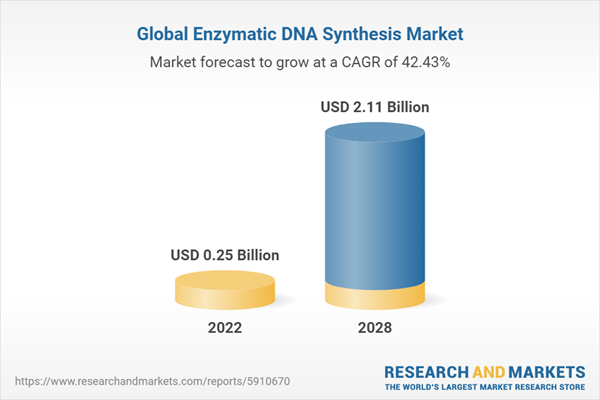

The global enzymatic DNA synthesis market was valued at US$253.42 million in 2022, and is expected to be worth US$2.11 billion in 2028. Enzymatic DNA synthesis involves the generation of DNA strands through the use of enzymes instead of conventional chemical techniques. DNA polymerases, a class of enzymes, play a pivotal role in this process by catalyzing the formation of phosphodiester bonds between nucleotides, resulting in the creation of a novel DNA strand. Enzymatic synthesis methods, closely resembling natural DNA replication, utilize enzymes such as TdT, eliminating the need for a template unlike DNA polymerase. This process involves piecing together individual nucleotides to form double-stranded DNA molecules. While resembling chemical synthesis in nucleotide coupling and terminator removal, enzymatic synthesis is primed for the next round of nucleotide addition. Despite its non-toxic nature, enzymatic methods currently fall slightly short of the accuracy achieved by chemical methods in producing oligonucleotides.

Several trends are expected to shape the production and demand for enzymatic DNA synthesis. Automation of the workflow is likely to become more prevalent, enhancing efficiency and reducing the need for manual labor. Continued research and development efforts are anticipated to lead to the development of more efficient enzymes and technologies, further improving the precision and scalability of the process. Furthermore, enzymatic DNA synthesis is likely to find integration with other molecular biology techniques, such as CRISPR/Cas9, for applications in gene editing and genome engineering. The enzymatic DNA synthesis market is expected to grow at a CAGR of 42.43% over the years 2023-2028.

Market Segmentation Analysis:

By Product Type: The report identifies two segments on the basis of product type: DNA Library Synthesis, and Custom DNA Synthesis. DNA Library Synthesis sector held the highest share in the market in 2022. Library Synthesis is a product and service offering that is particularly important in the field of genomics, functional genomics, and proteomics research. As genomic research continues to advance, the need for high-quality DNA libraries has increased. Researchers require well-constructed libraries to conduct experiments and uncover valuable insights, which is driving the growth of the segment. Furthermore, studying the function of genes and their role in various cellular processes is essential for understanding diseases and developing therapies. DNA libraries support functional genomics research.

By Technology: The report provides the bifurcation of enzymatic DNA synthesis market into four segments on the basis of technology: PCR (Polymerase Chain Reaction), CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats), SOLA (Synthetic Oligonucleotide Ligation-Activated DNA synthesis), and Others. The PCR (Polymerase Chain Reaction) segment dominated the market in 2022. PCR is pivotal in DNA synthesis, particularly for amplifying specific DNA sequences through cycles of denaturation, annealing, and extension, ensuring exponential DNA amplification. Its applications span genotyping, DNA sequencing, and molecular diagnostics, driven by speed, accuracy, and versatility. PCR is indispensable for tasks such as identifying genetic mutations, detecting infectious agents, and conducting gene expression analysis. High demand persists due to its vital role in biological research, applied sciences, and clinical diagnostics, making it a preferred choice among researchers and clinicians for its efficiency and reliability.

By Application: The report provides the bifurcation of enzymatic DNA synthesis market into five segments on the basis of application: Synthetic Biology, Therapeutic Antibodies, Genetic Engineering, Vaccine Design, and Other. Synthetic biology segment dominated the market in 2022. This segment's adoption is driven by the need for creating synthetic genes, pathways, and organisms for biotechnological, medical, and industrial purposes. Factors such as the increasing demand for genetically modified organisms (GMOs), biofuels, and the development of novel biopharmaceuticals are propelling the growth of enzymatic DNA synthesis in the field of synthetic biology.

By End User: The report identifies four segments on the basis of end users: Biotech and Pharmaceutical Companies, Academic and Research Institutes, Diagnostic Laboratories, and Others. Academic and research institutes segment is expected to grow at the fastest CAGR during the forecasted period. The adoption of enzymatic DNA synthesis in this segment is likely to be driven by the continuous quest for scientific knowledge and the need to develop innovative solutions. Funding from government agencies and academic grants further supports the demand for DNA synthesis technologies in academic and research settings.

By Region: In the report, the global enzymatic DNA synthesis market is divided into five regions: North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America accounted for the largest share in the global enzymatic DNA synthesis market in 2022. This region boasts a rich ecosystem comprising a multitude of pharmaceutical and biotechnology giants, esteemed academic institutions, and cutting-edge research centers, all of which collectively propel the demand for DNA synthesis. At the forefront of biotech research, North America leads the world with significant investments in research and development (R&D), resulting in a substantial appetite for DNA synthesis products. Furthermore, the region's robust healthcare infrastructure adds to this demand, especially in the realms of diagnostics and personalized medicine, both of which heavily rely on enzymatic DNA synthesis.

The Asia Pacific region is expected to be the fastest-growing market. The region has witnessed a remarkable expansion of its biotechnology and life sciences sector. Countries like China, India, Japan, and South Korea have been making substantial investments in research and development, particularly in the fields of genomics, personalized medicine, and genetic research. This surge in scientific activity has naturally led to an increased demand for enzymatic DNA synthesis techniques, which are critical for precisely assembling DNA strands in these cutting-edge areas of research. Moreover, the Asia-Pacific region is home to numerous prestigious academic and research institutions that have been actively engaged in genetic and molecular biology research. These institutions are driving the demand for DNA synthesis as their researchers work on a wide array of projects, spanning from disease diagnostics to advancements in agriculture and environmental studies.

Market Dynamics:

Growth Drivers: The market has been growing over the past few years, due to factors such as rising prevalence of genetic disorders, advancements in enzymes and technologies, customization and precision, synthetic biology applications and increasing demand for DNA. Recognized genetic disorders like Down syndrome, autism spectrum disorder, cancer, diabetes, cystic fibrosis, and sickle cell anemia are just a fraction of the 10,000 known rare diseases, impacting around 400 million people globally. While some disorders show symptoms at birth, others emerge gradually. The global burden of genetic diseases is growing. Enzymatic DNA synthesis, widely used in synthetic biology, genetic engineering, and therapeutic antibody research, proves valuable. Coupled with enzymatic assays, it enhances diagnostic capabilities, providing crucial insights into susceptibility to genetic disorders. This facilitates informed decisions on diagnosis and treatment, acknowledging the rising need for early detection and driving the enzymatic DNA synthesis market.

Challenges: However, some challenges are also impeding the growth of the market such as stringent government regulations and guidelines and high costs and complex procedures. This powerful technology holds the potential for transformative advancements in healthcare, agriculture, and biotechnology. However, it comes with inherent risks, including the potential creation of harmful pathogens or unethical misuse. Consequently, government authorities require DNA synthesis facilities and researchers to obtain licenses and register with relevant regulatory bodies. Additionally, oversight entities may mandate regular reporting of DNA synthesis activities, including details like synthesized DNA sequences, the purpose of synthesis, and quantities produced. While these measures aim to mitigate risks, they may, to some extent, hinder market growth.

Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as emerging fields, CRISPR-Cas9 integration and cell-free synthetic biology. CRISPR-Cas9 Integration is emerging as a groundbreaking trend in the enzymatic synthesis market, revolutionizing the way DNA is manipulated. This technology, originally developed for gene editing, is now being harnessed to enhance enzymatic synthesis processes. One of the key advantages of integrating CRISPR-Cas9 into enzymatic synthesis is its precision. Cas9, guided by a specific RNA sequence, can precisely target and cut DNA at desired locations, allowing for the insertion, deletion, or modification of genetic material with high accuracy. This precision is invaluable in creating customized enzymes for various applications, such as pharmaceuticals, biofuels, and biotechnology.

Impact Analysis of COVID-19 and Way Forward:

The enzymatic DNA synthesis market experienced a nuanced impact from the COVID-19 pandemic. Initially, disruptions in global supply chains and laboratory closures created delays in research projects, leading to a temporary decline in demand for enzymatic DNA synthesis services. However, the crisis highlighted the crucial role of rapid DNA synthesis in vaccine development, diagnostic test kits, and virus-related genomic studies. As the pandemic unfolded, companies in the sector adapted by embracing remote work, automation, and stringent safety measures, enhancing industry resilience. Additionally, the growing demand for customized DNA constructs for vaccine and therapeutic research expedited the adoption of enzymatic DNA synthesis techniques. Furthermore, the trend toward personalized medicine continues to drive the demand for customized DNA constructs, which is being further facilitated by enzymatic DNA synthesis.

Competitive Landscape:

The enzymatic DNA synthesis market exhibits consolidation, marked by fierce competition among leading players striving to expand their market share globally. The sector experiences an influx of startups, each presenting innovative solutions to address DNA construction challenges. Companies in the DNA synthesis sector can be evaluated based on key metrics such as cost, throughput, turnaround time, quality, and accessibility. Cost, often the primary customer consideration, has the potential to shift buyers from in-house DNA production to outsourcing. As the utility of synthetic DNA grows, throughput becomes crucial, necessitating customers to split orders among suppliers, introducing complexity and error risks.

The key players of the global enzymatic DNA synthesis market are:

- Telesis Bio Inc.

- Twist Bioscience Corporation

- GenScript Biotech Corp.

- Evonetix

- Ansa Biotechnologies, Inc.

- Camena Bio

- Molecular Assemblies

- DNA Script

- Touchlight

- Kern Systems

Technological advancements play a pivotal role in shaping the competitive landscape, with companies dedicating efforts to research and develop novel enzymes and processes. The focus is on improving the speed, accuracy, and efficiency of DNA synthesis. This dynamic environment underscores the industry's commitment to staying at the forefront of scientific and technological progress, fostering a continual drive for innovation and excellence. In April 2022, DNA Script introduced a program catering to customers using its SYNTAX System. Through this initiative, organizations gain early access to the most recent developments in their EDS technology.

Table of Contents

1. Executive Summary

Companies Mentioned

- Telesis Bio Inc.

- Twist Bioscience Corporation

- GenScript Biotech Corp.

- Evonetix

- Ansa Biotechnologies, Inc.

- Camena Bio

- Molecular Assemblies

- DNA Script

- Touchlight

- Kern Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 157 |

| Published | November 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 0.25 Billion |

| Forecasted Market Value ( USD | $ 2.11 Billion |

| Compound Annual Growth Rate | 42.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |