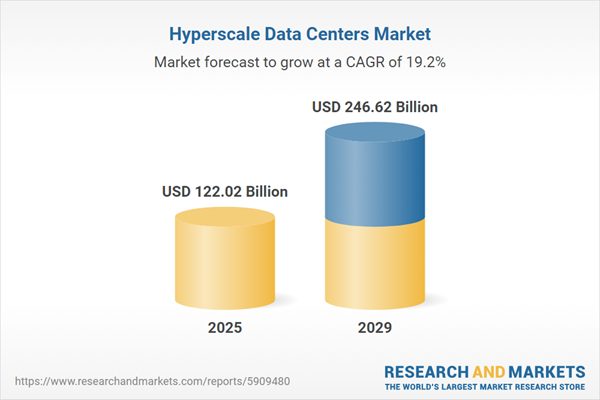

The hyperscale data center market size has grown rapidly in recent years. It will grow from $105.85 billion in 2024 to $122.02 billion in 2025 at a compound annual growth rate (CAGR) of 15.3%. The growth in the historic period can be attributed to cloud computing growth, internet services expansion, data explosion, energy efficiency.

The hyperscale data center market size is expected to see rapid growth in the next few years. It will grow to $246.62 billion in 2029 at a compound annual growth rate (CAGR) of 19.2%. The growth in the forecast period can be attributed to increasing data volumes, edge computing expansion, cloud services, ai and machine learning. Major trends in the forecast period include cloud computing dominance, ai and machine learning, hybrid and multi-cloud strategies, software-defined data centers (sddcs).

The surge in internet users results in an amplified data generation that necessitates management and storage by hyperscale data centers. For example, according to the Canadian Internet Use Survey 2022 by Statistics Canada in July 2023, internet usage among Canadians aged 15 and older escalated from 92% in 2020 to 95% in 2022. Notably, individuals aged 75 years and older witnessed a significant increase, rising from 62% in 2020 to 72% in 2022. The mounting count of internet users and the availability of faster wireless internet connections drive the demand in the hyperscale data centers market.

Anticipated growth in cloud-based services is expected to propel the expansion of the hyperscale data center market. Cloud-based services encompass a range of resources delivered over the Internet from remote data centers or cloud providers. They play a pivotal role in hyperscale data centers by consuming their extensive computing and storage resources to offer scalable and on-demand services to users. For example, in December 2023, Eurostat, a Luxembourg-based intergovernmental organization, reported that 45.2% of EU enterprises utilized cloud computing services in 2023. This marked a 4.2 percentage point increase compared to 2021. These services include access to software, computing power, storage capacity, and more, all provided over the internet. Hence, the growth in cloud-based services is steering the hyperscale data center market.

Hyperscale data centers necessitate a constant high-power supply for processing and storing data. Forbes Technology Council’s report revealed that U.S. data centers consumed more than 90 billion kilowatt-hours of electricity annually. The facilities depend on power for data-intensive operations, and any power outage can bring data center operations to a standstill. For example, a 30-minute power failure impacted Amazon's data center in the US-EAST-2 region, causing connectivity issues that affected several services such as RDS, Redshift, WorkSpaces, EC2, and EBS stored in the US-EAST-2 data center, resulting in significant disruption to Amazon's business model and services.

The major entities operating in the hyperscale data market are actively investing in alternative solutions to meet the high-power demands of their existing and upcoming facilities worldwide. This strategic shift aims to reduce their carbon footprint and promote sustainability. Leading data center providers are notably acquiring clean, renewable energy sources to power their operations. For example, Apple's announcement of a $921 million investment in constructing a hyperscale infrastructure facility in Denmark indicates their commitment to exclusively utilizing renewable energy sources. Similarly, Google has plans to invest approximately $700 million in a Danish data center, intending to harness renewable energy through power purchase agreements (PPAs).

Major companies operating within hyperscale data centers are significantly concentrating on the introduction of new data centers like SGRUTB05, aiming to gain a competitive advantage in the market. SGRUTB05 operates solely with certified renewable energy and is designed to function with an exceptional Power Usage Effectiveness (PUE) of less than 1.4. For example, in May 2023, Scala Data Centers, a US-based data center provider, unveiled SGRUTB05. This site is the second-largest vertical data center in Latin America, situated in the Tamboré Campus in Barueri City, São Paulo State, Brazil. With 6 MW of IT capacity, SGRUTB05 contributes to the Tamboré Campus, recognized as the most extensive data center complex in Latin America and one of the world's top five in terms of size. Spanning 6,700 sq m, this 35.5-meter high facility encompasses five floors, three of which are dedicated to data halls, housing a high-density of nearly 400 racks with an aggregated power capacity of almost 9 MW.

Hyperscale data centers are large-scale facilities designed to efficiently manage vast amounts of data storage, processing, and networking, primarily serving major tech companies and cloud service providers. These data centers are known for their extensive infrastructure, scalability, and high-performance capabilities, enabling them to handle massive workloads and large volumes of traffic. Hyperscale data centers play a crucial role in cloud computing, big data, and digital services, serving as the backbone for online platforms and services used worldwide.

Hyperscale data centers serve a variety of user types, including cloud providers, colocation providers, and enterprises. These centers are comprised of a combination of solutions and services. Cloud providers, for instance, are responsible for managing software infrastructures that store data on remote servers. Data centers come in various sizes, with distinctions between small and medium-sized data centers and larger facilities. Data hosted within hyperscale data centers is typically accessible over the Internet, offering wide-reaching connectivity. These data centers cater to an array of applications across sectors such as manufacturing, government utilities, banking, financial services, and insurance (BFSI), information technology (IT) and telecommunications, healthcare, and the energy industry.

The hyperscale data centers market research report is one of a series of new reports that provides hyperscale data centers market statistics, including hyperscale data centers industry global market size, regional shares, competitors with a hyperscale data centers market share, detailed hyperscale data centers market segments, market trends and opportunities, and any further data you may need to thrive in the hyperscale data centers industry. This hyperscale data centers market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the hyperscale data centres market include NVIDIA Corporation, Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., International Business Machines Corporation, Hewlett-Packard Company, Dell Inc., Orange Business Services, Cavium Inc., Lenovo Group Ltd., Hewlett-Packard Company, Intel Corporation, Western Digital Corporation, NVIDIA Corporation, Oracle Corporation, OVHcloud Company, Tencent Holdings Limited, Alibaba Group Holding Limited, Apple Inc., Microsoft Corporation, Meta Platforms Inc., Equinix Inc., Digital Realty Trust Inc., CyrusOne Inc., NTT Communications Corporation, Interxion Holding N.V., Global Switch Holdings Limited, CoreSite Realty Corporation, QTS Realty Trust Inc., Switch Inc., Iron Mountain Incorporated, Cologix Inc., Cyxtera Technologies Inc., Zayo Group Holdings Inc., CenturyLink Inc., AT&T Inc., Verizon Communications Inc.

The Asia-Pacific was the largest region in the hyperscale data centers market in 2024. Asia-Pacific is expected to be the fastest-growing region in the hyperscale data centers market report analysis during the forecast period. The regions covered in the hyperscale data centres market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the hyperscale data centres market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The hyperscale data centers market consists of revenues earned by entities by providing hyper scale data centers which support a large number of physical and virtual servers at the same time. This industry includes companies with distributed data warehouses that focus on maintaining the data's scalability and managing a large amount of data. Hyperscale data centers operate in buildings or dedicated space within a building, or a group of buildings that house computer systems and related components, such as telecommunications and storage systems on large scale with thousands of individual servers operating together through a high-speed network. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Hyperscale Data Centers Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on hyperscale data centers market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for hyperscale data centers ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The hyperscale data centers market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Cloud Providers; Colocation Providers; Enterprises2) By Component: Solution; Service

3) By Application: Manufacturing; Government Utilities; BFSI; IT and Telecommunication; Healthcare; Energy

Subsegments:

1) By Cloud Providers: Public Cloud Providers; Private Cloud Providers; Hybrid Cloud Providers2) By Colocation Providers: Retail Colocation; Wholesale Colocation

3) By Enterprises: Large Enterprises; Small and Medium Enterprises (SMEs)

Key Companies Mentioned: NVIDIA Corporation; Cisco Systems Inc.; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co. Ltd.; International Business Machines Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Hyperscale Data Centers market report include:- NVIDIA Corporation

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- International Business Machines Corporation

- Hewlett-Packard Company

- Dell Inc.

- Orange Business Services

- Cavium Inc.

- Lenovo Group Ltd.

- Hewlett-Packard Company

- Intel Corporation

- Western Digital Corporation

- NVIDIA Corporation

- Oracle Corporation

- OVHcloud Company

- Tencent Holdings Limited

- Alibaba Group Holding Limited

- Apple Inc.

- Microsoft Corporation

- Meta Platforms Inc.

- Equinix Inc.

- Digital Realty Trust Inc.

- CyrusOne Inc.

- NTT Communications Corporation

- Interxion Holding N.V.

- Global Switch Holdings Limited

- CoreSite Realty Corporation

- QTS Realty Trust Inc.

- Switch Inc.

- Iron Mountain Incorporated

- Cologix Inc.

- Cyxtera Technologies Inc.

- Zayo Group Holdings Inc.

- CenturyLink Inc.

- AT&T Inc.

- Verizon Communications Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 122.02 Billion |

| Forecasted Market Value ( USD | $ 246.62 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |