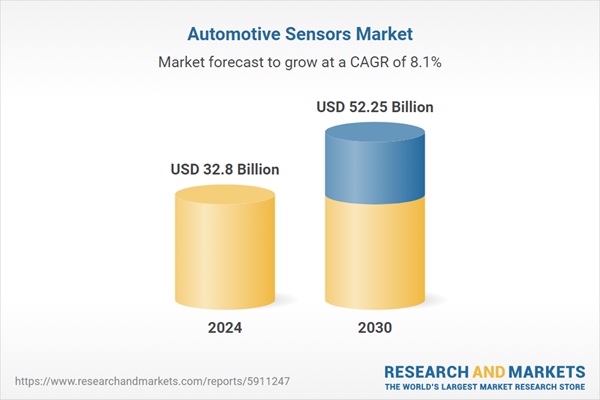

Pressure Sensors is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing integration of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicle technologies stands as a principal accelerator for the global automotive sensors market. These systems, designed to enhance vehicle safety and driver convenience, rely on a complex array of sensors including radar, lidar, cameras, and ultrasonic devices to perceive the driving environment, detect obstacles, and facilitate automated functionalities. As these features become standard or widely adopted across vehicle segments, the demand for sophisticated and reliable sensor solutions escalates.Key Market Challenges

The increasing complexity involved in integrating a multitude of disparate sensor technologies into intricate vehicle architectures significantly impedes the growth of the Global Automotive Sensors Market. This complexity necessitates substantial research and development investment from automotive manufacturers and suppliers. Diverse communication protocols and data formats across various sensor types, such as radar, lidar, and camera systems, demand extensive engineering efforts to ensure their seamless interoperability within the vehicle's electronic control unit. Furthermore, robust software validation for these integrated systems poses considerable hurdles. The exhaustive testing required to certify the reliability and safety of complex sensor arrays, particularly for advanced driver-assistance systems and autonomous driving functionalities, extends development cycles and increases overall production costs.Key Market Trends

The integration of artificial intelligence and sensor fusion represents a significant evolution in automotive perception capabilities. This trend involves combining data from diverse sensors such as radar, lidar, and cameras, then processing it with advanced AI algorithms to construct a more robust and accurate environmental model. This composite understanding enhances obstacle detection, object classification, and scene interpretation, which are critical for increasing vehicle safety and enabling higher levels of automated driving functionalities.Key Market Players Profiled:

- Bosch

- Continental

- Denso

- Delphi

- Sensata

- Infineon

- NXP

- Analog Devices

- Melexis

- TE Connectivity

Report Scope:

In this report, the Global Automotive Sensors Market has been segmented into the following categories:By Type:

- Temperature Sensors

- Pressure Sensors

- Speed Sensors

- Level/Position Sensors

- Magnetic Sensors

- Gas Sensors

- Inertial Sensors

By Application:

- Powertrain

- Body Electronics

- Vehicle Security Systems

- Telematics

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Sensors Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Automotive Sensors market report include:- Bosch

- Continental

- Denso

- Delphi

- Sensata

- Infineon

- NXP

- Analog Devices

- Melexis

- TE Connectivity

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 32.8 Billion |

| Forecasted Market Value ( USD | $ 52.25 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |