Mexico In-vitro Diagnostics Market Analysis

The in-vitro diagnostics (IVD) market in Mexico is experiencing significant growth, driven by the increasing prevalence of chronic diseases, rising healthcare expenditures, and advancements in diagnostic technologies. IVD encompasses a variety of tests performed on samples such as blood, urine, or tissue to detect diseases, conditions, or infections. The Mexican market is witnessing a growing adoption of these diagnostic tools in both public and private healthcare sectors, contributing to improved patient outcomes and the overall efficiency of healthcare services.Market Drivers

Rising Prevalence of Chronic Diseases: The increasing incidence of chronic diseases such as diabetes, cardiovascular diseases, and cancer is a major driver of the IVD market in Mexico. The need for early and accurate diagnosis to manage these conditions effectively has led to a higher demand for diagnostic tests.Advancements in Technology: Innovations in diagnostic technologies, including molecular diagnostics, point-of-care testing, and automation, have significantly enhanced the accuracy and efficiency of IVD tests. These advancements are making diagnostics more accessible and affordable, thus driving market growth.

Growing Healthcare Expenditure: The Mexican government’s initiatives to improve healthcare infrastructure and increase healthcare spending are positively impacting the IVD market. Increased investment in healthcare services and facilities ensures better access to advanced diagnostic tools.

Aging Population: The aging population in Mexico is contributing to the increased demand for diagnostic tests. As the elderly are more susceptible to various diseases, the need for regular and comprehensive diagnostic testing is on the rise.

Market Challenges

Regulatory Hurdles: Navigating the regulatory landscape in Mexico can be challenging for IVD manufacturers. Stringent regulations and the lengthy approval process can delay the entry of new diagnostic products into the market.High Costs: The high cost of advanced diagnostic tests and equipment can be a barrier to widespread adoption, particularly in lower-income regions. This can limit market growth as affordability remains a significant concern.

Lack of Skilled Professionals: There is a shortage of trained healthcare professionals capable of performing and interpreting advanced diagnostic tests. This gap in skills can hinder the effective utilisation of IVD technologies.

Limited Awareness: In some regions, there is limited awareness and understanding of the benefits of early and accurate diagnosis. This lack of awareness can result in underutilisation of diagnostic services.

Future Opportunities

Expansion of Point-of-Care Testing: The development and expansion of point-of-care testing (POCT) present a significant opportunity for the IVD market in Mexico. POCT allows for rapid and on-site diagnosis, improving accessibility, especially in remote and underserved areas.Integration of Artificial Intelligence: The integration of artificial intelligence (AI) and machine learning in diagnostic tools can enhance the accuracy and efficiency of tests. AI-driven diagnostics can help in early detection and personalised treatment plans, thus offering substantial growth potential.

Government Initiatives: Continued government initiatives aimed at improving healthcare access and quality will support market expansion. Policies promoting public-private partnerships and investments in healthcare infrastructure will further drive the growth of the IVD market.

Focus on Preventive Healthcare: Increasing emphasis on preventive healthcare and regular health check-ups is expected to boost the demand for diagnostic tests. Preventive measures and early diagnosis can reduce the burden of chronic diseases and improve health outcomes.

Rural Market Penetration: Expanding the reach of diagnostic services to rural and remote areas offers a vast untapped market. Efforts to improve healthcare delivery in these regions can significantly contribute to market growth.

Mexico In-vitro Diagnostics Market Trends

The Mexico in-vitro diagnostics (IVD) market is experiencing dynamic changes driven by technological advancements and evolving healthcare needs. These trends are shaping the future of diagnostics, leading to more efficient and accessible healthcare solutions.Market Trends

Growth of Point-of-Care Testing (POCT): The shift towards point-of-care testing is one of the most notable trends in the IVD market. POCT allows for immediate testing and results, facilitating faster clinical decision-making and improving patient outcomes. This trend is particularly significant in rural and underserved areas where access to traditional laboratory services is limited.Rise of Molecular Diagnostics: Molecular diagnostics are gaining traction due to their high accuracy and ability to detect diseases at an early stage. Techniques such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) are becoming increasingly popular for diagnosing infectious diseases, genetic disorders, and cancer.

Integration of Artificial Intelligence (AI): AI and machine learning are revolutionising the IVD market by enhancing the accuracy and efficiency of diagnostic tests. AI algorithms can analyse complex data sets quickly, leading to more precise diagnostics and personalised treatment plans.

Increased Focus on Personalised Medicine: There is a growing emphasis on personalised medicine, which tailors medical treatment to the individual characteristics of each patient. IVD plays a crucial role in this approach by providing detailed diagnostic information that guides customised therapies.

Adoption of Telemedicine and Remote Diagnostics: The COVID-19 pandemic has accelerated the adoption of telemedicine and remote diagnostics. Patients and healthcare providers are increasingly relying on these technologies to conduct tests and consultations remotely, reducing the need for in-person visits and improving healthcare accessibility.

Mexico In-vitro Diagnostics Market Segmentation

Market Breakup by Product Type

- Reagents and Kits

- Instruments

- Software and Services

Market Breakup by Technology

- Immunoassay/ Immunochemistry

- Clinical Chemistry

- Molecular Diagnostics

- Haematology

- Microbiology

- Blood Glucose Self-Monitoring

- Coagulation and Haemostasis

- Urinalysis

- Others

Market Breakup by Therapeutic Area

- Infectious Diseases

- Diabetes

- Cardiology

- Oncology

- Autoimmune Diseases

- Nephrology

- Others

Market Breakup by End User

- Hospitals

- Laboratories

- Homecare

- Others

Mexico In-vitro Diagnostics Market Competitive Landscape

The Mexico in-vitro diagnostics (IVD) market features a competitive landscape with key players including F. Hoffmann-La Roche Ltd, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Siemens Healthineers AG, bioMérieux SA, Abbott Laboratories, Quidel Corporation, WAMA Diagnóstica, OraSure Technologies, Inc., Thermo Fisher Scientific Inc, Hologic, Inc., and Cepheid Inc (Danaher Corp.). Common market activities include mergers and acquisitions to enhance market presence and expand product portfolios. Research initiatives are prominent, focusing on developing innovative diagnostic solutions. Frequent product introductions aim to address unmet medical needs and improve diagnostic accuracy. Strategic partnerships and collaborations are also common, enabling companies to leverage shared expertise and technology advancements, ultimately driving market growth and competitive positioning in the region.Key Questions Answered in the Report

- What is the current and future performance of the Mexico In-vitro Diagnostics market?

- What are the main challenges facing the Mexico In-vitro Diagnostics market?

- What are the key drivers of the Mexico In-vitro Diagnostics market?

- What emerging trends are shaping the future of the Mexico In-vitro Diagnostics market?

- How is the trend towards personalised medicine influencing the development of companion diagnostics?

- Why do reagents and kits dominate the IVD market, and how are instruments evolving?

- How are molecular diagnostics, clinical chemistry, and haematology evolving in the IVD market?

- What factors are driving the sustained demand for diabetes diagnostics?

- Why do hospitals dominate the IVD market in terms of diagnostic test volumes?

Key Benefits for Stakeholders

- The industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico In-vitro Diagnostics market from 2017-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico In-vitro Diagnostics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico In-vitro Diagnostics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

This product will be delivered within 5-7 business days.

Table of Contents

Companies Mentioned

- F Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Siemens Healthineer AG

- Abbott Laboratories

Table Information

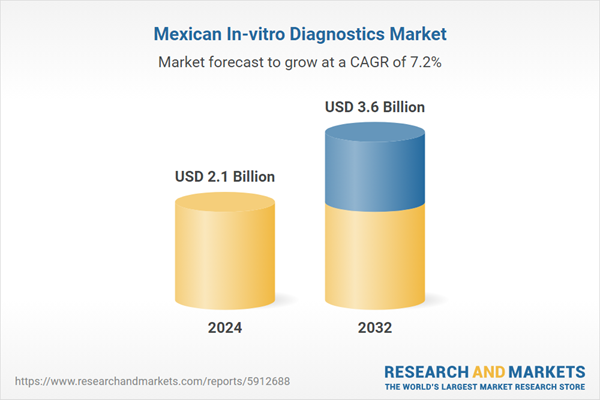

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | September 2024 |

| Forecast Period | 2024 - 2032 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 5 |