of hours, leading to reduced downtime and increased reliability for light towers. LED lights also provide improved illumination quality, offering bright and uniform lighting across the work area. This enhanced visibility enhances safety, productivity, and overall working conditions in various industries. Additionally, LED lights can be dimmed and adjusted, allowing for better control over lighting levels based on specific needs. The shift towards LED lighting aligns with broader sustainability initiatives and environmental concerns. Governments and organizations are increasingly focused on reducing carbon footprints and minimizing energy consumption. LED lighting's energy efficiency directly contributes to these goals, making it a compelling choice for companies seeking to align with sustainable practices.Remote Monitoring and Telematics

Remote monitoring and telematics are poised to be major drivers of growth in the global Oil & Gas light towers market. These technologies have revolutionized the way Oil & Gas equipment, including light towers, are managed and operated. With their integration into light tower systems, several transformative impacts are anticipated. First and foremost, remote monitoring and telematics bring a new level of efficiency to Oil & Gas operations. These technologies allow operators to remotely track the status, performance, and location of light towers in real-time. This means that any issues or malfunctions can be detected immediately, enabling proactive maintenance and minimizing downtime. Such efficiency gains are highly valued in industries where uninterrupted lighting is critical, such as construction, mining, and emergency response.Moreover, remote monitoring and telematics enhance safety in Oil & Gas settings. With the ability to monitor light towers remotely, operators can ensure that lighting is appropriately directed and functioning correctly. This is particularly vital in hazardous environments where proper illumination can prevent accidents and injuries. Additionally, these technologies offer security benefits, as they can help deter theft and vandalism of light towers by providing instant alerts in case of unauthorized movement or tampering.

Environmental concerns are also driving the adoption of remote monitoring and telematics. Industries worldwide are under increasing pressure to reduce their carbon footprint. By remotely controlling light towers, operators can optimize their usage, minimizing unnecessary energy consumption. Furthermore, the integration of solar-powered and hybrid light towers, which are inherently eco-friendly, is facilitated by telematics, contributing to sustainability goals. The trend towards renting Oil & Gas equipment, including light towers, is gaining momentum. Remote monitoring and telematics play a pivotal role in this rental market growth. Rental companies can remotely track their assets, ensuring proper usage and maintenance by lessees. This promotes cost-effectiveness and prolongs the life of equipment. In summary, remote monitoring and telematics are catalysts for innovation and growth in the Oil & Gas light towers market. They offer increased efficiency, safety, and sustainability, while also facilitating the expansion of rental services. As industries increasingly recognize the value of these technologies, their adoption is expected to continue driving the global Oil & Gas light towers market forward.

Segmental Insights

Channel Insights

Rental segment is expected to dominate the market during the forecast period. The rental segment within the global light towers market entails the temporary leasing or renting of light towers to various industries and sectors that require portable lighting solutions for a specific duration. This segment has witnessed substantial growth due to the advantages it offers to businesses, including cost savings, flexibility, and access to modern technology without the need for a significant upfront investment. Renting light towers can prove to be a more cost-effective option for businesses with intermittent or short-term lighting needs. Instead of investing in equipment purchase, they can opt to rent light towers as per their requirements, thereby avoiding capital expenditure. Rental companies are now integrating telematics and remote monitoring systems into their equipment, enabling them to track equipment usage, monitor fuel consumption, schedule maintenance, and provide real-time support to renters. Industries such as construction, events, and disaster relief often have project-based demands for lighting solutions. Renting light towers allows them to align their lighting needs with the duration of their projects, providing the desired flexibility. To cater to environmentally conscious clients and align with sustainability trends, some rental companies are even offering eco-friendly options like hybrid or solar-powered light towers.Type of Power Source Insights

Diesel Powered segment is expected to dominate the market during the forecast period. The diesel segment in the global light towers market pertains to a specific category of light towers powered by diesel engines. Light towers are portable lighting devices commonly utilized in construction sites, outdoor events, emergency situations, and various other applications requiring temporary lighting. Diesel light towers are equipped with robust diesel engines that drive generators, generating electricity to power the lighting fixtures mounted on the tower. Diesel engines exhibit durability and the ability to provide consistent power over extended durations, making diesel light towers well-suited for demanding applications and environments. Moreover, diesel engines display relative fuel efficiency, striking a good balance between power output and fuel consumption. This attribute is particularly valuable for applications necessitating prolonged operation of the light tower.Regional Insights

North America is expected to dominate the market during the forecast period Light towers are portable lighting solutions widely utilized in construction sites, outdoor events, emergency scenarios, and various Oil & Gas applications. The North American market has played a significant role in the growth of light towers, owing to its extensive construction and infrastructure projects, large-scale events, and the imperative need for reliable lighting during emergencies. The construction industry in North America has been a major catalyst for the light towers market. The region consistently witnesses infrastructure development, including roadways, bridges, commercial buildings, and residential complexes, thereby creating a steady demand for portable lighting solutions. Moreover, North America hosts a diverse range of outdoor events, such as music festivals, sports events, and community gatherings. Light towers play a vital role in providing adequate lighting during these events, thereby enhancing safety and visibility for attendees.The advent of LED technology has revolutionized the light towers market by offering lighting options that are longer-lasting, energy-efficient, and brighter. Consequently, LED light towers have emerged as the preferred choice due to their cost-effectiveness and reduced environmental impact. Furthermore, modern light towers are equipped with telematics systems that enable remote monitoring, fuel consumption tracking, maintenance scheduling, and deployment optimization. This advanced technology significantly enhances operational efficiency.

Report Scope:

In this report, the Global Oil & Gas Light Towers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Oil & Gas Light Towers Market, By Channel:

- Sales

- Rental

Global Oil & Gas Light Towers Market, By Type:

- LED

- Metal Halid

Global Oil & Gas Light Towers Market, By Type of Power Source:

- Solar Powered

- Diesel Powered

- Hydrogen Fuel Powered

- Directly Powered Sales

Global Oil & Gas Light Towers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oil & Gas Light Towers Market.Available Customizations:

Global Oil & Gas Light Towers Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Inmesol Gensets SL

- ABB Ltd.

- Aesseal Plc

- Beacon Gasket & Seals Co.

- Ebara Corp.

- EnPro Industries Inc.

- Flowserve Corp.

- Parker Hannifin Corp.

- Smiths Group Plc

- The Timken Co.

Table Information

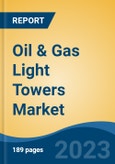

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2023 |

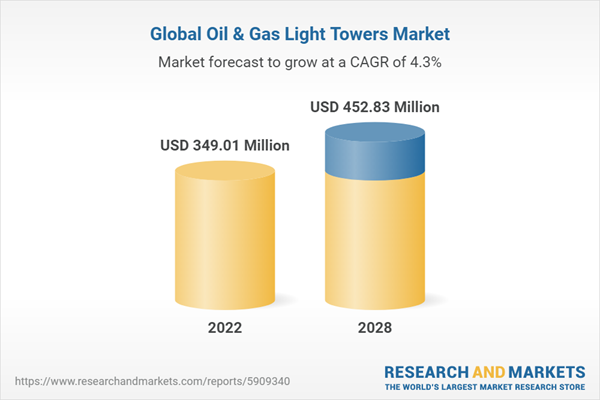

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 349.01 Million |

| Forecasted Market Value ( USD | $ 452.83 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |