Empty IV Bags: Introduction

Empty IV bags are used to administer medications, fluids, blood, and solutions intravenously through a port. It is a vital component of intravenous therapies that are also used to rehydrate or provide nutrients to patients who cannot consume food through the mouth. Empty IV bags are available in different sizes to accommodate various volumes of fluid, depending upon the requirement of the patient. They are commonly composed of plastic.Global Empty IV Bags Market Analysis

The empty IV bags market value has witnessed significant transformation in the past few years, owing to the COVID-19 pandemic. In response to the shortage of bags, BAUSCH Consumables started their production of customised IV bags tailored for pharmaceutical applications. These bags are crafted from multi-layered non-PVC films with various properties, including gas and vapour barriers, UV protection, lipid safety, and a PE contact layer. The introduction of polypropylene bags offer enhanced safety, compatibility, lightweight design, and eco-friendliness.With an upswing in minimally invasive surgeries, the demand for such safety-enhancing products has been on the rise. Therefore, BD has launched their SmartSite Bag, which is equipped with a needle-free valve. This is aimed at reducing the risk of needlestick injuries, which are a prominent source of occupational infections among healthcare workers. Such inventions are expected to drive the empty IV bags market growth in the upcoming years.

Furthermore, the convergence of digital technologies into healthcare has given birth to the Internet of Things (IoT) IV bag monitoring and alert system as well. Such technologies are becoming increasingly prevalent, providing real-time monitoring of IV bags, improving patient care, and streamlining healthcare operations.

Global Empty IV Bags Market Segmentation

Empty IV Bags Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- PVC

- Non-PVC

Market Breakup by Products

- Single

- Multi-Chamber

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Empty IV Bags Market Overview

Intravenous therapies find wide applications in various medical procedures including dialysis, chemotherapy and oncology, paediatrics, ambulatory care, and other surgical procedures. Therefore, the empty IV bags market demand has observed rapid growth in recent years.In North America, the United States holds a substantial portion of the market size owing to an enormous healthcare system that is both technically equipped and digitally enabled to cater to the high demand. In addition, several healthcare companies are present in the market which are working seamlessly to bring the latest innovations that improve patient experiences.

Europe is expected to lead the empty IV bags market share in the forecast period owing to a robust healthcare network to provide necessary treatment to patients across different parts of the region. However, the Asia Pacific region is expected to grow at the fastest rate. The growth can be accredited to continuous infrastructure developments and increasing foreign investments, fostering research and developments to leverage the academic talent present in the region. Moreover, the rising population in countries like China and India is set to maximise the market value in the future.

Global Empty IV Bags Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Sippex IV Bag

- Technoflex

- Wipak Group

- B. Braun

- ICU Medical, Inc.

- Polycine GmbH

- Renolit SE

- Pfizer Inc.

- CODAN Medizinische

- West Pharmaceutical Services Inc.

- Jinan Youlyy Industrial Co.

More Insights On:

United States Scented Garbage Bags Market Intravenous (IV) Fluid Bags Market Cell Culture Media Bags Market North America Silo Bags Market Urinary Drainage Bags Market Non-PVC IV Bags Market PP Jumbo Bags Market Plastic Bags Market Paper Bags Market Trash Bags MarketThis product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Sippex IV Bag

- Technoflex

- Wipak Group

- B. Braun

- ICU Medical, Inc.

- Polycine GmbH

- Renolit SE

- Pfizer Inc.

- CODAN Medizinische

- West Pharmaceutical Services Inc.

- Jinan Youlyy Industrial Co.

Table Information

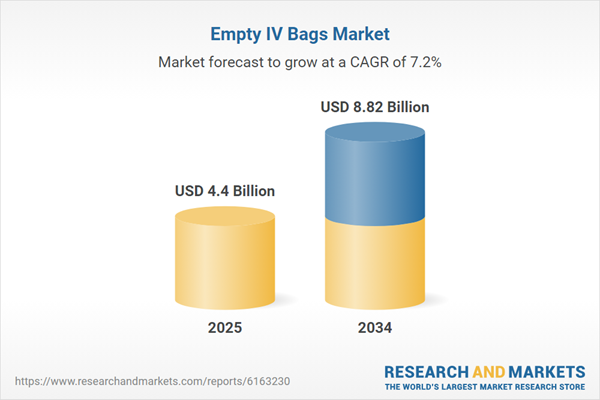

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 8.82 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |