Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

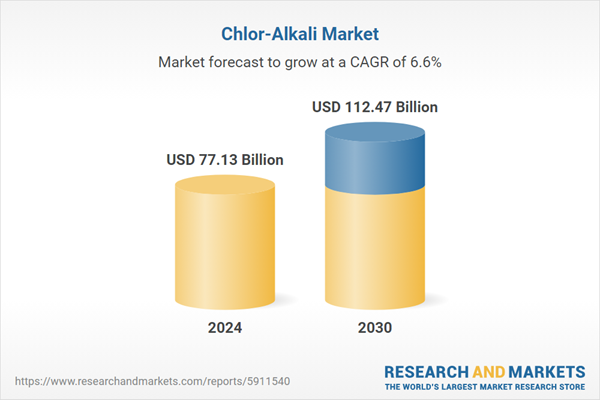

The market’s growth is being driven by increasing demand from end-user industries such as automotive, construction, food processing, and agriculture. Furthermore, with rising industrialization, producers are shifting towards energy-efficient and environmentally sustainable production technologies, especially membrane cell processes, to meet both regulatory standards and operational efficiency. As caustic soda remains a vital input in alumina refining, the anticipated growth of the alumina industry is expected to further bolster demand, thereby supporting the expansion of the chlor-alkali sector globally.

Key Market Drivers

Growing Demand of Chlor-Alkali from Agriculture Industry

The agriculture industry is a significant consumer of chlor-alkali products, particularly chlorine and its derivatives. These chemicals are widely used in the production of agrochemicals such as herbicides, fungicides, and pesticides that are essential for crop protection and higher yield. Furthermore, polyvinyl chloride (PVC), derived from chlorine, is extensively used in modern irrigation systems, especially in the form of durable and corrosion-resistant piping solutions. The increased use of PVC pipes in agricultural water management has contributed to more efficient water delivery and conservation, supporting global food security goals. With expanding global agricultural output and rising mechanization, the sector’s reliance on chlor-alkali inputs is poised to grow, reinforcing their relevance in sustainable agricultural practices.Key Market Challenges

Volatility in Price of Raw Materials

Raw material cost volatility presents a significant challenge to chlor-alkali producers. The process heavily depends on critical inputs such as electricity and natural gas, which are subject to price fluctuations due to geopolitical factors, regulatory shifts, and supply chain constraints. Energy expenses constitute a major portion of the overall production cost for caustic soda and chlorine, making the sector vulnerable to changes in energy markets. These fluctuations can lead to unstable production costs, ultimately affecting pricing strategies and profit margins. Additionally, the unpredictability complicates inventory management and contract pricing for downstream consumers, potentially impacting long-term supply agreements and investment decisions within the industry.Key Market Trends

Shift from Mercury Cell to Membrane and Diaphragm Technologies

Environmental concerns and tightening regulatory frameworks are accelerating the transition from traditional mercury cell technology to membrane and diaphragm technologies in chlor-alkali manufacturing. Mercury-based systems have come under scrutiny for their environmental hazards and health risks. Global initiatives, including those by the United Nations Environment Programme, are advocating for the phase-out of mercury use in industrial processes. In response, industry players are investing in cleaner, more efficient alternatives. Membrane technology, in particular, offers lower energy consumption, zero mercury emissions, and improved operational safety. This shift not only supports sustainability goals but also enhances competitiveness by reducing long-term operational and compliance costs.Key Players Profiled in this Chlor-Alkali Market Report

- ANWIL SA (PKN ORLEN SA)

- BorsodChem (Wanhua Chemical Group Co. Ltd)

- Ciner Resources Corporation

- Covestro AG

- Dow Chemical Company

- Ercros SA

- Genesis Energy LP

- Hanwha Solutions/Chemical Corporation

- Olin Corporation

- Tata Chemicals Limited

Report Scope

In this report, the Global Chlor-Alkali Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Chlor-Alkali Market, by Product Type:

- Chlorine

- Caustic Soda

- Soda Ash

- HCL

- Hydrogen

- Others

Chlor-Alkali Market, by Application:

- Soaps & Detergents

- Agrochemicals

- Glass

- Food

- Pulp & Paper

- Water Treatment

- Others

Chlor-Alkali Market, by Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Chlor-Alkali Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Chlor-Alkali market report include:- ANWIL SA (PKN ORLEN SA)

- BorsodChem (Wanhua Chemical Group Co. Ltd)

- Ciner Resources Corporation

- Covestro AG

- Dow Chemical Company

- Ercros SA

- Genesis Energy LP

- Hanwha Solutions/Chemical Corporation

- Olin Corporation

- Tata Chemicals Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 77.13 Billion |

| Forecasted Market Value ( USD | $ 112.47 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |