The growing demand for environmentally friendly goods can be a significant opportunity for this industry to expand. The Asia-Pacific is leading the organic LED industry, accounting for the majority of the market revenue share.

Market Segmentation

“Organic LED Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Flexible OLED

- Rigid OLED

Market Breakup by Product

- Display

- Lighting

Market Breakup by Technology

- Passive Matrix OLED

- Active Matrix OLED

- Transparent OLED

- Top-emitting OLED

- Foldable OLED

- White OLED

Market Breakup by Application

- Television and Monitors

- Smartphones

- Laptops and Tablets

- Automotive

- Others

Market Breakup by Sector

- Commercial

- Residential

- Industrial

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

Favourable properties of the product like high productivity, low power utilisation, enhanced image quality, durability, and lightweight are the major factors affecting the organic LED market positively. The Asia-Pacific is leading the organic LED market globally, followed by North America and Europe.Competitive Landscape

The report presents a detailed analysis of the following key players in the global organic LED market, looking into their capacity, competitive landscape, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- Au Optronics Corp. (TPE: 2409)

- Cambridge Display Technology Limited.

- Universal Display Corporation (NASDAQ: OLED)

- LG Electronics Inc. (KRX: 066570)

- Samsung Electronics Co., Ltd. (KRX: 005930)

- Others

Table of Contents

Companies Mentioned

The key companies featured in this Organic LED market report include:- Au Optronics Corp. (TPE: 2409)

- Cambridge Display Technology Limited.

- Universal Display Corporation (NASDAQ: OLED)

- LG Electronics Inc. (KRX: 066570)

- Samsung Electronics Co., Ltd. (KRX: 005930)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | August 2025 |

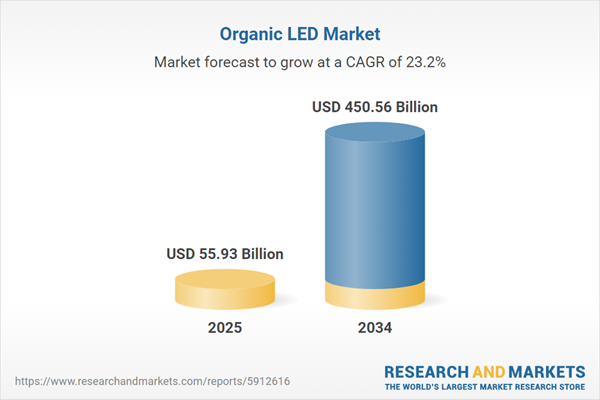

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 55.93 Billion |

| Forecasted Market Value ( USD | $ 450.56 Billion |

| Compound Annual Growth Rate | 23.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |