Molecular Quality Controls: Introduction

Molecular quality controls are standardized materials or substances used in molecular diagnostic testing to assess the accuracy, precision, and reliability of the testing process. These controls mimic patient samples and contain known quantities of specific nucleic acids, proteins, or other molecular targets of interest. By including molecular quality controls in the testing process, clinical laboratories can monitor the performance of their molecular assays and ensure that the results are accurate and consistent.Global Molecular Quality Controls Market Analysis

The market for molecular quality controls is driven by advancements in molecular diagnostic technologies, coupled with the continuous evolution of RT PCR (Reverse Transcription Polymerase Chain Reaction) and NGS (Next-Generation Sequencing) technologies. These technologies are becoming increasingly sophisticated and efficient, enabling more accurate and comprehensive molecular diagnostics. The emergence of ultrafast PCR technology, utilizing photothermal nanomaterials, represents a groundbreaking trend in the field. This technology has the potential to revolutionize molecular testing by significantly shortening test times, offering results in a fraction of the time compared to conventional PCR testing. Such innovations are enhancing the speed and efficiency of molecular diagnostics, a crucial trend in the healthcare industry.The molecular quality controls market growth is also aided by the rising mergers and investments, along with the rising investment from the government on the development of healthcare sector. Furthermore, the collaborative efforts between pharmaceutical companies like Vertex and CRISPR Therapeutics in developing CRISPR-based therapies for conditions like sickle cell disease are opening new frontiers in molecular medicine. If approved, these therapies would mark a historic milestone as the first CRISPR-based treatments for human use. This signifies the growing potential of CRISPR technology to advance human health, making it a prominent trend to watch.

Global Molecular Quality Controls Market Segmentations

“global molecular quality controls market and forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- DNA- Based Quality Controls

- RNA-Based Quality Control

- Protein-Based Quality Controls

- Nucleic Acid and Protein Mixtures

- Others

Market Breakup by Analyte Type

- Single Analyte Control

- Multi-Analyte Control

Market Breakup by Applications

- Infectious Diseases

- Oncology

- Genetic Testing

- Other Applications

Market Breakup by End User

- Clinical Laboratories

- Hospitals

- IVD Manufacturers

- Contract Research Organizations

- Academic and Research Institutes

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Molecular Quality Controls Market Overview

The market for molecular quality controls is driven by the rising prevalence of infectious diseases, which has prompted the need for accurate and reliable molecular diagnostic tests. This increasing demand for diagnostics is fuelling the adoption of molecular quality controls as they play a vital role in ensuring the accuracy and precision of these tests. Rapid advancement in molecular diagnostic technologies is another significant driver which is anticipated to drive the molecular quality controls market demand. As diagnostic methods become more sophisticated and sensitive, the need for equally advanced quality control solutions becomes paramount. Molecular quality controls help diagnostic laboratories validate their tests and maintain high standards of accuracy. The growing emphasis on quality assurance in diagnostic laboratories is promoting the uptake of molecular quality controls. Ensuring the reliability of test results is crucial for patient care, and these controls provide an essential tool for achieving this goal.Moreover, the widespread adoption of internet-based technologies has facilitated the distribution and management of molecular quality controls, making them more accessible and efficient for laboratories worldwide. The growing adoption of third-party quality controls offer laboratories independent and unbiased assessments of their testing processes.

Furthermore, increasing government funding for genomic projects is driving research and development efforts in the field of molecular diagnostics. This funding helps in the advancement of technology and encourages the development of high-quality molecular quality controls to support these initiatives.

Global Molecular Quality Controls Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- SeraCare Life Sciences, Inc.

- QIAGEN N.V.

- Abbott Laboratories

- LGC Limited

- ZeptoMetrix Corporation

- Microbiologics, Inc.

- Maine Molecular Quality Controls, Inc.

- Seracare Life Sciences, Inc.

- Technopath Clinical Diagnostics

- Randox Laboratories Ltd.

- Helena Laboratories

- Streck, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- SeraCare Life Sciences, Inc.

- QIAGEN N.V.

- Abbott Laboratories

- LGC Limited

- ZeptoMetrix Corporation

- Microbiologics, Inc.

- Maine Molecular Quality Controls, Inc.

- Seracare Life Sciences, Inc.

- Technopath Clinical Diagnostics

- Randox Laboratories Ltd.

- Helena Laboratories

- Streck, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

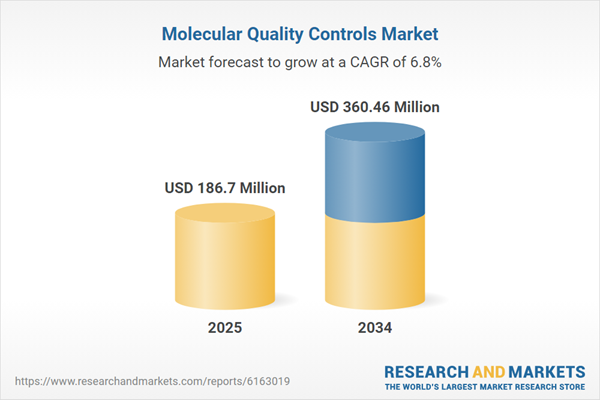

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 186.7 Million |

| Forecasted Market Value ( USD | $ 360.46 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |