Patient Temperature Monitoring: Introduction

Temperature monitoring is performed to measure and record the temperature of a specific environment or process to control it. This is performed using temperature sensors, which are devices that convert temperature into an electrical signal that can be recorded and analyzed. Several devices and equipment are used to manage appropriate temperature for a patient including both heating and cooling devices, such as warming blankets, cooling pads, and intravascular temperature management systems. Patient temperature management is used to maintain a healthy body temperature for better patient recovery and prevent complications. It is used in a variety of medical settings, including surgery, critical care, and emergency medicine.Global Patient Temperature Monitoring Market Analysis

The market is witnessing significant advancements driven by emerging technologies and innovative solutions. For instance, Blue Spark Technologies, a pioneer in wearable remote patient monitoring, is set to exhibit TempTraq® at the 2023 Consumer Electronics Show (CES). This continuous temperature monitoring device, integrated into the Medidata Sensor Cloud, offers valuable data for clinical trials. Additionally, BABYFM is revolutionizing rare disease treatment with its continuous temperature monitoring, AI analysis, and machine learning models. These capabilities enable early detection, treatment monitoring, and research contributions, ultimately improving patient care, and in turn aid the patient temperature monitoring market growth.Tenovi's cellular-enabled Infrared thermometer, coupled with their Cellular Gateway, allows patients to transmit real-time temperature data to clinicians, particularly crucial for early detection in conditions like sepsis. These trends are reshaping the landscape of patient temperature monitoring, enhancing healthcare outcomes and research efforts.

Global Patient Temperature Monitoring Market Segmentations

Patient Temperature Monitoring Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Wearable

- Digital

- Smart

- Continuous

- Infrared

Market Breakup by Applications

- Fever

- Anesthesia

- Hypothermia

Market Breakup by End User

- Hospitals

- Home Care

- ASCs

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Patient Temperature Monitoring Market Overview

The market is experiencing significant growth driven by the increasing prevalence of infectious diseases leading to a higher incidence of fever, boosting the demand for body temperature monitoring devices. Additionally, the growing paediatric population is playing a crucial role in driving market growth as well. With a continuous rise in the number of children, the demand for body temperature monitoring devices is expected to surge in the coming years. Furthermore, the introduction of new products in the market is contributing to the global patient temperature monitoring market share. These product launches are enhancing the options available for temperature monitoring. However, some challenges co-exist, such as concerns related to the use of rectal thermometers and infrared thermometers. These concerns may temporarily hinder the growth of the market.Innovations in temperature monitoring are also making an impact on the market. For example, the integration of continuous temperature monitoring, AI analysis, and machine learning models, particularly in rare disease treatment, is gaining momentum. Such advancements enable early disease detection, monitor treatment effectiveness, and support remote patient monitoring, ultimately improving patient care and contributing to research efforts. One significant development is the release of a cellular-enabled infrared thermometer by Tenovi, a leading innovator in remote patient monitoring solutions. Paired with the Tenovi Cellular Gateway, this FDA-cleared medical device allows patients to transmit real-time temperature readings to clinicians, which is especially critical for early infection detection, such as in cases of sepsis where timely treatment is paramount. Overall, these factors are significantly propelling the global patient temperature monitoring market demand.

Due to a large number of surgical procedures and increase in blood donation and transfusion, North America is expected to dominate the regional market.

Global Patient Temperature Monitoring Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Cardinal Health Inc.

- 3M

- Koninklijke Philips N.V.

- Drägerwerk

- Hill-Rom Holdings, Inc.

- Becton, Dickinson and Company

- Omron Healthcare Inc. Financial Analysis

- Masimo Corporation

- Terumo Corporation

- Paul Hartmann AG

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Cardinal Health Inc.

- 3M

- Koninklijke Philips N.V.

- Drägerwerk

- Hill-Rom Holdings, Inc.

- Becton, Dickinson and Company

- Omron Healthcare Inc. Financial Analysis

- Masimo Corporation

- Terumo Corporation

- Paul Hartmann AG

Table Information

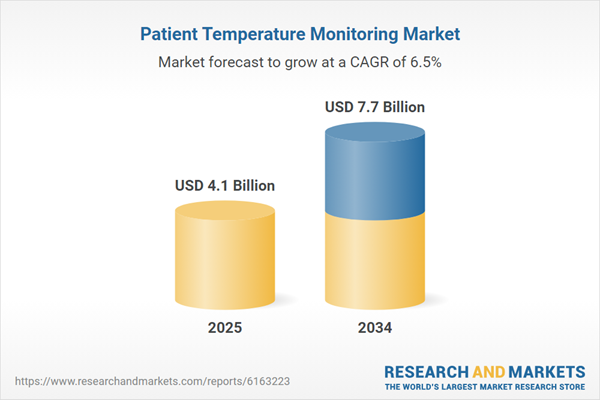

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 7.7 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |