Blood Glucose Test Strip: Introduction

Blood glucose test strip, also known as diabetes test strip, are used to check sugar levels in the body. These strip can help people identify, monitor and control diabetes.Blood glucose test strip are coated with a thin layer of gold. This end becomes the strip's circuit, while the other end has a chemical coating. The latter soaks blood and converts the glucose in your blood to electricity. The electric signal travels from the strip to the meter and shows the blood sugar levels on the meter.

Global Blood Glucose Test Strip Market Analysis

Every year, there are approximately 1.5 million mortalities due to diabetes. While the incidence of diabetes continues to grow, researchers suggest that early detection can lower the burden of deaths associated with the disease. Hence, there has been a significant emphasis on sugar level monitoring leading to high blood glucose test strip market demand.The prevalence of diabetes type 1 has opened a new horizon for medical research and innovation to control the fatal disease. Owing to the technical and digital advances, smart and non-invasive glucose monitoring devices have emerged in the market. In February 2023, Apple announced that the new Apple Watch will come inbuilt with a feature that allows assessing blood sugar levels without taking a blood sample. It works with the help of a silicon photonics chip to determine the concentration of glucose levels in the body. Similarly, LifePlus, a Silicon Valley startup, is developing a non-invasive wearable wristwatch called LifeLeaf. A sensor that fits inside a smartwatch is also being developed by Afon Technology.

Considering the prevalence of non-invasive and smart technologies, the blood glucose test strip market value may appear to stumble. However, diabetes is a global disease that affects people in both high-income and low-income countries. While people may be able to afford the new technologies in developed countries, the population of low income and developing countries will prefer using blood glucose test strip as an affordable alternative for diabetes diagnosis.

Global Blood Glucose Test Strip Market Segmentation

Blood Glucose Test Strip Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Thick Film Electrochemical Films

- Thin Film Electrochemical Films

- Optical Strip

Market Breakup by Technology

- Glucose Oxidase

- Glucose Dehydrogenase

Market Breakup by Application

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Pre-Diabetes

- Others

Market Breakup by Distribution Channel

- Online

- Offline

Market Breakup by End User

- Hospitals

- Home Care

- Diagnostic Laboratories

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Blood Glucose Test Strip Market Overview

Diabetes affects more than half of the world's population, with the current global prevalence of 6.1%. Consequently, it is the one of top leading reasons for disabilities and deaths worldwide. Type 2 diabetes contributes to 96% of the overall cases. High BMI (body mass index) is one of the key causes, followed by low physical activity, alcohol and tobacco consumption, dietary risks, and environmental risks. Given the current lifestyle, the population is more likely to develop the disease in the future. Therefore, we can expect blood glucose test strip market growth in the future.Diabetes is particularly evident in population older than 65 years and above. As Europe and Northern America have the highest share of geriatric population, they have held a huge portion of the blood glucose test strip market share in the historic period. However, sub-Saharan Africa, Northern Africa and Western Africa are expected to witness fastest growth in the population of older people in next three decades. Hence, in the future, it has the potential to become a substantial market for blood glucose testing.

Global Blood Glucose Test Strip Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Abbott

- F. Hoffmann-La Roche Ltd

- LifeScan IP Holdings, LLC

- i-SENS, Inc.

- Ascensia Diabetes Care Holdings AG

- Universal Biosensors

- Nipro

- TaiDoc Technology Corporation

- APEX BIOTECHNOLOGY CORP.

- B. Braun Melsungen AG

- Betachek

- Terumo Corporation

- OMRON Corporation

- Bayer AG (Germany)

- GlaxoSmithKline plc

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott

- F. Hoffmann-La Roche Ltd

- LifeScan IP Holdings, LLC

- i-SENS, Inc.

- Ascensia Diabetes Care Holdings AG

- Universal Biosensors

- Nipro

- TaiDoc Technology Corporation

- APEX BIOTECHNOLOGY CORP.

- B. Braun Melsungen AG

- Betachek

- Terumo Corporation

- OMRON Corporation

- Bayer AG (Germany)

- GlaxoSmithKline plc

Table Information

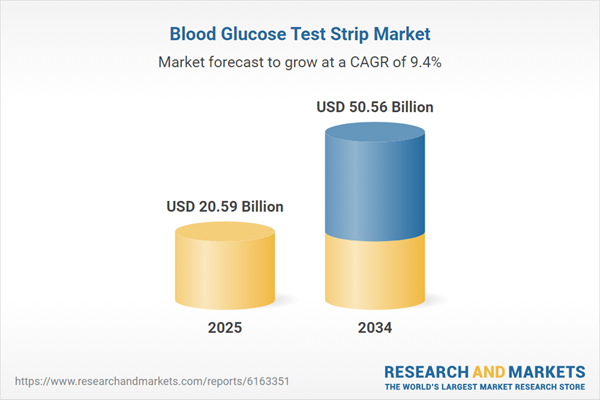

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 20.59 Billion |

| Forecasted Market Value ( USD | $ 50.56 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |