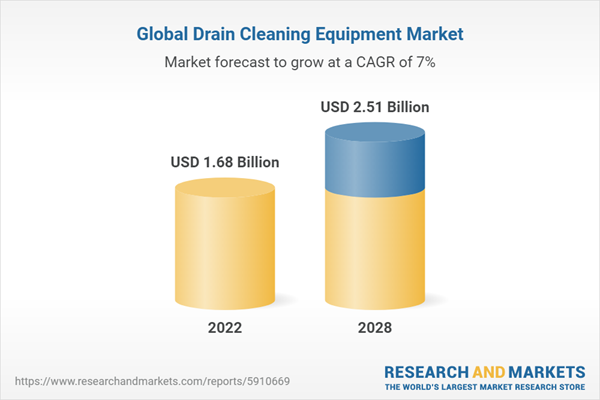

Drain cleaning equipment refers to a wide range of products, tools & machinery, including, drain snakes, augers, hydro-jetting machines, and sewer cameras, among others, that are used to clean and clear pipes and drains of debris, clogs, and other obstructions. Drain cleaning equipment are commonly used by plumbers, facility managers, and maintenance personnel to ensure the proper functioning of drainage and plumbing systems. The drain cleaning equipment market is associated with production, designing, distribution and sale of equipment, tools, machinery, and devices used for maintaining and cleaning drainage systems of commercial, residential, or industrial settings. The global drain cleaning equipment market value stood at US$1.68 billion in 2022, and is expected to reach US$2.51 billion by 2028.

Global drain cleaning equipment market demonstrated a consistent growth, primarily driven by increasing level of public & private investment in the creation of reliable and effective public utilities, ongoing development of commercial and residential infrastructure, recurring need for drainage system upkeep and cleaning in developed nations and heavily populated cities, growing demand for maintenance and repair of drainage systems, rising number of do-it-yourself (DIY) activities, and increasing adoption of drain cleaning equipment by various industries, including manufacturing, healthcare, hospitality, commercial & retail, etc. Also, increasing demand for innovative cleaning equipment from the municipal sector, growing investment by the government as well as commercial enterprise towards the development of robust and efficient public utilities, ongoing adoption of preventive maintenance strategies, rising public awareness for proper sanitation and sewage infrastructure, and growing construction activities in major developing economies such as Cambodia, India, China, Brazil, Myanmar etc., is expected to boost the growth of overall drain cleaning equipment market in upcoming years. The market is expected to grow at a CAGR of 7% over the projected period of 2023-2028.

Market Segmentation Analysis:

By Product: The report provides the bifurcation of the drain cleaning equipment market into nine segments based on product: locating equipment, jetters, sectional machine, push rod cameras, flexible shaft machine, drum/continuous cable machine, sink machine, hand tool, and rodders. The locating equipment is the largest segment of global drain cleaning equipment market owing to increasing infrastructure development, positive shift from reactive to proactive and preventive maintenance, increasing public awareness about environmental and health implications of poorly maintained drainage system, and added advantage offered by locating equipment in terms of reduced disruption, increased cost savings, reduced accidental damage of other utilities or infrastructure during excavation, efficient repairs, and positive environmental impact in terms of reduced disruption to the surrounding landscape and a smaller carbon footprint.

By Sales Channel: The report provides the bifurcation of the drain cleaning equipment market into three segments on the basis of sales channel: online, retail, and distributor. Retail is the largest segment of global drain cleaning equipment market owing to increasing number of retail stores selling plumbing & home improvement products, rapid urbanization, immediate gratification associated with retail stores, rapid growth of commercial and residential real estate sectors, and bulk purchases, product testing, personalization, security & trust, targeted marketing and promotions, etc., provided by retail stores. Distributor is the fastest growing segment of global drain cleaning equipment market, as a result of broader geographic reach of distributors in comparison to individual manufacturers or retailers, rapidly expanding cleaning service industry, rise in construction activity, and added benefits provided by distributors in terms of supply chain efficiency, bulk purchasing, product variety, logistical convenience, risk mitigation, and brand & manufacturer neutrality.

By Pipe Size: The report provides the bifurcation of the drain cleaning equipment market into three segments on the basis of pipe size: Less than 3 Inch, 4-8 Inch, 9-11 Inch, and Above 12 Inch. The 4-8 inch segment is the largest and fastest growing segment of global drain cleaning equipment market, owing to increasing number of residential and commercial buildings, recurring need for drainage system upkeep and cleaning in developed countries, positively expanding restaurants & food processing facilities, increasing number of construction and commercial real estate expansion activities, and ongoing technological advancements in terms of increasing integration of robotics, AI, remote monitoring and control, video inspection systems, etc.

By End User: The report provides the bifurcation of the drain cleaning equipment market into four segments on the basis of end user: municipal, industrial, commercial, and residential. The municipal is the largest segment of global drain cleaning equipment market, driven by increasing investment in procuring & deployment of water utility management systems to improve city operations, growing demand for regular drain maintenance services to preserve the quality of municipal sewer & drainage systems, urbanization and population growth in cities and towns, occurrence of extreme weather events, growing awareness of the importance of well-maintained municipal drainage systems, and increasing number of environmental regulations that require municipalities to maintain clean & efficient drainage systems.

By Region: The report provides insight into drain cleaning equipment market based on the regions namely, Europe, North America, Asia Pacific, and rest of the world. North America is the largest region of global drain cleaning equipment market, owing to rapidly expanding industrial sector, increasing demand for efficient & eco-friendly drain cleaning solutions, rising concerns regarding sanitation, rapid urbanization, ongoing real estate development projects, increase in number of commercial, residential, & hotel buildings, rising need to maintain & clean drainage systems in region’s densely populated cities, and increasing government support and investment in the field of implementation and development of sewerage infrastructure and drain cleaning equipment. North America drain cleaning equipment market is divided into three regions on the basis of geographical operations, namely, the US, Canada and Mexico, where the US is both the largest & fastest growing region of drain cleaning equipment market within North America, owing to highly developed infrastructure, region’s heavy emphasis on sanitation work around regional territories, increasing public awareness about the importance of well-maintained drainage systems, and the presence of major drain cleaning equipment market players, such as Emerson Electric Co., Goodway Technologies Corp., BrassCraft, Gorlitz Sewer & Drain, Inc., etc., in the region.

Asia Pacific is the fastest growing region of global drain cleaning equipment market as a result of growing construction activities in major Asian economies, presence of large consumer base, rising focus of municipal sector on sanitation, presence of manufacturing hubs like India and China, increase in demand for residential and commercial construction as a result of growing population, and growing popularity of the do-it-yourself (DIY) culture, for residential maintenances.

Market Dynamics:

Growth Drivers: The global drain cleaning equipment market has been rapidly growing over the past few years, due to factors such as, rapid urbanization, rise in construction activity & infrastructure projects, increasing popularity of do-it-yourself (DIY) tools, rising focus of municipal sector on sanitation, increasing demand from various end user industries, etc. Rising adoption of smart cities and smart buildings, will continue to fuel the demand for state-of-the-art drain cleaning equipment capable of handling diverse cleaning challenges. Also, environmental regulations require municipalities to manage wastewater and storm water in an environmentally responsible manner, requiring the use of specialized drain cleaning equipment needed to keep drainage systems clean, clear and functional. Furthermore, municipalities receive government funding for infrastructure improvement projects, including sanitation, allowing them to invest in the latest drain cleaning equipment, and adopt advanced technologies in sanitation efforts. Therefore, rising public awareness for proper sanitation, and increased focus of municipal sector on proper sanitation and drainage practices will continue to boost the market growth.

Challenges: However, the global drain cleaning equipment market growth would be negatively impacted by various challenges such as market instability, high cost of initial investment, etc. Advanced drain cleaning equipment and its pieces of machinery are expensive, and can cost up to thousands of dollars. The high initial investment acts as a barrier to entry for new players in the market, especially small businesses and startups. In addition to this, there is a significant lack of availability of labor required to operate these heavy priced advanced drain cleaning equipment, creating an additional barrier for small or medium-sized players to enter the market.

Trends: The market is projected to grow at a fast pace during the forecasted period, due to increasing integration of AI and ML technologies, rapidly expanding cleaning service industry, increasing demand for trenchless drain cleaning solutions, ongoing technological advancements, etc. The cleaning service industry's demand for better and more advanced drain cleaning tools and equipment has been incentivizing manufacturers to innovate & develop more efficient, user-friendly, & technologically advanced drain cleaning equipment to meet the industry's needs. Furthermore, the increased use of robotic technology in drain cleaning equipment to navigate pipes, locate blockages, and perform cleaning tasks with minimal human intervention has increased efficiency and tuned out to be an appealing alternative to both service providers and clients, resulting in increased demand for robotic drain cleaning equipment market in the forecasted period of 2023-2028.

Impact Analysis of COVID-19 and Way Forward:

COVID-19 brought in many changes in the world in terms of reduced productivity, loss of life, business closures, closing down of factories and organizations, and shift to an online mode of work. Lockdown policies imposed by the government to prevent virus spread forced various end user industries to either shut down or run low on production capacity, resulting in lower production and manufacturing activities by various end user industries, including oil and gas, hospitality and hotels, commercial and retail, and so on, that require drain cleaning tools and solutions to efficiently maintain and manage their clogs and large-scale drainage systems. Therefore, a sudden drop in demand for effective drain cleaning solutions as a result of reduced production and lower output generation, negatively impacted the growth rate of global drain cleaning equipment market during the period, 2019-2020.

Competitive Landscape:

The global drain cleaning equipment market is fragmented, with increasing number of large and medium sized players accounting for the majority of market revenue, and presence of a substantial number of regional market players with limited business offerings and customer base. However, in developed economies, such as the US, Canada, the UK, Germany, and Japan, a selected number of market manufacturers dominate the global market with their strong brand recognition and competitive positioning, and so the market is dominated by a selected number of recognized and well-positioned market players that provide several market-related offerings.

The key players of the global drain cleaning equipment market are:

- Emerson Electric Co. (RIDGID)

- Techtronic Industries Co. Ltd. (Milwaukee Tool)

- Nilfisk Group

- Goodway Technologies Corp.

- BrassCraft

- Gorlitz Sewer & Drain, Inc.

- Electric Eel Manufacturing

- Spartan Tool

- Duracable Manufacturing Company

- ROTHENBERGER Werkzeuge GmbH

- Water Cannon, Inc.

- Cam Spray

Table of Contents

1. Executive Summary

Companies Mentioned

- Emerson Electric Co. (RIDGID)

- Techtronic Industries Co. Ltd. (Milwaukee Tool)

- Nilfisk Group

- Goodway Technologies Corp.

- BrassCraft

- Gorlitz Sewer & Drain, Inc.

- Electric Eel Manufacturing

- Spartan Tool

- Duracable Manufacturing Company

- ROTHENBERGER Werkzeuge GmbH

- Water Cannon, Inc.

- Cam Spray

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 157 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.68 Billion |

| Forecasted Market Value ( USD | $ 2.51 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |