Rising Amount of Space Debris Fuels North America Satellite Optical Ground Station Market

All non-functional artificial materials orbiting the Earth at different altitudes can be termed space debris. Debris includes rocket body parts, fragmentation debris, refuse created during crewed missions, exhaust products from rockets, and defunct satellites. Most of such debris orbit the Earth at an average speed above 26,000 km per hour in Low Earth Orbits (LEO), posing a severe threat of collision for functional space assets. Such threats increase with each rocket launch for LEO and deep space. Growing collision threats of space objects are a persistent problem for the safe and sustainable use of outer space. These threats restrict unhindered access to space and prompt relevant parties to take necessary steps to mitigate risk. In November 2021, the Russian military conducted an anti-satellite test (ASAT) and blew up its defunct Cosmos 1408 satellite (which was launched in 1982) with a Nudol missile. Immediately after the blast, American and Russian astronauts aboard the International Space Station had to take preventive measures to avoid being struck by debris from the satellite, as the International Space Station was supposedly reasonably close to the satellite.North America Satellite Optical Ground Station Market Overview

The North American satellite optical ground station market is segmented into US and Canada. Advanced satellite optical ground station technologies are being widely adopted in the US and Canada to improve defense capabilities. In August 2020, the US Space Center announced that United Launch Alliance (ULA) was awarded to launch its critical national security space missions for the US Space Force. The missions are planned to be deployed from Cape Canaveral Air Force Station in Florida in FY2027. These types of satellite launch help in the adoption of the ground station technologies.Moreover, the launch of new satellite ground stations across the region and the expansion of existing ground stations is another major factor driving the growth of satellite optical ground stations across the North America region. For instance:

- In 2022, BlueHalo won a contract worth US$ 1.4 billion from the US Space Force for the upgrade of 12 military ground stations across the country wherein BlueHalo will replace the old parabolic satellite dishes with electronic phased array antennas across the military ground stations.

- In February 2023, Satellite operator KSAT announced that it is expanding its network with the installation of new ground station antennas across Antarctica and expanding its capacity in the US through multiple antennas in Hawaii, Alaska, and the Southeast US.

- In January 2023, SpaceX’s Starlink announced the launch of its fleet of second-generation satellites and expansion of its ground station infrastructure across the US.

- In May 2019, GigaSat, part of Ultra Electronics Communications & Integrated Systems (CIS), in partnership with Inmarsat, delivered 16 satellite multiband earth ground station terminals to Canada’s Department of National Defence (DND).

North America Satellite Optical Ground Station Market Segmentation

The North America satellite optical ground station market is segmented into operation, application, end user, equipment, and country.Based on operation, the North America satellite optical ground station market is segmented into laser satcom and optical operations. The optical operations segment held a larger market share in 2023. The laser satcom segment is sub-segmented into OISL, direct-to-earth, and feeder links.

Based on application, the North America satellite optical ground station market is segmented into laser operation, debris identification, earth observation, and space situational awareness. The earth observation segment registered the largest market share in 2023. The laser operation segment is further sub-segmented into ranging and communication.

Based on end user, North America satellite optical ground station market is segmented into government & military and commercial enterprises. The government & military segment held a larger market share in 2023.

Based on equipment, the North America satellite optical ground station market is segmented into consumer equipment and network equipment. The network equipment segment held a larger market share in 2023.

Based on country, the North America satellite optical ground station market has been categorized into US and Canada. The US dominated the North America satellite optical ground station market in 2023.

AAC Clyde Space AB; Ball Corp; Comtech Telecomm Corp; General Atomics Aeronautical Systems Inc; Hensoldt AG; Mynaric AG; and Thales SA are some of the leading companies operating in the North America satellite optical ground station market.

Table of Contents

Companies Mentioned

- AAC Clyde Space AB

- Ball Corp

- Comtech Telecomm Corp

- General Atomics Aeronautical Systems Inc

- Hensoldt AG

- Mynaric AG

- Thales SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 129 |

| Published | September 2023 |

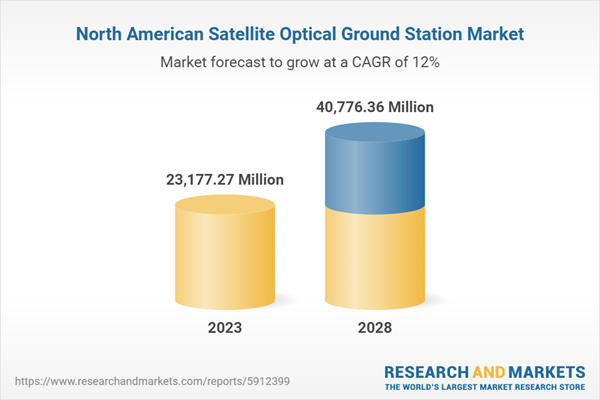

| Forecast Period | 2023 - 2028 |

| Estimated Market Value in 2023 | 23177.27 Million |

| Forecasted Market Value by 2028 | 40776.36 Million |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | North America |

| No. of Companies Mentioned | 7 |