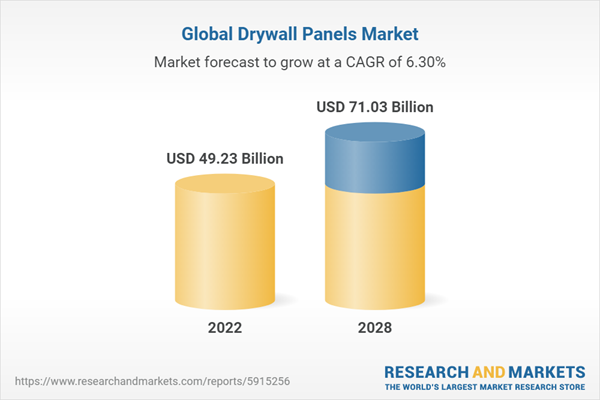

Drywall panels, also known as gypsum board or plasterboard, are prefabricated construction materials used for interior wall and ceiling finishing. Composed of gypsum plaster sandwiched between thick paper sheets, these panels offer easy installation and create smooth, even surfaces. They serve as a versatile building material, providing fire resistance, soundproofing, and a sturdy base for paint or wallpaper. Drywall panels are widely utilized in residential and commercial construction for their cost-effectiveness, flexibility, and ability to create partitions or coverings within structures quickly. The global drywall panels market was valued at US$49.23 billion in 2022. The market value is expected to reach US$71.03 billion by 2028.

The global drywall panels market has experienced substantial growth, driven primarily by various influential factors. Rapid urbanization has led to increased construction demand, fueling the need for efficient, cost-effective building materials like drywall panels. Rising disposable incomes have empowered consumers to invest in housing, consequently boosting construction and renovation activities. Government initiatives and investments in infrastructure further amplify this growth, creating a conducive environment for the construction sector. Additionally, the surge in renovation projects, especially in mature markets, has contributed significantly to the expanding market. These panels' versatility, ease of installation, and benefits in terms of fire resistance and soundproofing have made them a preferred choice, aligning with the evolving demands of modern construction practices worldwide. This confluence of factors is expected to sustain and further propel the growth of the global drywall panels market. The drywall panels market is projected to grow at a CAGR of 6.30% over the years 2023-2028.

Market Segmentation Analysis:

By Type: The report identifies six segments on the basis of type: Regular, Type X, Moisture-resistant, Plaster baseboard, Paperless, and Others. In 2022, regular drywall panels remained the dominant segment in the market, while the Type X drywall panels segment is projected to experience the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This surge in Type X drywall panels' popularity stems from their prized fire-resistant properties, significantly impacting the broader drywall panels market. Their utilization in fire-prone zones like garages and workshops highlights their crucial role in bolstering safety measures. The market stability and expansion are significantly influenced by Type X drywall's provision of a reliable fire prevention solution, broadening the market's product range and extending its use into environments susceptible to fires.

By Application: On the basis of application, the global drywall panels market can be divided into three segments: Residential, Commercial, and Others. During 2022, the Residential segment dominated the market share, while the Commercial segment is anticipated to experience the most rapid expansion in the forecasted period. Drywall panels, serving as versatile construction components, find widespread use in offices, retail spaces, educational institutions, garages, warehouses, and industrial facilities within the Commercial sector. These panels cater to various purposes like walls, ceilings, and partitions, with Type X variants specifically ensuring crucial fire safety. The escalating demand for drywall panels within these sectors propels market growth, largely propelled by ongoing commercial and institutional construction ventures.

By Region: In the report, the global Drywall Panels market can be divided into four regions namely, Asia Pacific, North America, Europe, and the Rest of the World. In 2022, the market was led by Asia Pacific, driven significantly by the region's burgeoning population, fostering substantial demand for drywall panels. The expanding populace, coupled with rapid urbanization, fuels the necessity for new residential and commercial structures, where drywall panels have emerged as a favored construction material, further elevating their requisition in this area. Furthermore, Asia Pacific enjoys a manufacturing advantage due to lower production costs, notably in countries like China and India. This advantage sustains the industry's growth, with reduced labor and material expenses enabling competitive pricing, thereby enhancing market accessibility. Additionally, government support contributes to bolstering market expansion.

Meanwhile, North America, especially the US, has seen remarkable growth in the drywall panel industry, influenced by a construction sector increasingly prioritizing sustainability and energy efficiency. Drywall panels' eco-friendly nature aligns with these industry shifts, driving their demand amidst growing environmental consciousness. Canada exhibits similar trends, leveraging urbanization, population growth, and governmental backing to stimulate construction, thereby escalating the demand for drywall panels.

Market Dynamics:

Growth Drivers: The global drywall panels market has witnessed sustained growth due to several driving forces. Rapid urban growth in developing nations drives a rising demand for housing and commercial structures. Drywall panels, prized for their affordability, ease of installation, and adaptability, cater to this need efficiently. They aid swift construction, offering soundproofing and insulation, contributing to better urban living conditions, and bolstering the construction sector in these nations. Other factors such as rising construction activities, an increase in disposable income, the surge in renovation projects, and upsurge in government investment are significantly influencing the drywall panels market.

Challenges: Despite robust growth, the drywall panels market contends with significant challenges. These include intense competition, concerns regarding substandard drywall, and fluctuating raw material costs. Intense market competition presents a formidable obstacle to the industry. The fierce battle for market share often triggers price wars, diminishing profit margins and impeding investments in innovation and quality enhancements. Moreover, this rivalry risks compromising product quality, potentially impacting customer satisfaction. Furthermore, market oversaturation could lead to fragmentation, posing difficulties for customers in selecting among numerous available products.

Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as the adoption of eco-friendly construction materials, recycling of drywall panels, expansion in emerging economies, aesthetic versatility, technological advancements, etc. The construction industry's growing sustainability focus steers a notable shift towards eco-conscious practices and materials. Drywall panels, celebrated for their eco-friendliness, emerge as a greener alternative in construction. Renowned for energy efficiency, they regulate indoor temperatures, curbing excessive heating/cooling needs and subsequently reducing energy usage and greenhouse gas emissions. Additionally, their recyclability minimizes construction waste, fostering a circular economy. Compared to traditional methods, drywall produces less dust, requires fewer resources, and speeds up building processes, cutting labor costs and environmental impact. As sustainability remains paramount, the surge in demand for drywall panels reflects their alignment with eco-friendly construction objectives.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic significantly affected the drywall panels market, causing disruptions in supply chains, construction delays, and fluctuations in demand. During the initial outbreak, lockdowns, restrictions, and reduced construction activity led to a downturn in the market. Supply chain disruptions, including shortages of raw materials and logistical challenges, hampered manufacturing and distribution. Moreover, uncertainty in economic conditions and project postponements affected the demand for drywall panels.

As construction gradually resumed, enhanced safety measures were implemented, impacting productivity and increasing operational costs. However, the latter part of the pandemic witnessed a rebound in construction activities, driven by stimulus packages, housing demands, and infrastructure projects, indicating a partial recovery for the drywall panels market. Overall, COVID-19 induced uncertainties continue to influence the market, shaping its dynamics and recovery trajectory.

Competitive Landscape:

The global drywall panels market is fragmented. However, the market share of organized players has increased significantly over the last few years and is expected to continue given the wide product offerings, better service, and higher brand visibility.

The key players in the global drywall panels market are:

- China National Building Material Group Co., Ltd

- Etex Group

- Saint-Gobain S.A.(Certain Teed)

- Georgia-Pacific LLC

- American Gypsum Company LLC

- Knauf Gips KG (USG Corporation)

- Beijing New Building Materials Public Co., Ltd.

- National Gypsum Company

- Gypsemna Co.

- PABCO Gypsum

- Yoshino Gypsum Co., Ltd.

- Sadaf Gypsum Co.

Some of the strategies among key players in the market are new launches, mergers, acquisitions, and collaborations. For instance, In October 2023, Etex signed an agreement with the Australian construction materials company BGC to acquire their plasterboard and fibre cement businesses.

Table of Contents

1. Executive Summary

Companies Mentioned

- American Gypsum Company LLC

- Beijing New Building Materials Public Co., Ltd.

- China National Building Material Group Co., Ltd

- Etex Group

- Georgia-Pacific LLC

- Gypsemna Co.

- Knauf Gips KG (USG Corporation)

- National Gypsum Company

- PABCO Gypsum

- Sadaf Gypsum Co.

- Saint-Gobain S.A.(Certain Teed)

- Yoshino Gypsum Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | December 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 49.23 Billion |

| Forecasted Market Value ( USD | $ 71.03 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |