Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In recent years, the market has witnessed significant transformation due to various factors. One of the most prominent trends is the rapid adoption of digital technology. With the rise of online and mobile banking, customers now expect convenient, secure, and user-friendly digital services. Banks have invested heavily in digital infrastructure, including mobile apps, online banking platforms, and AI-driven chatbots, to meet these expectations and remain competitive.

Moreover, the emergence of fintech startups has disrupted traditional banking models. These agile and innovative companies offer specialized financial products and services, challenging traditional banks to adapt or collaborate. As a result, partnerships and collaborations between banks and fintech firms have become common.

Additionally, customer preferences are shifting towards personalized experiences and sustainable banking practices. Retail banks are increasingly focusing on data analytics to offer tailored financial solutions and incorporate environmental, social, and governance (ESG) criteria into their operations.

Lastly, financial inclusion remains a global goal, with efforts to provide banking services to unbanked or underbanked populations, often leveraging technology and mobile banking solutions.

In summary, the global retail banking market is characterized by digitalization, fintech disruption, personalization, and financial inclusion initiatives, reflecting the evolving landscape of the financial services industry.

Key Market Drivers

Digital Transformation

Digitalization is at the forefront of the retail banking industry. With the proliferation of smartphones and increasing internet connectivity, customers expect seamless digital experiences. Banks have invested heavily in modernizing their infrastructure to offer online and mobile banking services. This includes user-friendly mobile apps, intuitive online platforms, and the integration of emerging technologies such as artificial intelligence and biometrics for enhanced security and convenience. The COVID-19 pandemic further accelerated the adoption of digital banking, with many customers preferring remote transactions over physical branch visits.Fintech Disruption

Fintech (financial technology) startups have disrupted traditional banking models. These agile and innovative companies offer a wide range of specialized financial products and services, from peer-to-peer lending and robo-advisors to digital wallets and payment solutions. Fintech firms often provide faster, more cost-effective, and user-centric alternatives to traditional banking services. As a result, traditional banks face the challenge of either adapting to this changing landscape or collaborating with fintech companies to remain competitive. Many banks have chosen the latter, forming partnerships and alliances with fintech startups to offer customers a broader array of services.Customer-Centricity and Personalization

Customers increasingly demand personalized banking experiences. They expect banks to understand their unique financial needs and preferences, providing tailored solutions and recommendations. To meet this demand, retail banks are leveraging data analytics and artificial intelligence to gain insights into customer behavior and offer personalized products and services. This not only enhances customer satisfaction but also helps banks cross-sell and upsell their offerings effectively. Customer-centricity extends beyond personalization; it also involves improving customer service, reducing wait times, and providing convenient self-service options.Sustainable Banking and ESG Integration

Environmental, Social, and Governance (ESG) criteria are becoming integral to the banking industry. Customers are increasingly concerned about the social and environmental impact of their banking choices. Retail banks are responding by incorporating ESG principles into their operations. This includes responsible lending practices, investments in renewable energy, support for social initiatives, and transparent reporting on ESG performance. Sustainable banking not only aligns with customer values but also helps banks manage risks and enhance their reputation in an increasingly socially conscious market.Financial Inclusion and Accessibility

Financial inclusion remains a global goal, with a focus on bringing unbanked and underbanked populations into the formal financial system. Retail banks are playing a crucial role in achieving this objective. They are leveraging technology, especially mobile banking solutions, to reach remote and underserved areas, making banking services accessible to a wider population. Additionally, simplified account opening processes, reduced fees, and microfinance initiatives are helping bridge the financial inclusion gap.Key Market Challenges

Cybersecurity and Data Privacy Concerns

As the banking industry becomes increasingly digital, it is more vulnerable to cyber threats and data breaches. Cyberattacks, including phishing, ransomware, and data theft, pose significant risks to both banks and their customers. A breach can result in financial losses, reputational damage, and loss of customer trust. Moreover, with the introduction of regulations like the General Data Protection Regulation (GDPR) in Europe and similar laws in other regions, banks are under more pressure to ensure the privacy and security of customer data.Addressing cybersecurity challenges requires continuous investment in robust security measures, including advanced encryption, intrusion detection systems, and security training for employees. Banks must also collaborate with cybersecurity experts and government agencies to stay ahead of evolving threats. Balancing the need for robust security with seamless customer experiences is an ongoing challenge, as stringent security measures can sometimes hinder user convenience.

Regulatory Compliance and Risk Management

Regulatory compliance is a constant and growing challenge for retail banks. Banks must adhere to a myriad of regulations, including anti-money laundering (AML) laws, know your customer (KYC) requirements, Basel III capital adequacy standards, and more. Compliance demands rigorous documentation, reporting, and auditing processes, which can be resource-intensive and costly.Additionally, banks must manage various risks, including credit risk, market risk, operational risk, and liquidity risk. Failure to effectively manage these risks can lead to financial instability and regulatory penalties. The ever-evolving regulatory landscape and the emergence of new regulations, such as open banking frameworks, further complicate compliance efforts.

To address these challenges, banks are investing in regulatory technology (RegTech) solutions that streamline compliance processes through automation and analytics. Effective risk management involves stress testing, scenario analysis, and comprehensive risk modeling to anticipate and mitigate potential threats.

Competition from Fintech and Big Tech

The rise of fintech startups and the entry of tech giants, known as Big Tech, into financial services have intensified competition in the retail banking sector. Fintech companies offer innovative and user-centric financial products and services, from peer-to-peer lending platforms to digital wallets and investment apps. These agile startups often have lower operating costs and can swiftly adapt to changing customer demands, posing a competitive threat to traditional banks.Big Tech companies, with their vast resources and user bases, are also encroaching on the financial services space. For example, companies like Amazon, Google, and Apple have introduced payment and lending services, leveraging their digital ecosystems. The convenience and familiarity of these platforms can lure customers away from traditional banks.

To address this challenge, traditional banks are exploring partnerships and collaborations with fintech firms to offer a broader range of services and improve customer experiences. Additionally, banks are investing in their own digital capabilities and enhancing their online and mobile banking offerings to compete with the convenience and innovation offered by fintech and Big Tech players.

Changing Customer Expectations and Demands

Customer expectations are evolving rapidly, driven by their experiences in other industries, such as e-commerce and entertainment. Today's customers demand seamless digital experiences, personalized services, instant access to information, and 24/7 availability. Traditional banks, often burdened by legacy systems and processes, can struggle to meet these expectations.Customers also want more control over their finances and access to innovative financial products. They are increasingly open to exploring non-traditional banking options like robo-advisors, digital-only banks, and cryptocurrencies. Meeting these changing demands requires banks to be agile, adaptable, and customer centric.

To address this challenge, retail banks are investing in digital transformation initiatives to enhance their online and mobile banking platforms. They are also leveraging data analytics and artificial intelligence to offer personalized financial advice and solutions. Additionally, banks are exploring ways to simplify their product offerings and improve the overall customer experience, both in-branch and online.

Key Market Trends

Digital-First Banking

The trend toward digital-first banking is perhaps the most defining shift in the industry. Traditional brick-and-mortar branches are no longer the primary interface between banks and customers. Instead, there's a strong emphasis on digital channels, including online banking platforms, mobile apps, and other digital tools. This trend has been accelerated by the COVID-19 pandemic, which highlighted the importance of remote and contactless banking services.Digital-first banking not only provides customers with greater convenience and accessibility but also allows banks to streamline operations, reduce costs, and enhance the overall customer experience. It involves the integration of cutting-edge technologies like artificial intelligence (AI), machine learning, and data analytics to offer personalized services, optimize processes, and detect and prevent fraudulent activities.

Open Banking and APIs

Open banking, facilitated by the use of Application Programming Interfaces (APIs), is a trend that promotes collaboration and connectivity within the financial ecosystem. It allows third-party developers to access financial data (with customer consent) and build innovative applications and services. This trend is driven by regulatory initiatives, such as the Revised Payment Services Directive (PSD2) in Europe, which mandates banks to open their APIs to authorized third parties.Open banking fosters a more interconnected financial landscape, enabling customers to access a broader range of financial services from various providers within a single interface. It encourages competition and innovation, as fintech firms and other financial institutions can develop and offer complementary products and services, creating a more dynamic and diverse financial ecosystem.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are revolutionizing various aspects of retail banking, from customer service to fraud detection and risk management. Chatbots and virtual assistants powered by AI are being employed to enhance customer interactions, providing instant support and information. Natural language processing allows these systems to understand and respond to customer queries in a human-like manner.AI is also used for credit scoring, underwriting, and risk assessment. Machine learning algorithms analyze vast datasets to make more accurate predictions about customer behavior and creditworthiness. Automation is streamlining back-office operations, reducing manual errors, and improving overall efficiency. The implementation of robotic process automation (RPA) is becoming commonplace, enabling banks to automate routine tasks and allocate human resources to more strategic activities.

Enhanced Customer Personalization

Customer expectations have shifted towards personalized experiences, and retail banks are leveraging data analytics and AI to meet these demands. By analyzing customer data, banks can gain insights into individual preferences, behaviors, and financial needs. This information is then used to offer targeted and personalized product recommendations, financial advice, and marketing messages.Personalization extends beyond digital interactions to include in-branch experiences as well. For instance, smart ATMs and interactive kiosks can provide a more personalized service by recognizing customers and offering tailored options based on their transaction history and preferences.

Enhanced personalization not only improves customer satisfaction but also helps banks build stronger relationships and increase customer loyalty. As customers receive more relevant and meaningful interactions, they are more likely to engage with their bank and consider additional services.

Sustainable Banking Practices

Sustainability has become a focal point for both consumers and businesses, and retail banks are increasingly incorporating environmental, social, and governance (ESG) principles into their operations. This trend aligns with the growing awareness of environmental and social issues and the desire for responsible business practices.Banks are evaluating their lending and investment practices to ensure alignment with ESG criteria. This includes financing green initiatives, supporting social causes, and adopting ethical business practices. Communicating these efforts transparently to customers is crucial, as individuals are increasingly choosing banks that share their values and contribute positively to society.

Sustainable banking is not only a response to customer expectations but also a strategic move to manage risks associated with climate change, regulatory shifts, and reputational considerations. As governments and regulatory bodies intensify their focus on sustainable finance, banks that prioritize ESG practices are likely to be better positioned for long-term success.

Financial Inclusion and Neobanks

Financial inclusion remains a global challenge, and the banking industry is embracing digital solutions to address this issue. Neobanks, also known as digital banks or challenger banks, are playing a significant role in expanding access to banking services. These are often branchless, mobile-only institutions that leverage technology to offer simple, accessible, and low-cost financial services.Neobanks are particularly important in regions where traditional banking infrastructure is limited. They can reach underserved populations, providing them with the ability to open accounts, make transactions, and access basic financial services through their smartphones. Additionally, neobanks often have lower fees and more straightforward account structures, appealing to customers seeking alternatives to traditional banks.

To promote financial inclusion, traditional banks are also leveraging technology, especially mobile banking, to reach remote and underserved areas. Simplified onboarding processes, reduced fees, and the integration of financial education initiatives are becoming common strategies to make banking services more inclusive.

Segmental Insights

Product Type Insights

Credit cards have emerged as a thriving and dynamic segment within the financial services market, experiencing substantial growth globally. In recent years, the popularity of credit cards has soared, driven by a combination of consumer preferences, technological advancements, and changing spending habits.One key factor contributing to the growth of credit cards is the increasing shift towards digital payments. As societies become more cashless, consumers are embracing the convenience and security offered by credit cards for everyday transactions. The rise of online shopping and the broader e-commerce landscape has further amplified the demand for credit cards, as they provide a seamless and widely accepted payment method in the digital realm.

Moreover, credit cards offer users a range of benefits, including reward programs, cashback incentives, and travel perks. These enticing features not only attract new users but also encourage existing cardholders to use their credit cards for a variety of purchases, fueling transaction volumes.

Financial institutions and credit card issuers are capitalizing on this trend by innovating and introducing specialized credit card products tailored to diverse customer needs. From premium cards with exclusive privileges to co-branded cards with retail partners, the market is witnessing a proliferation of options that cater to specific demographics and lifestyles.

As the credit card segment continues to evolve, the integration of advanced technologies such as contactless payments, mobile wallets, and enhanced security features is expected to sustain its growth trajectory. Overall, credit cards have firmly established themselves as a dynamic and expanding segment, playing a pivotal role in the modern financial landscape.

Bank Type Insights

Private banking is emerging as a rapidly growing and influential segment within the retail banking market. This specialized service caters to high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) seeking personalized financial solutions, wealth management, and exclusive privileges.Several factors contribute to the growth of private banking. First, there is a continuous increase in the number of affluent individuals seeking professional assistance to manage their wealth, plan for retirement, and navigate complex financial markets. Private banking offers tailored investment strategies, estate planning, and tax optimization to meet the unique needs of this clientele.

Second, globalization has led to greater wealth mobility, with individuals seeking international investment opportunities and asset diversification. Private banks are equipped to provide a global perspective on wealth management, offering access to international markets and investment products.

Third, technological advancements have enabled private banks to enhance their digital capabilities. Clients can now access their portfolios, receive real-time updates, and communicate with their relationship managers through secure online platforms, making wealth management more convenient and transparent.

Moreover, regulatory changes, such as the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA), have increased demand for compliant wealth management services, making private banks essential for maintaining financial transparency and regulatory compliance.

In summary, private banking is a thriving segment due to the increasing number of affluent clients, globalization, technological innovation, and evolving regulatory landscapes. As the segment continues to grow, private banks are expected to further expand their offerings and enhance their digital capabilities to cater to the evolving needs of high-net-worth individuals.

Regional Insights

Europe represents a significant and growing segment in the global retail banking market. Several factors contribute to this region's prominence in the industry.Firstly, Europe has a diverse and mature banking sector, with a presence of both traditional banks and a burgeoning fintech ecosystem. This mix creates a competitive environment that drives innovation and customer-centric solutions. European consumers have access to a wide array of banking services, from traditional brick-and-mortar banks to digital-only banks and fintech startups.

Secondly, regulatory changes, such as the Revised Payment Services Directive (PSD2) and the open banking initiative, have opened up opportunities for increased competition and innovation in the European retail banking landscape. These regulations have mandated banks to share customer data with authorized third-party providers, fostering the development of innovative financial products and services.

Additionally, Europe's commitment to sustainability and responsible banking practices is influencing the industry. Environmental, social, and governance (ESG) considerations are increasingly integrated into banking operations, with European banks at the forefront of ESG investments and responsible lending.

Furthermore, Europe's embrace of digital banking and mobile payment solutions has positioned the region as a leader in digital transformation. Mobile banking apps, contactless payments, and digital wallets have become commonplace, reflecting the region's readiness to adopt advanced financial technologies.

In conclusion, Europe's retail banking market is growing and evolving, driven by a blend of regulatory changes, technological advancements, competitive dynamics, and a strong focus on sustainability. As customer preferences continue to evolve and digitalization accelerates, Europe's retail banking sector is expected to remain a prominent and dynamic force in the global financial services industry.

Report Scope:

In this report, the Global Retail Banking Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Retail Banking Market, By Product Type:

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- ATM Cards

- Mortgages

- Home Loan

Retail Banking Market, By Bank Type:

- Community Development Bank

- Private Banking

- Public Banking

- NBFCs

Retail Banking Market, By End User:

- Payments

- Processing Services

- Customer & Channel Management

- Wealth Management

- Others

Retail Banking Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Argentina

- Colombia

- Brazil

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Retail Banking Market.Available Customizations:

Global Retail Banking market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bank of America

- Wells Fargo

- Citigroup

- Barclays

- ICBC

- HSBC

- NP Paribas

- China Construction Bank Deutsche Bank

- JPMorgan Chase

- Mitsubishi UFJ Financial Group

Table Information

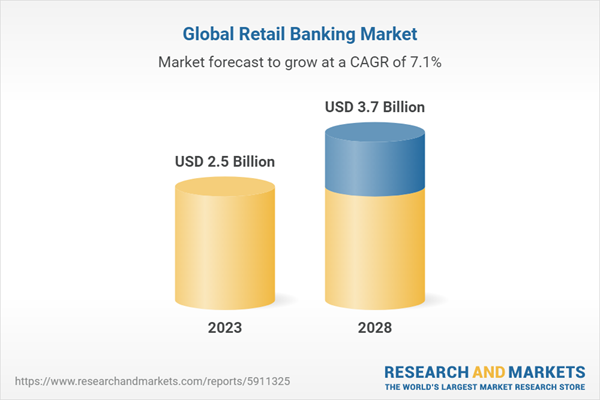

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | November 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |